Valuations Prove M&A Headlines Are Misleading

After quite a while without a real down year for insurance brokerage mergers and acquisitions, that’s exactly what we got in 2023.

Not just a year that failed to set new records but a materially down year. S&P Global Market Intelligence cited 555 announced deals in 2023, falling from 639 in 2022, which was itself down from 977 in 2021. That represented a falloff of over 43% from peak activity in just two years and the lowest announced deal total since 2016, according to S&P’s numbers.

Deal volume is down, but the fundamentals supporting consolidation remain intact.

The deal market became more concentrated in 2023, and prized assets sought peak pricing.

The characteristics of those firms capturing the most interest are larger size, strong organic growth, demonstrated specialty capabilities and a youthful team.

There are many reasons for this trend, but the main culprit was the impact of rising interest rates on available capital. The U.S. Federal Reserve began raising the federal funds rate in earnest in mid-2022 to combat inflation and continued through much of 2023. The process pushed many buyers out of the brokerage market and made others much more selective. It was the collective reaction that you would expect when things get more expensive. The blackjack dealer raised the table minimum, and, predictably, the crowd thinned out a bit.

The buyers that most quickly left the table were those highly leveraged brokerages that had exhausted their borrowing capacity under existing debt facilities. With rapidly rising interest rates, it became too costly to raise more money. With some buyers absent, deal activity fell.

Thus, the headlines are true: deal volume is down. But don’t read too much into this decline. The fundamentals supporting consolidation remain intact, and one year of interest-rate inspired slowdown does not make a new M&A market.

Concentrated Buyers

The market remained active in 2023, and companies with capital and lower debt levels continued their aggressive pursuit of premier properties. Gallagher, for example—with relatively modest 2.8x total debt to EBITDA (earnings before interest, taxes, depreciation and amortization) as of Dec. 31, 2023—took advantage, closing on two top-100 firms during the year: bank-owned agencies Eastern and Cadence.

The deal market became more concentrated in 2023, tightening the far-flung exchange of buyers and sellers of 2020-2022. Buyers that remained in the market crowded around the prized assets. For those prizes, pricing remained at peak levels and maybe even inched slightly higher.

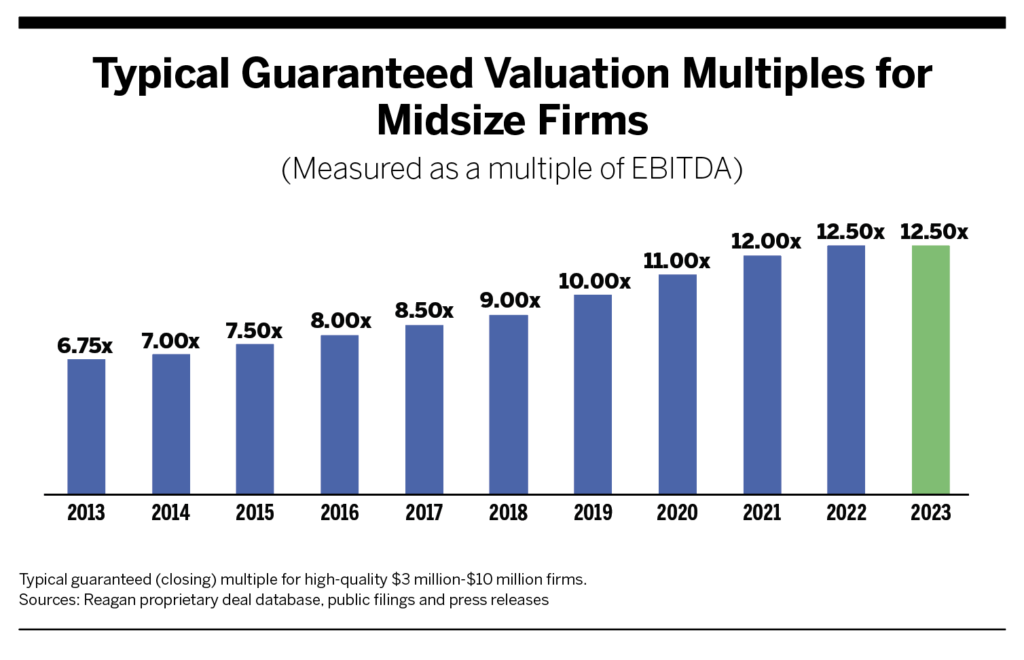

We track the typical guaranteed purchase price for growing, successful firms in the $3 million-$10 million (midsize) revenue range; in 2023 the typical price was approximately 12.5x EBITDA—equal to the multiple in 2022.

