The Capital Effect

This will be a pivotal year for the insurance brokerage industry, as capital structures in 2026 will significantly influence the mergers and acquisitions (M&A) landscape.

In some ways, things will look different—new buyers entering the market and reshaped dealmaking dynamics. In other ways, they may look the same—demand continuing to outpace supply, reinforcing the importance of growth strategies and leadership.

After several years of elevated interest rates and inflation, the cost of capital has dictated the players and pace of M&A, as the ability to finance acquisitions has been tied to balance sheet strength. As interest rates stabilize and potentially decline in 2026, several themes tied to shifting capital structures could emerge.

Recapitalization will likely be the primary theme this year. Lower rates would allow firms to refinance expensive debt, freeing capacity for renewed acquisition activity and maybe even improving valuations for sellers. This trend could particularly benefit midsize consolidators and private equity platforms that have been sidelined by expensive financing. Based on current investment horizons, upward of 20 firms might be looking for a new capital partner in the next 12 to 24 months. Additionally, we expect new private equity players to enter the insurance brokerage space. This market has long been attractive to PE investors; with many brokers looking to recap, now is the time for new investors to jump in.

As many firms seek recapitalization, several existing PE-backed brokers could be sold to strategics. The recently announced $1.3 billion sale of Newfront Insurance to WTW may start the falling dominoes of larger brokers looking for new partners in 2026. Scale and specialization are becoming critical competitive advantages.

Perhaps not a trend, but newly public brokers are certainly something to look for in 2026. Two of the industry’s largest privately held brokers—Hub International and Acrisure—are both positioning for public listings. Public listings would provide these firms with permanent capital, enabling them to pursue transformative deals without the constraints of private equity liquidity cycles. Moreover, IPOs could set new valuation benchmarks, influencing expectations for seller values across the middle market.

M&A activity in 2026 will likely be defined by well-capitalized brokers and newly public entities and dominated by large, strategic acquisitions. Meanwhile, smaller firms may need to focus on niche plays or seek partnerships to remain competitive. For sellers, timing will be critical. Those aligning with buyers undergoing recapitalization or preparing for IPOs may command premium valuations.

M&A Market Update

The preliminary M&A numbers are in for 2025—but stay tuned for further updates, as many buyers delay calendar year announcements until January. As of Dec. 31, there were 753 announced insurance brokerage M&A transactions in the United States in 2025. This represents a 4.7% increase from the 719 deals announced at the end of 2024, putting deal volume for 2025 on track to be the third-highest year on record. With counting likely to continue for several weeks, 2025’s deal total could exceed 2024’s final number of 847.

