Buyers Still Hungry for Deals

Once again, the insurance industry has demonstrated that it could possibly be the greatest industry in the world.

From what we have seen in 2021, the bar has been set higher than ever. From an improved unemployment rate to an uptick in GDP and a continuation of merger and acquisition (M&A) activity, the insurance industry continues to thrive with assertive buyers, a rise in specialty market activity, demand for employee benefits (EB), and notable increases in the wealth and advisory sector.

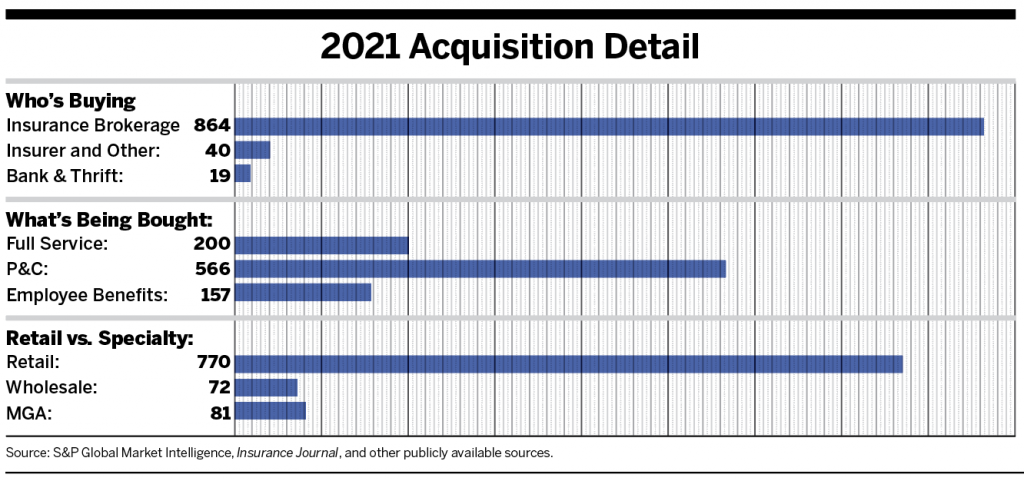

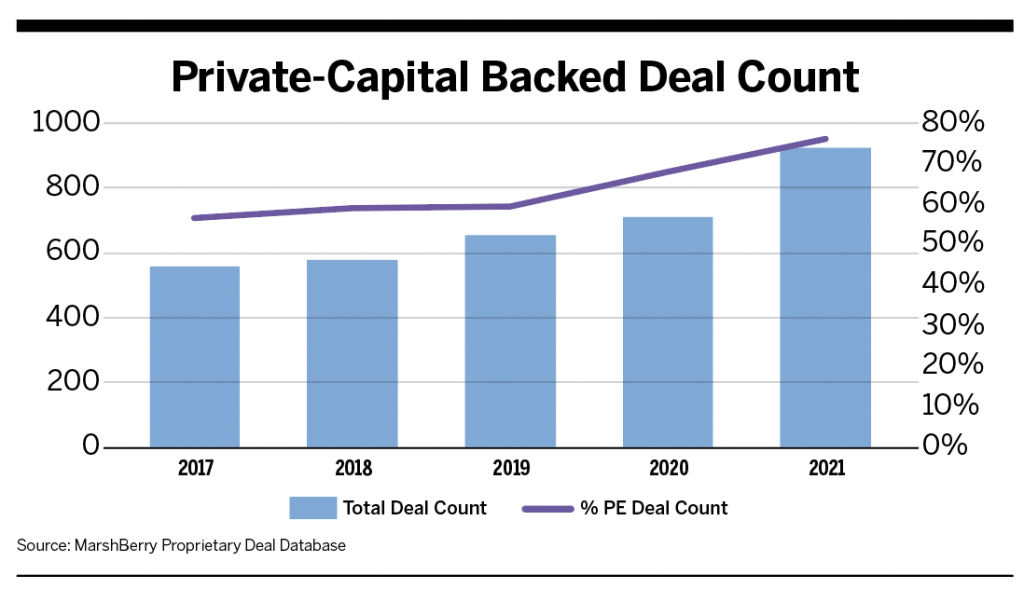

A new high watermark in M&A activity was set with 923 transactions reported as of Dec. 31, 2021.

Total revenue of the 100 largest brokerages in the United States more than doubled during the last year.

In 2020, 10 of the top 100 were acquired, and the trend of consolidation at the top continued in 2021.

In 2021, the industry experienced the most active consolidation year on record, driven by demand, inflation, potential tax changes, and a range of other favorable market conditions.

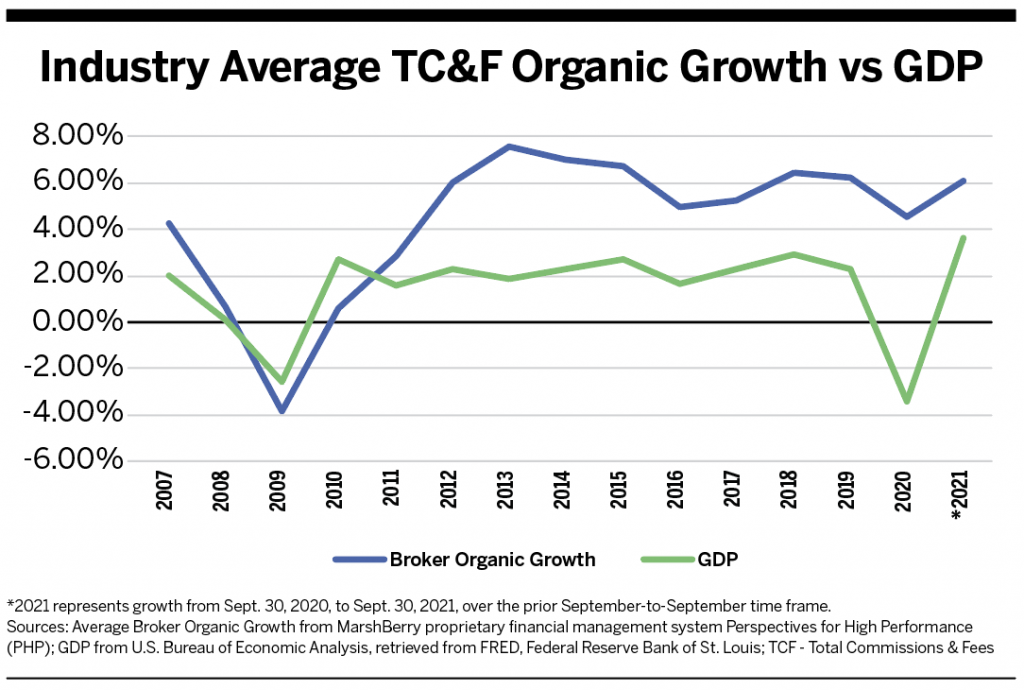

A Goldman Sachs 2021 outlook suggested positive movement in the economy across the board: higher labor productivity, greater earnings per share growth, higher research and development budgets, and more favorable demographics. Notably, U.S. equities produced a strong 28.7% return, with other developed countries posting a 19.9% return. This comeback amid the pandemic indicates resiliency and momentum, which Goldman Sachs expects to continue into 2022. In fact, it estimates that unemployment will decline to 3.1% by year-end. In addition, Kiplinger’s Economic Forecast in January 2022 suggested GDP will likely grow by 4% in 2022 following a rise of 5.6% in 2021. Since GDP is an indicator of whether an economy is growing or receding (which can guide investment decisions), the steady increase shows us that the risk of recession is low. However, inflation and higher interest rates are wild cards moving forward. While the Fed held short-term interest rates steady in January 2022, it signaled a hike by March. Fed Chairman Jerome Powell said in a release, “The economy no longer needs sustained monetary policy support.”

