The Gift That Keeps on Giving

Managing general agent (MGA) and specialty markets across the globe have been thriving for the past few years, driven by hardening market conditions in commercial insurance that have led insurers away from challenging classes of business.

According to a report by Amwins and Conning, MGA business written in the United States rose 19.1% in 2021. This was mostly due to a 38.8% increase in written premiums from non-affiliated MGAs, which are third parties and can establish relationships with multiple insurers, compared to a 4.1% increase in premiums generated by affiliated MGAs, which are wholly owned or majority-owned by an insurer.

Non-affiliated MGA business written in the United States rose 38.8% in 2021.

Established retail brokerages have expanded their sources of revenue by developing new product lines or by acquiring MGAs.

Some see the addition of an MGA as benefiting both upstream and downstream.

Many MGAs are tech-forward, using data and advanced technology to underwrite risk. Their typical small size and entrepreneurial nature make them nimble and able to invest in new platforms more quickly than traditional insurers. At the same time, their relationships with multiple carriers can give them access to new products and capacity on a more continuous basis.

“By definition, programs and MGAs are going after niche markets or emerging markets that carriers just don’t have the flexibility to respond to,” says Ryan Armijo, chief operating officer of Amwins Underwriting, an MGA with 100 specialty programs and $2.8 billion in underwritten premium. “Now that MGAs are more sophisticated, I think there’s less of a hesitancy to delegate the authority to the MGA. Part of that is talent. We see a lot of talent coming out of carriers wanting to go into the MGA space. A lot of that’s probably the entrepreneurial itch…they’ll go to an MGA that has an infrastructure…they bring their expertise that they couldn’t really deploy inside of a carrier because it’s just not as fluid, and they’ll go to an MGA…and be able to move much more quickly.”

In recent years, many established retail brokerages have expanded their sources of revenue to include specialty products by developing new product lines or by acquiring MGAs.

“There are significant benefits to participating in the market as an MGA for retail brokers,” according to a panel of McKinsey financial services and insurance experts, including partner Matthew Scally, partner Grier Tumas Dienstag, and associate partner Andrew Reich. “These include (1) simple diversification of revenue streams with margin expansion, (2) better insight into MGA commissions/overrides for specific lines of business, (3) greater exposure to niche lines in a hardening market, and (4) direct capacity access.”

For example, Acrisure, typically in the top 10 brokerages in terms of acquisitions, touted an “ambitious MGA strategy” earlier this year when it announced its acquisition of Volante Global, a multi-class, multi-territory, international MGA. Volante is one of several MGAs the company has acquired over the past year. In a statement about the deal, Greg Williams, the co-founder, CEO and president of Acrisure, says Volante is attractive because it “accelerates our value chain compression initiative.”

In speaking with Leader’s Edge about Acrisure’s MGA strategy, Grahame Millwater, president of global insurance for Acrisure, notes the “excellent use of technology and data analytics, because those are at the core to effectively understand risk and understand the portfolio of risks. Other important aspects of successful MGAs are specialized underwriting talent and a high regard for the sustainability of the firm’s relationship with underwriting capital.”

Repositioning in the Insurance Value Chain

According to research by Deloitte, insurers, brokers and reinsurers have all been repositioning themselves within the insurance value chain in recent years in order to defend, create or capture greater value. Insurers, for example, have moved up the value chain largely through acquisition by moving into the reinsurance market. Meanwhile, reinsurers have moved down the value chain by growing their insurance business to gain more direct access to risks.

Brokerages, on the other hand, have moved through the value chain in two ways: upward, into underwriting through vehicles such as MGAs, lineslips, binders and broker facilities; and downward, into client-facing services such as data provision, data analytics and consultancy.

“I think the lines of distribution are definitely getting blurred,” Armijo says. “Especially on the capital side, we’ve got the same parent company, some participating in reinsurance, some participating on primary insurance, some fronting, all within the same umbrella. It’s all a little bit nebulous. I think that has also made it a little bit less, maybe, verboten for distribution to start to creep up into the capacity space or get closer to the risk bearing entity.”

