Coming to a Highway Near You

In 2019, carmaker Tesla began offering insurance to Tesla owners in California, boasting 20% to 30% lower premiums resulting from the company’s ability to “leverage the advanced technology, safety, and serviceability of our cars to provide insurance at a lower cost.”

For autonomous truck makers, Tesla’s move could become a more common practice due to the challenges of finding coverage for these vehicles, which is considered a barrier to adoption.

Despite harrowing commercial auto and truck rates, the time for commercial trucking insurers, agents and brokers to get in autonomous gear is now, experts say. If the industry is not part of the journey, “the economy will solve its own problem because there is such a need,” warns Veysel Sinan Geylani, underwriting manager of autonomous technology and new-economy autonomy for AXA XL, which covers autonomous trucks for manufacturers, software developers, owners and operators.

Widespread adoption of autonomous trucks may be a decade away, but a market is already moving in that direction.

Just as with the development of the automobile, the evolution of automated vehicle technology is fraught with variations in innovation, development and use cases.

Despite the harrowing premiums, experts say now is the time for commercial trucking insurers, agents and brokers to get in gear with autonomous vehicles.

Related Content

While sources estimate that widespread adoption of autonomous trucks is five to 10 years away, there is a market moving in that direction. TuSimple, an autonomous truck manufacturer, is one example. The company offers an autonomous freight network that utilizes Level 4 autonomous Class 8 trucks equipped with TuSimple’s self-driving technology, digital maps, and strategic terminals for autonomous trucks hauling freight. While the system currently operates in the Southwest, the company plans to expand it nationwide by 2023. Partners include the United States Postal Service, United Parcel Service, Navistar and Penske.

The American Transportation Research Institute (ATRI) is enthused about automated truck technology. Autonomous trucks are “responsibility neutral,” says Daniel Murray, the organization’s senior vice president, and that could help keep trucking companies out of the courtroom. Studies show that, much of the time, an accident involving a professional truck driver is the other driver’s fault, Murray says, but the truck owner is often sued anyway. Besides safety advantages, the technology could help solve the quality truck driver shortage, he adds.

To encourage adoption, ATRI is working with the Federal Motor Carrier Safety Administration (FMCSA) and other organizations to document autonomous truck technology’s return on investment by price point through Tech-Celerate Now, part of a government-industry partnership, led by the FMCSA, to accelerate the adoption of advanced driver assistance systems (ADAS).

Understanding Autonomous Technology

Just as the development of automobiles more than a century ago required mechanical planning, implementation and experimentation, the automated vehicle technology race is fraught with variation in innovation, development and use cases. Essentially, autonomous trucks are evolving along two different paths. There are conventional trucks that sport advanced driver assistance systems, a tool that may evolve into eventual full autonomy. There are also manufacturers working on vehicles that operate with little driver interaction.

