M&A Utopia

Editor's Note: This analysis was written prior to the global COVID-19 pandemic.

I truly believe there is possibly no better investment in the world than to own an insurance brokerage. We are experiencing a confluence of circumstances that has helped create incredible value and wealth across the industry. It is like we are living through an industry utopia.

Market conditions for the insurance brokerage industry are more favorable today than they have been in decades, and valuations remain at or near all-time highs.

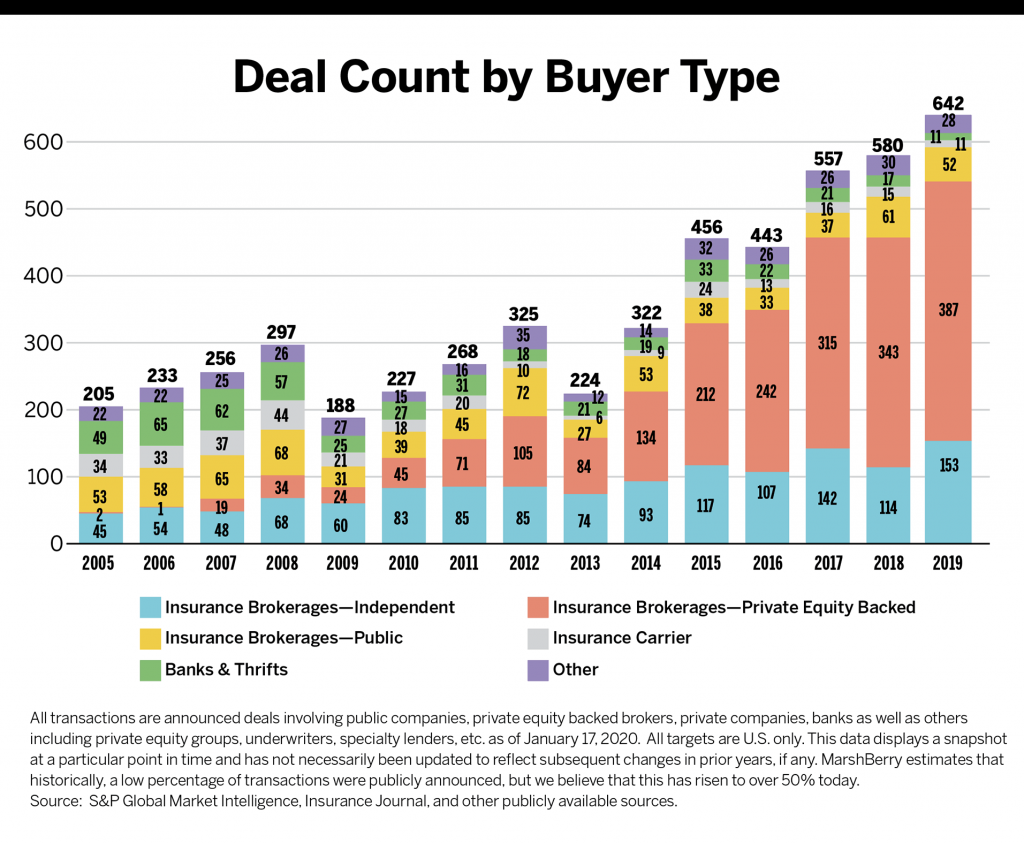

MarshBerry tracked 642 deal announcements in 2019, compared to 580 in 2018, the previous high-water mark.

While heightened deal activity is expected to continue, looming economic concerns related to the 2020 election, among other things, could impact M&A activity in the second half of the year.

Read the companion sidebar, “2019 Deal Values Still Rising.”

