The Mother of Invention

The global pandemic has underscored that even the world’s most advanced countries are exposed to more risk than they are properly covered for.

And many are scrambling for solutions to help businesses and communities survive the ongoing economic effects.

Middle-income and poor countries have for years been working on solutions for systemic risks that threaten their fragile communities, and their experience could provide a guide for potential solutions to catastrophic risks facing developed economies.

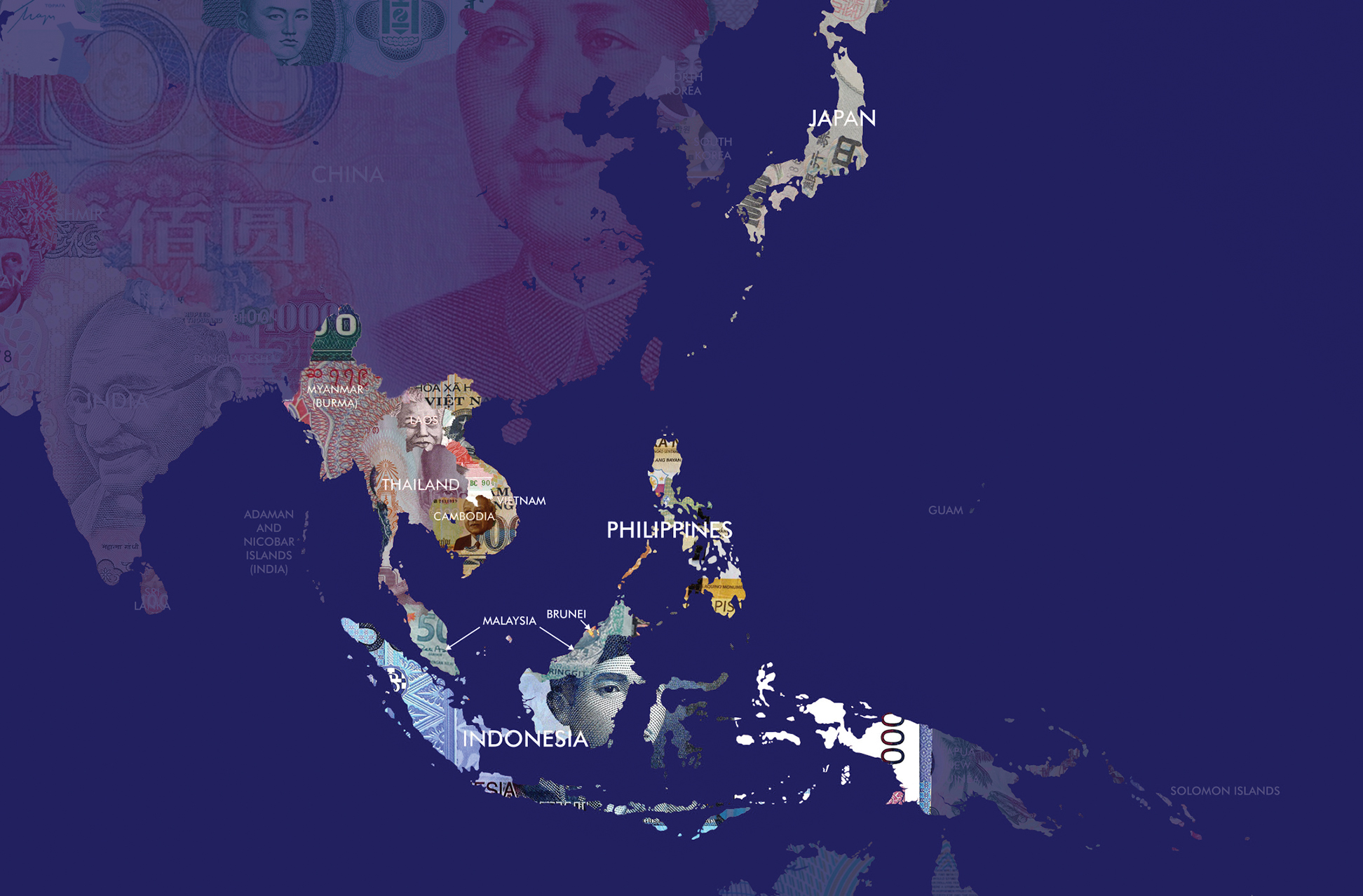

Risk layering is being used in Southeast Asia by the newly formed Southeast Asia Disaster Risk Insurance Facility (Seadrif), which is working with the World Bank to help narrow the region’s natural catastrophe protection gaps through multipronged risk financing and advisory.

