Can We Bear the Risk of Renewables?

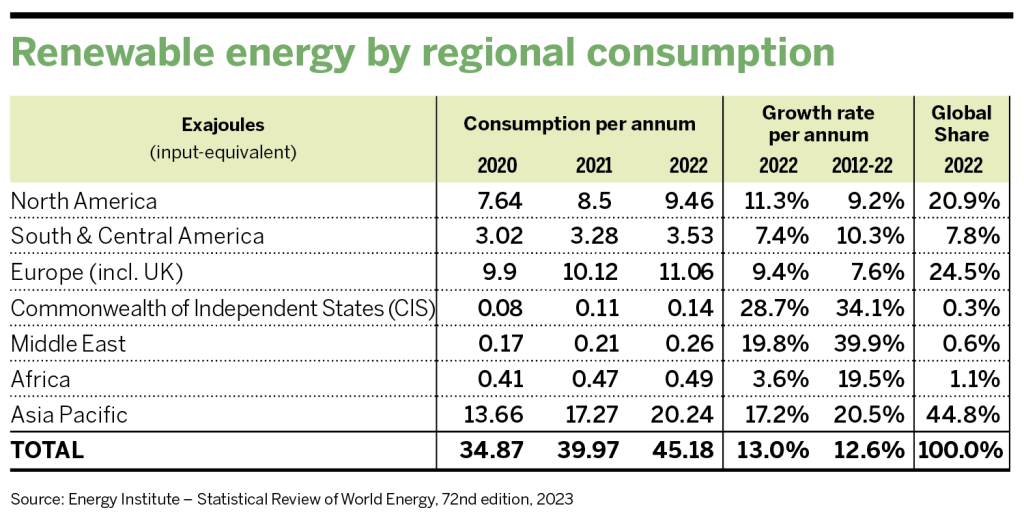

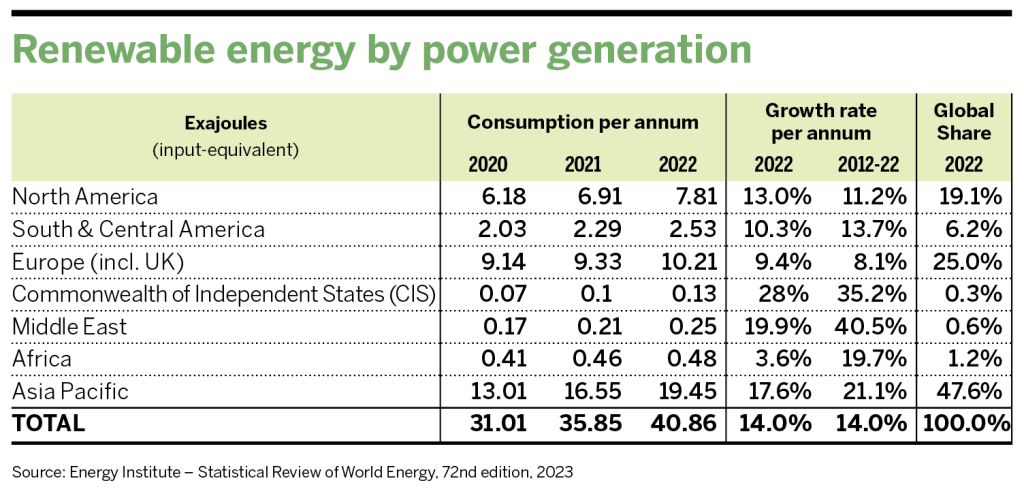

The rise in our use of renewable energy, begun decades ago, has only recently reached the spotlight, given the increased pressure to reduce our reliance on coal and hydrocarbons.

In recent years, government regulations, some including subsidies, have attracted more interest in renewable energy.

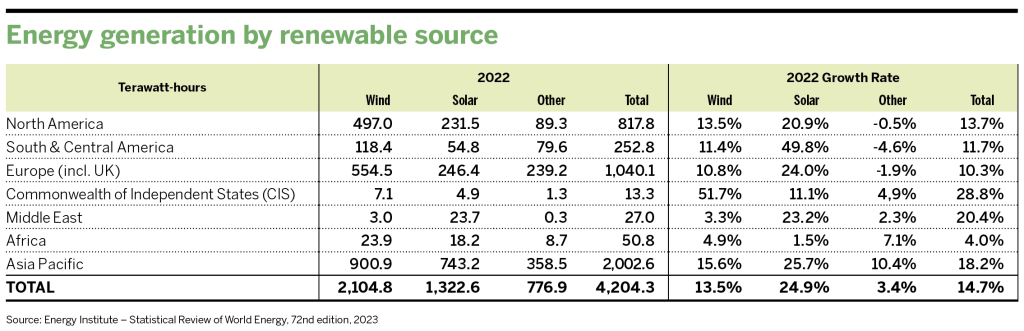

Last year, wind power capacity added more than 77 gigawatts to the world’s power grids.