While persistent high pricing at the top end amid decreased demand seems to violate a basic law of economics, the valuation impact says more about the sheer level of demand in the marketplace, even in a down year. In a market with dozens of well capitalized buyers, does the absence of some players change the marketplace? For firms at the upper end of the size and quality range, the answer was no. Gallagher chairman and CEO Pat Gallagher eloquently captured the market’s robust appetite in his fourth-quarter 2022 earnings call in April 2023: “If you had 20 people bidding on a property 18 months ago, you still have 11 today…there is competition out there.”

For smaller firms that are not growing as quickly, the laws of economics held: demand and pricing fell.

What Drives Interest?

The characteristics of those firms capturing the most interest are larger size, strong organic growth, demonstrated specialty capabilities, and a youthful team.

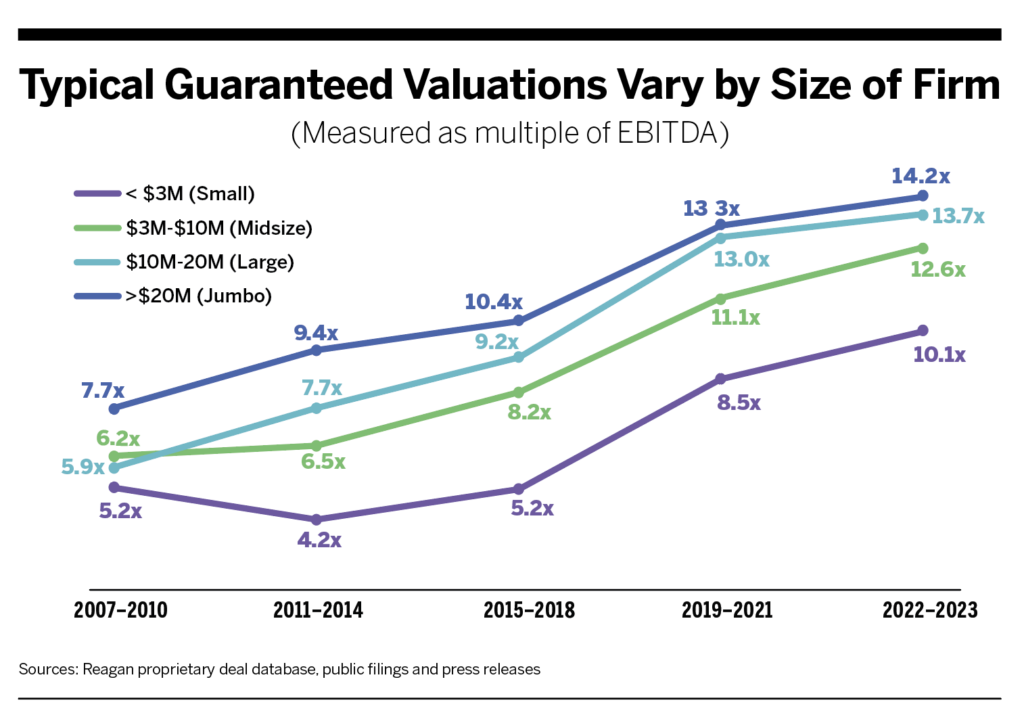

There have always been size differences in pricing. The premium that the largest firms receive over the smallest firms, as seen in the next chart, has been fairly consistent during the last decade. The size premium for jumbo firms (>$20 million in annual revenue) versus large firms ($10 million-$20 million) narrowed from 2019 to 2021 and then widened slightly in the last two years.

