Headed for Catastrophe

Prior to the passage of the Affordable Care Act (ACA) in 2010, health insurance plans traditionally used mechanisms like annual or lifetime maximums to avoid paying for people with expensive care.

The ability to attach these restrictions to health plans limited insurers’ liability whenever an employee in a group had a costly chronic condition or suddenly needed high-cost acute care, such as a premature birth, which can cost from $76,000 to $600,000 for six months of treatment.

Stop-loss insurance for self-insured employers expanded following passage of the Affordable Care Act.

Many of the most expensive patients aren’t even employees—they are dependents.

What keeps insurers and stop-loss providers up at night are specialty pharmaceuticals and gene therapies.

These maximums served as a de facto stop-loss, shielding employers and insurers from catastrophic payouts. When the ACA mandated these safeguards be removed, stop-loss insurance became the new protection for self-insured employers.

In recent years, the number of catastrophic claims has been on the rise.

Financial services company Sun Life collects data for an annual stop-loss report from its member companies. Its 2020 report tallied information from 2,600 businesses and performed analysis on 40,000 employees who had stop-loss claims over a three-year period. Almost one quarter of businesses with 50 to 100,000 employees had someone with a $1 million claim. Since 2016, the number of $3 million-plus claims has doubled. Claims on the steeper end of the scale—those between $2 million and $3 million—are growing at the fastest rate: 44% during the study period. Their highest claim was $8.1 million.

“At one point, to see a $1 million claim was almost unheard of,” says Steffan Moody, vice president and global accounts director at Oswald Companies. “If it happened, it was a huge deal around the office. It was like the roof was on fire. Now it is more common. We had 15 $1-million-plus claimants in our book of business in 2021.”

Moody attributes some of the rise to the medical community in general. He says it is difficult to believe that high-cost claims just randomly began increasing “rather significantly” shortly after lifetime maximums disappeared.

“I’m not saying it wasn’t a good decision for individual consumers,” he says, “but I don’t believe hospitals, pharmaceutical companies, etc., didn’t have a light bulb go off and say, ‘Oh, we have open checkbooks now.’ Is it a coincidence? Or a business decision made by those charging for treatment?”

Ongoing Events

Some of these high-cost claims are single events, hitting a plan for one year and not impacting the beneficiary again, but others are ongoing.

