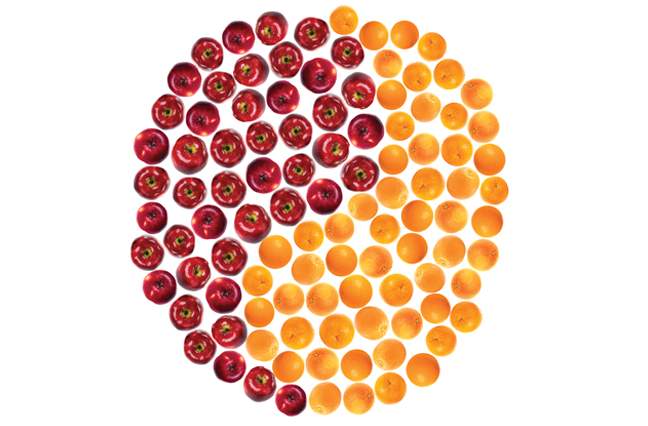

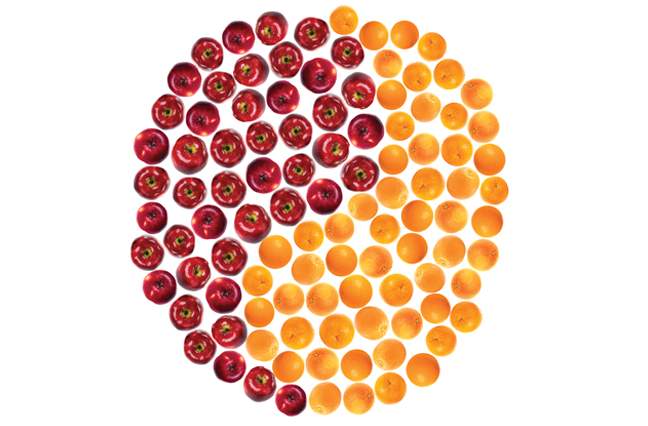

Opposites Attract

In the aftermath of historic healthcare reforms, the onus is on many insurance brokerages to maintain or add rigor to the employee benefits side of the house.

Operating a major property-casualty business with a middling benefits operation just isn’t going to cut it in the new margin-compressed, competitive environment.

This is not news to the many brokerages that have always given equal attention and resources to both flanks of the business. The lessons they have learned about forging a cohesive organization—despite dissimilar types of business—may be instructive to other intermediaries enduring the compliance demands brought about by healthcare reform.

Top-performing firms recognize employee benefits and property-casualty as different sides of the same coin, requiring unique skill sets and separate leadership teams. They understand the value inherent in a culture of collaboration, which helps break down barriers and encourages trust and comfort in cross-selling activities.

Brokerages that fail to capitalize on these differences will suffer the consequences, potentially squandering cross-selling opportunities. “Firms with small benefits operations compared to their property-casualty operations will find themselves in a difficult position to compete going forward,” says Rob Lieblein, executive vice president of MarshBerry.

The healthcare reforms, Lieblein says, are driving a brokerage model in which firms must help client companies foster a healthier and thus more productive workforce, which will result in lower healthcare premiums. No longer can brokerages get by, he says, with substandard employee benefits resources. “The transition to a consumer-driven healthcare model, as opposed to merely selling products and services to the employer, has become a big management struggle for many brokers, even good-sized ones with small benefits operations,” he says.

Lieblein contends many brokerages need to make significant investments in employee benefits similar to the capital they directed toward their property-casualty lines two decades ago. “Back then, firms needed to beef up their loss control, claims and safety operations, which required capital resources to maintain competitiveness,” Lieblein says. “Now they need to hire wellness directors and medical directors on the benefits side to continue to provide value and maintain competitiveness.”

Creating Unity

In this new environment, Lieblein and others affirm the importance of a unifying brokerage culture. Each side of the house is so different—benefits is more of a consulting work model, while property-casualty is more of a producer work model—that a firm needs a unifying culture to bridge the divide.

“We hire people on the benefits side here who may call themselves producers, but they are really consultants who have developed specific technical expertise,” says Michael Turpin, executive vice president of New York-based USI Insurance Services. “They generally don’t have a Rolodex of prospects like a property-casualty producer.”

Such differences should be respected and cultivated, not homogenized. “To think you can create an organization where the same people provide both property-casualty and employee benefits products and services is flawed,” Turpin says. “These are two very specialized sets of skills.”

A silo approach separating the business lines is equally faulty, as it will impede the communications, interactions and collaboration necessary to effectively cross-sell one unit’s wares to customers of the other unit, and vice versa. The solution is partly structural. Top-performing brokerages have built operating structures in which a single executive leads each side of the business. Both leaders report up to the firm’s CEO, or in some cases to an executive vice president of marketing.

While this would appear to further separate the lines of business, it actually ensures that each house is run efficiently and profitably. Aligning these discrete organizations is the firm’s singular culture. “My dad back in the 1970s decided that benefits and property-casualty were two very different and distinct businesses, and he separated them from a structural standpoint,” says J. Patrick “Pat” Gallagher, chairman and CEO of Chicago-based brokerage Arthur J. Gallagher & Co. “What holds them together is our culture—the Gallagher Way.”