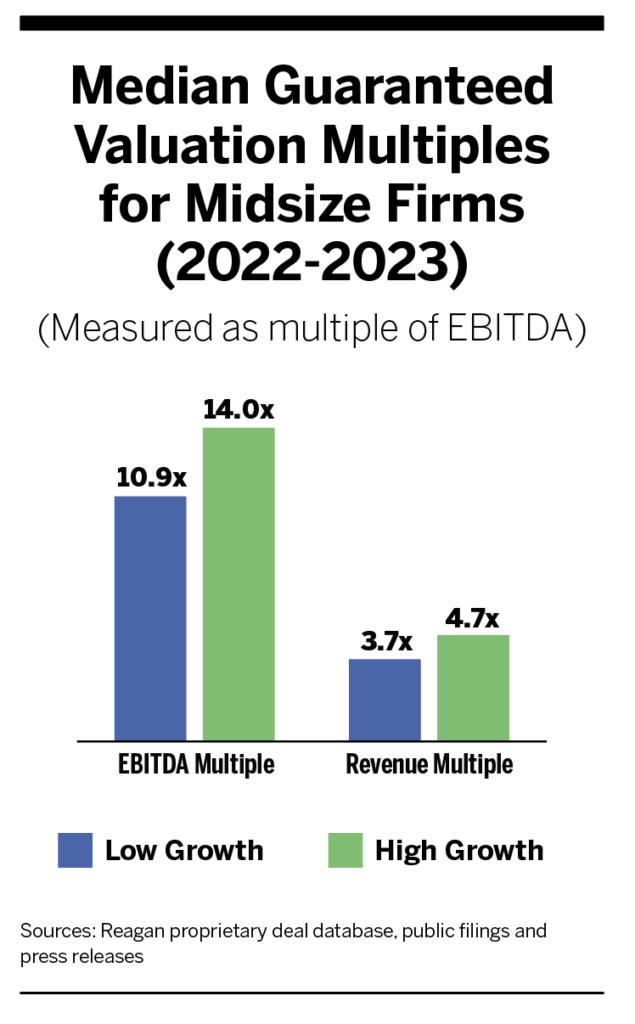

While median valuations for quality midsize brokerages remained consistent from 2022 to 2023, valuations diverged for high-growth brokerages versus low-growth brokerages. High-growth brokerages generate consistent double-digit organic growth prior to a transaction while lower-growth firms are single-digit organic growers.

High-growth midsize brokerages commanded median guaranteed valuations of 14x EBITDA (or 4.7x revenue) compared to 10.9x EBITDA (or 3.7x revenue) for lower-growth firms over the last two years. While most of the transactions fall into this midsize band, this was a common thread across all sized bands—buyers want growth and are willing to pay for it.

