Weighing Public Broker Performance

Since collectively peaking at the end of March 2025, valuations for the six public brokers have gone into sudden free fall, dropping collectively by 23% since that month and down 11.4% year to date (as of Oct. 31), as calculated by the MarshBerry Broker Composite Index.

Is this a sign of things to come? Should independent brokers prepare for a valuation correction across the broader M&A market? As the great college football broadcaster Lee Corso would say, “Not so fast, my friend.”

This run-up in public broker values over the past few years was in part driven by double-digit organic growth during this hard market, buoyed by rising insurance premiums (partially supported by years of global inflation). Seeing this, investors have poured into this sector, riding the wave of growth.

Now, as economic conditions show signs of stabilization and premium rate increases slow or even decrease, the tide is receding. But this drop in stock price and value is more reflective of general investor caution or rotation out of a softening sector, and less about the industry’s continued fundamental strength.

In their Q3 2025 earnings calls, each of the publicly traded brokers— Gallagher, Aon, Brown & Brown, Marsh & McLennan, Willis Towers Watson, and The Baldwin Group—all reported flat or declining organic growth amid a softening commercial insurance pricing environment. However, each of the big brokers still show strength in the general fundamentals: increased revenue, stable margins, high client retention, and sustained acquisition strategies.

Despite slowing tailwinds and declining public broker performance, independent brokers continue to demonstrate value resiliency. Just as valuation multiples for average and platform firms didn’t spike in 2024 when public broker values soared, don’t expect a retreat in 2025–2026 valuations based on declining performance from those brokerages.

While it certainly matters what the public brokers are doing and how they financially perform, their general values are not a leading indicator of the industry’s broader valuations going forward. Values will remain driven more by the supply versus demand model. In today’s market, where platform firms are highly sought but in limited supply, valuations should stay elevated. There will be fluctuations from year to year, influenced by market conditions or economic uncertainty, but massive swings are unlikely unless demand significantly shrinks. Even then, this industry has proven its resiliency during tough economic times, and investors will always look to insurance as a safe haven.

M&A Market Update

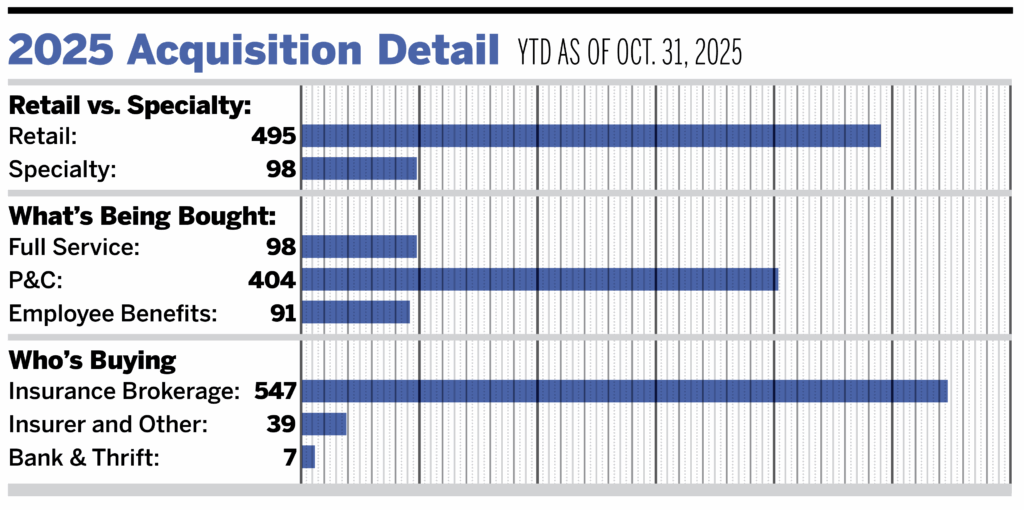

As of Oct. 31, there were 593 announced insurance brokerage M&A transactions in the United States in 2025. This represents a 3.3% increase from the 574 deals announced through the same period in 2024, signaling continued resilience in deal activity despite market headwinds. Last year ultimately closed with 807 transactions; 2025 continues to track ahead of that performance on a year-to-date basis.