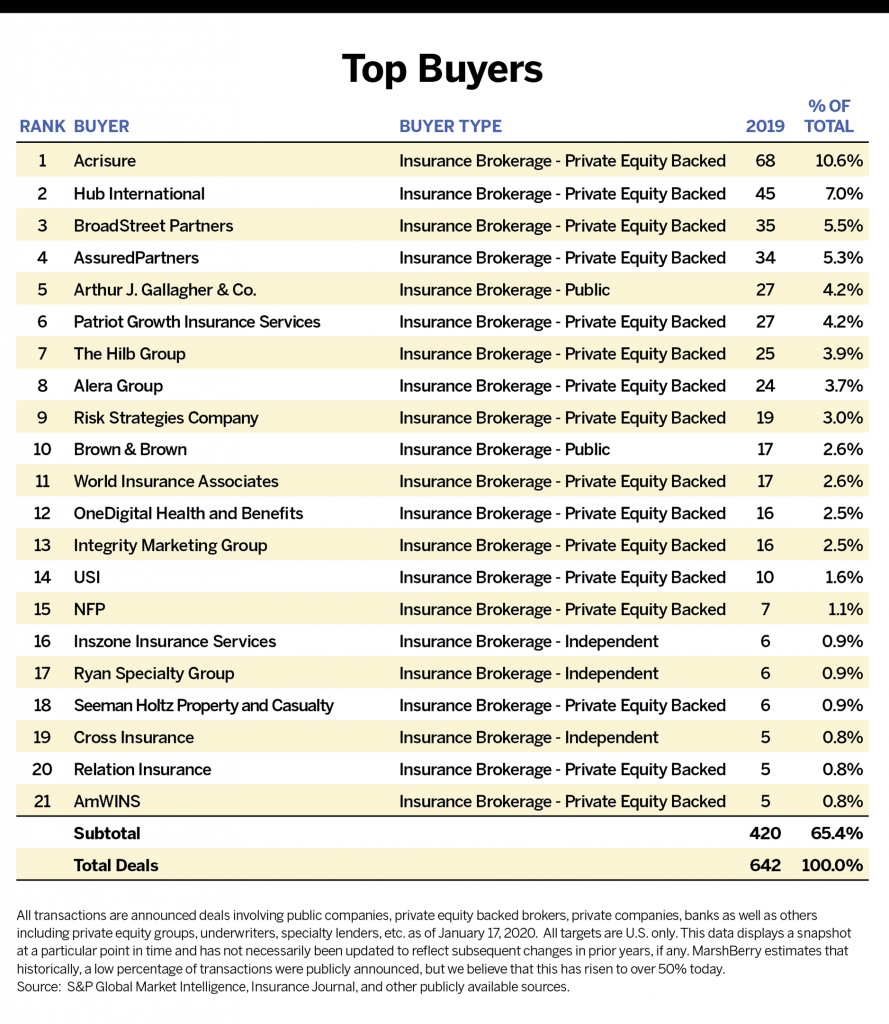

For a list of all the major players in M&A, check out our sidebar, The Buyer’s Club.

Average organic growth is up, deal counts are up, the number of firms acquiring is up, and private capital demand to enter the insurance brokerage marketplace is up. Now a full decade removed from the worst economic recession in the last 100 years, we are seeing market conditions more favorable than we can ever remember seeing. Certainly, no market cycle has collectively been as good as it is today in the almost 40-year history of our firm.

For some ownership groups, there is an acute awareness of how good things really are. These firms are making strategic decisions to grab available capital and double down on their business. They are trying to grow at a rate greater than 15% so they can double their firms in the next three to five years. Others are recognizing the need for scale and resources in order to continue to compete at a high level. This is pushing them to sell and partner with a firm that has already made those investments, recognizing that partnering may be less risky than trying to build or invest in those resources by yourself.

For other ownership groups, there is still a “head in the sand” mentality. Recently, better growth than normal has been driving up profitability—and creating the opportunity for continued complacency in an industry that has 90%+ of its revenue renew/recur on an annual basis. For some, what is important or critical never becomes urgent. Certain firms don’t have a plan or strategy to address what the future holds, and frankly that has worked out just fine given the current buyer appetite. The industry is incredibly forgiving and resilient. The buyer community is also still willing to pay a significant value for firms that are performing at or even below average relative to their peers. These sellers are generally, however, not seeing valuations in the marketplace as high as their peers who are focused on outgrowing the industry and planning for the future.

This dichotomy of these two approaches is a great example of the beauty of the industry. There is no one right way to approach the future. Some are digging in to create dramatic scale, while others are living in the now and enjoying the moment. Both will still have value in an external sale, although those with their head in the sand may be leaving value on the table. And that value will continue to be predicated on the vantage point of the buyer.