Some see the addition of an MGA as benefiting both upstream and downstream work for brokers, as it gives them more options to present to clients in need of more tailored solutions.

“A lot of brokers have realized that they have the most important thing out of anyone in the insurance industry—the relationship with their clients,” says Adam Blumencranz, a partner at Distributed Ventures, a venture capital firm investing in insurtech and fintech. “One way to develop more meaningful relations is by acquiring or building their own MGAs to offer more specialized solutions, which can lead to significantly more commission on the same client. That’s easier said than done, but they’re all trying to figure out how to do it.”

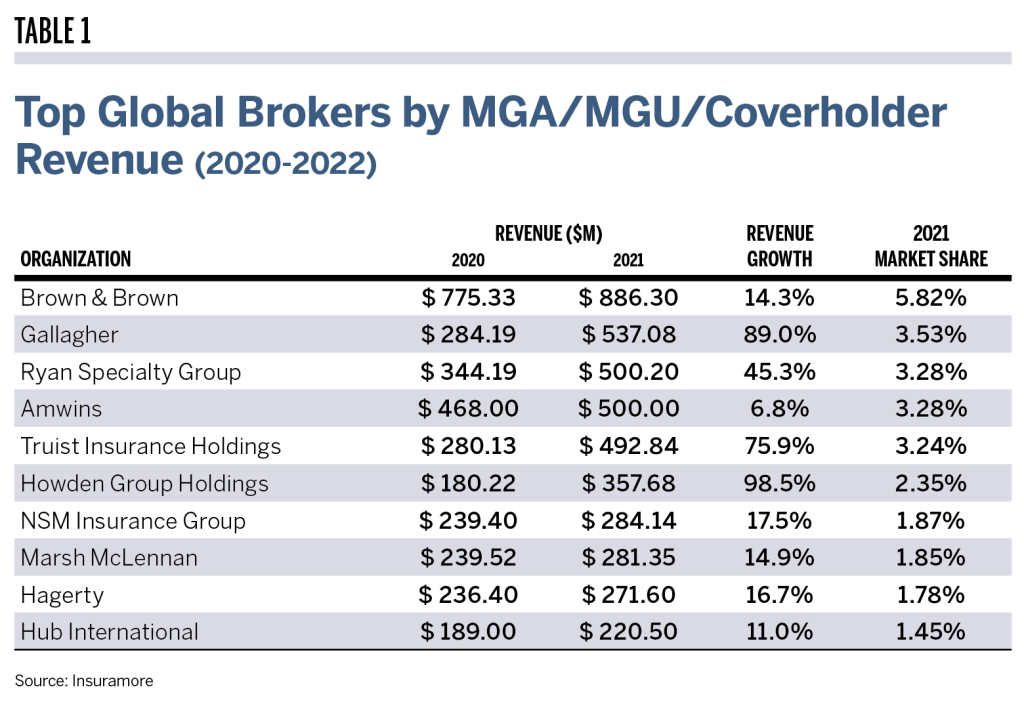

As demonstrated in Table 1, there has been some significant investment in activities beyond traditional broking that expands brokers’ reach across the value chain. During 2020-2021, revenue growth for the top 10 MGAs, MGUs and coverholders in this category averaged 38.9%, led by some outstanding revenue growth from Howden Group (98.5%), Gallagher (89%), Truist (75.9%) and Ryan Specialty (45.3%).

The brokerages included in Table 1 account for 23.4% of the total MGA, MGU and coverholder revenue across the globe in 2021. This is a significant percentage of market share for the top 10 brokerages to own. At the same time, however, the MGA market is very much up for grabs, given the lack of well established and market-dominant players. Brown & Brown, the leading organization by MGA, MGU and coverholder revenue, accounts for only 5.82% of the global market. The fact that no insurance brokerage has reached $1 billion in MGA, MGU and coverholder revenue shows not only that this is a nascent market but also that consolidation between players could be the faster—and potentially cheaper—way for brokerages to become dominant within this market.