The firm is in the thick of re-branding itself to achieve a more unified culture. Previously, the brokerage was split into Arthur J. Gallagher & Co. (for p-c products and services) and Gallagher Benefits. Moving forward, both operations will be known by the brokerage’s primary name. “Our new tagline is ‘Business without Barriers,’” Gallagher says. “We will not have any impediments inside our firm that preclude the client from getting the best we have to offer. We’re doing everything we can now to knock down barriers. We may have different disciplines, but we are one brand here.”

While the firm’s two divisions remain separated from an operational standpoint, the units’ respective marketing heads are “joined at the hip,” Gallagher says. “They run joint meetings, encouraging sales calls with both sides attending the sales calls—marketing our brand as a cohesive enterprise all the time.”

M3 Insurance also believes a single culture produces a cohesive organization. In its case, the firm’s culture can be boiled down to a consistent focus on superior client service. “Our job is to identify specific areas where we can help clients, whether it’s property-casualty insurance products and services or benefits consulting,” says Sean LaBorde, executive vice president of sales and marketing at the Madison, Wis.-based multiline brokerage. “This focus on the client is what creates our cross-selling opportunities.” The heads of the firm’s employee benefits and p-c units, respectively, report to LaBorde.

A similar culture is in place at multiline brokerage Oswald Companies in Cleveland. “If we have an employee benefits client, for instance, we’ll introduce them to the property-casualty side of the house because we see this as helping them,” says Robert Klonk, Oswald’s CEO. “We’re not asking them to do us a favor. Our job is to manage their risk—that’s what we do. If we can manage risk holistically for a client, leveraging both parts of the firm, we’re doing a better job for them.”

That Oswald Companies is employee-owned only adds to the brokerage’s coherence, Klonk says, enabling its “we’re-all-in-this-together” culture. This principle puts pressure on both p-c and benefits producers, for example, to respect the cross-selling opportunity the other side provides. “We work hard to encourage interactions between the units, where they can get to know each other better,” Klonk says.

Group Thought

To achieve the same aims, M3 Insurance developed a marketing approach five years ago around the concept of practice groups. The firm assembles employees from both sides of the house in specific industry segments such as construction, real estate or manufacturing. Although M3 initially launched the practice group structure solely with property-casualty personnel, the company quickly realized the value of having its benefits professionals participating in the same groups.

“Someone on the property-casualty side may know everything there is to know about the risks confronting his particular industry segment, but having the benefits person in the same room pointing out a state’s recent changes to Medicaid can be invaluable knowledge to the p-c person,” LaBorde says.

Willis North America also encourages broader interactions and engagements among the organization’s employees—in its case putting both groups under one roof throughout its substantial retail network.

“People from either side literally run into each other in the hallways,” says Todd Jones, CEO of the New York-based multiline brokerage. “At sales meetings in a retail office, we’re all in one room. Always. This helps us generate ways to assist all our clients. More importantly, it helps everyone here develop trust, comfort and confidence in each other’s abilities.”

Jones says a p-c producer who has worked hard to build a close relationship with a major client needs to trust the level of service the benefits person provides the client. “The right leadership structure and a culture of trust is what facilitates superior cross-selling,” he says.

Lieblein agrees. “The more successful firms have created a structure that involves separate leadership for each practice, with someone who is an expert in benefits, for instance, running the benefits shop,” he says. “But processes must also be put in place to encourage integration between both lines, where property-casualty people understand what is going on in the benefits world and vice versa. Above this structure sits the CEO, who understands the global picture and what it takes to grow the business.”

Talent Directives

When recruiting, most of these firms seek out talented individuals with the skills needed to generate business for one side of the firm or the other. Willis North America, on the other hand, seeks to hire people with demonstrated leadership skills, as opposed to just sales or technical talent.

“We obviously hire different people for each side of our business, but the commonality they share is their unique leadership characteristics, such as strategic planning and communication,” Jones says. “We’re looking for individuals who have the ability to connect with different people and motivate them.”

To encourage each part of the firm to pursue cross-selling activities, successful brokerages provide incentive compensation linked to specific metrics. “We’ve identified every single account where we don’t have both sides of the business,” Gallagher says. “We then ask each of them why this is the case. They then develop the strategy to make this a reality, and if they are successful they are compensated for this expansion in our portfolio.”

Not that both sides of the house should always be paid a commensurate compensation. Turpin says a brokerage’s subject matter experts should be paid more than its sales staff. “We believe that everyone should be paid the same amount for bringing in the business, but a producer who handles the account on an ongoing basis is more valuable than the guy bringing the business in,” he explains. “Certainly, an agency needs both door openers and SMEs, but in the current environment of compressed profit margins on the benefits side, the consultant becomes more important than the producer, given the risk of losing the client.”

Many executives say running a multiline brokerage has made them better overall leaders. “These are all complex products, and as you continue to move up within an organization from a leadership perspective, you find yourself responsible for product areas for which you have no technical expertise—myself as a great example,” Jones says. “I came up the property-casualty side but endeavored throughout the years to become conversant about employee benefits. Fortunately, I’m an intellectually curious person who enjoys the challenge of learning new things.”

Although Klonk was brought up on the employee benefits side of Oswald, he agrees that a CEO need not become an expert in both businesses to be an effective leader. “I know enough about property-casualty to be dangerous, but there is no way I actually could do it,” he says, laughing. “Still, it’s been fun to learn and appreciate the challenges.”