High levels of specialty are required in the insurance industry to grapple with the risks presented by alternative energy sources.

“From the broader financial markets and insurance perspective, everything started around 2015, when insurers announced their unfriendly policies towards coal,” says Zviadi Vardosanidze, a Vienna-based managing director at Greco Specialty. “Insurers began restricting renewals, restricting capacity, and increasing pricing on any project that was connected to coal mining and coal-fired electricity generation. Those policies led to increased interest in renewable energy projects from the financing side.”

Given there was proven technology, insurers’ need to replace legacy conventional power generation policies in their portfolios drove many of them to the renewable energy space, which was perceived as a relatively straightforward class of business.

Meanwhile, various government regulations and subsidies have attracted more interest from investors and producers. In the European Union, for example, the Green Deal policy pledged the equivalent of $1.07 trillion in sustainable investments over the next decade.

The goal is to reduce, by 2030, net greenhouse gas emissions by at least 55% from 1990 levels. The policy has helped investors who had been keen to support renewable energy projects and original equipment manufacturers (OEMs) that began to upscale their capacities and their technological progress. In the United States, it is estimated that the Inflation Reduction Act, passed last year, will sponsor about $600 billion worth of investments, many of them focused on renewable energy and the transition to low-carbon activities.

While the technological improvements brought by OEMs, such as GE, Siemens and Vestas, allow for much larger amounts of renewable energy creation, their increased risks took some insurers by surprise. “When the leading OEMs upscaled their technologies, they quickly doubled or tripled the megawatts of capacity of turbines,” says Pawel Kowalewski, head of energy, power and mining at Greco Specialty. “Insurers’ portfolios started to deteriorate. Perhaps insurers didn’t predict such fast technological advancements or did not account for the new risks those advancements would bring.”

Not all insurers were caught off guard, Kowalewski says. “While small and regional insurers scaled back their portfolios by changing the terms and conditions and increasing rates to reflect the now increased risk levels, the more savvy insurers that had updated their risk profiles have not made these changes. So, it’s a very interesting point in time for the market as there is some disconnect between some of the local players and the big international players.”

Defining the Niche

Renewable energy is any form of energy derived from natural (and thus renewable) resources. In terms of clean renewable energy, most comes from solar and wind. Other renewable energy sources include geothermal, hydropower, ocean energy and biopower.

Wind Energy

Wind is used to produce electricity by converting the kinetic energy of air in motion into electricity. In modern wind turbines, wind rotates the rotor blades, which converts kinetic energy into rotational energy. This rotational energy is transferred by a shaft attached to the generator, thereby producing electrical energy.

According to the “Renewables 2023 Global Status Report” (GSR), last year more than 77 gigawatts (the equivalent of 77 billion watts) of wind power capacity was added to the world’s grids, increasing the total operating capacity by 9%. Taiwan and China are viewed as high-growth markets when it comes to offshore wind farms. China has a formidable pipeline of projects, costing about $180 billion, that are driven mostly by domestic investment. Meanwhile, Taiwan is attracting more foreign participants and is expected to develop about $20 billion worth of projects. For those two countries alone, according to Marsh, the premiums from such projects are expected to generate $2 billion by 2025.

“There has been impressive growth in wind technologies recently,” Vardosanidze says. “Wind turbine generators have doubled their power-generating capacity in just a couple of years. We used to talk about two to three megawatts generated by onshore wind turbines, while now we are up to six megawatts. Offshore wind generating capacities have increased massively as well. We’re now looking at larger and taller turbines capable of generating between 20 and 25 megawatts.”

Such technological features come with their own disadvantages. In fact, as wind turbine technology scales up, the cost of poor risk and quality management is dramatically increasing. Additionally, insurers are concerned that many new technologies available on the market have been rushed through product development to meet market demand without sufficient prior testing.

Today, Vardosanidze says, the testing for new products is more likely to be done by customers. “This means that, from an insurance perspective, we’re dealing with prototypical technology,” he says.