As we put a ribbon on 2019 and look forward at 2020, it remains critically important that you as owners and leaders have a sense of what you are trying to accomplish—a vision and a purpose. Be aware of how good market conditions really are today and what changes to our economy, insurance rates, interest rates, tax rates, government leaders, or even your own health and wellness could do to your business. Today’s M&A environment creates the ultimate contingency plan for tough circumstances, but I implore you not to leave your future up to fate.

U.S. Economy Beneficial

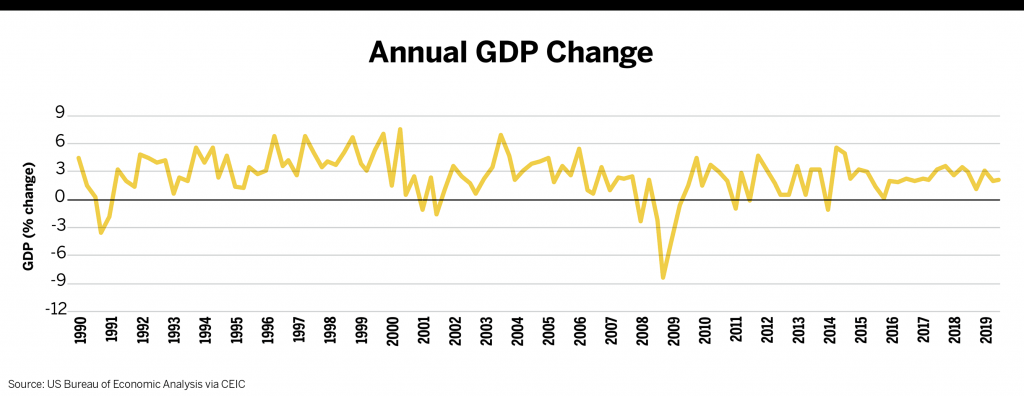

The insurance distribution industry has been a beneficiary of economic growth over the past several years, with an expanding exposure base and relatively low unemployment that continued through 2019. Additionally, a broad increase in commercial line premium pricing during the year supported industry growth.

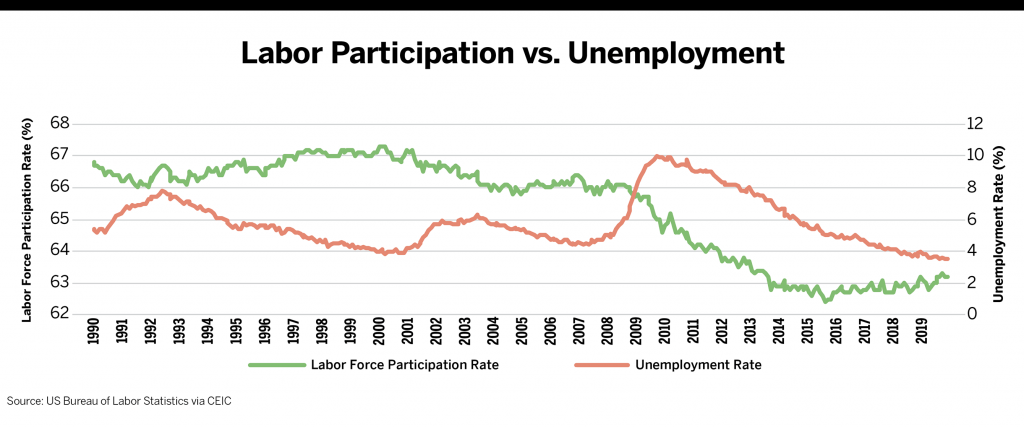

The unemployment rate in the United States is at its lowest point in decades (finishing 2019 below 4.0%) and will intensify competition for key talent. Although labor costs are increasing at a slower pace than expected, there is upward pressure that could impact agency and brokerage profitability.

The Federal Reserve Bank of Philadelphia’s most recent survey of professional forecasters anticipates gross domestic product growth of 1.8% for 2020, a slowdown from 2019’s rate. Moderate economic growth coupled with a potential increase in insurance rates will likely result in higher organic growth rates in the short term.

The federal funds rate has an impact on both short- and long-term interest rates and thereby holds great influence over the broader economy. The Federal Reserve has switched from a hawkish stance in 2018, with four rate increases, to a dovish approach in 2019, with three rate cuts. Business valuations may be positively affected by a decrease in borrowing costs.

