The Real Cost of Risk

As companies increasingly seek ways to control costs and remain competitive, one concept that is getting considerable attention is total cost of risk (TCOR), which recognizes a claim has more impact on a customer’s bottom line than just the insurance premium and the cost of the claim.

“I think what has evolved is the world of risk in general,” says Debbie Michel, executive vice president of National Insurance Casualty, Commercial Insurance for Liberty Mutual. “Companies are doing their best to manage risk, but new risks emerge every day, whether it is driverless vehicles or cyber risk. It just makes it that much more important to be thinking about the whole picture of risk. It is much bigger than just your insurance premium and money spent on settling claims.”

“We’ve been talking about TCOR for at least 20 years and how we use it in our risk control approach with accounts,” agrees James Merendino, vice president and general manager of Commercial Insurance Risk Control for Liberty Mutual. “The industry at large has talked more about hard dollars—premiums in and premiums out—but they are now starting to come around and say maybe there is something here.”

The concept of TCOR resonates particularly well when discussing workers comp claims, which for larger companies represent one of the biggest and costliest risks.

“Something that gets a risk manager’s or CFO’s attention is talking about the real cost of a $20,000 loss,” Merendino says. “Our studies show that a workplace injury with $20,000 in direct costs would actually cost two to four times more in indirect costs, for a total loss that is close to $100,000. If the margin a business makes is 10%, that business would have to generate $1 million in revenue to cover all the costs associated with that loss.”

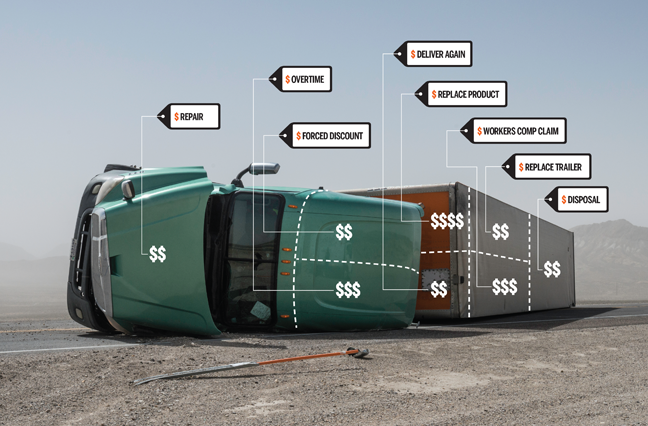

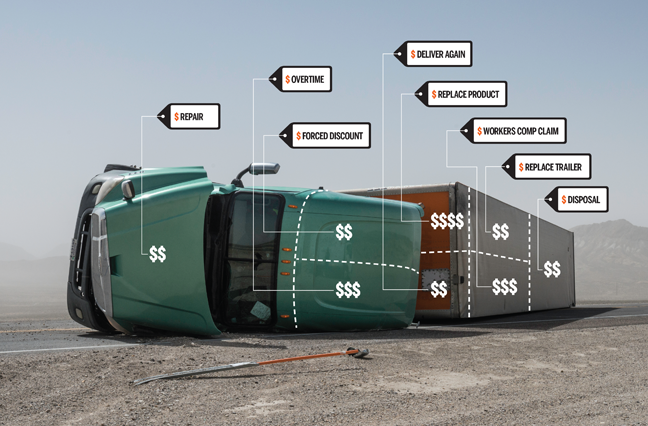

TCOR is also relevant to other lines of commercial insurance, such as auto, property and general liability.

“Say a tractor-trailer truck delivering a product overturns,” Merendino says. “That product needs to be refrigerated, so that product is lost and cannot be delivered. Because of the type of business, there is no extra inventory available to replace the order. The business will incur costs to dispose of the ruined product and to produce and deliver new product to the waiting customer, potentially paying overtime to make that happen. Most likely, the business will also give the customer a discount because of the delayed delivery. And all of that happened because of an overturned vehicle.”

After nearly 15 years of a soft market, commercial casualty insurers are focusing on the value they add to their programs as a way to keep their existing customers and attract new accounts.

“The abundance of capacity in the marketplace has driven downward pressure on pricing, so carriers have responded by highlighting their value-added proposition,” says Gary Shertenlieb, senior vice president of Lockton Companies. “Value can be reflected in pricing, but it also can be enhanced through cost containment of claims, loss control services, data analytics and other administrative and ancillary services. You will find that carriers are focusing a lot more attention on selling those capabilities than meeting the next person’s price.”