As a result, most construction and operations claims have risen and will, most likely, continue to rise. This trend has caused insurers to become increasingly risk averse by either increasing premiums or drastically changing terms and conditions, which ultimately means investors will be forced to absorb the cost of unmanaged construction and operations risks directly.

Additionally, there is high need for coverage against losses due to delay in startup, contractor’s error, business interruption and marine cover. The capacity to support these coverages is already available in the market, but as the size and complexity of the offshore wind farms grow, the reinsurance market will need to expand to accommodate such exposures.

Solar Energy

The market for solar renewable energy continued its strong growth in 2022, with both concentrated solar thermal and photovoltaic (PV) projects playing a key part.

Concentrated solar thermal (CSP) power is produced by converting the sun’s energy into high-temperature heat using various mirror configurations. CSP is an indirect method that generates alternating current (AC), which is then distributed on the power network.

Solar photovoltaic (PV) panels convert the sun’s light into electricity by absorbing light and knocking electrons loose, generating a direct electric current (DC). The direct electric current is then converted into AC so it can be distributed on the power network.

Production capacity of CSP increased by 200 megawatts (MW) in 2022 after a decade of having plateaued. In fact, while Spain and the United States invested heavily in CSP in the early 2010s, neither of those markets has added capacity since. There are, however, new projects that have come online or are under construction in emerging markets, including Chile, China, Israel, Morocco, South Africa and the United Arab Emirates.

The solar PV market grew by 243 GW of new installations in 2022, bringing the cumulative global solar PV capacity to over one terawatt—enough to light more than a million homes a year. In 2022, several countries relied on solar PV generation to meet a large share of their electricity demand. For example, nine countries meet at least 10% of their electricity demand via solar PV—Spain leads the pack with 19.1%. Another 22 countries meet 5% of their electricity demand via solar PV, according to the International Energy Agency.

“We’re seeing a lot of solar development in California and the sunshine states, but we’re also seeing projects in the Midwestern states, which have a lot of nat cat risk,” says Josh Jennings, head of inland marine and property programs at Aspen. “In the first half of the year, we’ve had record tornado sightings, which play a huge impact on the severity of damage to solar panel projects.”

Despite the increased investments, the risks that insurers have to account for are often too many to provide enough capacity. Because of this, insurers supporting lots of solar farm construction are doing so on a quota share basis or by pulling capacity together and sharing the risk.

“This will be the new normal for the next several years because we are still managing nat cat aggregations as an industry,” Jennings says. “The only way for this to change is via specialized underwriters that truly understand the nuances in the space, better data collection to understand these assets, and improved predictive modeling.”

While insurers and brokers look at investments in data and technology, they’re also looking at investments in organizational talent. “A lot of talent focused on renewable energy has transitioned from other industries into insurance,” Jennings says. “Some MGAs have deep knowledge and data on solar assets since they’ve been collecting it for the past decade. For example, we work closely with kWh Analytics, a leading insurtech in the solar risk management space, because they have very creative ideas and are leading the charge on how they underwrite and price solar energy projects.”

In addition to existing risks, many of the OEMs that provide these technologies are not profitable. “This is especially true for the leading EU and U.S. players,” Kowalewski says. “This trend brings about a lot of concerns about the viability of those technologies and regarding the service contracts that the OEMs are providing to their clients.”

To mitigate risks coming from possible OEM insolvencies, some carriers have developed new insurance products to allow a constant stream of investments in the renewable energy space. For example, a photovoltaic module performance warranty, which is often offered through the OEMs, provides a bankable backstop to performance metrics guaranteed in a procurement contract. Such a warranty can strengthen the reliability of year-over-year production estimates and provide assurance that obligations will be fulfilled in the event of OEM insolvency. Similarly, a solar production insurance solution can mitigate project-level production risk due to underperformance of PV modules, shortfall in solar irradiance, excessive soiling, and other production losses. This is done by setting a production floor to add additional reliability to the project financial model.

Hydroelectric Energy

Hydroelectric energy harnesses the power of water in motion to generate electricity. In hydroelectric power, water gains potential energy just before it spills over the top of a dam or flows down a hill. That potential energy is converted into kinetic energy by turning the blades of a turbine, which generates electricity.

Despite being often sidelined by the emerging wind and solar energy sources, hydroelectric power (or hydropower) has been a critical source of low-carbon electricity generation for years. According to the International Energy Agency, hydropower supplied one sixth of global electricity generation in 2020, the third-largest source after coal and natural gas. While the IEA forecasts global hydropower capacity to increase by 17% by 2030, it predicts net capacity additions to decrease by 23% compared with the previous decade.

