The Next Evolution of Group Captives

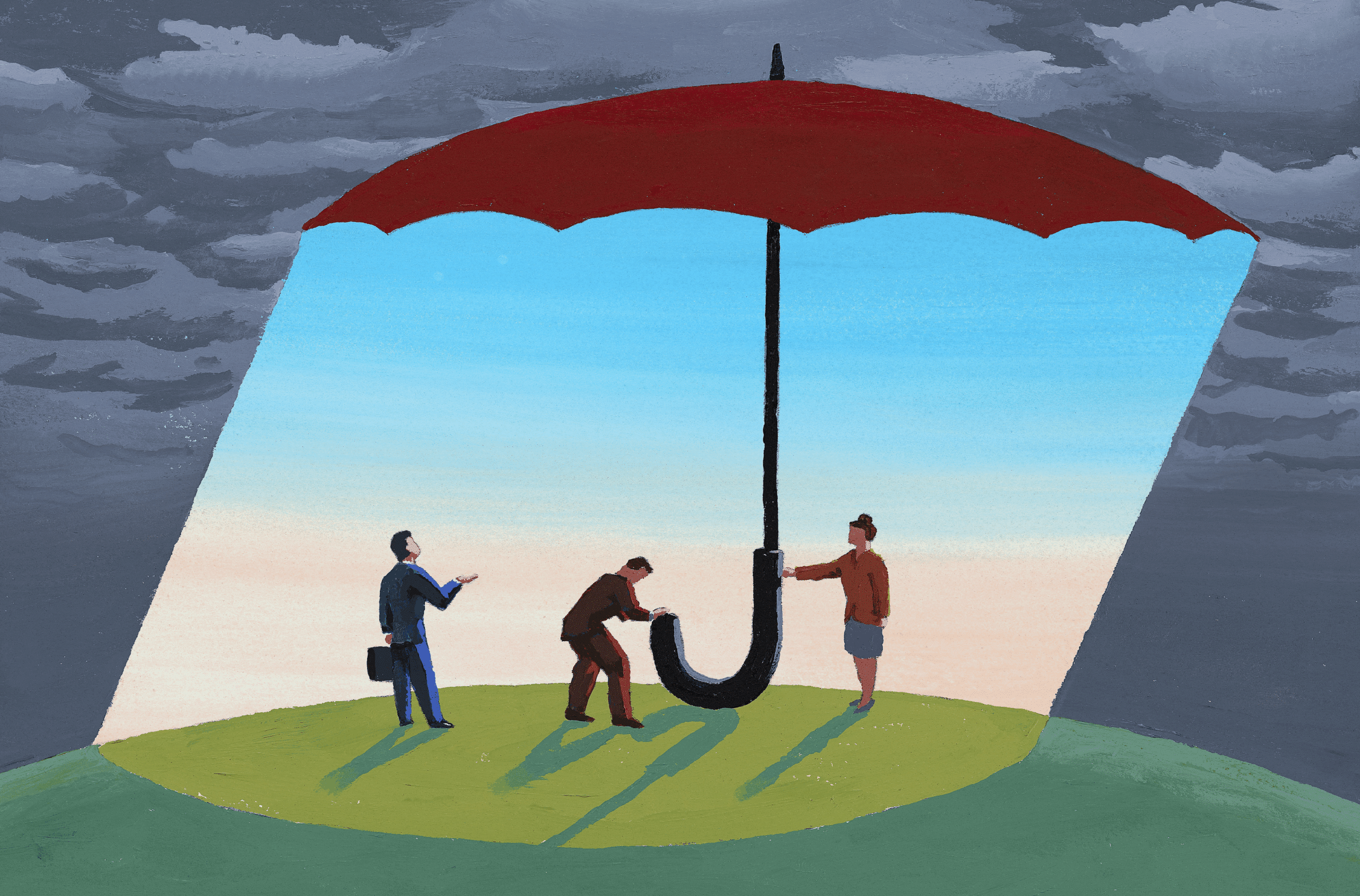

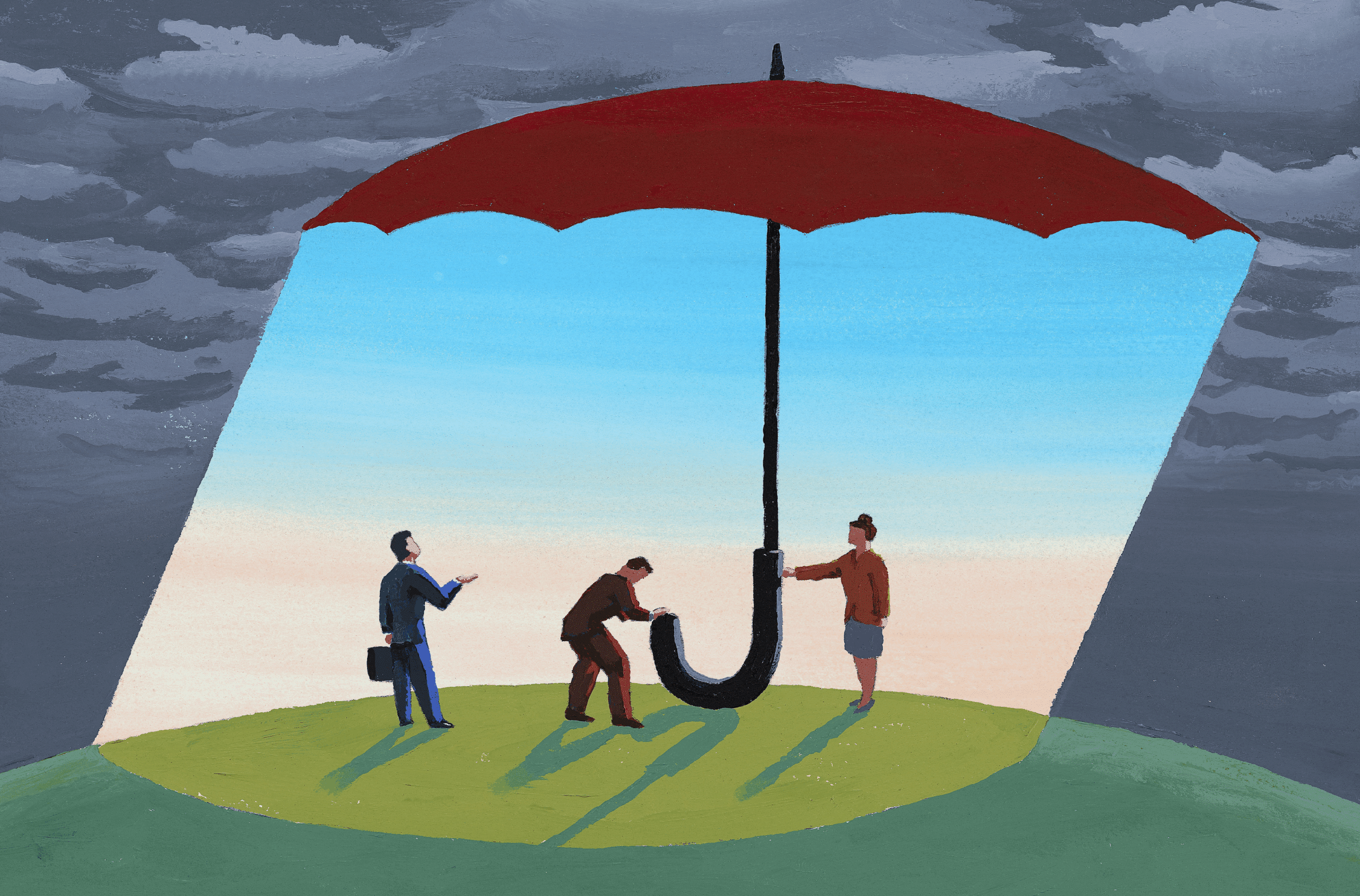

Captive insurance has for a century been a powerful example of how businesses can take control of risk management when traditional markets cannot provide a solution.

What began with single-parent captives— giving large corporations autonomy over their risk programs—has evolved into the collaborative model in which group captives offer small and midsize businesses similar benefits by pooling resources with firms carrying corresponding risk profiles. Now, we’re advancing into the next frontier for group captives: the complex world of specialty risk.