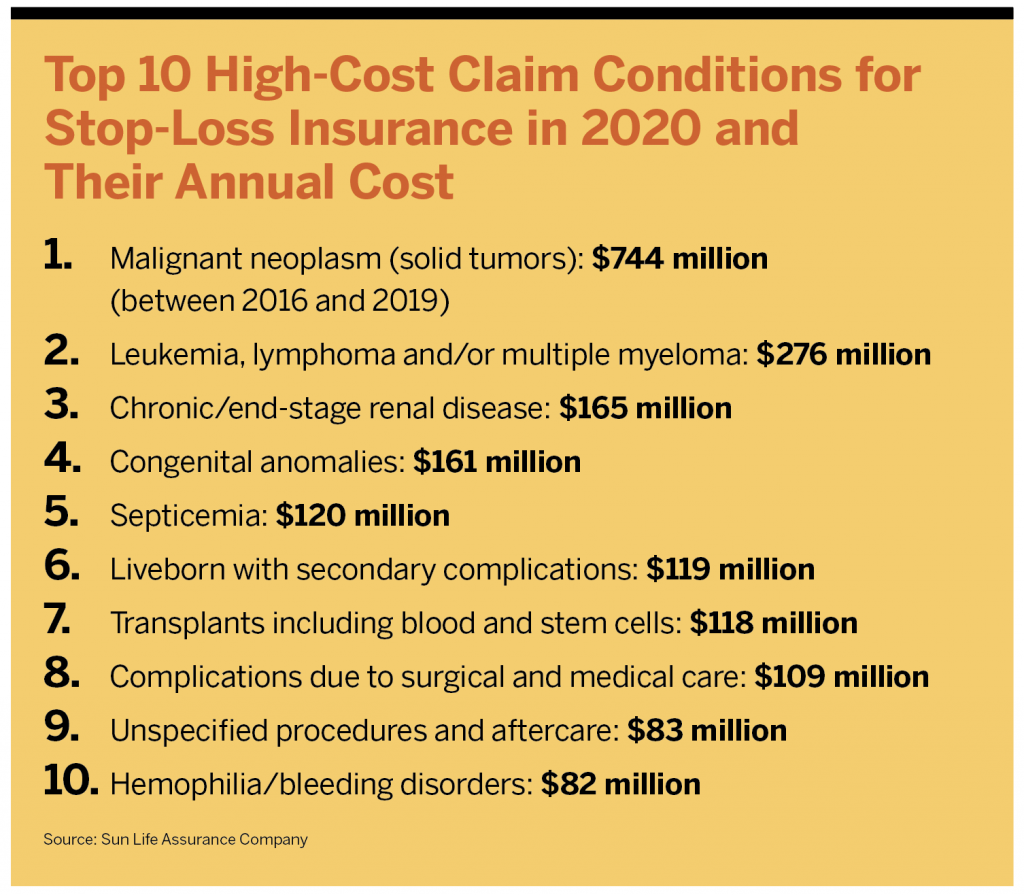

According to the Sun Life report, the top costliest conditions have remained steady in recent years. They are malignant tumors, which cost $744 million between 2016 to 2019; leukemia, lymphoma and/or multiple myeloma, which cost $276 million; chronic renal disease at $165 million; congenital anomalies at $161 million; and sepsis at $120 million. In fact, the top 10 costliest conditions account for one-half of all stop-loss claims. Many of these conditions will be treated over months or years, causing stop-loss to kick in annually.

These conditions and medications are ubiquitous—no employer is safe from taking a major hit. According to the Sun Life report, employers in their groups had a 72% chance of having a stop-loss claim in one of the top 10 costliest conditions in any year. And many of the most expensive patients aren’t even employees—they are dependents. Children under 2 years old accounted for just 6% of total claims, but they represented more than one quarter of million-dollar claims. Forty-six percent of claims of more than $1 million were for people younger than 20 years old.

Though the list of top conditions remains somewhat stable, a new addition, “unspecified procedures and aftercare” came in at $83 million, ranking number nine in 2020. In 2021, COVID-19 claims were the fifth costliest. Jen Collier, senior vice president of health and risk solutions at Sun Life, says early in the pandemic the company did not see a lot of high-cost claims related to COVID-19 because the major disease states were appearing in elderly or immunocompromised patients. As the disease progressed, it has moved into the workplace.

“We have seen a very big shift from early- and mid-2020 to 2021 and 2022 in COVID claims,” Collier says. “Especially among people who have comorbidities—they have been on the rise significantly for us. These are people who have long hospitalizations, are on a ventilator and in ICUs. We are seeing management while hospitalized and management and treatment of comorbidities as well.”

Big Pharma

The costliest conditions tend to be chronic ones that need long-term, intensive care. But what keeps insurers and stop-loss providers up at night are specialty pharmaceuticals and gene therapies.

“There are tons that have come out and others in the pipeline that have high price tags associated with them,” says Andrew Peel, Mercer’s national stop-loss leader. “They do a great job, but they come with high price tags and are a huge driver in the million-plus claims space.”

These pharmaceuticals are so expensive because of the technology it takes to create them, particularly gene therapies. Also, many of the conditions they treat are relatively rare.

