Looking Back: 2019 Emerging Trends to Watch

1

Commercial P/C Market Conditions Continued to Harden

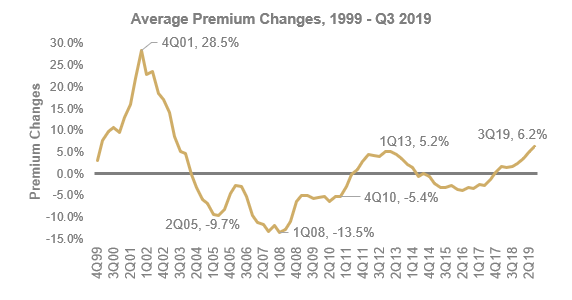

Commercial Property rates continued to rebound from several years of soft market conditions, according to results from The Council’s Commercial P/C Market Index. Starting in the second half of 2018, commercial P/C rates experienced notable increases in 2019. Premium pricing across all sized accounts increased 6.2% in Q3 2019, marking the eighth consecutive quarter of rate increases.

Read our latest Commercial Property/Casualty Market Index for Q3 2019.

2

Specialization Is Key

With signs of a firming market becoming clearer, brokers and insurers are pondering what can be done to differentiate themselves in this changing market. The answer seems to be specialization: “insurers will focus on core lines of expertise and profitability, and move capital and people to those lines. Companies will be forced to do the things that they are really good at, and let go of the rest,” according to Gary Grose, Argo Group EVP, producer management and marketing leader and head of Colony Specialty.

Take a look at our interview with Tim Turner, chairman & CEO of RT Specialty, on how true specialists will succeed in a firming market.

3

Social Inflation Pressure on Premium Prices Increases Further

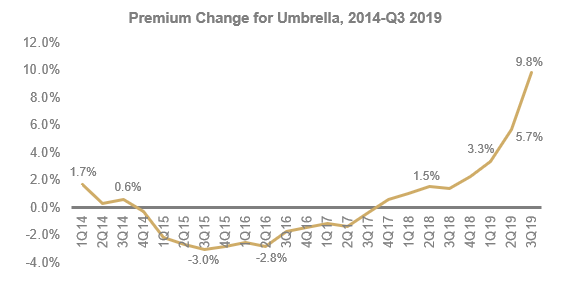

The rising costs of insurance claims resulting from societal trends and views toward increased litigation, broader contract interpretations, plaintiff friendly legal decisions, and larger jury awards are all part of social inflation and grew in 2019. While this costly trend impacts the broader insurance industry, we expect social inflation to continue to drive pricing upward in 2020. Negative public sentiment toward large businesses and corporations will likely lead to larger settlements and claims. Premium pricing for Umbrella insurance has likely been an effect from this trend as well – rates for umbrella insurance increased 9.8% in Q3 2019 alone.

One respondent from The Council’s P/C Market Survey noted “The Umbrella and excess casualty market is getting firm with the market pushing for increased premium… The increased frequency of nuclear verdicts, a.k.a. verdicts over $10 million, are on the increase, and the market is taking note of it.” Be on the lookout for Leader’s Edge coverage of social inflation in early 2020.

Top Trends in Insurtech:

1

Implementation

Over the past four years, the evolution of “insurtech” is best described using four words: Disruption (2016), Collaboration (2017), Partnership (2018), and Implementation (2019). In order to leverage the technology readily available, one must promote a digital culture and incite change before reaping the benefits.

2

API-fication of Applications and Platforms

While it’s clear the “insurtech” side of the business is building for the future, with APIs (application programming interfaces) being a key component of many companies, there is much frustration with API capabilities (or lack thereof) among both incumbents and new players. Between carriers, legacy AMS systems and brokerages, technology firms are receiving mixed signals on when our industry will be API-ready.

3

The Chicken or the Egg

What insurtechs

need to be successful is buy-in from both the carriers and the brokers –

without the right carriers and capacity, the brokers won’t get on board. But

without broker participation, carriers have no incentive to offer their

products on a platform, thus leading to the chicken-or-the-egg dilemma.” Until

we begin to see meaningful buy-in from brokers and carriers, market comparison

tools and ratings platforms will not be able to serve the whole industry.

Two of our Q&A’s this year touched on this question:

- Building a Next-Gen Toolbox for Brokers of the Future: Q&A with Erik Mitisek, President of Highwing

- Streamlining Small Business Insurance through Broker-Carrier Connectivity: Q&A with Mike Ferber, CEO, Dovetail Insurance

4

Real-Time Risk Management:

It’s

clear the industry is moving toward proactive, real time risk management as a

solution to offer front-end risk management services, more comprehensive

coverage, and better pricing. As we begin to see telematics, IoT, and open

source data being leveraged correctly, accurately, and instantaneously, the

commercial insurance sector will transition from a reactive, risk transfer

solution to a proactive, risk management solution.

