In the late 1950s, an ambitious young agent beginning his insurance career at Metropolitan Life found himself in the midst of an entirely untapped and underserved market.

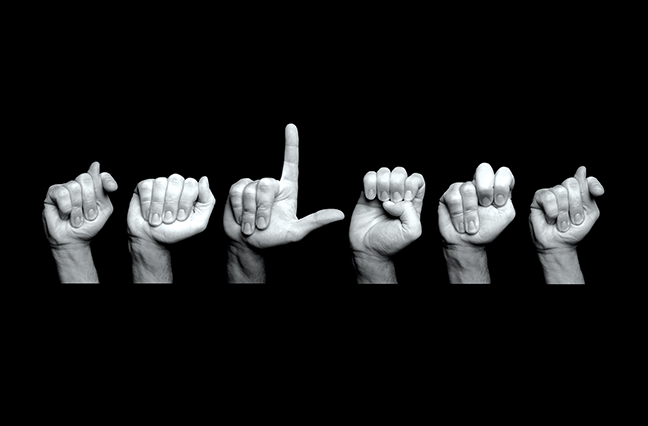

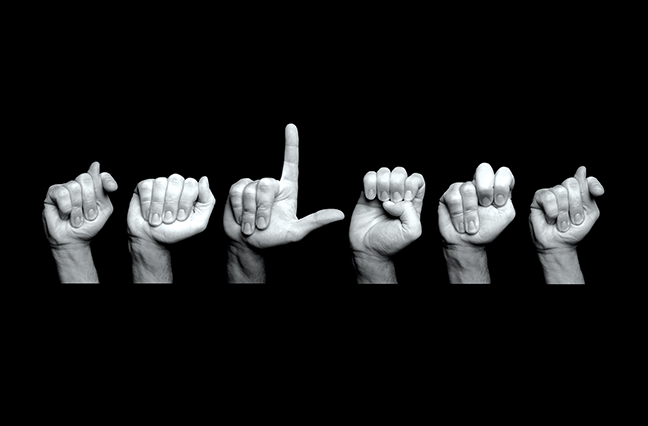

James Maguire was attending church with his friends and neighbors, Victor and Helen Saggase. The Saggases were deaf, and the service was conducted in sign language. When the minister opened his sermon by introducing Maguire to the congregation, “Victor leaned to me and said, ‘Stand up now,’” Maguire recalled. “I had no idea what was happening. They told me that there may be some people who wanted insurance after the service. I sat in the back of church that day, writing policies for hours. And that’s how it started.”

Maguire had already realized the deaf community didn’t have access to standard-rated policies, so it didn’t take long for a mutual respect to form between him and his new clients. He had such a flood of business that others marveled at his success. That flood continued for the next 55 years. He established the Maguire Insurance Agency in 1960, then Philadelphia Insurance Companies in the 1980s. Maguire is now 84 years old, and the Maguire Foundation that carries his name has impacted countless lives—including a new generation of the deaf community.

Cloning Saint Joseph’s

Born during the Great Depression into a large family, Maguire moved around a lot due to his father’s job with Met Life. Moving from city to city meant new schools for Maguire. He struggled with his studies and eventually fell behind academically at Niagara University, which he attended on basketball and work-study scholarships. He left school and was conscripted into the Korean War. After two years in Japan with the U.S. Army, he enrolled in Saint Joseph’s University on the GI Bill.

It was during this time at Saint Joseph’s that Maguire’s life would begin to take a new direction. As a senior basketball player, he volunteered to work with athletes from a nearby deaf school. His father, who died unexpectedly of spinal meningitis at age 45 on the night Maguire graduated high school, had also been partially deaf. Before long, Maguire had formed a relationship with the local deaf community.

It was also at Saint Joseph’s that Maguire met Reverend Hunter Guthrie, a noted pioneer in the study of dyslexia. Maguire credits Guthrie with first recognizing that his educational struggles were related to dyslexia. That discovery radically transformed Maguire’s life. After working with Guthrie, Maguire graduated from Saint Joseph’s with a 3.0 GPA.

Forever grateful to the school that helped him finally succeed academically, Maguire has given many gifts to Saint Joseph’s over the years. One of the most significant is the Maguire Academy of Insurance and Risk Management, which supports the school’s risk management and insurance (RMI) program. The program is an industry leader, graduating 400 students last year. A handful of years back, Maguire had the idea of cloning it.

And while he didn’t quite clone it, in 2015 Maguire’s two passions came together when he helped establish an RMI program at Gallaudet University in Washington, D.C. Founded in 1864, Gallaudet is a private university for the deaf and hard of hearing.

The Gallaudet program, now in its third year, has 38 students, and 19 students have declared RMI as a major. In 2017, a new chapter of Gamma Iota Sigma, the international risk management, insurance and actuarial sciences fraternity, was chartered at the school, with 28 members inducted. December 2018 will see the program’s third graduate, and six more students are expected to graduate throughout 2019.