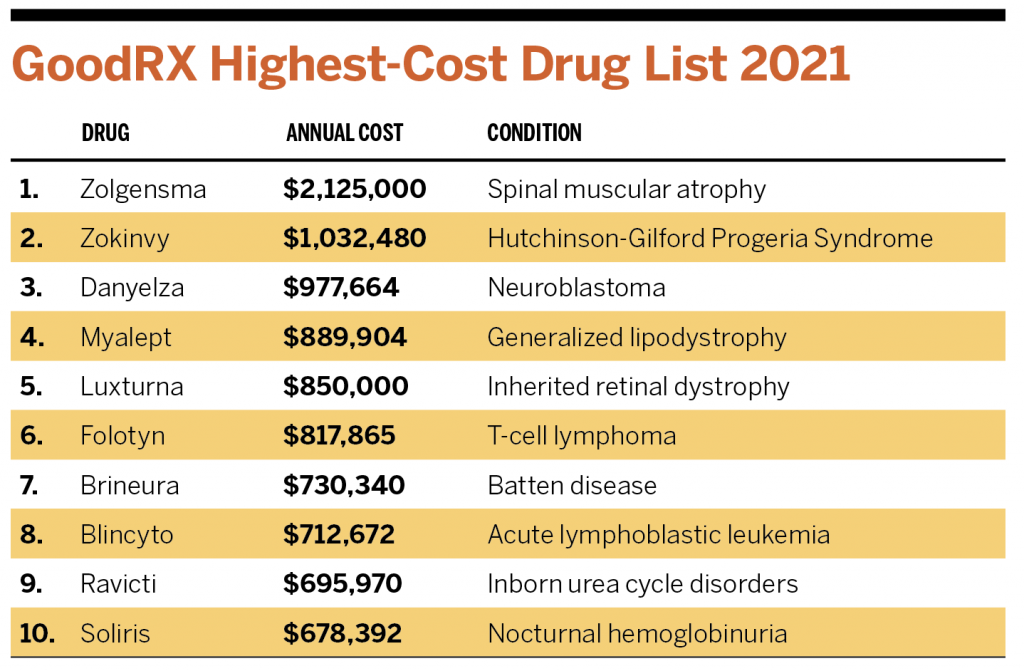

A couple of the top prescriptions concerning insurers are Zolgensma, for young children with spinal muscular atrophy, and Luxturna, a gene therapy used for treating vision loss in children. One infusion of Zolgensma costs about $2.1 million. A treatment of Luxturna costs $850,000.

Stop-loss carriers track high-cost medications on the horizon—drugs in the process of seeking approval from the Food and Drug Administration (FDA). Peel says one medication everyone is keeping an eye on is Roctavian, which is used to treat hemophilia A. In 2020, the FDA decided to delay its approval. Peel says he expects Roctavian to be on the market later this year or in early 2023. The estimated price tag for one dose is between $2 million and $3 million.

In 2018 and 2019, many in the insurance industry were watching as some high-cost medications made their way through clinical trials, Collier says. But when COVID-19 hit in 2020, the rapid spread of the virus interrupted their approval process as funding was funneled toward vaccine development.

Carriers are now watching the market trying to determine when some of these gene therapies and medications will hit and what they may cost. “We anticipate toward end of 2023 three to five of these drugs coming to the market, and there is quite a pipeline, which is feeding into people’s concerns about sustainability in the market,” Collier says. “When they keep coming to the market and there is no path or structure to how they are priced, we begin to wonder when there will be a tipping point where employers can’t afford to pay what we would charge to include these in a plan.”

Tom Belmont, U.S. health and benefits practice leader at Gallagher, says part of the fear is the unknown: Insurance carriers know clients will likely have some of those top-10 most expensive medical conditions hit at some point. Carriers know how to rate for end-stage renal disease and cancer and can plan for them, spreading the cost out over time. But if, for instance, a 100-life group has a sudden $8 million claim, Belmont says, “You can’t, as a stop-loss carrier, charge enough to cover that claim. What we’ve seen in the industry over the last five years is self-funding has become a vehicle that isn’t just for employers with more than 5,000 lives.”

Self-funding is being seen in a range of employer sizes, but according to Kaiser data, self-funding in the 3-199 worker range still has the smallest uptake of any other size company. It did see growth, however, from 16% in 2010 to 23% in 2020.

Belmont says many of these high-cost medications are meant to be curative. His concern is whether that will be true over time or if people will need additional therapies five or 10 years down the line.

The priciest gene cell therapies have low incidence levels, so stop-loss carriers haven’t yet needed to make many adjustments to their product offerings. Peel hasn’t heard that carriers have begun refusing to cover any of the medications, but as the medications come to the market in increasing numbers, carriers may view them differently. Even though the conditions may be rare, the Sun Life study found that 58% of employers have at least one stop-loss claim associated with an injectable drug annually.

“Cancer, in totality, is our biggest spend over the past four years: 25% of our claims paid were for that,” Collier says. “We had four cases of Zolgensma last year for our entire block of business, so the threat is very small, but if it hits you, it hits you.”

Therapies that treat conditions with higher incidence rates are also something carriers are watching. Hemophilia A, for instance, is found mostly in males and occurs in about one in every 5,000 male births in the United States, according to the Centers for Disease Control and Prevention. About 400 babies are born with hemophilia A every year. Peel says it wouldn’t surprise him if stop-loss carriers chose not to cover high-priced medications that are used for more commonly treated conditions in the future.

The Market Responds

The ripple effect of the cost—and the impending increase in the number—of specialty pharmaceuticals on the market is small but growing. Some reinsurers and stop-loss providers are adjusting plans and implementing requirements to help mitigate catastrophic losses. But others see an opportunity for a new product.