While the economy appears to be on a healthy trajectory, rising interest rates coupled with inflation could limit GDP growth, based on an analysis by the St. Louis Fed released in December 2021. The Federal Open Market Committee’s inflation target is 2%. Eighteen FOMC participants said the target rate will increase at least once in 2022, while only four participants said this in 2021. Already, we’re feeling pricing pressures as the U.S. consumer price index surged 7% in 2021, posting the largest 12-month, year-on-year increase since 1982, according to a January 2022 Reuters report.

What does inflation mean for the insurance industry? For property and casualty (P&C) insurers, inflation can impact liabilities, pricing and investments. A 1% inflation uptick can hike the P&C industry combined ratio by two to three points. If inflation is greater than anticipated in pricing, insurers might be short on funds to pay claims in the long term. In addition, long-term claims reserves may need to be augmented in future years. This may put pressure on carriers’ balance sheets if businesses try to mitigate inflation risk by holding on to assets like stocks and real estate, since this transfers more risk to their balance sheets.

Meanwhile, supply chain shortages are lasting longer than expected, in spite of positive economic movement. Labor costs are also up. These factors also could slow GDP growth in 2022.

Still, the insurance industry experienced new levels of M&A activity in 2021. This is the fifth straight year of hitting a record high in deal count, and it seems as though we may never reach a peak in activity (or valuations). Robust activity is expected to continue into 2022, as there are many irons in the fire already. In fact, in a Lincoln International survey of nearly 400 private equity (PE) investors, 62% of respondents expect a slight increase in deal activity in 2022. And even if 2022 is flat, it continues the unprecedented M&A activity over the last few years.

Heading into 2021, we weren’t sure if M&A deals would putter out or if unemployment would hold still as labor shortages plagued businesses of all kinds. But once again insurance proved its resilience as a nearly recession-proof, essential industry that continued to attract investors.

While 2021 saw record deal-making, the pace is expected to be steady this year based on an S&P Global report released in January 2022. Mid-market fund managers are mindful of high valuations and inflationary pressures, but they’re deploying record amounts of cash. PE managers are planning for another boom year in 2022 because of the number of funds in the market, continued interest in this industry, and positive fund performance. This doesn’t mean the market is free from risk, but demand will continue to push up valuations, as will volume, and buyers will likely be paying prime prices for attractive deals.

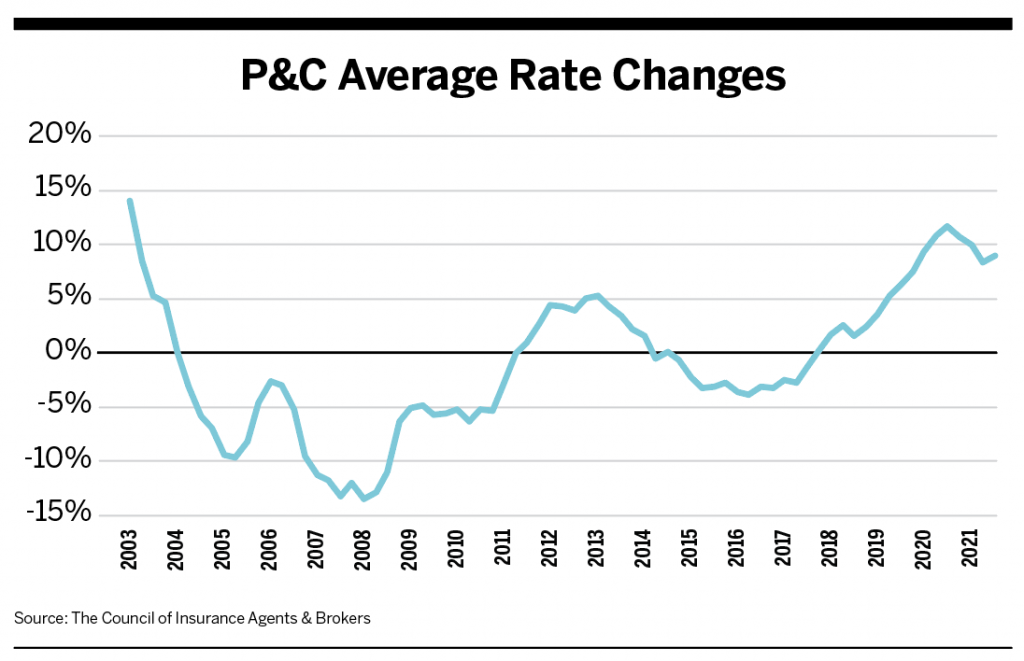

What we learn time and again about the insurance industry is that it is resilient—even in the toughest times. This very truth is also what attracts PE investors. And while the hard market continues into 2022 with increasing insurance rates, there is a measurable slowing of rate of increase as compared to 2020 and 2021. Nonetheless, these increases bode well for both carriers and brokerages, as carriers should further shore up balance sheets and brokerages generally benefit from increasing commissions.