For Amwins, acquiring an MGA is more than just building scale. “What we’re really looking for is culture fits and white spaces,” Armijo says. “Let’s say, our portfolio has a gap. We know that capacity would like to participate in that area or there’s an MGA that already participates in that area with capacity. And maybe we’re friendly with that capacity, so it’s accretive to an overall relationship that we already have. That’s very interesting to us,” he says.

“We don’t acquire for synergies. We want those entrepreneurs. They’re coming on because they do something better than we do it for the most part. We want the founders or the team to stay. We want to make sure they know what they’re getting into. We support them…and it’s a culture fit. Because we’re really acquiring capability and people,” Armijo says.

Continued Consolidation

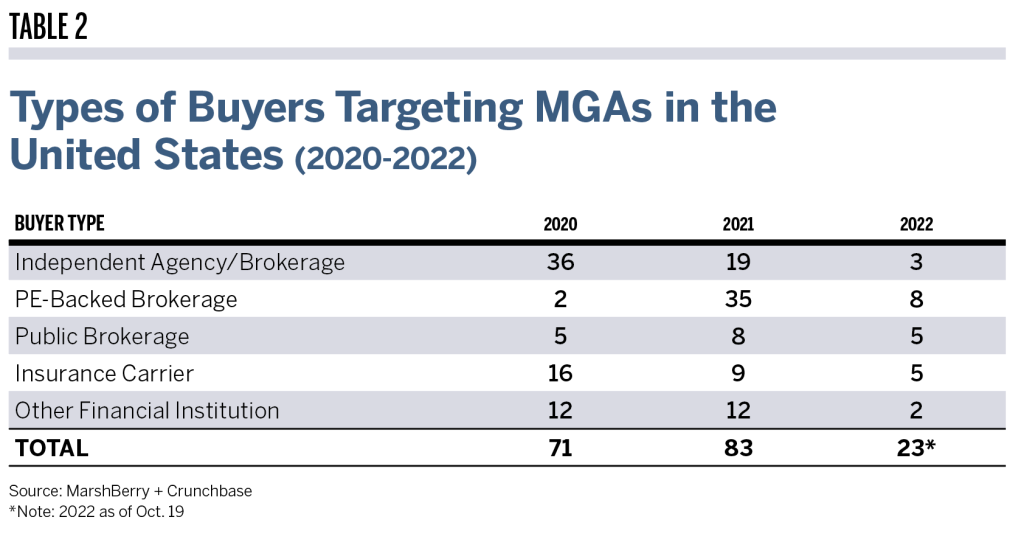

Consolidation and acquisition in the MGA market has already begun, and before economic conditions pushed global economies closer to recession, 2022 was forecasted to follow the same deal volume as previous years. However, as of Nov. 16, this year has seen only 23 M&A transactions targeting MGAs. This is in contrast to 2021’s record-breaking 83 announced MGA-targeted transactions, which represented a 17% increase in deal volume over the previous year.

Notably, the leading organizations targeting MGAs are mostly brokerages—some independent, some backed by private capital.

