Flipping the Script

In the world of insurance brokerage mergers and acquisitions (M&A), the narrative has always been about buyers and private equity investors looking for quality firms with quality leadership and strong organic growth.

And that is still a popular narrative. However, there is a shifting storyline in which top-performing independent brokers that are exploring partnerships are starting to ask the larger, acquiring firms, “How are you going to help me grow or make me better?” Some buyers don’t always have a good answer.

Many of these highly sought after brokers, which already show outsized growth, are seeking partners that can help them reach the next level of growth. In this environment, with an imbalance between heavy demand for quality brokers and the available supply, sellers are in the driver’s seat to determine that partner.

It’s no longer just about which buyer is willing to pay the most—although that remains incredibly important. It’s now also about what else a buyer can offer to convince these top sellers to join their organization. Many larger firms lean on their track record of acquisition success, their integration strategy, and the culture they’ve built. But none of that really explains how they plan to take a successful and growing firm and help it grow exponentially.

Sellers now want to know a potential partner’s investment strategy; its go-to market strategy; and the tools, resources, niche expertise, and technology that will be available to them. They want to know what unique or proprietary solutions a partner might offer to help them provide better options to clients and give them a competitive, growth-fueling advantage in the marketplace.

So, while buyers are still asking sellers, “Why should we buy you?” they might also be on the receiving end of questions like, “Why should we join you?” or “How are you going to make us better?” Buyers that can’t articulate their value proposition, with solid examples of how they are different from other dealmakers, will have a hard time convincing these high performers to join them and will likely be left wondering why they weren’t the firm of choice.

M&A Market Update

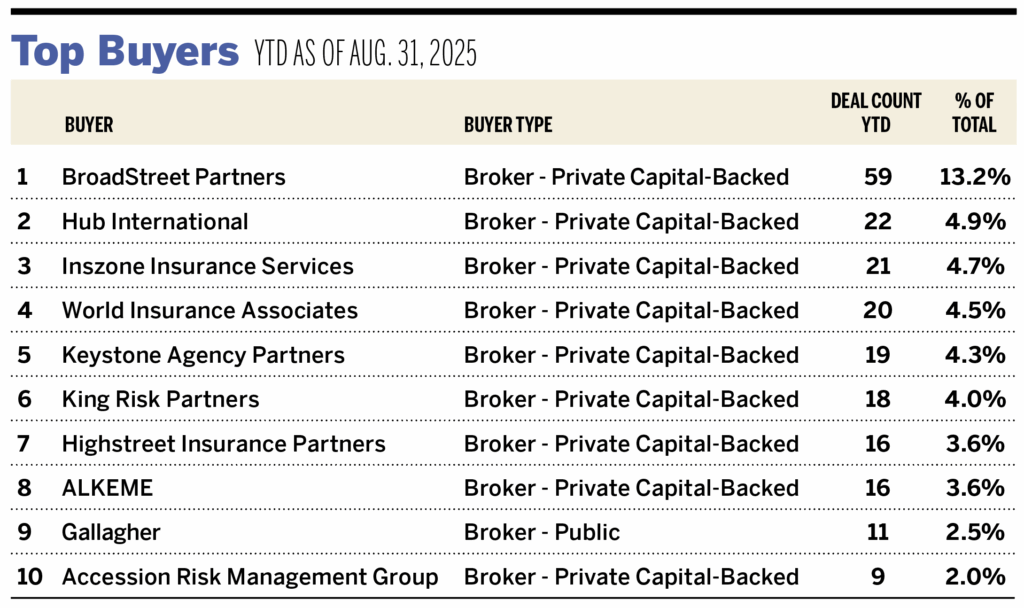

As of Aug. 31, there were 446 announced insurance brokerage M&A transactions in the United States in 2025. Private capital-backed buyers accounted for 324 of the 446 deals (72.6%) through August. Independent agencies were buyers in 65 deals, representing 14.6% of the market. There have been six announced transactions by bank buyers in 2025. Deals involving specialty distributors as targets accounted for 71 transactions, about 16% of the total market, continuing the trend of low supply of specialty firms.

Ten buyers accounted for 47.3% of all announced transactions year to date, while the top three (BroadStreet Partners, Hub International, and Inszone Insurance Services) accounted for 22.9% of the 446 transactions.

Notable Transactions

- Aug. 15: Brightstone Specialty Group, a Michigan-based subsidiary of Highstreet Insurance Partners, has acquired RMS Hospitality Group and its affiliated claims firm, Fortis Risk Solutions, from RMS Insurance Brokerage. Based in Garden City, N.Y., RMS Hospitality brings over 20 years of experience providing insurance to the franchise food, hospitality, and restaurant sectors, while Fortis serves as a third-party claims administrator. MarshBerry advised RMS Hospitality on this transaction.

- Aug. 29: Marsh McLennan Agency has acquired Robins Insurance, a Nashville-based independent agency founded in 1976. Robins specializes in business and personal insurance, with niche expertise in sectors such as real estate, construction, hospitality, community associations, and manufacturing. MarshBerry advised Robins Insurance on this transaction.