U.S. Economy

Unemployment

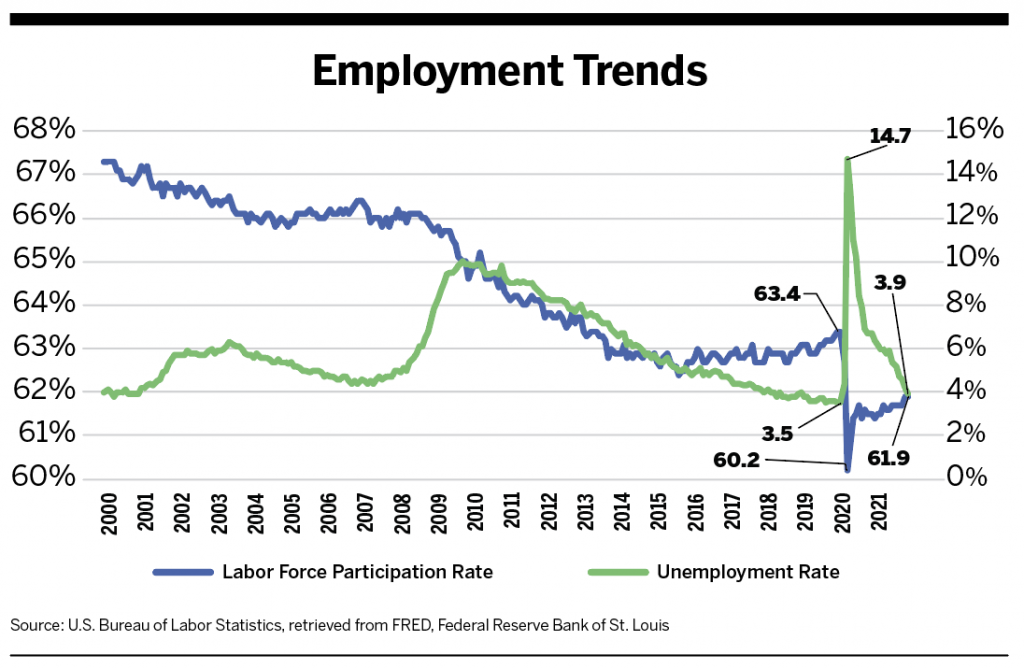

The unemployment rate saw a significant improvement at the beginning of 2021 with a rate of 6.4% compared to a peak of 14.8% in April 2020. During 2021, unemployment gradually recovered, ending the year in December at 3.9%, according to the Bureau of Labor Statistics (BLS). What does this mean? Overall, unemployment is slightly higher than the natural rate of 3.78%, as estimated in the Federal Reserve Bank of Philadelphia’s third-quarter 2021 Survey of Professional Forecasters. This indicates there is still room for improvement.

While unemployment rates improved during 2021, the labor force participation rate—that is the share of the working-age population who are either employed or actively looking for a job—changed very little from the June 2020 rate, staying in the range of 61.4% to 61.7%. The low was recorded in April 2020, with a rate of 60.2%. By December 2021, BLS shows the labor force participation rate registered at 61.9%. Still, it’s important to note that the rate is more than 1.5 percentage points lower than February 2020’s pre-pandemic level of 63.4%, as fewer eligible labor force participants choose to reenter the market. Also, prior to the April 2020 decline, the labor force participation rate had not shrunk below 62% since 1977.

GDP

Consumer spending drove GDP increases—likely facilitated by federal stimulus payments and loosened social distancing during the second quarter. In the first quarter, expenditures on motor vehicles and parts were the largest contributor to consumer spending, while spending on food services and accommodations was the leader in the second quarter. In 2021, real GDP rose 5.7% from 2020 levels. Non-residential fixed investment also supported growth throughout the year, particularly investment in equipment and intellectual property products, though contributions were mainly during the first half of the year, according to the U.S. Bureau of Economic Analysis.

Market Conditions

P&C and Health Premium Rates

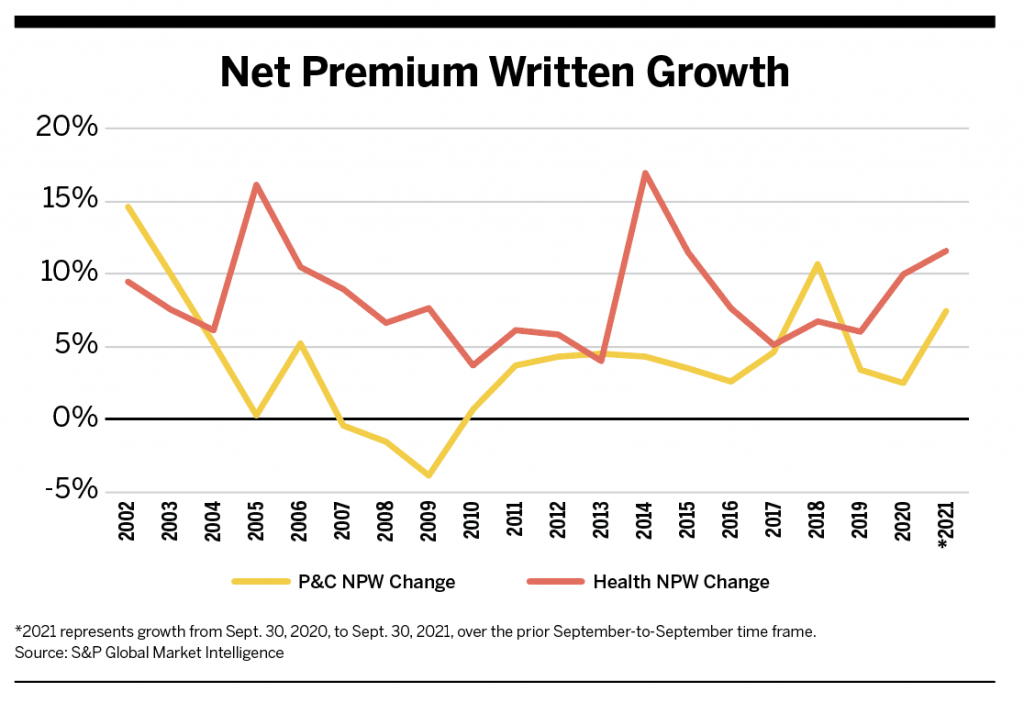

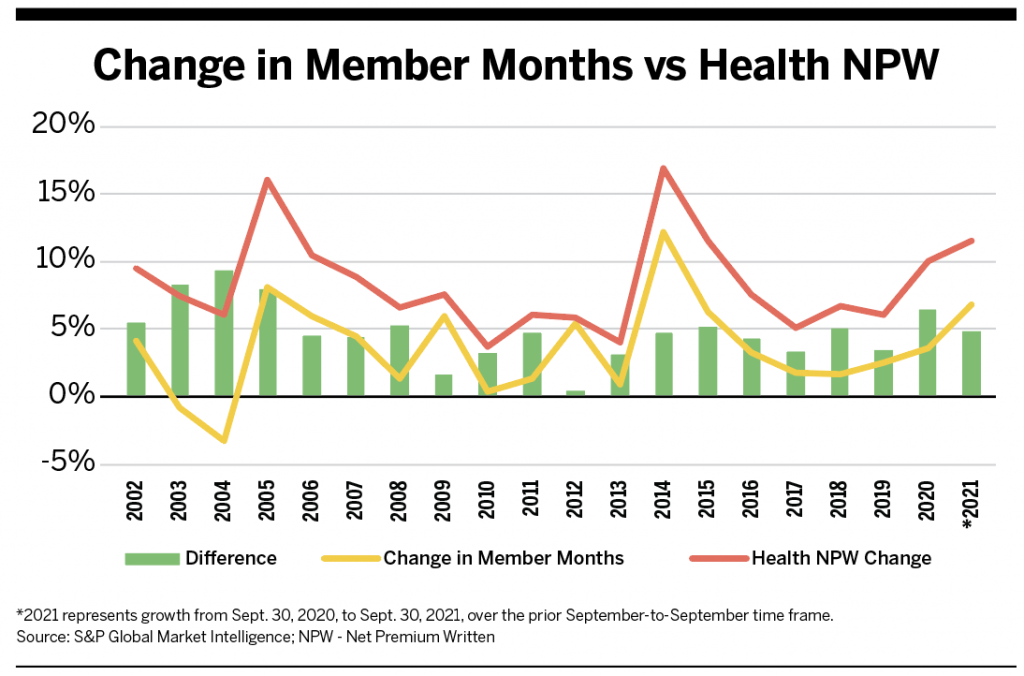

Rising premium pricing rates drove increases in both P&C and health markets. During the 12 months ending on Sept. 30, 2021, net premiums written (NPW) for P&C insurance increased 7.4%, while NPW for the health insurance industry grew 11.6%.