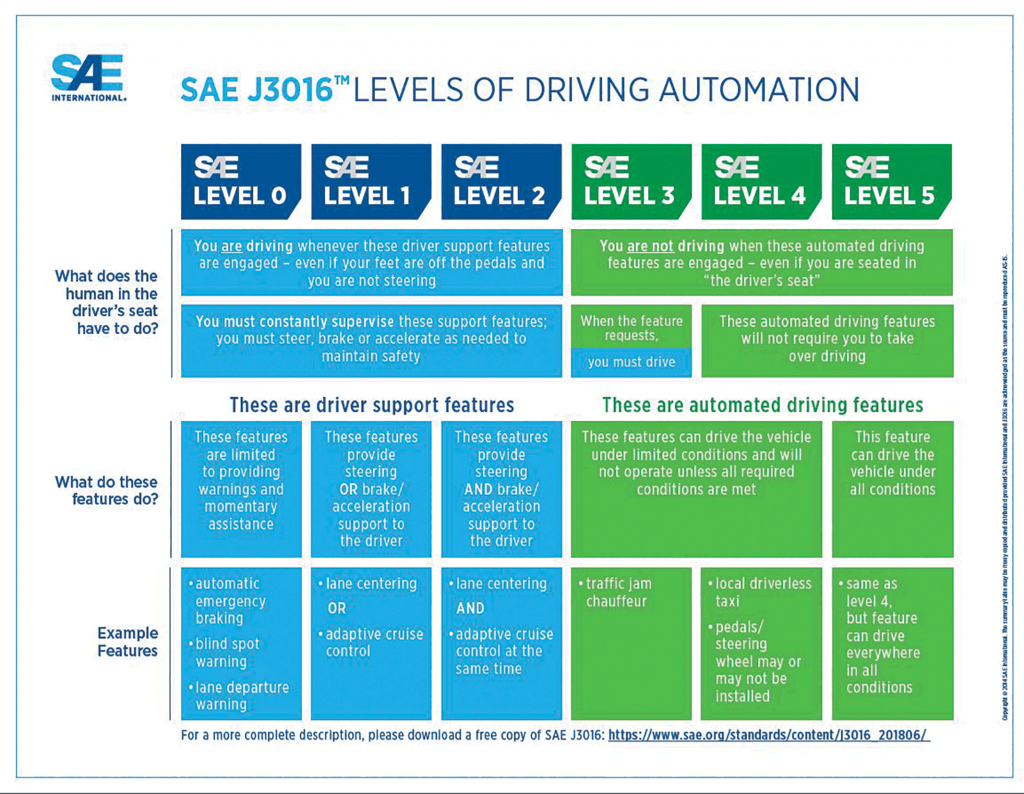

As with any evolving industry, nomenclature is dynamic and cannot fully capture nuances associated with individual trucks. One option is The Society of Automotive Engineers’ Levels of Automation.

Level 1 refers to ADAS by part, such as forward collision warning (FCW). At Level 2, different parts work together to improve safety, such as lane centering and adaptive cruise control. As trucks move through levels of autonomy, risk and liability shift from the driver to the technology operating the truck. At Levels 0 through 2, which are currently on the market, the driver is primarily in control. At these levels, insurers generally see the trucks as conventional with ADAS features.

Adoption of Level 2 technology has been slow, Murray says. Autonomous technology still has some snags to work out, he adds, such as when to engage brakes for a passing turtle or deer and for pedestrians or bicycles.

At Level 4, “the truck is in control under predefined circumstances, such as driving on highway segments,” says Drew Groth, associate actuary for actuarial consulting firm Milliman. “But the driver needs to intervene in situations outside of those circumstances.” He adds that Level 5 represents full autonomy with minimal, if any, ability for drivers to take control. At Levels 4 and 5, liability rests with the manufacturer. Level 3 technology essentially asks the driver for help when a situation becomes too difficult, he says. Because the driver and the truck’s automation can switch control, it is more difficult to establish accident cause and liability.

The Safety Debate

There is general agreement that autonomous vehicles are and will be safer than human drivers. That does not mean, however, there is a straight line from fewer accidents to the premium discounts truck owners crave.

According to a National Highway Transportation Safety Administration (NHTSA) bulletin released in 2008, human error caused 93% of accidents. The agency updated the conclusion in 2015, backpedaling from the word “cause” and stating that drivers are the “critical reason” for 94% of accidents. The logic was that technology would be safer than humans and therefore would reduce accidents.

While the notion was great for raising national interest and marketing the technology, it does not gel with how the insurance industry sees risk. In 2018, when Casualty Actuarial Society volunteers reviewed the same data from the transportation safety administration study, they concluded that human error was the cause of 74% of accidents. More importantly, the society’s report delineates the potential risks from vehicle and autonomy and anticipates liability and coverage issues.

In June, an analysis by the Insurance Institute of Highway Safety (IIHS) suggested that about a third of 5,000 crashes examined in the NHTSA study would have been avoided if autonomous technology had been used. IIHS cited the technology’s ability to provide more accurate perception and to eliminate the influence of drugs, alcohol, medical problems or falling asleep. Partners for Automated Vehicle Education, which represents self-driving technology companies, told Reuters that autonomous vehicles could avoid some 72% of crashes, including more complex errors caused by drivers who make inadequate or incorrect evasive maneuvers.

Both the insurance industry and manufacturers agree that autonomous technology can reduce accident frequency.

Milliman estimates that autonomous trucks could reduce truck driver fatalities by 18.3% over the next 30 years by just replacing highway truck drivers.

In a report released in September, the IIHS found that tractor-trailer and large trucks weighing at least 33,000 pounds with forward collision warning (FCW) and automatic emergency braking (AEB) could reduce more than two out of five rear-end crashes. The study also found that large trucks equipped with FCW experienced 22% fewer crashes and those with AEB had 12% fewer crashes than those lacking either equipment. Numerous IIHS studies looking into advanced driver assistance systems at SAE Levels 1 and 2 identify safety potential and occasional risk for particular safety parts in various scenarios.

Some in the industry note the lack of transparency from manufacturers that promote safety potential but haven’t shared data with the insurance industry. The underlying cause of limited data, however, might not be intransigence as much as a dearth of information. The data to statistically prove autonomous truck technology is safer are unavailable, AXA XL’s Geylani says. He says the trucks “need to get on the street.”

There are other risk factors to consider, especially cyber. As drivers have less control, maintenance of autonomous technology will become a more considerable concern, Groth, the Milliman actuary, says. Perhaps the greatest worry is hacking. Automotive technology relies heavily on wireless communications. “You have to make sure that those communications can’t be compromised,” Groth says.

Examples from Tesla show how such a compromise can happen. In September, the semi-autonomous auto manufacturer’s network dropped, causing a massive outage that thwarted connectivity. In October, researchers demonstrated how bad actors could easily hack Teslas by creating split-second “phantom” images remotely that caused the car to overreact and led to accidents and traffic jams.