Respondents from our first-ever Claims & Risk Management Benchmarking

Survey offered some methods they utilized to shift from a reactive stance to a

proactive one. These included: “partnering with their clients’ safety and risk

management teams to educate them and work with them to implement successful

programs and action steps” to help mitigate risk and reduce the likelihood of

accident or injuries, “seminars geared towards client education,” “using the

sales team to educate the customer more at the front end at the point of sale,”

and “scored risk management assessments and surveys in order to teach clients

how to identify, assess, and control their risk.”

5

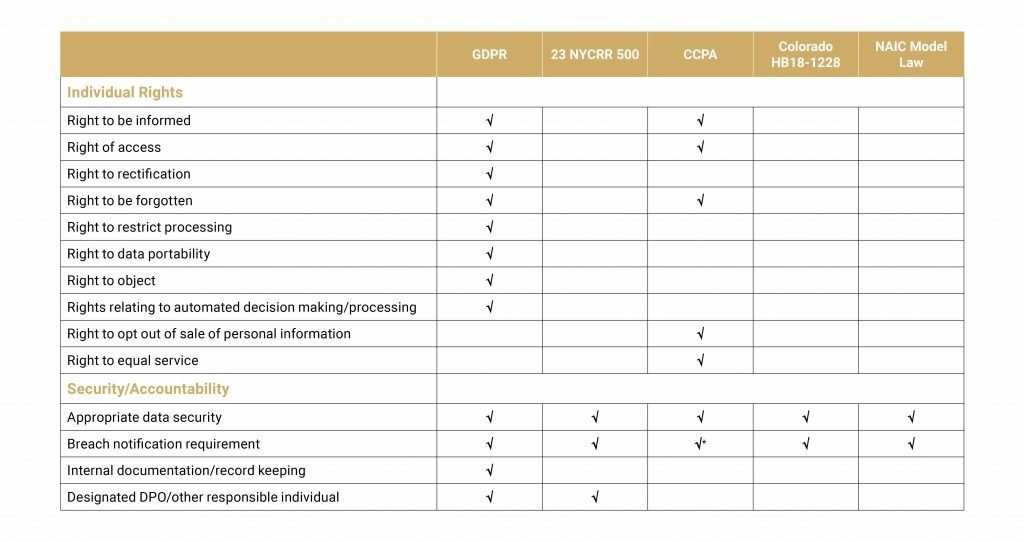

Cyber Regulation Alphabet Soup: GDPR, CCPA, NYDFS Rule, NAIC Model Law

Cyber regulation continued to evolve and mature in 2019, as new laws strive to put more power in the consumer’s hands. This trend began in 2018, as regulations such as the European Union’s General Data Protection Regulation (GDPR) and the New York District of Financial Services (NYDFS) Cybersecurity Rule came into effect. Since then, more states have followed suit, and we expect to see more strenuous regulation in 2020.

Of the new regulations in the states, the California Consumer Privacy Act (CCPA), due to take effect January 1, 2020, hews the closest to the draconian model set by the GDPR; 23 NYCRR 500, also known as the NYDFS Cybersecurity Rule, also imposes demanding requirements on those it binds, such as the third-party service provider (TPSP) clause (which includes brokers brokers), requiring TPSP’s to conform to all cybersecurity structures imposed upon them by any and all entities they serve. Fortunately, a good number of states—specifically, Alabama, Delaware, Michigan, Mississippi, New Hampshire, Ohio, and South Carolina—follow the less onerous model set by the NAIC Model Law.

6

Cyber Insurance Put to the Test

Recent cyber attacks, such as NotPetya and Petya, have brought the issue of “silent cyber”—potential cyber-related losses due to silent coverage under policies not designed to cover cyber risk—to the forefront. Lloyd’s of London has taken steps to confront the issue by requiring all policies not expressly granting or denying cyber coverage to add clarifying language regarding whether cyber risk is covered. But we have also seen a trend of insurers denying cyber claims for policies providing affirmative cyber coverage by citing the war exclusion, which has resulted in ongoing litigation brought by their insureds. These ongoing developments in the realm of cyber insurance are worth keeping an eye on as we move into 2020.

Last but not least, Happy New Year from The Council! Be on the lookout for the next Emerging Trends newsletter on January 29, 2020.