Large employers have historically not been users of stop-loss insurance, because they have more cash and can cover the occasional large claim. But Collier says they have begun to rethink that employer segment, to potentially put in place stop-loss plans with a high deductible—like $1 million—so they have some form of catastrophic coverage.

Moody says some regional reinsurance carriers have started requiring clients to decide at the beginning of a contract renewal whether they want gene therapies included on their stop-loss policy or not. If they want them, the rates are set higher upfront. If they decline, they can’t decide to include them even when renewing plans in future years.

“If they want these, the carrier is loading the rates in the event that it may happen. They are padding the book for the entire stop-loss block in case one person needs one of these medications,” he says. “And if they don’t help fund the pool all year long, they don’t get a second chance.”

Some carriers are requiring businesses to decide when they sign a contract if they want to “laser” any of their claimants. This is a practice where stop-loss vendors assign larger deductibles to high-risk employees. At renewal the next year, this can leave the employer on the hook for any costs above that deductible in future years, should the employee continue to need expensive treatments.

Just five years ago, employers could find carriers with contracts that excluded new lasers. But Peel says it’s becoming less frequent that stop-loss carriers are willing to make those agreements. According to a report by Stealth Partner Group, for the first two quarters of 2021, one third of its business block had lasers applied to some claimants.

One tool that has hit the market to help businesses manage high-cost pharmaceutical claims is supplemental stop loss—insurance on insurance.

RxPharmacy Assurance (sister to RxBenefits) began offering a stop-loss supplement to self-funded employers late last year. The product “sits on top” of an existing stop-loss plan, limiting what the plan or employer must pay for large claims, says Paul Fortunato, senior director of clinical initiatives at RxBenefits and product owner of RxPharmacy. Eligible expenses are paid up to $1.25 million annually and $3 million over a lifetime.

The product also limits the carrier’s liability for some therapies treating chronic conditions, which could help self-insured employers negotiate better stop-loss rates, which have been on a steady rise in recent years. Benefits and HR consultant Segal reported their stop-loss rate increased by 8% from 2020 to 2021; Stealth Partner Group’s stop-loss rate increased almost 8% between 2019 and 2020, then another 2% between 2020 and 2021.

RxPharmacy Assurance works with brokers and third-party administrators to identify employers who might need their product. And the company has seen “robust uptake” during the first year, particularly for midsize employers.

Solutions for high-cost pharmaceutical claims will continue to be needed for employers unable to shoulder the costs. Fortunato says 44% of new specialty prescription drugs treat chronic conditions and 90% of claimants stay on plans for more than one year. And there are more than 1,000 drugs in development meant to treat rare and chronic conditions.

“Traditional stop-loss was never designed to protect employers from recurring specialty drug costs and limits full employer protection through contract restrictions, lasering and the potential for massive rate increases,” Fortunato says.

Focusing on the Individual Market

Toward the fourth quarter of last year, Belmont says, some self-insured employers that were unable to take more increases in their premiums began looking to the individual market for some relief.

A small number of employers are using individual coverage health reimbursement arrangements (ICHRAs) to save costs and move people from employer health plans. First offered in 2020, these accounts allow employers to provide a defined contribution to reimburse employees for medical expenses such as monthly premiums and co-pays. Employees on the plans must be enrolled in individual plans through their state marketplace.

Among Belmont’s clients, ICHRAs have mainly been a solution for smaller employers, typically workforces with fewer than 100 people. Changes in the marketplace induced by the pandemic are forcing innovation. This product allows some employers to better manage the cost of their benefit plans. They also enable some small employers to offer benefits to part-time workers or other groups who may not have previously received insurance. This helps employers attract and retain talent in a competitive market. Additionally, employers with high-churn populations can use ICHRAs to avoid benefits administration, including managing renewals and selecting various plans to work for different employees.

“It’s going to be a small percent of what is out there in the marketplace, but it is growing,” Belmont says. “All of it gets to a point where an employer has X number of dollars to allocate toward their total rewards for their employees. They have to take that and determine how to offer benefits in that range while meeting employees’ needs.”

According to a report by PeopleKeep Inc., the average monthly allowance employers offering ICHRAs gave to employees was $882 in 2021.

Moody says his firm finds ICHRAs to be a good tool to carve high-cost claimants from some of their larger employer groups. For instance, if a large organization has a million-dollar claimant in a particular division, that entire group can be placed on an ICHRA, improving their stop-loss plans.