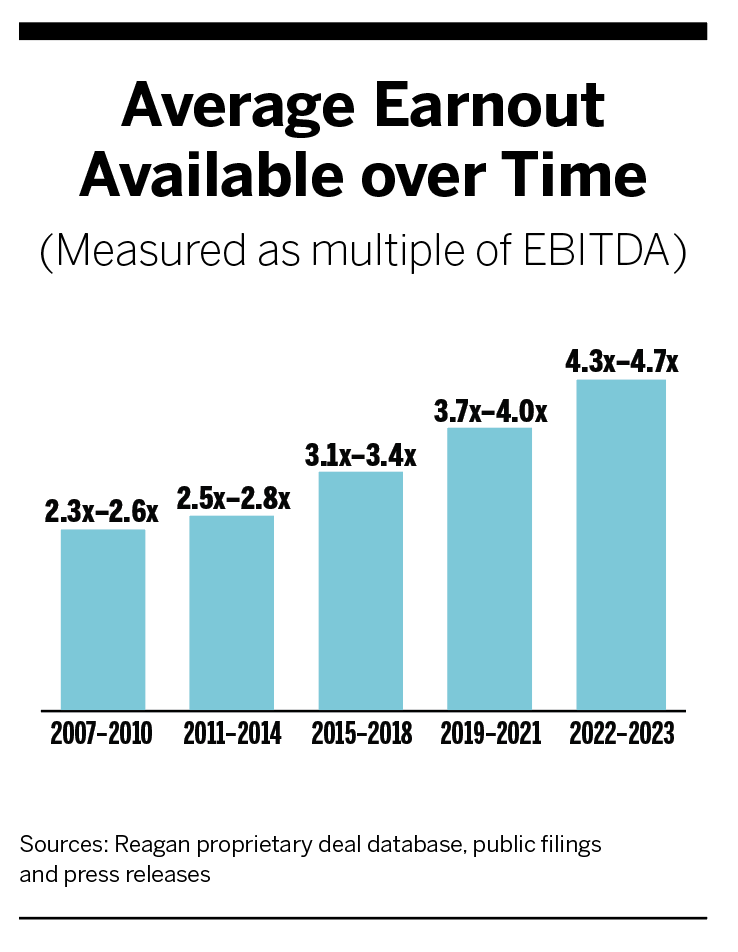

Increasing demand for higher organic growth is amplified through buyers’ post-closing earnout structures. Buyers more often now add significantly higher earnout opportunities for sellers that are bullish on growth and capable of delivering outsized performance.

So while the reduced activity dominated the surface headlines, the undercurrents in the M&A market remained robust. This year’s headlines may be different.

Buyers Are Reloading Capital for 2024 Dealmaking

Everything the M&A market struggled with in 2023 seems perhaps a little bit easier in 2024, starting with capital. First and foremost, buyers are faced with a choice: can they afford to sit on the sidelines and wait out the higher cost of debt while others continue to acquire? Buyers had different answers to this question in 2023, but in 2024 we think everyone’s answer will effectively be no. In fact, in the second half of 2023, capital reloading was already highly visible.

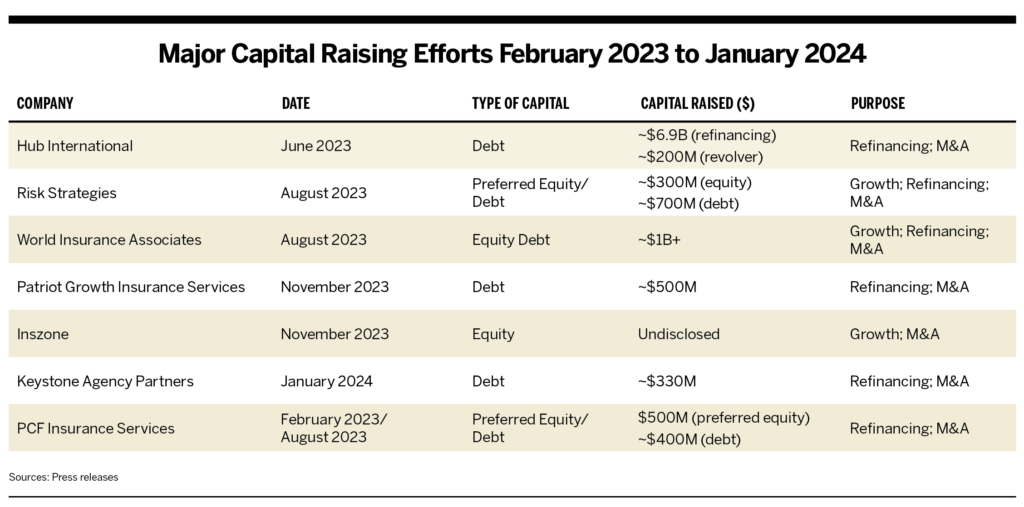

Here are just a few brokerages that raised funds late last year into early 2024.

PCF is perhaps the most extreme example of the reload-for-2024 dynamic. The brokerage largely exited the M&A game in 2023, announcing only two deals versus 43 in 2022. However, the company raised a $400 million debt facility in August 2023 to restart dealmaking. “We will use the financing proceeds to further fund the expansion of our Office Partner network,” said CFO and COO Felix Morgan, “as we look to accelerate execution of our M&A strategy with the support of our great partner investors.”

The industry pullback in 2023 was a temporary reaction to rate hikes and economic concerns, not a change in strategy. We are still operating in a fragmented market with considerable benefits from scale.

In addition, the Federal Reserve has signaled as many as three interest rate cuts in 2024, which would lower the cost of deal fuel.

We anticipate more deal activity in 2024 than 2023. This is an obvious consequence of buyers’ access to more capital to deploy. Some buyers that stood aside will return to the market, and buyers that remained will continue to be active. This means more demand and more transactions.