Average commercial lines premium pricing for all accounts has been rising at a rate greater than 3% since the first quarter of 2019, according to data from The Council’s P&C Market Index Survey. Through the third quarter of 2021, pricing increases were led by growth in premiums for large accounts (those with commissions and fees greater than $100,000). In spite of recorded price increases dating back to fourth quarter 2017, uncertainty surrounding the COVID-19 pandemic fueled that trend. Each quarter from second quarter 2020 to first quarter 2021 saw average pricing growth of more than 10%, according to The Council’s P&C Market Index Survey. While rate increases fell below 10% in the second and third quarters of 2021, they were still elevated and exceeded the prior year by 8%.

P&C rate increases in 2021 were driven primarily by premium increases in umbrella, D&O, commercial property, employment practices, and commercial auto due to an increase in the number and severity of claims. Additionally, cyber insurance displayed the largest price increases throughout the year, driven by the growing frequency and severity of cyber attacks. Results from the survey point to widespread reductions in underwriting capacity as carriers have tightened underwriting practices and tend to be more disciplined.

Even as health insurance rates (due to increased medical costs) continue to rise, these factors aren’t solely responsible for rate changes, according to a Cigna Form 10-Q filing. Specifically, because of the passage of the Affordable Care Act (ACA), beginning in 2014, all medical health insurers with aggregate new premiums written of more than $25 million were subject to an annual fee. This ACA fee was suspended in 2017, reinstated in 2018, suspended in 2019, reinstated in 2020, and permanently repealed for 2021 going forward. For the most part, this fee was passed through to insureds’ premiums.

Inflation

The Consumer Price Index (CPI) is a primary measure of U.S. consumer inflation, and it rose by 7% from December 2020 to December 2021. This represents the fastest 12-month increase since June 1982.

Higher than anticipated inflation presents a challenge to the insurance industry, because it’s a threat to reserve levels and underwriting profitability. For instance, the rising cost of building materials makes repairing or replacing damaged structures more expensive.

For a historical look at how the insurance industry performs during inflationary times, we can rewind to the 1970s and 1980s. Then, inflation was a significant problem, with CPI increases peaking at 14.6% in March 1980. Subsequently, the industry recorded combined ratios well above 100%, indicating underwriting losses. During this time period, total premiums written rose 22% (1985 and 1986). This indicates large increases in pricing. While premium levels translate to higher commissions, profitability generally is tied to contingents, bonuses and profit shares. However, the current situation doesn’t mirror the 1980s. Inflation has begun to rise to high levels only in the past year, rather than being elevated during the last decade. Additionally, industry reserves are in a much stronger position now than they were 30 years ago. If inflation persists for an extended period of time, however, carriers could be hit with reduced profitability and less capital adequacy, resulting in pressure on agency commissions.

Organic Growth

In 2021, brokerages’ average organic growth recovered to 6.1%, which is in line with pre-pandemic levels, as the economy rebounded, including a GDP increase of 3.6% during the same period.

2021 Transaction Review

A new high watermark in M&A activity has been set with 923 transactions reported as of Dec. 31, 2021. The total deal count represents a 22.6% increase from 2020 and a compound average growth rate (CAGR) of 16.8% since 2018.

The heightened activity was largely driven by firms that were concerned about a potential federal capital gains tax increase. While tax legislation was not enacted in 2021, there are still some looming concerns that changes could occur. Although the potential for significant tax increases has declined slightly, retroactive tax legislation is a possibility and was a concern driving some year-end deal activity.

Sellers flocked to the table, with the major driver being insureds’ evolving expectations. Since the beginning of the pandemic, insureds have demanded that their brokers act as consultants, and they want much more than a transactional relationship. The client is looking for an advisor who can help provide strategic guidance and risk management or mitigation services. This creates a conundrum for insurance brokerages. They must keep investing in tools, resources and talent in order to compete. Also, they face the decision whether to use significant amounts of cash flow to invest in these resources or to partner with a firm with the infrastructure already in place. The build-versus-merge decision is bringing a lot of firms to the deal table. This dynamic is not going away, and we believe the market is going to continue to be very robust.

Broker Buyers

For 2021, private-capital backed buyers accounted for 703 of the 923 transactions (76.2%), as they continued expanding their presence in the marketplace. Independent agencies accounted for 109 deals (11.8%) of the total deal count. This portion of the total announced transactions is consistent with 2020 yet an overall decline since prior years. From 2015 to 2020, independent firms completed 23.2% of deals on average.