Middle-income and poor countries have been working on solutions for systemic risks that threaten their fragile communities for years.

The Association of Southeast Asian Nations is home to more than 650 million people with a combined 2019 GDP equivalent to nearly $3 trillion.

In the event of a 200-year disaster, Laos, the Philippines and Cambodia are likely to see bills totaling at least 18% of total public expenditure.

Read our related article, Government Help Needed!

In countries where financial protection strategies are underpinned by risk layering, prearranged financing instruments (such as contingent credit or insurance) are combined with other traditional funding (such as budget or reserves). The reason is simple: no single instrument can help the governments weather the storm in a sustainable manner. Efficiency gains are best achieved when the instruments work in complementary ways, to respond to post-disaster funding needs.

While the European Union looks at a risk-layering strategy for dealing with future pandemics, perhaps the work already being done in poorer countries can be a guide.

Seadrif was established by six national governments: Cambodia, Indonesia, Laos, Myanmar, Singapore and Japan. Seadrif Insurance Company, a licensed direct general insurer in Singapore, provides disaster risk-management and insurance solutions to the member states of the Association of Southeast Asian Nations (ASEAN)—Indonesia, Thailand, Singapore, Malaysia, Philippines, Vietnam, Brunei, Cambodia, Laos and Myanmar. ASEAN is home to more than 650 million people with a combined 2019 GDP equivalent to nearly $3 trillion. They are highly prone to disaster and weather events. Floods, tropical storms, droughts, earthquakes and tsunamis all have left severe physical, economic and human impacts in the region, with more than 400 million lives affected over the past 30 years—and annual regional average expected losses equivalent to greater than 0.3% of regional GDP.

Five of the governments—Cambodia, Laos, Myanmar, the Philippines, and Vietnam—could together face average annual disaster response bills in excess of 0.5 percent of total public expenditure. In the event of a 200-year disaster, Laos, the Philippines and Cambodia are likely to see bills totaling at least 18% of total public expenditure.

According to Guy Carpenter, “Seadrif is the first regional facility in the Association of Southeast Asian Nations (ASEAN) to address disaster risk financing in a comprehensive manner, from risk identification, reduction and preparedness to insurance and resilient recovery.”

Experts who have been concerned about the region are now welcoming the news about Seadrif’s initiatives: “In coming years and decades, Southeast Asia could face climate shocks of a similar scale to the COVID-19 pandemic,” said Sanjay Khanna, a futurist at global law firm Baker McKenzie. “The regional cooperation that Seadrif represents is critical to addressing wide-ranging physical risks and material consequences that climate-driven natural disasters pose. After Southeast Asia recovers from COVID-19, the question is whether funds for disaster reconstruction will be available in proportion to actual risk. It’s likely that financial arrangements will need to be continually reassessed as climate risks become better quantified by forward-looking risk models.”

Seadrif’s First Initiative

ASEAN countries are all at different stages of economic development, have different sociopolitical structures, and differ by risk profiles, fiscal space, and level of access to financial markets, all of which generate different funding needs following disaster and weather events.

Although ASEAN’s financial sector remains generally underdeveloped, the insurance industry in Indonesia, Philippines, Thailand and Vietnam has started providing products for disaster risks at the household level with subsidies from the governments. These programs, however, remain small in scale.

Smaller ASEAN economies, especially Cambodia, Laos and Myanmar, face short-term funding gaps for emergency response. Those three underfunded governments have allocated contingency budgets and reserve funds to be used for emergency response, but all remain exposed to catastrophic events, relying heavily on international donor assistance for response, relief and recovery.