Such contraction—and determinations on the insurability of hydropower projects—are driven by two main concerns: high-profile losses and aging hydropower plants.

Hydropower projects have always been deemed too high-risk due to their complex construction projects, which often combine extensive civil engineering with mechanical works in remote locations. In simpler terms, claims related to hydropower projects, especially during the construction phase, are extremely large. For example, the Ituango Dam, Colombia’s largest hydroelectric project, cost insurers almost $1.4 billion in losses. In 2018, heavy rainfalls and landslides threatened a catastrophic collapse of the structure as the river’s diversion tunnel was blocked. Additionally, the flood caused irreparable damage to the plant’s electromechanical equipment and to the structure of the powerhouse itself.

Due to similar recent claims, some major lead insurers have withdrawn from the sector or significantly restricted cover. Any further reduction in carrier choice may call into question the financing and viability of future hydroelectric projects. “There’s been a tremendous amount of change in the past few years,” Derek Whipple, senior vice president of energy and marine at Alliant, explained in a recent podcast. “Recently, the loss activity has been, on average, greater than the amount of premium coming in from the market. So the industry had to make some adjustments in terms and conditions and pricing to accommodate for those losses and, ultimately, to create a sustainable market.”

In advanced economies, the share of hydropower in electricity generation has been declining, and plants are aging. In North America, the average hydropower plant is nearly 50 years old; in Europe, the average is 45 years. These aging structures need to be modernized so they can contribute to generating electricity for decades to come.

“Aging infrastructure is a challenge we’ve been dealing with for quite some time,” Whipple said in the podcast. “We’re starting to see some investments in this space, but much more of that needs to occur over the next few years to manage this phase.”

Marine Energy

The global ocean (or marine) power sector has continued its journey to commercialization, with significant new funding announcements and an increasing number of successful flagship projects to prove their reliability. While most deployments are pilot projects, a few have advanced to higher technology readiness levels and, most importantly, have developed a pipeline for commercial-scale deployments.

Wave energy projects extract energy from waves on the surface of the water or from wave motion deeper (roughly 30 meters) in the ocean. Surface wave energy technologies capture the kinetic energy in breaking waves, which provide periodic impulses that spin a turbine.

Tidal energy projects force water through a turbine or a “tidal fence” that looks like a set of subway turnstiles. The systems depend on regular tidal activity to generate power, which means tidal energy projects have the advantage of being able to provide a fairly predictable amount of electricity.

Given its early development, the technology has unique characteristics and challenges that set it apart from other renewable energy sources. Insurers are typically reluctant to offer a 100% line, as well as any delay in startup and business interruption coverage for wave and tidal devices/projects.

“How do you insure something like wave and tidal energy projects? It’s still very difficult as, in many cases, you’re likely to go to the marine, energy and renewable energy markets to try and get full capacity coverage,” says Rhys Newland, head of renewable energy and environmental technology for Miller Insurance. “Another issue is that insurers are geared up to ‘old’ hydrocarbon energy. In fact, as an industry, insurers often work in silos where, within energy departments, there is an upstream energy team, a downstream or midstream energy team, plus different departments often for power teams, which are generally geared towards coal or gas power stations, and others. However, the renewable energy specialists are often sitting within the same insurer but in completely different teams and not talking to each other.”

Geothermal Energy

Geothermal energy is derived from thermal and pressure differentials in the earth’s crust, providing direct thermal energy or electricity by use of steam turbines.

Geothermal energy represents a small fraction of the global energy balance and is dwarfed by other renewable energy sources. In a few locations around the world, however, it can represent a valuable and even critical component of the energy mix. Geothermal energy can be hard to reach in most places other than where the earth’s lithospheric plates meet. New technologies are being developed to make this energy source more economically accessible in more locations.

Another critical component of geothermal projects is the resource risk, which is often divided into the short-term risk of not finding an economically sustainable geothermal resource after drilling and the long-term risk of the geothermal resource naturally depleting.

Developers cannot be sure about the success of a planned geothermal project until after drilling into the geothermal reservoir. This risk is often mitigated by local risk insurance funds, such as in Europe. But such funds do not exist in several countries with high prospects for geothermal deployment, rendering new projects more difficult. This is when insurers play a much-needed role by supporting the early drilling phase. One example of such support is Munich Re’s geothermal exploration risk insurance in Kenya, where the insurer helped cover risk on a series of eight wells.