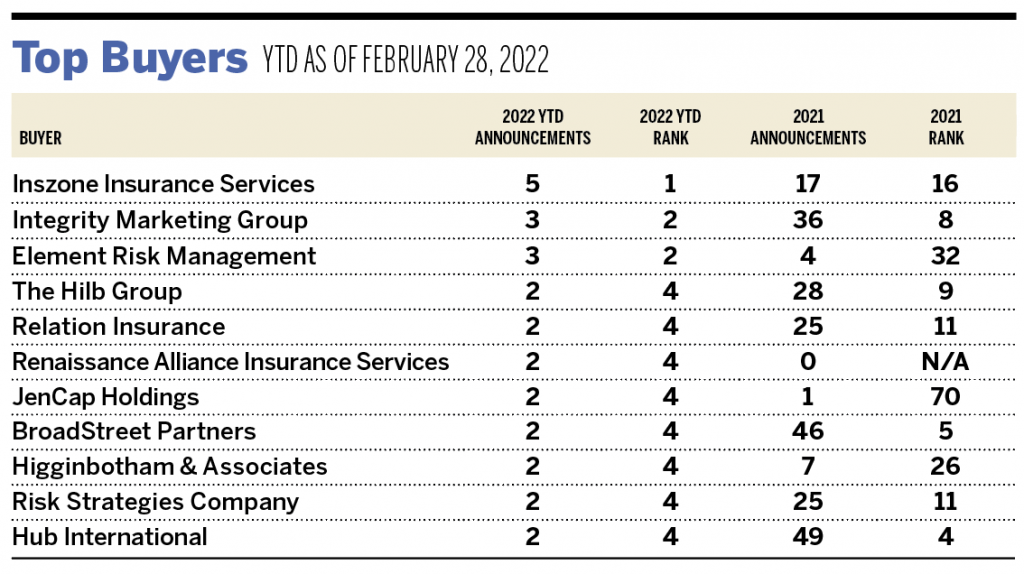

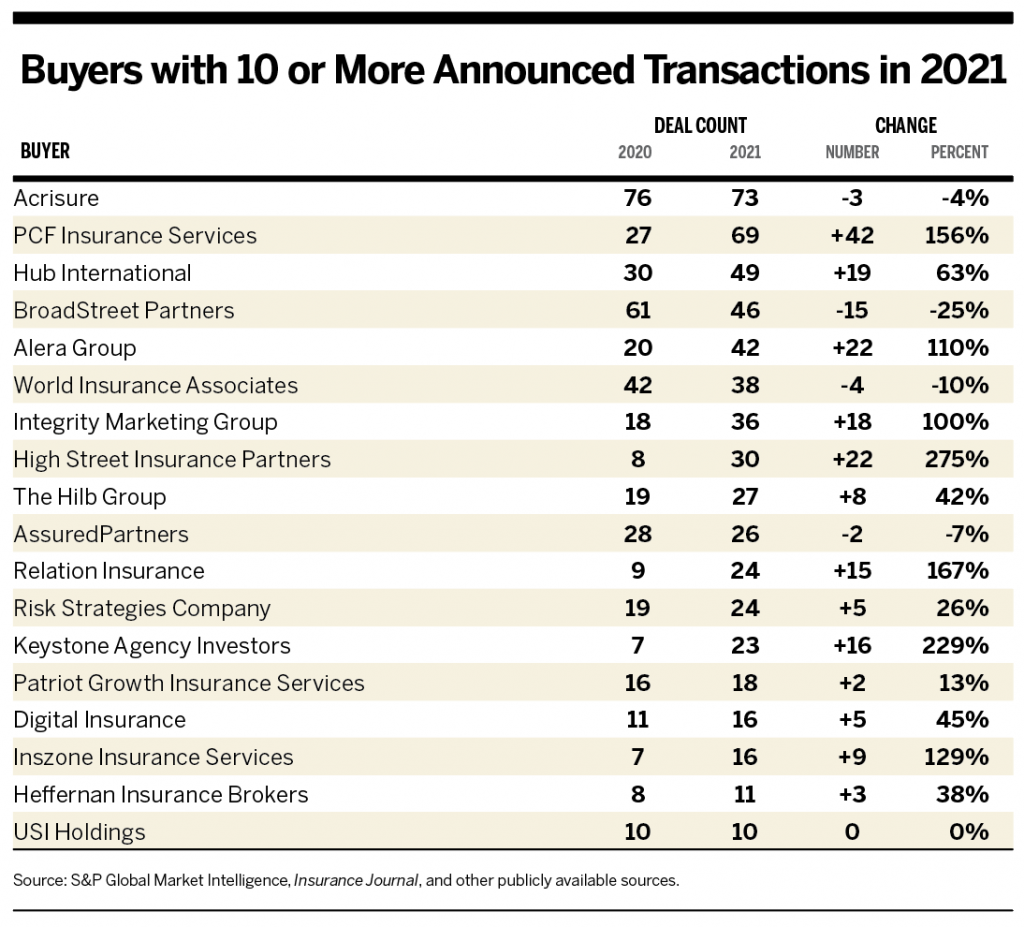

The top three most active U.S. buyers in 2021 were Acrisure, PCF Insurance Services, and Hub International. Their combined transactions represented 22.1% of the 923 total transactions. The top 10 most active buyers completed 479 of the 923 announced transactions (51.9% of total).

Some of the more notable announced transactions involving larger strategic brokerages as buyers throughout 2021 include:

- Jan. 7: Higginbotham announced that it acquired Lipscomb & Pitts Insurance, the largest independent insurance firm in Tennessee. Lipscomb & Pitts provides full-service commercial and personal insurance, employee benefits, and other products. Financial terms of the transaction were not disclosed.

- Jan. 21: AssuredPartners announced its acquisition of Murray Insurance Associates. Based in Lancaster, Pennsylvania, Murray is a provider of solutions for risk management, insurance, employee benefits, wealth management, third-party administration, and human resources. It has 170 employees and $31 million in annualized revenue.

- March 5: AmWINS Group announced its acquisition of Worldwide Facilities. AmWINS and Worldwide are the largest and fourth-largest wholesale brokerages in the United States, respectively. The addition of Worldwide will result in the combined firm having more than 6,000 employees and $24 billion annual in placed premium.

- April 5: Marsh & McLennan Agency announced that it acquired PayneWest Insurance. Based in Missoula, Montana, PayneWest has 26 locations across the Northwest and employs over 700 people. PayneWest will operate as Marsh & McLennan Agency’s Northwest regional hub under PayneWest’s CEO, Kyle Lingscheit.

- May 1: IMA Financial Group announced that it is partnering with Bolton & Company to expand its brokerage services to California. The combined brokerage will employ 1,200 people and generate over $300 million in revenue, making it a top-20 insurance brokerage in the United States.

- July 1: BRP Group completed its previously announced acquisition of RogersGray. RogersGray is a Massachusetts-based multi-line agency with annual revenue of approximately $38.8 million.

- Sept. 8: Alera Group announced a definitive agreement to merge with Propel Insurance Agency, one of the nation’s top-50 largest privately held insurance brokerages. Headquartered in Tacoma, Washington, Propel’s leading property and casualty capabilities bolster Alera’s presence in the Northwest and Southeast regions, complementing the company’s current insurance and financial services offerings.

- Oct. 1: BRP completed its acquisition of Jacobson, Goldfarb & Scott (JGS). Based in Holmdel, New Jersey, JGS is a specialty brokerage and MGA primarily focused on commercial insurance services in the middle market nationwide. With annual revenue of about $43.3 million, JGS has a keen focus on the construction and habitational real estate industries.

- Oct. 27: IMA announced its acquisition of Parker, Smith & Feek (PS&F) to expand its footprint in the Pacific Northwest, Alaska and Hawaii. PS&F’s acquisition is expected to double IMA’s healthcare specialty and bolster its construction practice. PS&F was the 49th-largest brokerage in the United States (according to Business Insurance) and is IMA’s largest partnership to date.

- Nov. 4: BRP announced its acquisition of Wood Gutmann & Bogart Insurance Brokers (WGB). Based in Tustin, California, WGB is a full-service middle-market brokerage providing a complete range of commercial, personal and employee benefits insurance products and services, with annual revenue of approximately $29.7 million.

- Dec. 1: The Hilb Group announced its acquisition of PSA Insurance & Financial Services. PSA is a top-100 agency with a range of employee benefits and commercial and personal insurance products and services. The team of over 150 individuals is expected to bolster Hilb’s presence in the mid-Atlantic region of the United States.

- Dec. 2: BRP announced its acquisition of Construction Risk Partners. CRP is a specialty retail insurance distributor that serves business owners, developers, general contractors, designers and subcontractors across the country. The firm has annual revenue of approximately $32.6 million.

- Dec. 31: Alera acquired Foa & Son Corporation. Based in New York City, Foa is a full-service brokerage with expertise that includes multinational business, retail and apparel, as well as precious metals, fine art and jewelry. Foa has been listed on Insurance Journal’s list of “Top 100” P&C agencies since 2013.

- Dec. 31: One80 Intermediaries, a subsidiary of RSC Insurance Brokerage, announced its acquisition of Pearl Insurance. Pearl offers coverage for affinity groups, with a primary focus on life and health products as well as professional liability. Pearl also maintains delegated biding authority with several carriers that offer differentiated products with strong loss ratio performance.