Private capital-backed buyers accounted for 428 of the 593 deals (72.2%) through October. Independent agencies were buyers in 83 deals, representing 14.0% of the market. There have been seven announced transactions by bank buyers in 2025. Deals involving specialty distributors as targets accounted for 98 transactions, about 16.5% of the total market, continuing the trend of low supply of specialty firms.

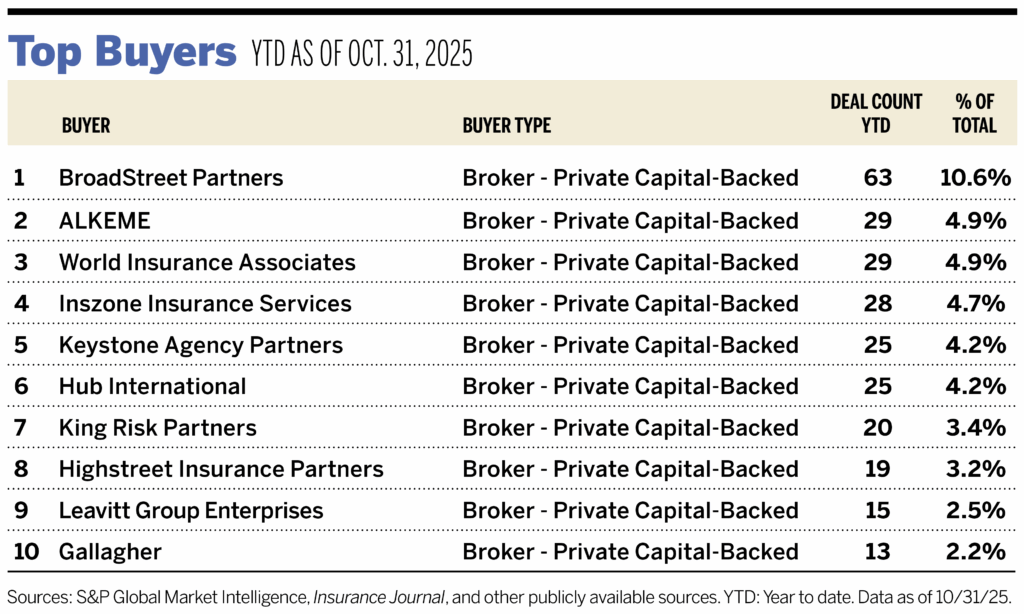

Ten buyers accounted for 44.9% of all announced transactions year to date, while the top three (BroadStreet Partners, ALKEME, and World Insurance) accounted for 20.4% of the 593 transactions.

Notable Transactions

- Oct. 15: Liberty Company Insurance Brokers acquired High Ground Insurance Services, a Torrance, Calif.-based regional insurance broker founded in 2007. High Ground provides specialized risk management and insurance for industries including manufacturing, retail, construction, nonprofits, and religious institutions. MarshBerry served as advisor to High Ground Insurance Services on this transaction.

- Oct. 28: Ryan Specialty signed a definitive agreement to acquire Stewart Specialty Risk Underwriting (SSRU), a Toronto-based managing general underwriter focused on large-account, high-hazard property and casualty insurance. The transaction is expected to close in Q4 2025 and will integrate SSRU into Ryan Specialty Underwriting Managers. MarshBerry is serving as advisor to SSRU on this transaction.

- Nov. 4: Wright National Flood Insurance Services, an affiliate of Wright National Flood Insurance and part of Arrowhead Programs (a Brown & Brown subsidiary), acquired the assets of Poulton Associates. Poulton, based in Salt Lake City, Utah, is a leading provider of private flood insurance in the United States and operates the CATcoverage.com platform, offering coverage through its National Catastrophe Insurance Program. MarshBerry served as an advisor to Poulton Associates on this transaction.