Hardening Market?

Many experts believe 2019 ended with signs of a hardening market. Net premiums written grew 10.8% over the course of 2018, and the national excess and surplus market experienced 13% growth through the first six months of 2019. Here are some major trends that are set to impact the insurance industry in the near term.

Growth in net premium written. As noted above, NPW growth is considered a factor for the hardening market. In the property/casualty market, NPW through September 2019 was 2.8% higher than the previous year, driven by an increase in rates and stronger economic conditions.

Rising P&C and health premium rates. Rate increases through the first three quarters of 2019 were driven primarily by higher commercial auto and commercial property prices due to an increase in claims.

Net premium income for the health insurance industry grew 6.0% in the first nine months of 2019 due to increasing rates. However, the suspension of the Affordable Care Act annual fee on all medical health insurers with aggregate new written premiums of over $25 million in 2019 adversely impacted premium flows, as most of this fee’s cost had been passed through to insureds. The ACA fee is expected to apply again in 2020 and beyond.

Solid surplus at P&C and health insurers. Policyholders surplus ended 2018 at $742.2 billion, its second highest level ever, and during the third quarter of 2019 that figure rose to $812.2 billion.

Improved P&C combined ratio. The combined ratio, a measurement of underwriting profitability calculated as the sum of incurred losses and expenses divided by total earned premiums, improved from 99.2 at the end of 2018 to 97.8 in the third quarter of 2019.

Strong organic growth. According to MarshBerry’s proprietary financial management system, member firms ended 2018 with an average of 6.4% year-over-year organic growth. They ended 2019 at the same pace, with preliminary results of 6.4% year-over-year organic growth. Of all firms in the system, preliminary results show those in the top 25% of organic growth finished the year particularly strong and outpaced last year’s 15.2% average organic growth rate by nearly a full percentage point.

Despite these trends, there simultaneously are industry metrics that run counter to the belief of a hardening market. In particular, there are preliminary signs that NPW growth may be leveling off. Data through the first half of 2019 showed NPW up only 1% after several years of roughly 4% growth and over 11% growth in 2018 alone. Figures released through the first nine months of 2019 show a slight recovery versus the first half of the year, at 2.7% growth, but still moderated from the previous several years.

There is also a potential for natural disasters to cause higher than expected insured losses in 2020, which would negatively impact the combined ratio and existing surplus. Insured catastrophic losses in the United States totaled an estimated $43.3 billion in 2018, down from 2017 levels but still the second highest since 2005 and well above the average of the past 30 years. However, insured losses in 2019 should regress toward the long-term average, as the year did not contain losses on the scale of 2018’s California wildfires and hurricanes Michael and Florence or 2017’s hurricanes Harvey, Maria and Irma.

2019 Transaction Review

Note: MarshBerry estimates that, historically, a low percentage of transactions were publicly announced (15%-30%), but we believe that this has risen to over 50% today.

Year after year, it doesn’t seem like the market’s appetite for acquisitions within the insurance distribution space can get any bigger, yet it does. The number of announced transactions in 2019 eclipsed 2018 (the previous high-water mark), with MarshBerry tracking 642 announcements, compared to 580 in 2018. The 11 most active buyers in 2019 each announced 17 or more transactions.