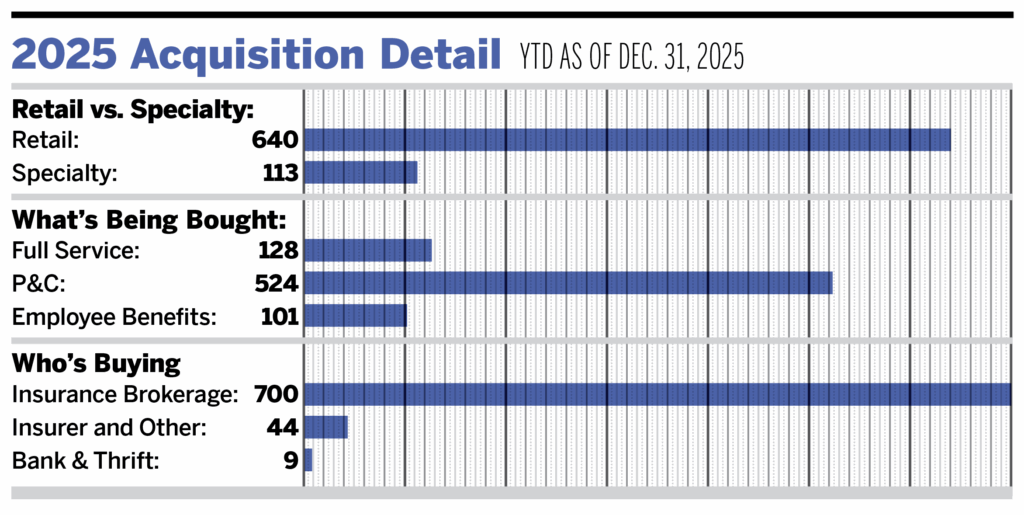

Private capital-backed buyers accounted for 547 of the 753 deals (72.6%) through December. Independent agencies were buyers in 103 deals, representing 13.7% of the market. There have been nine announced transactions by bank buyers in 2025. Deals involving specialty distributors as targets accounted for 113 transactions, about 15.0% of the total market, continuing the trend of low supply of specialty firms.

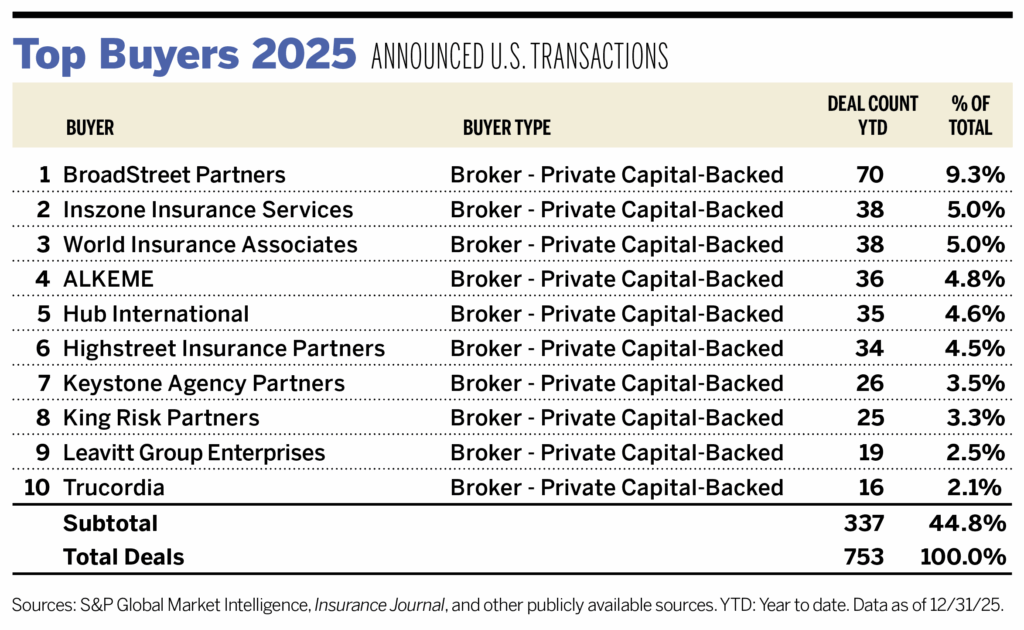

Ten buyers accounted for 44.8% of all announced transactions year to date, while the top three (BroadStreet Partners, Inszone Insurance Services, and World Insurance Associates) accounted for 19.4% of the 753 transactions.

Notable Transactions

- Dec. 1: Marsh McLennan Agency (MMA) acquired Honolulu-based brokerages Atlas Insurance Agency, Pyramid Insurance Centre, and IC International from Tradewind Group. The acquisition expands MMA’s capabilities in Hawaii in commercial, personal, and employee benefits insurance, with industry specializations in municipalities, transportation, and hospitality. MarshBerry served as an advisor to Tradewind Group on this transaction.

- Dec. 2: The Baldwin Group entered into a definitive agreement to acquire CAC Group. The deal, expected to close in the first quarter of 2026, will create one of the largest independent insurance advisory and distribution platforms in the United States. MarshBerry served as an advisor to The Baldwin Group on this transaction.

- Dec. 17: NFP, an Aon company, has acquired Hamilton Insurance Agency, a Fairfax, Va.-based brokerage specializing in senior housing and long-term care with additional capabilities in benefits administration and risk management. MarshBerry served as an advisor to Hamilton Insurance Agency on this transaction.