Consolidation Spreads East

The wave of insurance brokerage consolidation is spreading across the Atlantic Ocean, from U.S. to European markets.

While U.S. insurance firms have become much more consolidated in recent years, much of Europe remains highly segregated, with many smaller independent agencies.

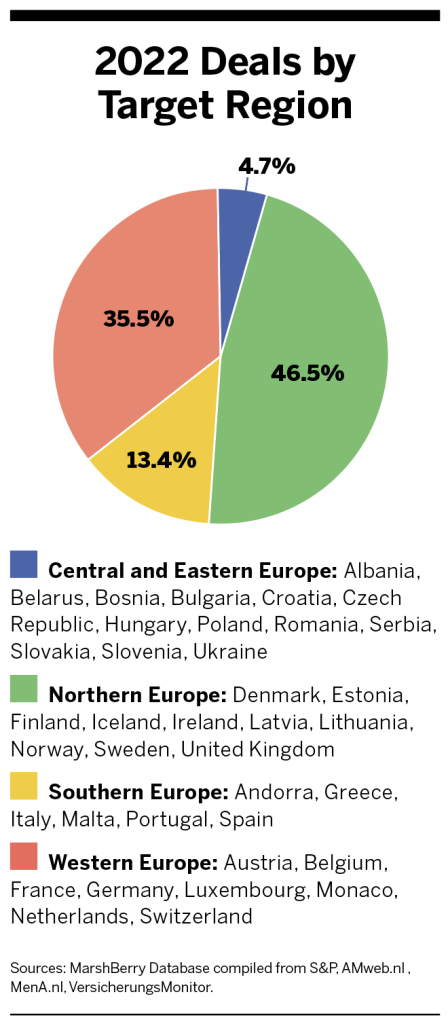

Consolidation in the European markets gained significant momentum in the United Kingdom about 10 years ago. Once the U.K. market became crowded with international and local buyers, the consolidation wave spread to other regions, quickly gaining traction in the Netherlands and then spreading further.

In the large and still highly fragmented German and French markets, consolidation is now well underway. As markets begin to become overwhelmed in certain areas, investors will look to expand their search to other, not yet consolidated countries, further spreading the trend.

Buyers in European Markets

Three main buyer types are competing to build their presence, each bringing unique advantages, leaving selling firms with tough choices.

Private-equity backed brokerages and private equity buyers are the main drivers of consolidation, accounting for 60%-70% of transactions. Their initial focus is to build a strong local presence through the acquisition of platform brokerages, with revenues surpassing $25 million. The platform brokerage is managed for strong growth, both organically and through acquisition of smaller firms, particularly in specialty or geographic areas. Private-equity backed brokerages provide varying degrees of autonomy, capital and tools to support growth.

Large international brokerages target firms of various sizes, from specialty brokerages and local market leaders to multi-country platforms. They bring a strong international network and easy access to wholesale and reinsurance markets.

Local heroes are strong, local brokerages that focus on building at a national scale by uniting smaller firms. They foster a culture focused on long-term success and capitalize on the advantage of proximity they have to local communities.

Notable Acquirers In Europe

A number of private-equity backed platforms are gaining a strong presence throughout Europe as they create pan-European platforms.

PIB Group, headquartered in the United Kingdom and backed by Apax Partners and Carlyle Group, expanded its European network with acquisitions in the Netherlands, Poland, Ireland, Spain and Germany.

Alpina, a fast-growing, PE-backed platform in the Netherlands, supported by Rothschild, has made several acquisitions in Belgium.

Groupe April, a leading French wholesale brokerage, signed a strategic partnership with KKR toward the end of 2022. KKR funded the €2.3 billion ($2.52 billion) transaction, at an estimated valuation of 15x EBITDA and over 4x revenues, on an all-cash basis, as banks were reluctant to finance the transaction, according to a Bloomberg report.

Challenges for European M&A Deals

Europeans tend to think more generationally and longer-term. Owners focus on passing down their family business to the next generation, with long lines of family ownership outweighing individual monetary gains.

For firms looking to create a pan-European business, it is important to be aware that, despite pan-European (EU) laws and regulations, Europe is not a single market. Local language and culture play an important role.

Similar to the United States, the European market faces multiple headwinds that are likely to impact valuations, but well managed brokerages will continue to be in high demand as a multitude of investors look to deploy capital in an industry that has proven to be resilient in turbulent economic times.

European debt yields rose quickly in the latter half of 2022, leading to a bifurcation in valuations, changing the market playing field. With higher debt yields putting pressure on brokerage valuations, competitive, well run platform brokerages will continue to underpin valuations for these scarce assets. Smaller, low-growth brokerages may see reduced valuations. As this environment persists in 2023, buyers who secured access to debt funding have a tactical advantage.

Projected Trends for 2023

Brokerage consolidation in Europe will continue at a sustained pace due to the fundamental attractiveness of the brokerage industry and amount of dry powder available within the investment community. Strong in-country PE-backed platforms and local heroes will increasingly look across borders with a goal to build multi-country or even pan-European platforms.

Although the inflationary environment will be a significant challenge for insurers, it will be a driver for rate momentum with an overall net positive for insurance brokerages.

Recent Activity: Coöperatie Licent Deal

Sixteen intermediary firms and existing cooperative MGAs merged into the Licent Cooperative. Backed by Dutch private equity investment company Gilde Equity Management, the group now has more than 30 branches with approximately 300 employees spread throughout eastern and northern Netherlands. The deal allows the 16 merging offices and additional partnering offices to operate under their own names with the support of the larger group to exceed growth expectations and reap the benefits of mutual support. The group is organized into clusters based on region and culture to maximize synergies, allowing branches to collaborate with those they best harmonize with.

This groundbreaking deal offers an alternative to the more traditional takeover by a large office or private investor, allowing firms autonomy while also being strengthened by the partnership. With the merging companies, Licent now ranks in the top 25 of insurance brokerages in the Dutch market.