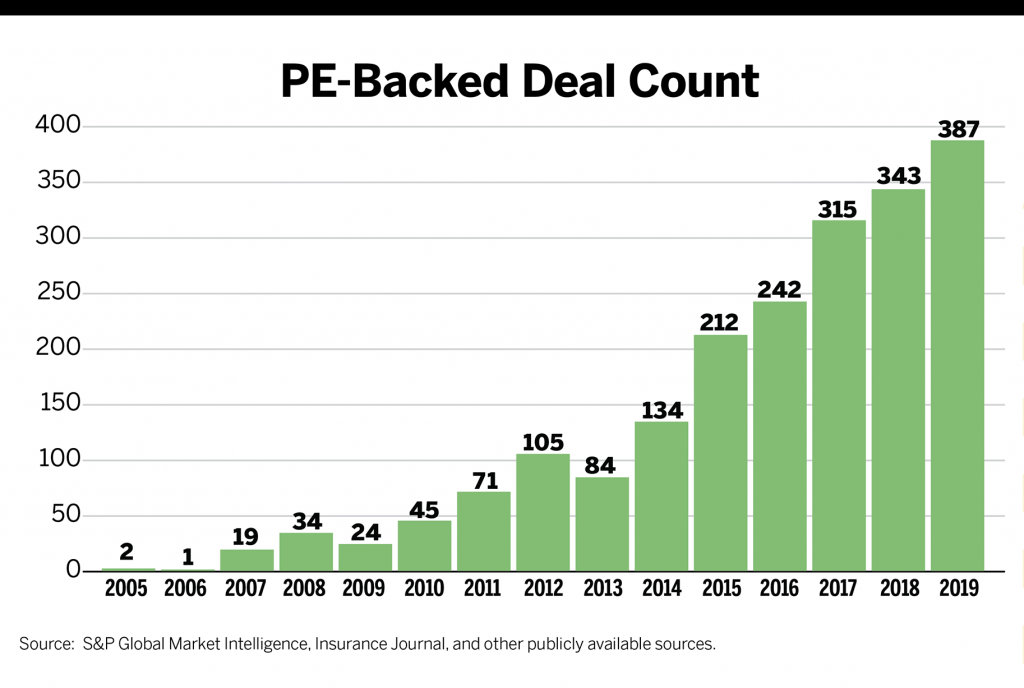

Over the past decade (2009-2019), deal activity has registered a 13% compound annual growth rate (CAGR), and we enter a new decade with the expectation that we will continue to see a heightened level of transactions in this marketplace. Industry fundamentals such as strong free cash flow and high recurring revenue, combined with favorable economic conditions, continue to support merger and acquisition activity. Values remain at or near all-time highs, which further drives sellers into the market.

Private-equity backed firms continue to drive activity; they were buyers in nearly 60% of the announced deals during the year. Independent firms (without a private-capital partner) were the buyers of another 24% of the deals, and public brokerages made up 8% of the acquirers. In total, these three buyer groups drove more than 92% of the reported M&A activity throughout the calendar year.

Property/casualty firms were the most popular targets of buyers during 2019 (46% of sellers), however multi-line firms, those with a P&C and employee benefits presence, represented a greater percentage of sellers in 2019 compared to 2018 (34% versus 25%).

The top buyers include some familiar and some new names. Patriot Growth Insurance Services, The Hilb Group, and Risk Strategies Company are among the top buyers in 2019 after having been outside the top 10 in 2018 (or not existing prior to 2019). Patriot was formed on Jan. 1, 2019, when 17 independent firms came together with financial backing from PE sponsor Summit Partners. Following the firm’s formation, Patriot completed seven other announced transactions, a total which alone would place it among the 15 most active buyers last year.

The following are highlights of activity from the four most active acquirers in 2019:

- Acrisure tops the list again in 2019 with 68 announced transactions, compared to 65 announced in 2018. The company has several private investors but is majority owned by its employees, largely former firm principals who have sold their firms in part for ownership in the Acrisure entity. Traditionally, Acrisure has neither announced all its transactions nor released target names for all its announced deals, though the company has publicly said that it completed more than 100 transactions in 2019. One notable transaction that was made public during 2019 was Acrisure’s acquisition of HNI Risk Services, a top-100 brokerage based in Milwaukee.

- Hub International ranks as the second most active buyer during 2019, having announced 45 U.S.-based transactions. The company has indicated publicly that it completed more than 60 acquisitions in 2019, with a number of these deals unannounced and others in Canada. Hub has two PE owners—Altas Partners and Hellman & Friedman. In December, Hub announced its acquisition of the SilverStone Group, “one of the largest insurance brokerages in the U.S. and the largest brokerage in Nebraska,” Hub said in a press release. Another notable acquisition was that of The Crichton Group, a multi-line brokerage in Nashville. This acquisition will create a new regional platform for Hub, called Hub Mid-South, covering Tennessee and Kentucky.

- BroadStreet Partners was the third most active buyer in 2019, with 35 transactions announced. Two of these transactions were new “core” partners for BroadStreet, which means they are significant acquisitions that will form their own platform to acquire other agencies. BroadStreet is a PE-backed buyer, although its majority sponsor, Ontario Teacher’s Pension Plan, is not the traditional Wall Street private investment group. Pension plans tend to have longer-term investment horizons and operate more conservatively given the funding source.