The program focuses on creating fresh opportunities for students and the industry alike, on changing mindsets, and on providing exposure in a time when the field desperately needs a new source of talent. Maguire calls it “a fantastic success.”

“The idea of teaching insurance to the deaf community seemed like a natural,” Maguire said. “Today, 90% of the communication in the insurance industry is done through the computer. These kids are smart. They can’t hear, but that’s their only handicap. And with a computer, that handicap is overcome.”

He Never Forgot

While Maguire is the vision and support behind Gallaudet’s RMI program, it has taken the work of many to get it off the ground, particularly Jim Bruner. The executive director of the Maguire Academy, Bruner was a member, in the 1970s, of the first integrated class of deaf and hearing students at the Rochester Institute of Technology. The school is home to the National Technical Institute for the Deaf. Initially Bruner gave little thought to what it would mean to have a deaf roommate—but it opened him up to a new world and a whole new language.

After graduation, Bruner went on to spend 30 years in risk management and insurance in various capacities, including time as an account executive with Wausau Insurance Companies/Liberty Mutual Insurance Companies and area vice president with Gallagher.

But he never forgot.

And in 2015, as an empty nester looking for a new life experience, he found himself living in a dorm with deaf students once again—this time preparing for his new role at Gallaudet. “I wanted to immerse myself in the culture,” Bruner says. “And three years later, here we are.”

“Brokers, insurance companies, we all want diversity and inclusion within the workplace now. It’s a real priority. But deafness has fallen through the cracks. We just don’t think about it. We have an amazing talent pool here that everyone should know about.”

Does it take a little bit of adjustment? Sure.

“But when you leave your comfort zone,” Bruner says, “that’s where the true growth happens.”

Thriving Interns

Once Bruner became executive director of the RMI program, it didn’t take long for him to recognize that industry internships would be an important component of its success. In 2016, he was invited to attend a meeting organized by the District of Columbia Insurance Federation, at which he and Robert Shilling, a representative from the Maguire Foundation, told those gathered about the program.

Stephen Taylor, commissioner of the DC Department of Insurance, Securities and Banking (DISB), liked what he heard. Supporting the effort was an easy decision, Taylor says, especially since it fit with his department’s goals to partner with academia and financial services providers through its Financial Services Academy. “The program has an excellent mission and focus, and, more importantly, it has an amazing advocate and leader in Jim Bruner,” Taylor says. DISB brought on its first intern that same year, another in 2017 and two more this year.

“We found that communicating with the interns was not the obstacle that some may imagine,” Taylor says. “Rather, we found various ways to express ourselves, such as using notes, interpreters and text messaging. What we also found were impressive, driven and outgoing students who would make valuable contributions to any internship program.”

In 2018 alone, 10 students have taken part in industry internships. In addition to DISB, they’ve worked at organizations such as Marsh, AHT Insurance, World Wildlife Fund, NFP and Philadelphia Insurance Companies, focusing on projects like telematics, blockchain, underwriting, policy analysis and wearable medical devices.

“These students are incredibly bright,” says Randy Jouben, a 30-year risk-management veteran who teaches several courses in the Gallaudet RMI program. “They have a desire to do well and to prove themselves. I think a lot of people might look at the fact that they’re deaf or hard of hearing as a negative, when it’s actually not. They’re gifted, imaginative students and have experiences that a lot of others haven’t had. It makes them adaptable. That’s a soft skill that’s hard to teach, but these students have it.”

Immediately Contagious

As the internship opportunities for Gallaudet students have continued to expand, so has student interest in working with brokers, insurance companies and risk management departments—and those entities have responded in kind.

Last spring, Sean Gormley, the director of commercial brokerage at AHT, and Kate Armfield, AHT’s chief operating officer, found themselves visiting the Gallaudet campus to interview five candidates.

“It was a very exciting experience,” Gormley says. “A lot of energy came from that initial meeting.” The candidates all brought enthusiasm and confidence, he says, “and it was immediately contagious.” Gormley had no previous experience with the deaf or hard of hearing, and he didn’t know what to expect. “But I was eager to expand what I knew about the community,” he says.

Gallaudet helped prepare the brokerage—a service it offers all host organizations—through a deaf awareness workshop. A dozen or so AHT employees attended, along with Montray Roberts—the inaugural intern—and several representatives from the university. The workshop offered insight into the deaf and hard-of-hearing experience, as well as practical suggestions for overcoming barriers both perceived and real. Take, for example, communication.

“Our work is so oriented toward technology that it really wasn’t a hindrance,” Armfield says. “Having worked around that, I think we would be game to have any kind of intern now, whether hearing impaired or a blind person. It was a real game-changer for us in terms of how we can bring on more talented people.” It simply came down to accommodating people with different needs.

At Marsh, meanwhile, Charmaine Davis, a senior vice president and Gallaudet board member, was having learning experiences of her own.

“The nature of the work we do, it’s about high expectations and constantly delivering,” she says. Working with the interns, however, she found that she had to stop and slow down to interact—and to think about how she communicates with others.