This activity will positively affect valuations, but we don’t think it will be enough to overcome the nuance and bifurcation in the market. Buyers will continue to favor greater pricing variation based on seller performance and will hesitate to let this dynamic leave the market.

Growth Under the Microscope

Buyers always pay the most for firms with high organic growth, that most valued of all seller attributes. A seller that demonstrates outsized organic growth is rewarded with an outsized multiple at the time of the deal. In recent times, most sellers have demonstrated strong organic growth. The hard market tailwind has tended to make everyone look good.

But as the winds begin to swirl and the eventual shift in property and casualty pricing moves closer, not everyone will perform in a changing market. Buyers will face an increasingly challenging question as they evaluate deals: which sellers can sustain their growth? We expect increased scrutiny during due diligence on the drivers of organic growth. Has a seller’s growth been driven by rates or new business? Are the production engines capable of sustaining performance going forward? Sellers with true sales cultures and strong new business production will emerge from this increased scrutiny with higher valuations.

Platform Pricing Might Get Even Stronger

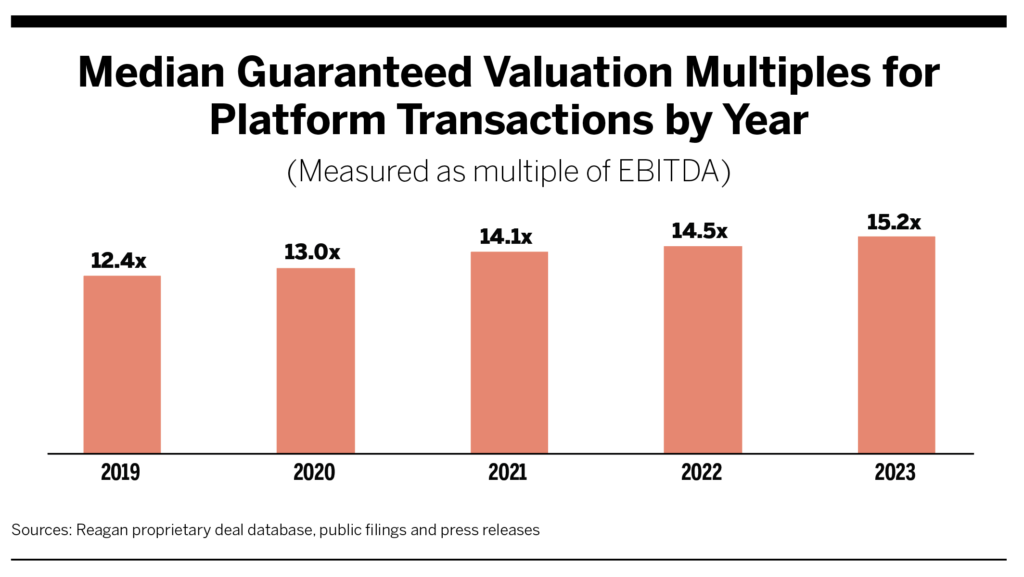

The competition for “platform” deals—deals that allow buyers to enter new territories, acquire substantial amounts of talent, or gain new specialty expertise—will remain intense. For the purposes of this analysis, platform deals provide over $15 million in annual revenue. The size of these deals ensures interest from buyers.

Platform pricing increased in 2023 even though pricing for midsize firms has remained relatively consistent. Pricing for these transactions has risen to guaranteed multiples around 15x EBITDA on average, plus an earnout. The scarcity of these transactions drove the multiple lift in 2023 and could allow for further lift in 2024. As these deals become tougher to find, buyers will be tempted to inch up their price to ensure that they have a greater chance of landing the acquisition.

The 2024 M&A market for brokerages will be healthy. Reduced activity in 2023 reflected a reaction to a changing rate environment, but the industry is still consolidating. Large brokerages are fighting for scale, and M&A is the quickest path to get there—especially if organic growth slows. Private equity investors are still pouring capital into the industry, and M&A is central to that capital deployment. Valuations will reflect these macro trends but will be nuanced based on seller performance. Larger firms that are proven growth engines are rarer—and more valuable—than ever.