- AssuredPartners announced 34 transactions in 2019—the same number it announced in 2018, making it the fourth most active acquirer of the year. During 2019, AssuredPartners received a new investment of capital from GTCR Group, its original sponsor which supported the founding of the firm in 2011 and then subsequently sold its stake to Apax Partners in 2016. Apax VIII, one of Apax Partners’ funds, sold its stake back to GTCR in the first half of 2019, though it is now held by a different fund than the original investment from GTCR. Many have wondered if the returns that some of the PE firms have seen with their insurance operations are sustainable; reinvestments like this one provide evidence that the investment community continues to see potential for value creation within the distribution space.

Private Equity: The 800-lb. Gorilla

Last year was no exception to the trend over the prior several years of PE-backed buyers dominating the insurance distribution M&A market. This group of buyers included 33 unique brokerages plus 11 “other” types of PE-backed buyers, i.e., investment firms. This contrasts to just 10 unique PE-backed buyers a decade ago in 2009. Several of these buyers were PE firms making new entry investments in the top acquiring brokerages, such as the previously mentioned investments by GTCR in AssuredPartners and Summit Partners in Patriot Growth Insurance Services. Other top acquirers that added or changed PE backing during 2019 include:

• The Hilb Group, which announced in October that its current sponsor, Abry Partners, was selling its majority investment to The Carlyle Group, a PE firm with experience in the insurance distribution industry through its previous investments in Edgewood Partners Insurance Center (EPIC) and current position in JenCap Holdings.

• During 2019, it was announced that Lovell Minnick was exiting its investment in Worldwide Facilities. Genstar Capital emerged as a new investor in Worldwide, although the portion of ownership and investment amount remain undisclosed. Based in Los Angeles, Worldwide is one of the largest national wholesale insurance brokerages, managing general agents and program underwriters in the United States. This investment by Genstar (which also is an investor in Alera Group) is yet another example of strong investor interest from private capital in the insurance industry—and specifically an increasing interest in the specialty distribution space.

• Heffernan Insurance Brokers took on a minority capital investment from PE firm SkyKnight Capital in mid-2019. Heffernan is a top-50 insurance brokerage in the United States, with revenues over $100 million. Minority capital investments are becoming increasingly popular among brokerages that want to maintain some private ownership but also need access to capital for acquisitions and/or want to take advantage of the high multiples in the marketplace.

• Aquiline Capital Partners acquired Relation Insurance Services from its former capital partners, Parthenon Capital and Century Equity Partners. Aquiline has invested in several other insurance brokerages as part of its financial services focus. Relation has since become an active acquirer in the marketplace, announcing five transactions in 2019.

• Alliant Insurance Services took on an investment from Public Sector Pension Investment Board in early 2019. It also received an additional investment from Alliant’s core PE sponsor, Stone Point Capital. Interest in the insurance distribution space by pension funds seems to be on the rise. Pension funds are likely attracted to the relative stability of insurance distribution and tend to have a longer-term investment horizon when compared to traditional PE investors.

There are also several new PE-backed buyers in the marketplace, and a number of them completed multiple transactions during the year. In addition to Patriot, the following firms completed multiple transactions throughout the year:

• High Street Insurance Partners (four transactions) completed its first transactions in the second half of 2018 but picked up steam in 2019 with several announced deals. The firm has PE backing from Huron Capital Partners and is based in Traverse City, Michigan.

• The Amynta Group (three transactions) focuses on the managing general underwriter/agent space. The firm is majority backed by PE investor Madison Dearborn Partners, which has invested in several other insurance distribution businesses as well. Amynta was spun out into its current operation during a reorganization of AmTrust Financial in 2018.

