I’m Right, You’re Wrong

As a country, we have never been so unwilling to communicate with those who have different opinions.

We are unaccepting of ideas that aren’t our own. If we don’t like what someone says, they must be wrong. Former President Bill Clinton made this point clear during his keynote at the 2019 CIAB Insurance Leadership Forum in Colorado Springs.

In President Clinton’s words, the good news is, as a nation, we are less racist, less sexist and less gender biased than the generations before us. However, we are far more judgmental toward others’ ideas, and we expect perfection. We have evolved into a culture of “we’re right, they’re wrong,” and we retroactively evaluate the decisions people make using this mindset.

But if you can never be wrong, how can you change? Let’s apply this same concept to your business. If you remain stagnant because new ideas are “wrong,” then how will your firm grow and remain relevant in an ever-changing world? If you don’t grow and recruit inspired team members who want to succeed, what is your business going to be worth? If you’ve said, “I’ll never sell,” and you still refuse to accept change, what choice will you really have?

When we listen to different opinions and engage in new ways of thinking, we create vibrant cultures that invite people to participate, grow and succeed. When we not only listen but ask for others to share their thoughts and evaluate what we could be doing better, then we improve performance and profitability. We open doors—we have choices.

So many firms in our industry are stuck in the old narrative, “I’ll never sell.” What if the conversation changed to, “I’m always for sale.” How would that impact the way you develop talent, drive profitability and plan for the future? I can envision how this type of openness to a different opinion could create significant opportunity. Ultimately, by running a business as if it is always for sale, you’ll grow a stronger, more sustainable organization that has greater value. You will run it like a real business. Your colleagues will want it to perpetuate and invest in it because they are a part of its success. They own the success. Carrying on the business legacy will become a reality because it will have evolved with the market and it will solve modern-day clients’ problems. The business will be relevant because it evolved.

The bottom line is, the only constant is change. If we can’t be open to others’ opinions and new ideas—embrace innovation and challenge the norm—then we lose our ability to choose. We miss out on opportunities. Change is happening whether you adapt or not. The firms that acknowledge it and leverage “the new” grow and thrive.

So, how well are you doing at accepting different ideas? Take a moment to read these statements and be honest about whether you’ve said or thought them to be true.

- It’s OK that I am not profitable because I am growing.

- It’s OK that I am not growing because I am really profitable.

- It’s OK if a producer doesn’t write at least $100,000 of new business.

- I know that producer isn’t really nice to all of their service team, but they have one of the biggest books of business in the company and are a new-business machine.

Did you say yes, even one time? If so, as former president Clinton said, it’s time to challenge your thinking. If you assume you are running a perfect organization and don’t need to change a thing, it’s time to seriously reconsider your mindset. And if you do, you can empower your people, grow your business, drive more value, and steer your future.

MARKET UPDATE

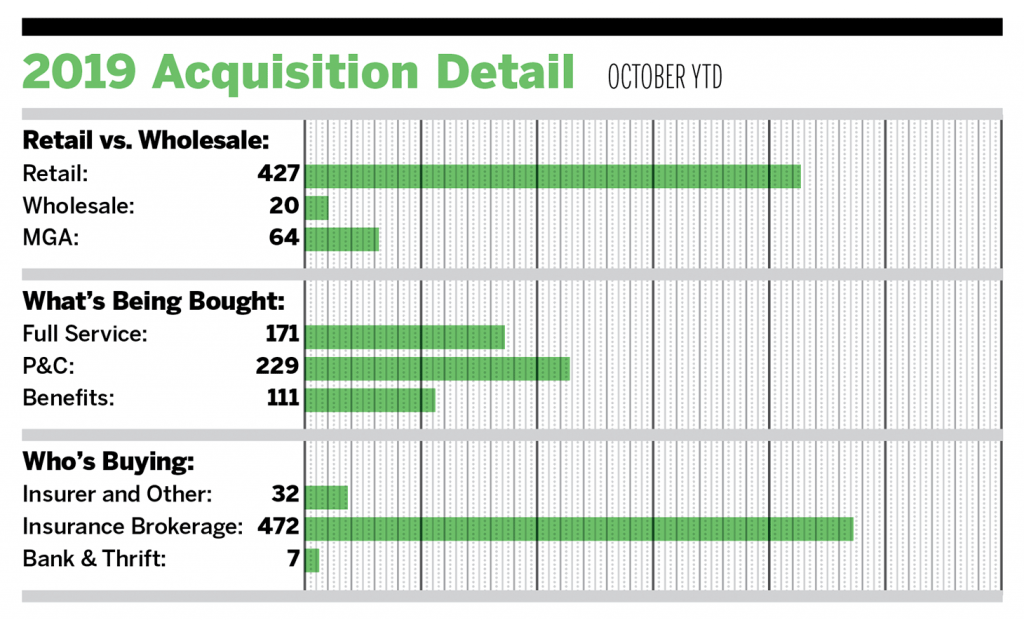

The 2019 announced transaction count has remained red hot through October. As of Oct. 31, there have been 511 transactions announced, compared to 479 announced transactions through last October (a 7% increase). With two months left in 2019, passing 2018’s total of 580 transactions seems like a near certainty.