“One of the reasons I think TCOR is getting more publicity lately isn’t because it is new but because we are better able to measure it,” says Joseph Peiser, the executive vice president and head of casualty broking for Willis Towers Watson. “Advanced analytics has really helped risk management by providing a more credible way to estimate losses that have been prevented by safety programs.”

“When I started out in this business,” he says, “the hardest part for risk managers was to measure the loss that didn’t happen. Often risk managers need to get funding from their company’s treasurer or CFO for safety programs, and they require a return on investment for money spent. Now because of advanced analytics and more sophisticated benchmarking, a risk manager can show, with a degree of credibility, estimates on the effectiveness of a safety program. Carriers like Liberty Mutual have superb safety resources to help with this.”

Three Prongs of Value

Liberty Mutual views TCOR as a three-pronged program of value-added services for its customers: risk assessment, risk control and claims management.

“The first part is really understanding the risk, diving in and analyzing what the underlying risk is, understanding trends, understanding exposures, understanding the nature of their business,” Shertenlieb says.

“With new customers, part of the assessment includes benchmarking current performance against industry data or our book of business,” Michel says. “It can be difficult to demonstrate what you can do for a new customer and how you can help them control losses. We often use other large customers that have seen positive results as examples. From there, we can discuss areas to target, potential goals, and the best program structure to achieve them.”

Once a client is on board, risk control comes into play. Merendino’s department has 480 employees, 400 of whom are safety engineers and field consultants who handle the risk assessment and risk control aspects of TCOR.

“We conduct interviews and ask a lot of questions to help us and the customer get a sense of where the business is going, what the key exposures are and what might be ahead,” Merendino notes. “Once there is a good understanding of the company’s operation and its root causes of loss, then we develop an action plan to address the key drivers. We can recommend ways to automate or modify activities to reduce risk, but the customer is the one that carries out the plan. That’s why we want to get the customer as involved as possible.”

Michel says one of the things that distinguishes Liberty Mutual from its competitors is its focus on consulting with customers to help them find ways to prevent losses before they happen.

“We’re able to partner with our clients to look at risk factors pre-loss, meaning before the accident,” she says. “We focus on what we do proactively to prevent loss rather than waiting for the risk to happen.”

“I would say more and more we’re seeing that pre-accident focus from the major carriers, and Liberty is particularly good at it,” Peiser says.

Nonetheless, no risk control program can prevent every accident, so to better manage total costs, it is critical to understand up front how a claim will be managed.

In commercial insurance, 20% of the claims account for 80% of the cost, says Tracy Ryan, executive vice president and chief claims officer, Commercial Insurance, for Liberty Mutual. That is why her department uses sophisticated analytics and predictive modeling to ensure the right resources and tools are assigned to every claim.

“We know the earlier we can get on an issue and investigate it, the better the outcome,” she says. “So we gather as much information as quickly as possible so we can get it to the appropriate staff. Our 5,000 claims professionals act as extensions of our customers’ risk management departments. We want to understand a customer’s service expectations and work with them to define metrics so everyone knows how the program is performing. Our commitment to our customers is that we have the right professionals, resources and tools in our claims organization so we can deliver the best outcomes for them.”

“I would say the clients who are most interested in TCOR are loss-sensitive programs, meaning those with a decent-sized deductible,” Peiser says. “We think about a $100,000 deductible is where the interest starts. The client is taking a significant amount of risk and therefore tends to be more attuned to loss activity.”

Michel agrees that larger commercial customers, especially those with high deductibles or those that self-insure, are the most receptive to Liberty Mutual’s TCOR strategy.

“I think at the smaller end of the market, customers may not focus on it because they don’t have a formal risk manager,” she says. “Companies that understand and appreciate the value usually have formal risk managers in place. Generally, it does correlate to the size of the risk and how sophisticated the program is. It also can depend on how much a company spends on insurance and how big the risk is for the company. For example, manufacturing and transportation are industry classes where risk is a big cost item, and those companies definitely pay a lot more attention to it.”

Our risk management approach is key to client retention, Michel says. “If a customer is in place, say, for five years, we have specific results that show the impact of different initiatives on the business’s total cost of risk over time,” she says. “We can demonstrate what we have been able to do together. In the large account space, our retention is about 90% annually. It sells itself.”