This next chapter is as much about innovation as it is about adaptation.

Group captives have proven their value in managing predictable risks, but as the world becomes more complicated, so do the risks businesses face. Whether it’s cyber threats, environmental liabilities, or regulatory uncertainties, the need for specialized solutions is growing. But before diving into what’s ahead, let’s revisit the origins of this transformative concept.

Captives as a Bold Alternative

Single-parent captive insurers emerged in the 1920s as a practical response to the limitations of traditional insurance. Large corporations, particularly in high-risk industries, found that standard coverages were either too costly or too narrow. By insuring their own risks, these companies gained control over coverage terms, stabilized premiums, and retained underwriting profits.

For big players, single-parent captives were a revelation. For small and midsize businesses, however, they were out of reach due to the model’s costs, administrative demands, and regulatory challenges.

By sharing structural costs and risk, group captives offered members the opportunity to access tailored insurance solutions without the financial burden of going solo.

In their early days in the late ’70s to early ’80s, group captives focused on straightforward risks such as workers compensation, general liability, and auto liability. These risks were relatively predictable, making them ideal for a shared model. For midsize businesses, group captives were a game-changer, offering cost savings, stable premiums, and a sense of control that had previously been reserved for larger organizations.

Amid rising premiums, constrained market capacity, and an intensified desire for control, businesses are increasingly turning to group captives as a compelling alternative. These innovative structures provide the dual advantages of financial stability and tailored coverage, granting organizations the autonomy to design their own risk management strategies. In an era marked by uncertainty and complexity, group captives stand as a refined and strategic solution, empowering businesses to navigate volatility with confidence and foresight while shaping their insurance future.

However, emerging risks—ranging from cyberattacks to supply chain disruptions— have exposed the potential limitations of the traditional group captive model. The question now is whether captives can adapt once again, this time to address the increasingly complex and specialized exposures that businesses face.

The Next Big Challenge: Specialty Risks

The expansion of group captives into specialty and complex risks marks an intriguing and ambitious new direction. Industries such as construction, healthcare, energy, technology, and transportation face risks that are increasingly intricate and multifaceted. They may benefit from more customized solutions and a comprehensive understanding of specific industry dynamics.

While the potential for group captives in these markets is enormous, the obstacles are equally significant. Traditional group captives may lack experience in areas that are central to managing specialty risks: advanced underwriting expertise, robust data analytics, dynamic risk management capabilities, and thoughtful capital providers. Additionally, the highly individualized nature of specialty risks means a “one size fits all” approach often applied by group captives may not be a good fit.

Despite these challenges, the opportunity is too compelling to ignore. Successfully addressing specialty risks could redefine group captives’ role in the insurance ecosystem, making them an efficient solution for businesses struggling to find this specific coverage elsewhere. This evolution would expand group captives’ scope and solidify their reputation as innovative and adaptable risk management tools.

Why Now? The Forces Driving Change

Technology is another key driver of this evolution. Advanced analytics and improved risk modeling make it possible to assess and manage complex exposures with greater precision. These tools are particularly valuable in specialty markets, where data-driven insights can mean the difference between success and failure. The advantage of advanced data analytics is even more pronounced in group captives, as members benefit from the data of the group. Collaboration among members remains a cornerstone of the group captive model. By pooling resources, expertise, and data, members can collectively tackle challenges that would be daunting on their own.

Finally, regulatory changes and shifts in the insurance marketplace have created opportunities for captives to step in where traditional insurers have struggled. Specialty risks, in particular, are often difficult for commercial carriers to underwrite, leaving an opportunity that specialty group captives are well positioned to fill.

The Road Ahead

The journey into specialty risks will require group captives to strike a delicate balance. On one hand, they must maintain their core principles of collaboration, cost-efficiency, and shared risk. On the other, they must develop new capabilities, including specialized underwriting teams, advanced risk modeling, and tailored coverage solutions. Specialty insurance companies are uniquely positioned to assist in this transition, bringing deep expertise in niche markets, a strong understanding of complex risks, and established frameworks for creating customized insurance solutions.

By solving the challenges of specialty risks, group captives can maintain their path of growth and innovation, continuing to provide businesses with cost-effective risk management solutions fit to their needs.