Bioenergy

The first distinction to be made when talking about bioenergy is to differentiate traditional from modern bioenergy. Traditional biomass is the largest renewable energy source, accounting for 12.6% of overall energy consumption in 2020, according to renewable energy think tank REN 21. Yet the use of traditional biomass involves the direct combustion of wood, charcoal, cow dung and crop waste in inefficient appliances such as open-fired stoves, which produces air pollution that is harmful to human health.

Modern bioenergy is produced from organic material, which contains carbon absorbed by plants through photosynthesis, such as wood and wood residues, energy crops, crop residues, and organic waste/residues from industry, agriculture, landscape management and households. This biomass is converted to solid, liquid or gaseous fuel which can be used to produce heat, electricity or transport fuel.

An example of a bioenergy project is anaerobic digestion plants, which process organic matter to create biogas. The biogas can be used as is, or it can be upgraded—by adding propane to increase the calorific value—and then be injected into the grid. The gas produced is used to heat homes and can be converted into electricity.

“One of the issues the anaerobic digestion sector has within the U.K. is that it’s not very big,” Carl Gurney, the renewable energy director at Marsh Commercial, said in a previous interview with Leader’s Edge. “There are only around 600 plants and, obviously, that’s not enough to create a balanced portfolio in which insurers are able to withstand large claims.

“On top of that, in the recent past, many insurers have pulled out of the market because of the severity of claims. To put it in perspective, an anaerobic digestion plant may earn 5,000 pounds per hour. So you definitely don’t want that plant offline for long, or the insurer will start ramping up some serious claim money. But despite those difficulties, I’m very optimistic about the industry as it has grown and matured over the past decade.”

Challenges Abound

The existing renewable energy sources are very diverse and at different evolutionary stages, yet they all seem to share three major challenges: vulnerability to weather-related events, connectivity to the existing grid, and their prototypical status.

“Ironically,” Newland says, “the biggest risk to renewable energy development is climate change itself. Natural catastrophes, in fact, highly impact the success rate and damage risks of certain renewable energy projects.”

Once deployed, renewable energy projects come with weather-related vulnerabilities that can hinder performance. Wind turbines, for example, which require the constant presence of wind to generate energy, can be damaged by icy conditions and even, it turns out, by strong winds.

According to WTW’s Renewable Energy Market Review, the greatest influencing factor for the renewable energy market in 2023 was the availability and pricing of natural catastrophe cover. Throughout 2002 reinsurers signaled a constriction in capacity for renewable projects and indicated the need for direct insurers to retain a greater degree of capacity in their portfolios. This caused pre-January 1 renewals to increase by high double-digits, particularly for nat cat property business in North America, where indications showed alarming increases of 20% to 50%.

Insurance capacity for renewable energy projects can vary depending on location. “Within Eastern Europe, insurance capacity for renewable energy projects is plentiful at the moment,” Kowalewski says. “We don’t have the same problems that exist for conventional power. Having said that, there’s little new capacity coming to the market, as, in the past three years, we’ve only seen four major players enter the scene.

“Fortunately, a large part of the Greco territory has very low nat cat risks, which is great when we talk to carriers, as it’s a great way to balance their renewables portfolio, especially if they have a lot of projects in Texas or Louisiana, which have high nat cat risks.”

Newland says another important issue to consider is the transition to renewable energy—in particular, efforts to integrate a variety of

low-carbon energy sources. “It’s important to focus on how new technologies and infrastructures need to fit together to allow for this change to happen,” he says.

Significant investments in grid infrastructure are required to support the electricity produced by renewable sources and to make that electricity available. While traditional forms of energy produce stable (or base) energy loads, energy supply from renewable sources is variable, allowing for shortages or surpluses of energy.

“Current grid systems,” Newland says, “do not cope well with those fluctuations because they are used to a base energy load. So, to not overhaul the grid system, battery storage and other forms of energy storage, which were mainly geared towards storing energy over the long term, are being used as short-term energy storage to balance the peaks and troughs of renewable energy.”

One more challenge shared by all renewable energy sources is that they are often considered prototypical projects. “In the insurance world,” Kowalewski says, “you don’t want to use the term ‘prototypical.’ So there is a gentle way of calling it, which is ‘upscale technology.’ But for all intents and purposes, upscale is prototypical.”

Despite these challenges, the future of renewable energy projects remains bright, thanks to the few insurance players that have continued to support emerging energy sources and their related technologies.

“At the moment,” Newland says, “with many of the new renewable energy technologies, it is very much like insurance research and development, where a few insurers decided to lead the way—regardless of whether it is a risky venue.”