Independent Firms: A Diverse Group

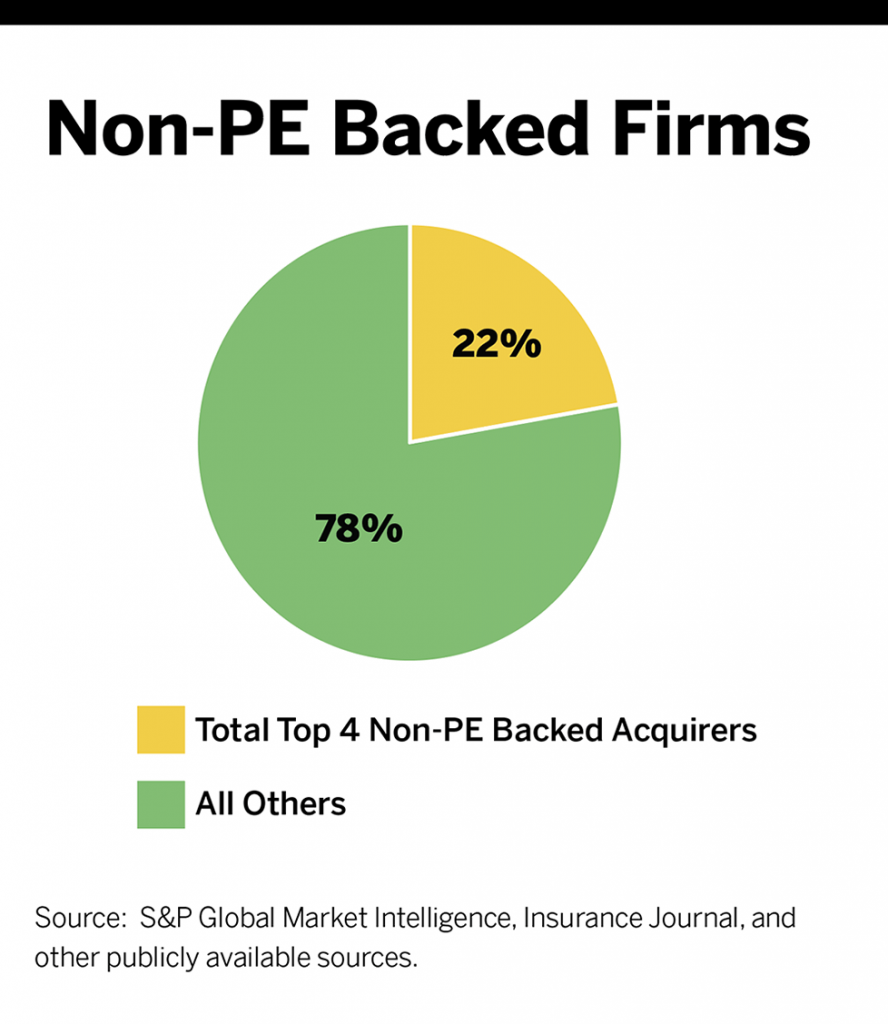

More than 110 different independent firms without known private-capital backing announced transactions during 2019, up from just over 80 unique buyers in this category in 2018. This group of acquirers accounted for 24% of deal activity, or 153 transactions. Roughly 100 of these acquirers completed only one transaction during the year, indicative of the breadth of firms this category covers. Over the last decade, we have tracked almost 650 unique buyers in this segment. It’s also likely that this is the most underreported piece of the M&A market, as local firm transactions often are never announced and involve buyers with little or no acquisition history.

In contrast to the PE-backed segment of the market, where the top four acquirers represent nearly 50% of the transactions within that segment, the top four buyers in the non-PE backed segment represent only 22% of the deals announced in this category.

PE Firms Dominate the Rest

This buyer segment includes PE groups (not their portfolio companies), underwriters, financial technology firms, specialty lenders, and other unclassified private investors and buyers. Activity within this buyer group decreased slightly from 45 transactions in 2018 to 39 in 2019. This segment represented only 6% of the transactions during the year, down slightly from 8% in 2018 but consistent with recent historical trends. The majority of these acquirers include PE firms making direct investments in brokerages. The three most active PE firms during the year included Reliance Global Group (three), Arch Capital Group, and The Carlyle Group. The only other buyer within this category to announce multiple transactions during the year was Tokio Marine HCC (two), a Japanese insurance company that has vertically integrated to acquire managing general agents and other brokerages. Tokio Marine also made investments in the carrier space, notably acquiring high-net-worth personal lines insurer Privilege Underwriters (Pure) from its PE sponsors, which included names familiar in the insurance space (Stone Point, KKR and others).