In some states, the individual plans can be as robust as ones provided by employers. In Alabama, the “Blues” are in the market and are more well-known than some of the carriers offered through the businesses’ plans.

“In a place like that, if we say, ‘I’m giving you BlueCross BlueShield back, just in a different environment,’ the employees are all happy, and we just solved a $1 million issue,” Moody says. “When you look at ICHRAs and some state exchanges, they do help solve for some of this. But at some point, when you squeeze the balloon, it’s going to show itself somewhere.”

But offloading employees, even if they aren’t being singled out, could be a slippery slope, says Kristi Gjellum, executive vice president of national client experience and partnership leader at IMA Financial Group. “This was not the intent of ICHRAs,” Gjellum says.

Targeting individual employees based on their health could legally expose an employer for ignoring HIPAA privacy laws, Gjellum says. “While a self-funded employer has the right to understand what is driving their cost and information on large claimants, they should not take action on that information,” she says. “I assume an employer could argue fiduciary responsibility to the plan. It is just too new to have any case precedent, which is why many shy away from this.”

Employers aren’t moving beneficiaries over in droves, so the practice might not be obvious yet in the state marketplaces. Gjellum says if it becomes more obvious, she thinks the insurers on the marketplaces might do something to stop the practice. “These large-cost claimants could literally mess up the state pools, which were intended for a population who does not have access to employer coverage and legitimate ICHRAs,” she says.

Other Solutions

Aside from leaving the health insurance business altogether, employers are trying myriad solutions to help reduce the brunt of high-cost claims. Though lasering may sound risky, Peel says it isn’t necessarily the worst option for some businesses. When evaluating risk, he says, stop-loss carriers “more often than not” miss the mark on the number at which they set the deductible. If an employer decides to roll the dice, it continues paying the regular premium, and the high claims may never materialize for the member.

Aside from lasers, Belmont says, insurance carriers and stop-loss vendors will likely work to carve out higher-cost treatments and services. “They can’t anticipate some $8 million claims,” he says, “so they work to take it out of the claims experience.”

Some plans pay specific drugs out in a rider policy, taking them out of the employer and stop-loss plan altogether. Moody says his organization has increasingly been working to get funding of high-cost pharmaceuticals through patient assistance programs for people who are covered under group health plans but are deemed underinsured. If a covered worker is diagnosed, he gets prescribed a medication that is denied by the insurer, then it gets “kicked over” to Moody’s advocacy people. If patient assistance programs are available, they sometimes entail a tedious process and plenty of paperwork, and patients have to meet certain qualifications, Moody says, but the programs can be beneficial for employers and members.

“Most of us, when hit with a $1 million or $2 million claim, are deemed underinsured,” Moody says. “This allows patients to get the needed medication, and we have eliminated a million-dollar risk to a health plan. We have had a great deal of success, when painted into a corner, in solving those issues.”

Some brokers are using data—for example, studying members’ medical and pharmaceutical spending to find risk factors that could lead to high-cost claims, Peel says. Then they use that data to enact interventions. And brokers and employers are partnering to perform assessments to see how likely it is that their company will incur the cost of some of the drugs soon to be entering the market.

“There are an endless number of carriers working on things from back pain to end-stage renal disease,” Peel says. “Groups claiming to help better manage existing high-cost claims to keep members from staying on that path forever—there are tons of different programs for that kind of thing.”

Curbing costs on the clinical side, not in pharmaceuticals, is where the focus has traditionally been in stop-loss, Collier says. One tool used by Sun Life is its work with PinnacleCare, a company that offers second opinions when a member has a major health diagnosis. “We wanted to see how we could get actively engaged with a member to make sure they were getting the right care and right diagnosis,” she says. “There are astronomical stats out there among people who are misdiagnosed or, when they get a second opinion, have changes to their care path.”

No employers are exempt from catastrophic claims—or at least the concern they might be hit by one. In recent years, Moody says, even clients who had high-risk tolerances are beginning to worry. “There are some in the middle market now—those with 400 to 500 employees—that are saying, ‘I know we have always been pretty risk tolerant, but everything is on the table now because costs are unsustainable, so bring all of your ideas,’” he says.

Some clients who were making small moves, such as increasing co-pays or considering high-deductible health plans, are now asking Moody about working directly with hospitals, using nurse case managers or having on-site clinics to manage costs. “Hell must have frozen over,” Moody says, “if these people are asking for that stuff.”