PE Investment

Some of the more notable transactions involving private equity funds investing in platform brokerages announced throughout the year include:

- July 1: Socius Insurance Services announced that it had received a significant growth investment from Abry Partners. Socius is a P&C and management liability wholesale brokerage based in San Francisco. The partnership is aimed to accelerate Socius’s growth strategy and accelerate its acquisition activities.

- Sept. 21: GI Partners announced the recapitalization of Patriot Growth Insurance Services. Summit Partners, which originally invested in Patriot in 2019, as well as Patriot management, will retain significant minority ownership positions in the company. Patriot was formed in 2019 and in its second year of operation was ranked in the top 40 largest insurance brokerages in the United States by Business Insurance. The transaction closed in the fourth quarter of 2021.

- Jan. 11, 2022: Warner Pacific announced its partnership with Lovell Minnick Partners. Warner Pacific provides a full suite of benefit administration products and services to the small group, large group and Medicare health insurance markets. M&A will be a key focus for Warner Pacific as it builds out its national general agency platform and expands into new insurance coverage and service offerings.

U.S. Buyers Expanding Internationally

In addition to the rapid consolidation that the M&A marketplace is seeing in the United States, similar deal activity is being observed overseas from U.S.-centric buyers. In fact, international deal activity for U.S.-based buyers has grown at a CAGR of 35% since 2017. Pinning down the driver for this activity isn’t so easy. However, buyers’ appetites for quality insurance brokerages have only increased, and expanding their footprint into new territories represents a large component to these firms’ growth strategy.

Top-100 Brokerage Consolidation

Ten of Business Insurance’s Top 100 Brokers of 2020 were acquired, equating to roughly $645 million in annual revenue. The M&A trend continued in 2021, as several firms from the top-100 list, such as PSA Insurance & Financial Partners, Foa & Son Corporation, and Propel Insurance, were acquired throughout the year.

The industry is seeing bigger investments from private equity firms, with several investors closing on some of the largest funds of all time. Hellman & Friedman Capital Partners, majority investor in Hub International, closed on Fund X with $24.4 billion raised. Alera Group and Patriot Growth Insurance Services also completed significant recapitalizations with Genstar Capital and GI Partners, respectively, in 2021.

Capital investment in the insurance industry is growing alongside the total revenue of the largest insurance brokerages. Total revenue of the 100 largest brokerages in the United States more than doubled during the last year. This highlights the industry’s resilience and why it is attractive to investors.

What’s next? Expect a continued infusion of capital that will be directed toward more M&A to drive growth in market share across the country’s largest brokerages.

More Activity From Experienced Buyers

A total of 157 buyers announced that they completed transactions in 2021, down from 169 in 2020. This is interesting considering that 69 firms completed two or more acquisitions in 2021 versus 57 buyers in 2020. What does this mean? One theory is that fewer independent firms are buying while experienced buyers are taking full advantage of a hyperactive M&A market and continuing to expand in the insurance distribution marketplace. Basically, the pandemic reminded the financial community that insurance brokerage firms are a great investment. Private firms might not be able to keep up with the speed and appetite of these more active buyers and are thus being squeezed out of the market during times of high activity.

The Most Active Buyers: Private Capital

In 2021, private-capital backed buyers continued a multi-year trend of dominating the insurance distribution M&A market. Total deals by these buyers has increased at a CAGR of 26.9% since 2018. Private capital remains interested in insurance distribution because of the industry’s continuous, strong resiliency. After all, people must continue to buy insurance, regardless of the state of the economy. And with a low-risk profile, the risk-adjusted return on investment is high.

Private-capital buyers included 41 unique insurance brokerages, plus 12 “other” types of private-capital backed buyers, such as investment firms. Compared to 2020’s 48 unique brokerages and 14 “others,” 2021 saw a small concentration in PE buyer count.

Comparing announced transactions among this buyer segment in 2021 to 2020, several firms showed significant increase in M&A activity last year, while a few experienced a decrease.

Firms that experienced a 100% or greater increase in M&A buying activity included PCF Insurance Services, Alera Group, Integrity Marketing Group, High Street Insurance Partners, Relation Insurance, Keystone Agency Investors, and Inszone Insurance Services. Combined, these firms accounted for an increase of 144 total announced transactions compared to 2020.

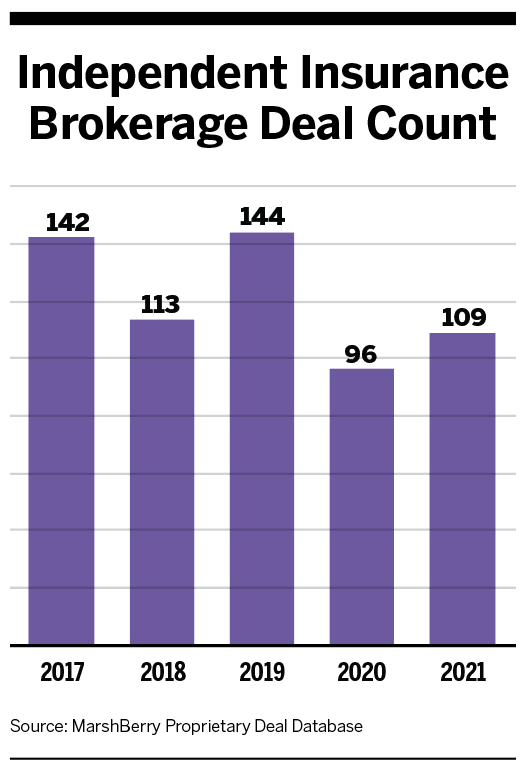

Independent Firms: Less Active?

Just fewer than 65 different independent firms without known private-capital backing announced transactions during 2021. This is a minor decline from 2020, when about 70 firms in this group announced transactions. In 2021, independent firms overall had 109 transactions, or 12% of deal activity (down from 14% in 2020).

The top five independent acquirers accounted for 28 announced transactions and 26% of the buying activity in this segment. This contrasts with the PE-backed segment of the market, where the top five acquirers represent 32.4% of the transactions within that segment, with 299 total transactions.

The notable change in this buyer segment is how many announced only one transaction. In 2021, 42 of these acquirers completed only one transaction during the year, while 2020 saw 59 complete only one. Does this indicate less deal activity among independent firms? It’s possible that they are less able to compete on price as easily as their private-capital and publicly traded counterparts. Keep in mind, however, there have been many hundreds of buyers in this segment during the last 10 years and it’s likely this is the tip of the iceberg for this segment, since many local transactions are not announced.