Hackability is not a new problem, nor is it limited to Tesla. One example is the infamous hack in 2015 when a Wired magazine writer allowed hackers to take over his car, compelling the automaker to recall 1.4 million vehicles to fix the tech bug.

There is an effort under way to address safety altogether. Earlier this year, ANSI/UL 4600, a safety standard for the design, manufacturing and deployment of autonomous vehicles, was published by Underwriters Laboratories with technical leadership from Edge Case Research. Insurance companies such as Liberty Mutual, Munich Re, and AXA XL participated as voting members in the UL 4600 standards technical panel.

What concerns manufacturers and insurers alike is the handoff point at which control shifts from the driver to the technology. Part of their concern relates to liability, given that who—or what—is driving would be at fault for an accident. But determining fault is tough. When both the NHTSA and the National Transportation Safety Board reviewed a 2016 fatal crash involving a Tesla, the NHTSA focused on the driver’s role while NTSB cited technology flaws.

Some are opting to just skip the handoff transition phase characterized in SAE’s Level 3. “A lot of my clients are working on Level 2 or future use of Level 4,” says Steve Miller, innovation lead of the Insurance Office of America Innovation Group. “I think the arbitrary assignment/classifications of levels doesn’t necessarily affect the deployment timeline.”

Moving straight to Level 4 does not eliminate the handoff concern, but the hope is that humans would rarely need to take over.

Reimagining Coverage

As the evolution of autonomous trucks continues, Groth is urging insurance companies and brokers to become even more engaged in offering coverage solutions. “Insurers should formulate their internal strategies now, before these decisions are made for them,” he says.

At least a handful of frustrated autonomous vehicle makers have already announced their intention to offer insurance to their customers, most likely through fronting arrangements, Groth says. Doing so helps manufacturers “sell technology that is widely difficult to insure,” he says. For example, Volvo’s autonomous mining trucks in Europe come with a package that includes operation support, maintenance, repairs and insurance.

Citing Tesla’s case, “This is something that insurers need to be ready for,” Groth says.

One of the challenges for insurers is factoring in the cost of claims. The price tag for repairing and replacing vehicles with safety features, which include the sensors, cameras and other equipment that make automated vehicles work, has been enormous. That might not be an issue years from now as driverless vehicles become more ubiquitous and parts reach more standardization.

Further, as automation evolves, Groth says, the industry lacks sufficient data to determine the difference it will make in claim costs. In the meantime, insurers need to collect sufficient premium to cover claim severity and the new risks autonomous trucks introduce.

AXA XL began working with manufacturers about five years ago. Insurance packages are designed on a per-customer basis and offer several types of liability coverage, along with extras such as cyber and crisis management and response service coverages.

To offer products and services geared for autonomous truck technology, the insurer invested in getting to know manufacturers from the ground up, which meant spending time with engineers to understand the technology well, Geylani says. Brokers and insurers that want to offer coverage need to have “skin in the game,” he adds, as trucking technology changes.

The transition for commercial trucking brokers is substantial, Miller says. “Our industry has a tall order in understanding how this new technology operates, how it adds to safety, and how to communicate the benefits to our carrier partners and drive cost savings for our insureds,” he says.

Although coverage for trucks up to Level 2 is available, Miller says, finding coverage that financially recognizes the technologies’ safety benefits is more difficult. If insurance companies furnish discounts to help offset the additional costs of autonomous trucks, some sources say, that would certainly encourage adoption.

Currently, the number of autonomous vehicles within fleets is minimal compared to normal vehicles, so they appear as a subset of the entire fleet, Geylani says. In time, higher-level autonomy—Levels 4 and 5—will be implemented, and more autonomous vehicles will be in use. At the early stage of this emerging risk, a combination of existing policies and products may help, he says. Ultimately, Geylani foresees a stand-alone policy designed for autonomous vehicle risks. He believes insurers will continue to compensate and help injured parties first and then launch and manage appropriate recovery actions. Geylani says he ultimately sees autonomous vehicles as a different vertical from conventional trucks when it comes to coverage.

Sources note that only a few brokers actually cover autonomous trucks that require little if any input from human drivers, and they say tech-focused brokers are leading the way in this market.

One of them is Founder Shield, which specializes in emerging technology and can provide coverage for truck technology Levels 4 or 5. Right now, autonomous trucks and vehicles as a whole are at different stages of development, says Jonathan Selby, general manager for Founder Shield. Being involved in autonomous trucks at this stage requires truly understanding the risk. Insurers offering coverage are watching autonomous trucks during the beta testing phase, Selby says.

Commercial trucks are reaching a critical transition point, moving from conventional operations with degrees of autonomous technology to being practically driverless. In the short term, the challenge is explaining why insurance companies are not providing meaningful discounts for safety technology when rates continue to skyrocket.

In the long term, viewing autonomous truck coverage through the technology, rather than the traditional commercial auto lens, may put brokers in a stronger position to help their customers transition into the future mode of transportation.