Specialty Firm Acquisitions Hit New High

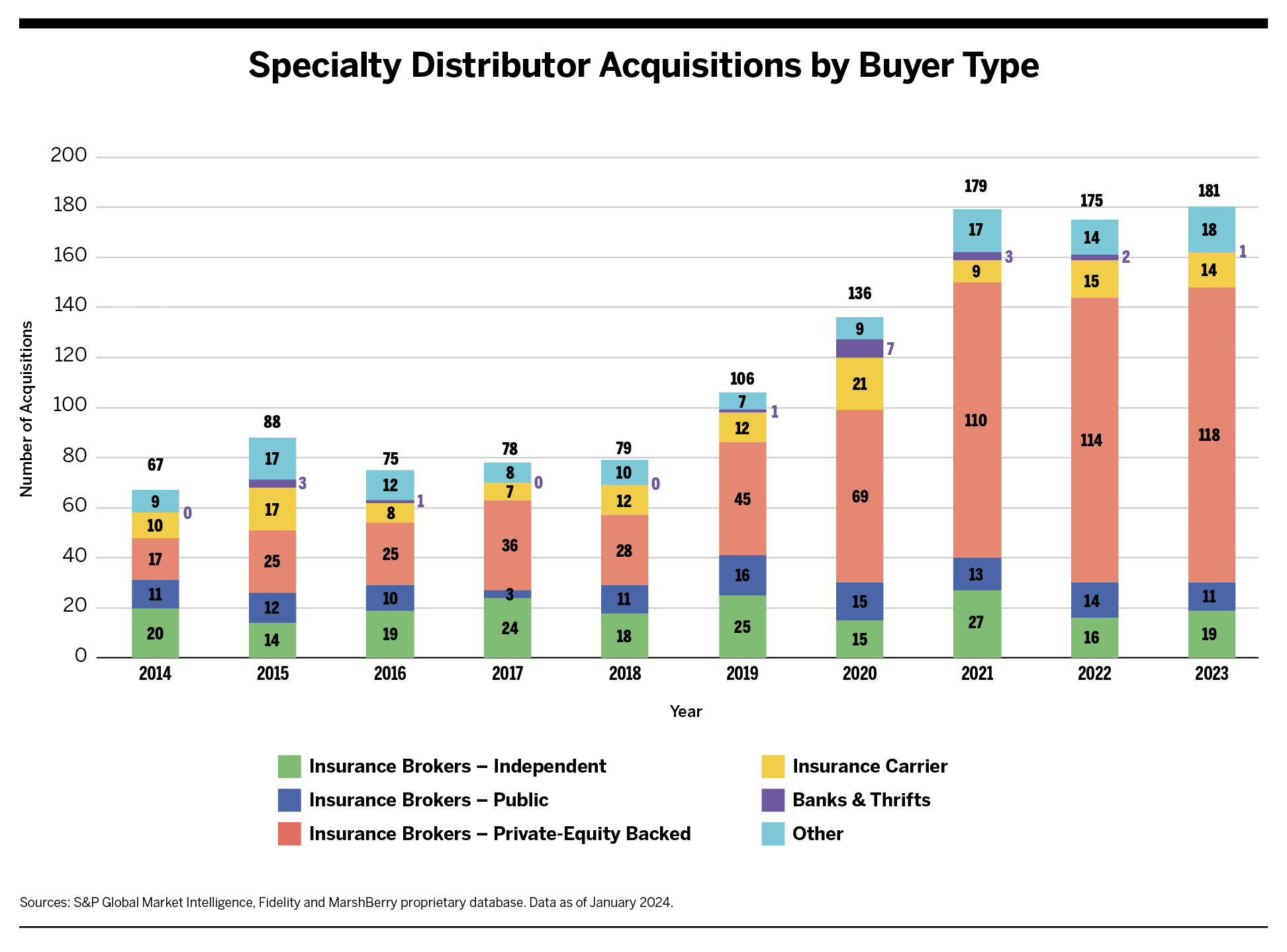

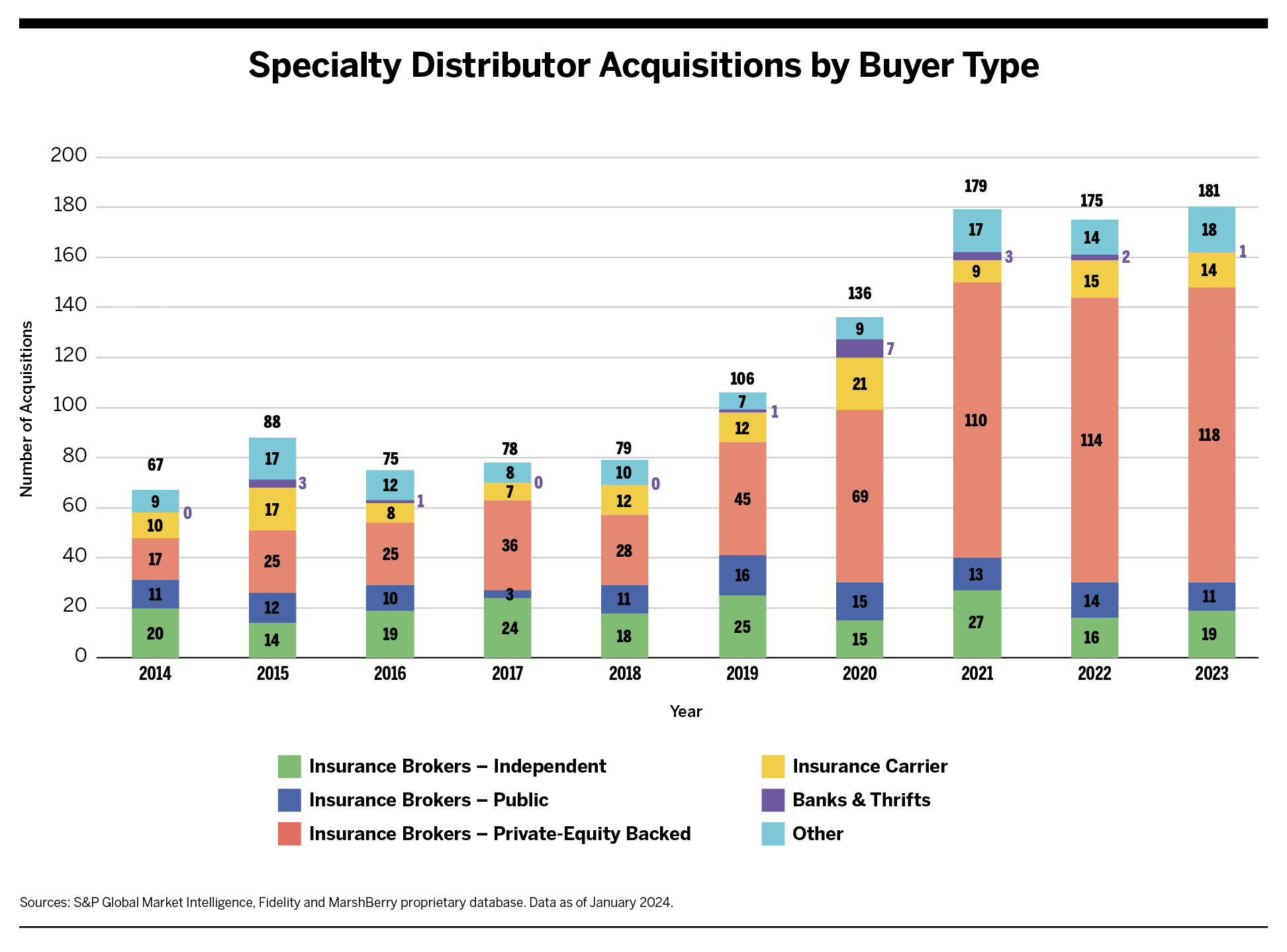

Bucking 2023’s heightened macroeconomic challenges and increased capital costs, the number of specialty insurance distributor M&A deals hit an all-time high at 181.

That represented 22% of total deal activity for the year, also a record high. Demand is driven principally by the continued rising premium volume in the specialty sector, which results in a higher propensity for organic growth of these firms.

Specialty firms are characterized as insurance distributors sitting between the retail brokerage and risk taker and/or having delegated authority from their carrier partners.