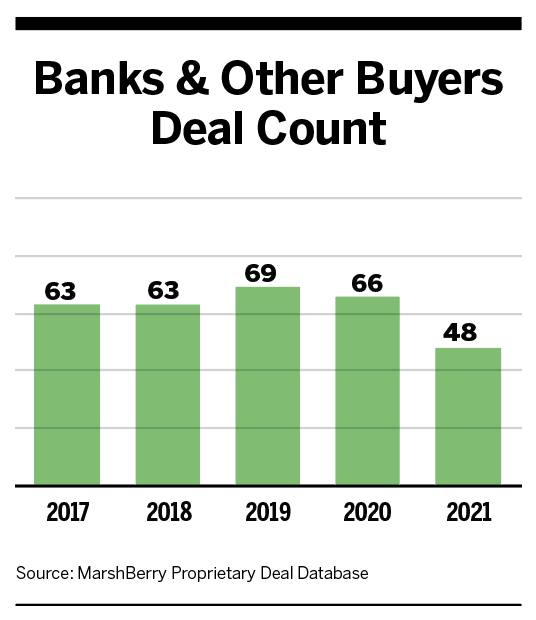

Banks & Other Buyers: Finding Competition

The “other buyers” segment includes PE groups (not their portfolio companies), underwriters, financial technology firms, financial institutions, specialty lenders, and other unclassified private investors and buyers. Activity within this buyer group decreased from 66 transactions in 2020 to 48 in 2021. This segment represented only 5% of the transactions during the year, down from 7% in 2020 and trending down since 2019. Last year, eight firms in this category completed more than one transaction, while six did so this year.

The most active acquirer of this segment was Colony Bankcorp, with four announced transactions. On Aug. 1, 2021, Colony Bankcorp acquired The Barnes Agency, an Allstate appointed consumer property and casualty insurance agency in Macon, Georgia. In conjunction with the transaction, the bank formed a new subsidiary that operates under the Colony Insurance brand. In the following month, Colony Bank acquired three additional Allstate agencies.

Other active buyers in this category include:

- First Mid Bancshares (3 transactions)

- Truist Financial Corporation (3 transactions)

- Eastern Bankshares (2 transactions)

- Porch Group (2 transactions)

- Reliance Global Group (2 transactions)

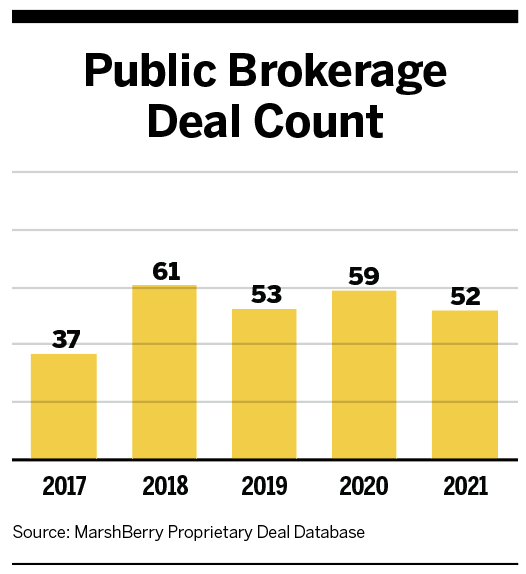

Public Brokerages: Driving Growth

Public brokerages announced 52 deals during 2021, or roughly 6% of the total transaction count (down from 8% in 2020). Like 2020, Arthur J. Gallagher was the most active within this group, with 42% of the announced transactions from this group (22 transactions). Baldwin Risk Partners (BRP) showed stability in its buying activity, with 13 total transactions (same as 2020), and Brown & Brown completed nine transactions.

Members of this segment continue to be confident about their M&A strategy contributing to growth. For example, Gallagher mentioned during its fourth-quarter 2021 earnings call that M&A in 2021 accounted for more than $1 billion in newly acquired annual revenue with approximately 35 term sheets being signed and prepared (totaling approximately $200 million in annualized revenue). BRP said that acquisitions helped drive its third-quarter 2021 growth and was confident that its M&A strategy was in place to meet its target of $100 million to $150 million in revenue in 2022 while also achieving the high end of its acquired revenue target for 2021. Brown & Brown also continued its high demand for insurance brokerage mergers and acquisitions.

Last year, the big news among public brokerages was Aon’s proposed $30 billion acquisition of Willis Towers Watson Public Limited Company (WTW). The transaction was expected to close in the first half of 2021. However, the potential transaction was scrapped in July after the U.S. Department of Justice filed a lawsuit to block the combination on antitrust grounds. Aon and WTW officially had been working on the deal for 16 months.

Employee Benefits: Demand Holds Strong

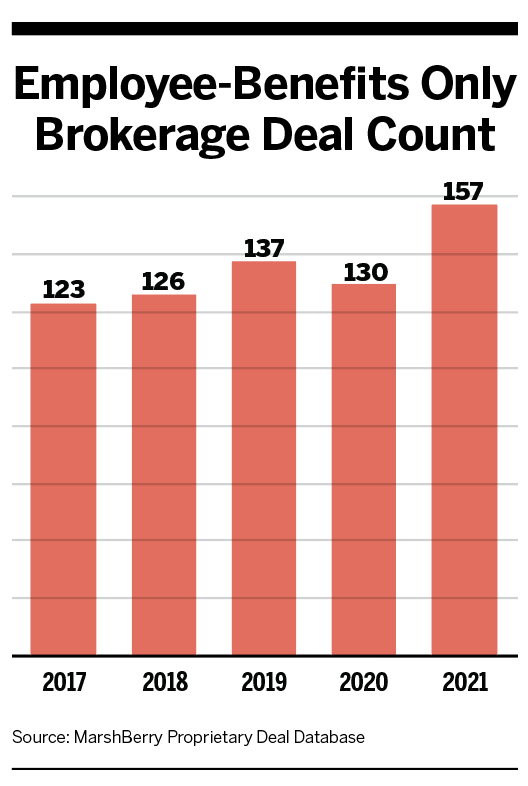

With 17% of all deal activity, transactions involving traditional employee benefits and consulting continue to be a priority for many buyers. The number of transactions is up 20.7% since 2020 (157 compared to 130). This trend is not expected to slow down or change in the coming years.

Three firms completed more than 10 transactions with EB firms during 2021.

- OneDigital (16 of its 16 transactions) continued its focus on EB firms in 2021.

- Hub International (14 of its 49 transactions) experienced a significant uptick in acquiring EB firms compared to only five in 2020.

- Alera Group (13 of its 42 transactions) has continued to be a top-10 acquirer in the EB marketplace since its founding in 2018.

Specialty Market: Riding A Wave

Specialty distributors continued to outpace the rate of consolidation of their retail brokerage counterparts, growing total M&A transactions from 123 in 2020 to 153 in 2021. This represents an increase of 30 deals compared to 2020 and is bolstering the four-year CAGR of 28%.

The specialty sector’s consolidation rate is so high that MarshBerry estimates that about 8% of independent specialty brokerages and agencies sold in 2021.

Growth in transaction activity during the last year was driven solely by private-capital backed organizations, which went from 62 deals in 2020 to 92 deals in 2021. All other buyer types collectively registered 61 deals in 2020 and 2021. Private capital continued to drive transaction activity in the specialty sector. In 2018, there were 27 private-capital backed specialty deals, in comparison to 87 deals reported in 2021. This represents a 240% increase during this period.