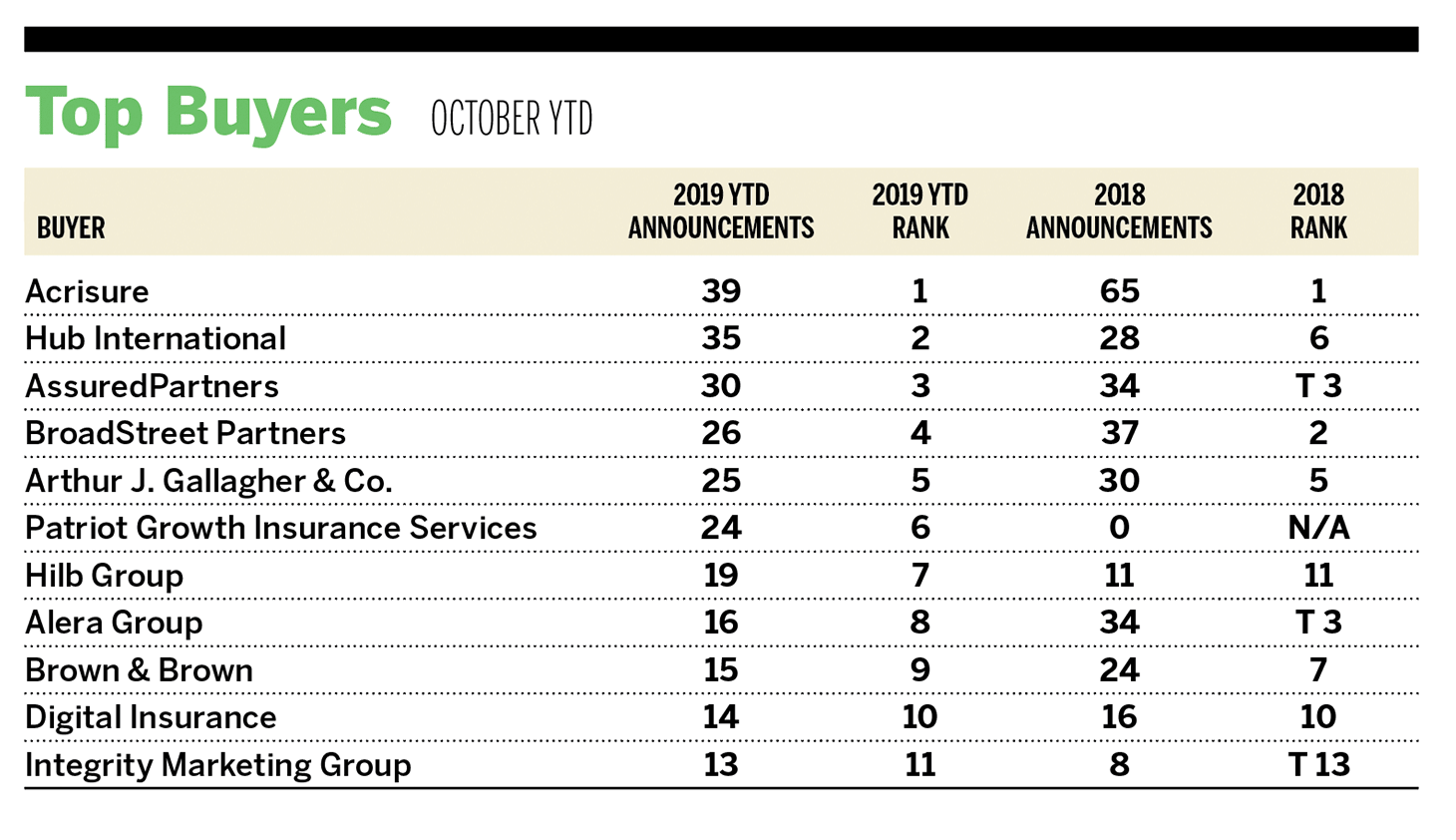

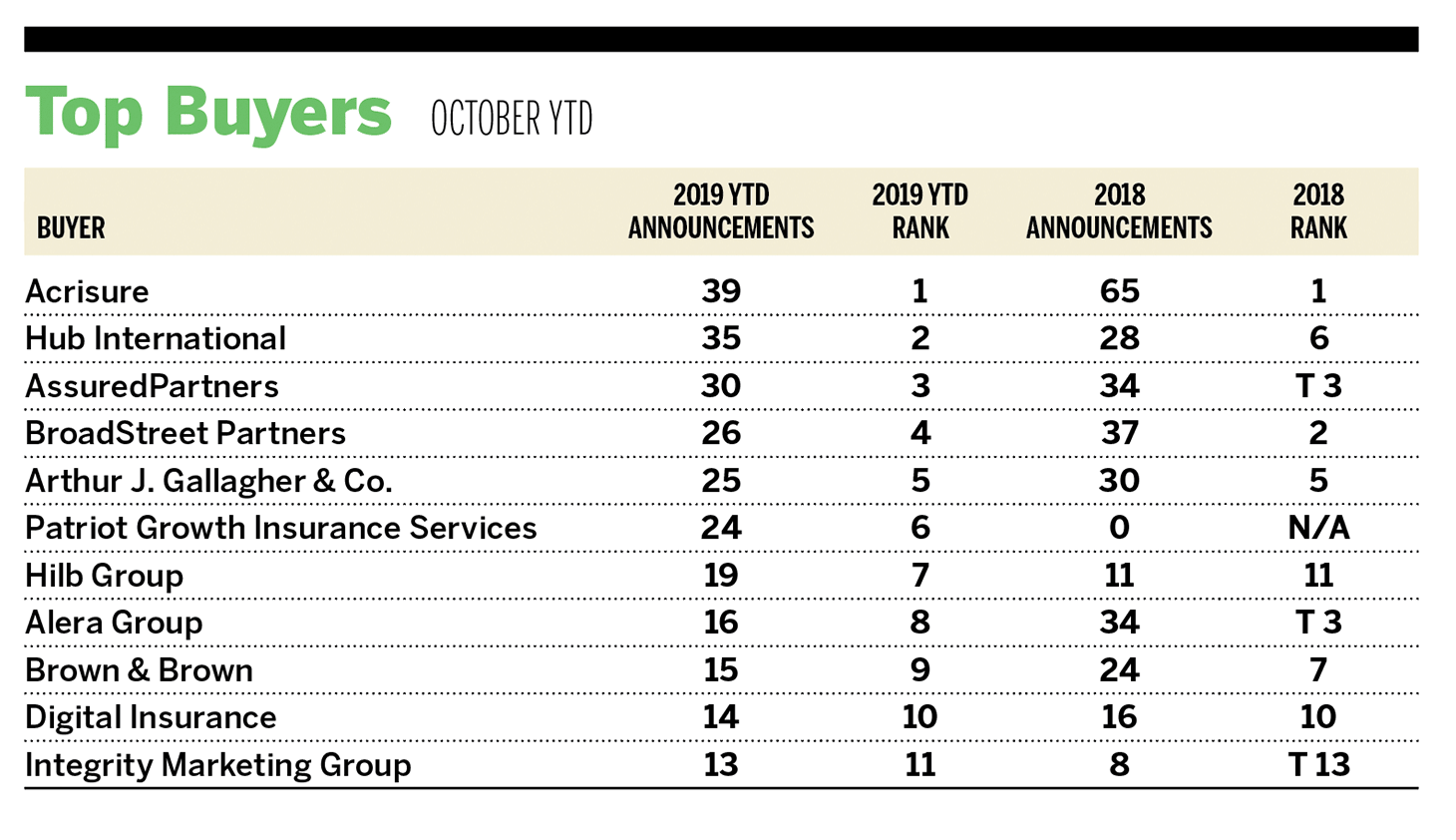

Private-equity backed buyers remain on top of the market. They have contributed 290 of 511 (57%) transactions year to date. The percentage of the total announced transactions is identical to the percentage of PE-backed transactions this time last year. However, independent agencies and brokerages still make up over a quarter of all announced transactions (27%). Acrisure, Hub International and AssuredPartners make up the top three most active buyers through October, contributing a combined 21% of the 511 deals announced so far this year. The top 10 most active private-equity backed agencies are responsible for 220 transactions so far this year (43% of the total).

Baldwin Risk Partners shocked the market with a recent initial public offering in October. The firm began trading on the Nasdaq on Oct. 24, with an opening share price of $14. It is estimated that the net proceeds of the offering will be $228.8 million. The firm has goals to become a top-10 insurance brokerage in the United States in the next 10 years.

The Hilb Group announced on Oct. 30 that it has entered into a definitive agreement to be acquired by The Carlyle Group. Hilb is currently a portfolio company of Abry Partners, and the acquisition by Carlyle is expected to continue supporting Hilb’s organic growth and acquisition growth strategies. According to Hilb’s press release, the transaction is expected to be completed in the fourth quarter of 2019. On Oct. 31, Risk Strategies Company secured a $1.6 billion unitranche loan from a group of direct lenders. The loan was priced at 550 basis points over Libor, and the proceeds are expected to refinance the company’s existing capital structure. Large-scale direct lending has been moving at an increased pace this year, as banks have exhibited a decreased appetite for risk, and private equity sponsors continually seek to mitigate execution risk. Direct lenders that move quickly and provide competitive terms have been a driving force in the uptick in direct placement unitranche loans. Opportunities to mitigate pricing and market flex risk have caused more private equity sponsors to lean away from the broadly syndicated market. According to Refinitiv, at least a dozen unitranche loans of $500 million or more have been made by direct lenders this year alone. This roughly doubles the seven deals completed in all of 2018.

Securities offered through MarshBerry Capital, Inc., Member FINRA and SIPC. Send M&A announcements to M&[email protected]

Disclosure: All deal count metrics are inclusive of completed deals with U.S. targets only. Scorecard year-to-date totals may change from month to month should an acquirer notify MarshBerry or the public of a prior acquisition. 2019 statistics are preliminary and may change in future publications.