Public Brokerages: Few Players Remain

Public brokerages announced 52 deals during 2019, or roughly 8% of the total transaction count. Arthur J. Gallagher & Co. was the most active within this group, representing more than half the deals announced by these public companies (27 of the 52). Brown & Brown also completed a significant number of transactions (17) during 2019. Notably, Baldwin Risk Partners joined the ranks of the public brokerages by conducting an initial public offering in October 2019. While there have been several other insurance distribution IPOs over the past few years, it is uncommon, particularly for a top-50 brokerage such as BRP. Other insurance IPOs have included startup firms and insurtech-type businesses rather than traditional brokerages.

Employee Benefits: Demand Remains Strong

Demand remains strong for traditional employee benefits and consulting firms. More than 130 of these type of firms were sold during 2019, which represented almost 20% of all deal activity. P&C and multi-line firms accounted for more transactions on an absolute numbers basis; however, we believe that is more of a function of sellers in the marketplace rather than an indication of buyer preference. The following four firms were the most active buyers of EB-only firms during the year:

- Patriot Growth Insurance Services (23 transactions) includes many of the founding firms that were primarily employee benefits firms. The firm is actively diversifying into P&C through acquisition.

- OneDigital Health and Benefits (15 transactions) is unique in its singular focus on the employee benefits space. The company has been an active acquirer for a number of years, having completed 16 transactions in 2018 and more than 80 over the past decade.

- Alera Group (14 transactions) has continued to be a top-10 acquirer in the marketplace since its founding in 2018. Having been assembled organically from firms within Benefit Advisors Network, Alera continues to attract employee benefits firms looking to partner with others that have a similar specialty. The 14 EB-only firms represented more than half of Alera’s 24 overall announced transactions during the year.

- Hub (13 transactions) acquired a significant number of EB and consulting focused firms in 2019, accounting for nearly 30% of its transaction activity. In particular, Hub has acquired several firms that specialize in retirement and wealth planning for employer groups and individuals.

Profitability Drives Specialty Market

Specialty distributors include managing general agents, managing general underwriters, and program administrators (collectively referred to as MGAs) and wholesale brokerages. This segment represented 15% of the seller market in 2019, up from 12% in 2018. Buyer demand is strong in this category, with nearly 60 unique buyers accounting for the almost 100 transactions of this type. Demand is strongest, and thus value is highest, for those specialty firms that have a more profitable customer profile (i.e., low loss ratios). Gallagher was the top specialty distributor acquirer during 2019 through its subsidiary Risk Placement Services, with nine announced specialty targets. Nearly 30% of the transaction announcements by Risk Strategies Company were specialty distribution sellers (six of its 19 deals), landing it in a tie with Ryan Specialty Group for second most active within the specialty seller segment.

2020 and Beyond

It truly was an amazing 2019 for the industry, and we are entering 2020 with a strong tailwind. The external forces around us should help support organic growth and brokerage valuations. And with the new PE entrants from 2019 and what could be another six to eight sponsor changes, we expect deal activity in 2020 to far exceed our prior years. We will likely have north of 700 announced transactions, with valuations having the potential to set another new high-water mark.

Beware, however, of the looming concerns over potential capital gains rates increases that could result from a change in the White House. There are also fears of a pending recession that could impact exposure base and reverse the growth that is benefitting most brokerages in today’s market.

We, along with many firms that are considering a transaction in the next three to five years, will continue to closely monitor the 2020 election cycle. Any change of significance with our president or in Congress could have a significant impact on M&A activity in the second half of the year.

Investment banking services offered through MarshBerry Capital, Inc., Member FINRA and SIPC, and an affiliate of Marsh, Berry & Co., Inc. 28601 Chagrin Blvd., Suite 400, Woodmere, Ohio 44122, 440-354-3230

Disclosure: All deal count metrics are inclusive of completed deals with U.S. targets only. Scorecard year-to-date totals may change from month to month should an acquirer notify MarshBerry or the public of a prior acquisition. 2019 statistics are preliminary and may change in future publications. Please feel free to send any announcements to M&[email protected].

Source: S&P Global Market Intelligence, other publicly available sources and MarshBerry Opinion & Experience