Also notable, some of the industry’s more acquisitive buyers sat on the sidelines in 2021 while they participated in large M&A integrations. In their absence, 2021 transaction activity grew for other players.

- Integrity Marketing Group had 36 transactions. IMG has led the specialty-buyer leader board for three years running and is the only buyer focused solely in the life and health sector.

- One80 Intermediaries is the runner-up again in 2021, with eight transactions.

- Scottish American recorded seven transactions.

- Risk Placement Services completed five transactions.

Another notable trend in 2021 was the size of specialty firms involved in M&A transactions. Ryan Specialty Group’s acquisition of All Risks in 2020 spurred a trend of large independent firms at the deal table. Larger specialty firms are generally $20 million or greater in net revenue.

A continuing trend for larger specialty players is their notable amount of delegated authority responsibilities from carrier partners. Delegated authority involves managing general agents/underwriters and program managers, for example. With wholesale brokerages having largely consolidated at this point (with a few notable exceptions), the delegated authority arena is the next area of focus in the specialty consolidation arena. While there are few larger independent players on the binding authority side, the temptation of high valuations, challenges on market capacity fronts, and capital accessibility have encouraged many of these firms to sell.

Will the specialty market “consolidate out”? Not exactly. This unique segment is positioned to regenerate and is often the breeding ground of the overall insurance distribution marketplace. With the highly publicized insurtech sector gaining traction, there is a wave of new specialty ventures.

Also supporting new growth is fronting carriers’ reinvestment in MGA startups. A re-emerging interest in these investments is likely to encourage the development and growth of future specialty organizations.

Overall, the specialty M&A marketplace continues a hot streak with no signs of slowing in 2022.

Traditional Brokerages & Insurtechs: Who’s Buying

Last year was a record year for insurtech capital, with total funding at approximately $13 billion globally. How has a massive influx of money into this segment influenced the M&A activity of traditional, U.S.-based insurance brokerages in 2021? During the last year, insurance brokerages made up fewer than 10 acquisitions of tech-driven brokerages, based on MarshBerry’s analysis of transactions announced by S&P. Most of the insurtech transactions occurred in the specialty segment (managing general agents, program administrators, wholesale brokerages, etc.). Also, nearly all acquired firms were established insurance brokerages that are highly specialized and technology-enabled.

With the exception of a few notable transactions (CoverHound and CoverWallet being the most prominent), we have not seen traditional brokerages acquire pure insurtech firms. A couple of factors are at play:

- Relative lack of maturity of insurtech firms due to their technology platforms still being under development

- Sky-high valuation expectations relative to their historical profitability.

Another aspect that likely plays a role is the generally short-term investment hold period of private-capital sponsors. This is relevant because it can take several years for insurtech firms to generate meaningful profits to offset upfront valuations.

The technological transformation of this sector is still in its infancy, and existing players continue to follow a playbook that has generated attractive returns for more than a decade. With the tech transformation expected to gain steam in the next couple of years, expect growing pressure for buyers to adopt the common investment hypothesis, which will lead to greater investments in technological infrastructure and higher demand for strategic acquisitions. The end result: higher valuations.

In fact, there are already early signs of these trends in today’s marketplace. While the average deal multiples across the industry have consistently trended up in the last 10 years, there has been a disproportionate increase in the valuation of high-growth brokerages with a strong technology platform during the last 24 months. Buyers are also demonstrating more flexibility when it comes to deal structuring in these situations.

While funding volume reached an all-time high in 2021, valuations of publicly listed insurtech firms have deteriorated within the last 12 months. The significant shift in market sentiment has resulted in some insurtechs deciding to delay their IPOs or other capital-raising. There is a chance this development in the public markets could trickle down to the private markets, ultimately impacting valuations of insurtech firms that are not living up to their hype.

Expect some interesting market dynamics in the near future due to an increasing pressure on traditional brokerages to accelerate tech transformation coupled with an evolving market environment and tightening monetary policies.

Retirement & Wealth Advisory

PE-backed and strategic acquirers have historically dominated acquisition in the retirement and wealth advisory space. However, recently, insurance brokerages have expanded into this arena and are quickly establishing a foothold through a noteworthy increase in M&A activity.

Insurance brokerages have invested millions of dollars in their M&A origination and integration capabilities. In expanding into the advisory vertical, they can leverage their existing platforms to efficiently absorb new firms and increase top-line growth.

Notably, an investment advisory offering allows insurance brokerages to assume the coveted role of trusted investment advisor. This allows them to take a holistic approach to risk management by managing assets and liabilities across the client life cycle while at the same time deepening the client relationship. Further, insurance brokerages have spent years honing their cross-selling skills, initially focusing on P&C and employee benefits. They now seek to apply this expertise to wealth management.

In certain cases, insurance brokerage firms look to the advisory marketplace to create economic value over and above the fundamental value of the acquired businesses. The valuation differential between the largest and smallest advisors is currently significant, making it possible for large brokerages to benefit from pricing arbitrage when acquiring smaller advisory businesses.

In 2021, there was an almost fourfold increase in M&A activity on the part of insurance brokerages in the retirement and wealth advisory vertical, with 26 closed transactions compared to seven in 2020.

The most active acquirers based on deal count were Hub International, which added 12 retirement advisory firms to its base, and OneDigital, which closed seven retirement and wealth advisory firm acquisitions during the year. Other noteworthy acquirers were Alera Group and NFP and its Wealthspire Advisors, which together closed five deals. A new entrant was Galway Holdings, parent company of Epic Insurance Brokers & Consultants, which acquired MAI Capital Management in August 2021.

While most insurance brokerage firms sought to expand their offering into retirement and wealth advisory, one firm exited the space. In late 2021, Lockton sold its U.S. retirement business to Creative Planning.

2022 Outlook

It’s clear that 2021 set a new high watermark in M&A activity, but what is expected for 2022? Throughout 2021 there was concern over a potential federal capital gains tax increase, which didn’t end up happening. While that risk still exists in 2022, the concern is overshadowed by other political and economic factors. Ultimately, M&A activity is expected to continue at the pace set in 2019 and 2020, with somewhere between 650 and 750 announced transactions. Much of the M&A activity is driven by time-tested trends related to resources, capabilities and strategy. At the end of the day, it’s the demands and expectations of the insureds that are at the forefront of these trends—they have created an expectation that their broker act as a consultant, not simply someone who helps them purchase insurance products. The insured is looking for someone who can help provide strategic guidance and risk management/mitigation services. To stay ahead of this, insurance brokerages must continuously invest in tools, resources and talent to compete. It becomes a “build-versus-merge” decision—brokerages must decide whether they want to use their own cash flow to make these investments or to partner with a firm that has already done it. This is bringing a lot of firms to the deal table, and the market will likely continue to be very robust.

Other MarshBerry contributors: Matt Brickner, financial analyst; George Bucur, director and specialty practice co-head; Courtney Ferrara, vice president; Eric Hallinan, director; Luke Hickman, data consultant; Kim Kovalski, managing director; Tobias Milchereit, vice president; John Orsini, director