One of the things that surprised her was how many of her colleagues took an interest in the interns. Some had hearing challenges of their own. Others had family members who were deaf or hard of hearing. “They were so engaged, having the students here,” she says. One colleague in particular learned enough sign language to invite the first two interns to lunch and carry on a conversation. Charmaine says she knew “a little bit” of sign language and the interns appreciated any attempt she made to use it. The company also displayed presentations on video screens and made use of instant messaging.

“They never seemed to be frustrated with us, even when we were trying to find ways to communicate,” she says.

Marsh has a complex diversity and inclusion program, and Charmaine says the partnership with Gallaudet allows the company to “cast a wider net.” Next time around, however, she says she’d like to see more interpreters available to help out. In some instances, there were workarounds, but it still could be better. “That was a missed opportunity for all of us,” she says. “From a board member’s perspective, we all buy into the mission. We all have empathy because of our personal experiences. Mine is about education, and therefore, there are no boundaries. Anyone who’s interested, I’m on board. I’m so privileged to be a part of people who are so passionately devoted to this community.”

Two-Way Learning

Aside from the direct lessons on underwriting, risk management, analysis and the like, the Gallaudet RMI program offers one other decidedly distinct element: a deaf insurance broker teaching classes. Gary Meyer, who also has 30 years of experience, believes he may be the only deaf insurance broker in the property and casualty business. He is vice president of DHH Insurance Agency, which he founded in 1996 (in 2005 the company became a division of C.H. Insurance Brokerage Services). DHH Insurance has provided insurance programs to the deaf and hard of hearing population since its start. Meyer met Maguire when his company approached Philadelphia Insurance Companies about setting up a national initiative to provide professional liability insurance for sign language interpreters, and the men became friends.

In pulling the Gallaudet program together, Maguire asked Meyer if he’d be willing to serve on the board and offer consultation. “We were always keeping in mind that someday I would be an instructor at Gallaudet, and now I am,” Meyer says. Video conferencing software allows him to teach remotely from Rochester, New York.

“I provide direct communication with the students,” Meyer says. “By that, I mean, it’s not relayed through an interpreter. It’s from me, right to them. Most deaf individuals would prefer direct communication. There’s a personal relationship that can be built that way, and wanting that is a very common feeling in the daily lives of deaf people.” He believes it makes an impact that he’s able to understand how deaf students think and to understand the culture. He says it’s also important to be able to be a positive role model for the younger generation.

While the students are learning from the instructors, the instructors are learning from them.

“I normally confuse people who ‘can’ hear me,” Jouben says. “When the interpreter is there, I have to slow down. I have to be conscientious. I’ve learned to pick up when there’s an understanding gap.” And that, he says, has transferred over to conversations with all people. “I know that people don’t understand me when I talk about risk management and insurance,” he says. “Now, I’m more cued in to the visual cues that people have lost my train of thought. I also am adapting to the usage of particular words, words that have multiple meanings.”

Continuing the Relationship

At Philadelphia Insurance Companies (PHLY), where the deaf community has richly been woven into the organization’s history, the partnership with Gallaudet began in 2015. There were two interns that year, placed within a larger 10-week summer program that typically brings 40 to 50 interns. Each year since, PHLY has brought in two more.

Laura Boylan, vice president of human resources, says the first year in particular was “a learning experience all around—for us, for Gallaudet and for the interns. We had done all of the research and homework and felt like we had the tools and resources in place to help them be successful in their internships. What we didn’t really factor in was that the students didn’t have any work experience in an office environment. The beautiful piece of that is we were open with one another and candid. We learned as we were going along together.”

The story of how the company started has long been emphasized among employees, she says. “And knowing we’re able to continue that relationship with the community of people that Mr. Maguire started the company on, to say that is a feel-good story seems underwhelming,” she says. “But it goes along with what the people here would expect us to do. The core values that shaped us back then still shape us today.”

As for Maguire, he’s still shaping the younger set, too.

Consider Emelda Sanders, who expects to graduate from Gallaudet in December 2019. As an African hard-of-hearing woman, she says, “I had lost all hope in obtaining a meaningful career.”

But then, opportunity arose. She spent the summer of 2018 with PHLY and found the experience very inspiring. In one pivotal moment, she met Maguire and his daughter, Megan Maguire Nicoletti, who is trustee, president and CEO of the Maguire Foundation. They encouraged Sanders to stand strong and believe in herself and to know that she could make her dreams come true.

“The diverse group of people I worked with encouraged me to be creative, motivated and innovative,” she says. “I am especially thankful for my supervisor and mentor, who were supportive role models. Our team collaborated in designing a new product for a competition, in which we took second place.” PHLY’s summer associates team up to revamp products that PHLY writes and then make presentations to senior leaders.

Her team’s diversity, collaboration and mutual respect was its strength, she says, and that wasn’t the only positive aspect of the experience. “All levels of management and employees were approachable and treated each other professionally, equally and respectfully. When I continue with my career in RMI, I would like to emulate these skills, because it felt like a place where everyone can grow and it contributes to the company’s success.”

Soltes is a contributing writer. [email protected]