There had been concerns that buyers would become more selective in 2023, given the higher cost of capital. However, well run firms—those typically with organic growth of 7-10% or more—are commanding valuations comparable to the historical valuation highs of 2021 and 2022.

The rate of M&A consolidation of specialty firms compared to their retail counterparts accelerated in 2023. Retail transactions decreased 14% year over year, with 626 transactions in 2023 versus 728 in 2022. The deal count for specialty firms has gone in the other direction—from 179 in 2021 to 175 in 2022 and then up another 3% to 181

in 2023—translating to a five-year CAGR of 18%.

All of this speaks to the overwhelming demand from buyers and investors covering almost all forms of conventional buyer types. Private-capital backed organizations continued to drive activity in this area, making 118 deals in 2023—up from 114 transactions in 2022 and 110 in 2021. All other buyer types collectively registered 63 deals for the year. Those private capital deals represent a 162% increase from the 45 specialty acquisitions in 2019. The Federal Reserve’s pause on its contracting monetary policy, along with a potential decrease in interest rates in 2024, bode well for private-capital backed acquirers to retain their dominant presence in the league tables.

Top Buyers of Specialty Firms

Integrity Marketing Group (IMG) made 32 transactions. IMG has led the specialty buyer leader board for four consecutive years and is focused on the life and health sector.

Simplicity Group was the runner-up in 2023 with 12 transactions. It also operates primarily in the life and health sector.

Alliant Insurance Services and One80 Intermediaries (an affiliate of Accession Risk Management Group, formerly known as Risk Strategies) each made nine transactions in 2023. While Alliant is a newer name on the top specialty-acquirer list, One80 has been at the top of the P&C acquisition board for several years.

NFP, through specialty division Totalis Programs, made eight transactions during the year.

Hub International, through specialty division Specialty Program Group, also recorded eight transactions in 2023.

Other Notable Dealmakers

Euclid Insurance Services: Reflecting a trend in the specialty sector, Euclid provides underwriting teams infrastructure and services to support growth. Euclid has sold (in part or in whole) five underwriting partnerships over the past decade.

K2 Insurance Services and Warburg Pincus: PE fund Warburg Pincus, which has extensive investment experience in insurance brokerage (including Foundation Risk Partners, which went through a recapitalization event in 2023), acquired K2 from Lee Equity Partners in 2023. K2 was seeking an investor that could help it with larger acquisitions, supplementing its successful growth strategy of acquiring books of business and smaller acquisitions. K2 is now leading acquirer of delegated binding authority entities.

Why the Heightened Interest?

Rising premium volume in the specialty sector is a large driver of buyer interest in the space. MarshBerry estimates specialty premium volume will be roughly 20% of total U.S. P&C direct written premium in 2023. This would be up from about 9% in 2010. Market share growth largely results from:

- Historical admitted premium flowing into the excess and surplus (E&S) market

- Rate (pricing) increases in several E&S-focused segments, such as catastrophe-prone property

- Exposure base expansion amid growing global complexities (e.g., geopolitical pressures, state governments getting in the way of allowing admitted markets to adjust to underwriting results, etc.)

This premium flow has driven the specialty segment (i.e., E&S and delegated authority premium) to grow at a CAGR of 17.8% between 2018 and 2023, compared to 6.8% for that of the non-delegated authority admitted markets during the same period. As such, wholesale brokerages and delegated authority agents (commonly referred to as MGAs) are reaping the benefits of higher premiums—as premium increases, so do the related commission dollars. This growth trend and positive outlook is driving strong buyer interest in this segment.

The rate increases in 2023 will likely continue into 2024, even as rates in the general admitted marketplace have moderated. This supports an ongoing firm rate environment that kicked off in 2019 and shows no signs of slowing.

Specialty Market Outlook for 2024

Even with uncertainty around interest rates and tightening capital costs, buyers of specialty firms appear poised for aggressive dealmaking in 2024, with plenty of dry powder and a debt market that finally loosened up and lent itself to several large issuances in late 2023. MarshBerry expects high-quality specialty firms with solid management teams, strong organic growth, and effective business plans with minimized concentration risks to continue commanding premium valuations this year and beyond.