Seadrif’s first initiative strives to address these funding gaps by developing a catastrophe risk pool for Laos and Myanmar, with support from Japan, Singapore and potentially other donor partners. The pool will be run by the Seadrif Insurance Company, which is housed under Seadrif Sub-Trust A, a subgroup of the Seadrif member countries and donor partners.

According to Seadrif, “the proposed regional catastrophe risk pool will act as a reinsurance- backed disaster liquidity facility, providing participating countries with immediate financing for response in the aftermath of a natural disaster. The countries join the pool through a payment of contribution or premium and receive quick payouts upon eligible disaster events. These payouts and their triggers are predetermined according to clear and transparent prior-agreed rules. The pool will retain some risk based on its joint reserves made of country premium contributions and donor contributions. It will transfer excess risk to international reinsurance markets in order to ensure that all claims can be paid in full.”

Payouts triggered by an insured event are designed to provide the affected governments with immediate post-disaster liquidity for disaster recovery. By providing quick liquidity in the aftermath of a disaster, Seadrif helps alleviate the fiscal constraints faced by the countries in managing the impacts of disaster and weather shocks, helping them prevent vulnerable populations from falling back into poverty and safeguarding the gains from development.

The focus is on opening new markets and opportunities for private solutions. The new risk pool expects to mobilize up to $40 million of risk capital from the industry in case that 1-in-30 years event occurs in both countries in one policy year. The company expects to crowd in expertise from insurance managers, asset managers, and technology companies to help deliver solutions to the beneficiary countries.

The initiative has twin goals: first, to make full insurance payout within 30 days of the occurrence of a covered event under parametric policies; and second, to have the capacity to make full payment for a 1-in-200 year insured loss, to be assessed in each financial year.

“Beyond Seadrif,” says Hideaki Hamada, a senior specialist in disaster risk finance at the World Bank, “the bank has provided advisory and analytical services to more than 60 countries worldwide to advance the policy dialogue and develop financial risk strategies and instruments.” The goal is to improve financial risk management in the event of disaster risks. Developing countries increasingly request support that goes beyond the technical work to actually implementing their financial strategies, including the development of financial instruments, among them risk transferring programs such as insurance.

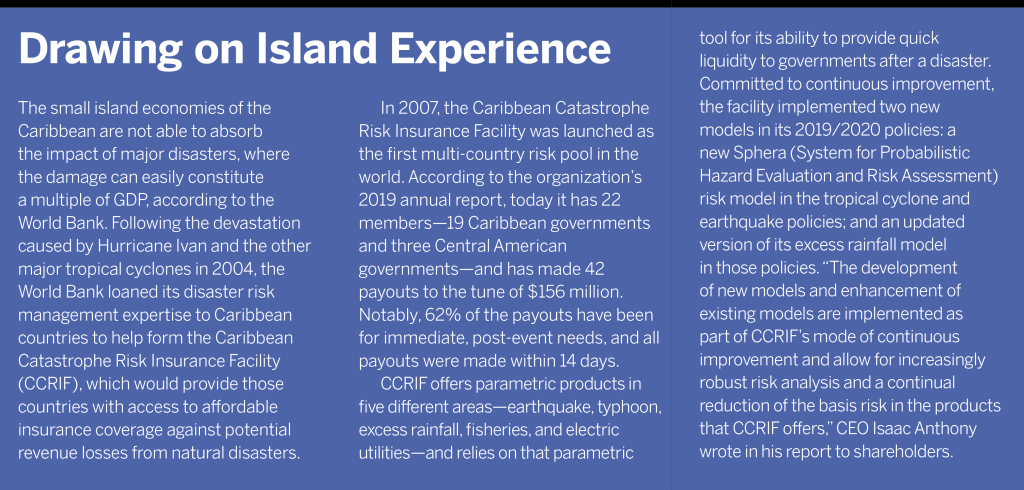

The World Bank hopes to eventually draw from Seadrif some transferable lessons about developing innovative insurance products. Because Seadrif was established just a year ago, Hamada says, “it would be premature to discuss lessons learned from the development of Seadrif’s insurance products, as it is still in the process of launching the initial product. This will be the first such pool in Asia, building on the experience of similar initiatives supported by the World Bank in the Caribbean and in the Pacific.”