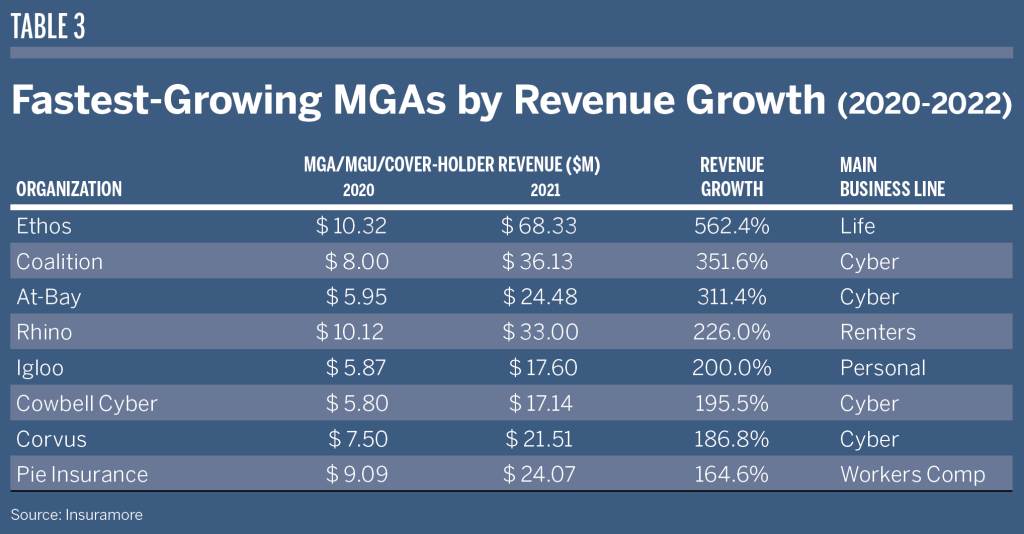

While the revenue numbers for brokerages due to MGA/MGU/coverholder activities is strong, it pales in comparison to year-over-year revenue growth for the fastest-growing pure MGAs. Revenue growth for the firms in Table 3 averaged 275.1%. However, comparing all MGAs simply by their revenue growth rate would be incomplete without accounting for the various business lines and geographies that can impact an MGA’s revenue.

“Various lines of business have different risk timelines,” Adam Blumencranz, partner, Distributed Ventures, says. “While some firms have a short tail, meaning that they can more quickly determine their loss ratio and profitability, other lines of business—like cyber, general liability or commercial trucking—may take years for claims to mature. So for those MGAs with long tail, it’s a good early start to not see losses, but we won’t know the full picture until years from now.”

The current uncertainty in global economies makes it extremely difficult to accurately predict how the MGA market will fare in the near future. For example, according to a McKinsey report, some insurance carriers have to restrict balance sheet capacity across multiple lines of business heavily impacted by claims inflation. This has forced some MGAs to exit or reduce their presence in certain asset classes—such as catastrophe-exposed property or cyber. In order to avoid such drastic measures, some MGAs have started to explore raising their own capital to assume some of the balance sheet that typically had been provided by insurers, effectively becoming a full-stack carrier. Investors, however, don’t always consider this transition favorable.

“We’ve seen growth path before, most famously with digital native insurtechs in personal lines P&C,” the McKinsey panelists say. “This vertical integration enables MGAs to put skin in the game by owning more of the value chain and controlling their capacity—therefore the potential, if successful, to earn more profit or suffer losses more directly. This trend is supported by an increase in the number of investors supplying both equity and capacity to MGAs. Becoming a full-stack MGA does change the economic model of the MGA and is not the end solution for all MGAs in our mind.”

Armijo also notes the challenges of making this type of transition. “We wouldn’t acquire an MGA that turns into a full-stack insurance carrier,” he says. “It’s very different managing a balance sheet than it is being a fee-income based business. And that totally changes the culture, changes the flexibility, the entrepreneurialism. “I think it changes a culture of an MGA or distribution firm when you then have to manage a very long-tail balance sheet and make decisions knowing that they could come back and hurt you in 10 years. That’s why insurance carriers are very good at that and MGAs are good at what they do.”

MGAs bring both tech and talent to an acquiring company.

Tech and Data

The strongest selling point for MGAs is their use of technology and data analytics. In contrast to carriers, MGAs have been taking advantage of multiple sources of data—like publicly available databases, geospatial data and parametric data—to underwrite more accurately and more efficiently. This, in return, produces more profitable books for the insurance companies holding the risk.

“The technology and data analytics expertise give the deep understanding and valuing of the risk the MGA is writing,” says Grahame Millwater, Acrisure’s president of global insurance. “This pairs critically with the underwriting talent, as it gives MGAs the track record and the experience to know how to turn that new understanding of risk into effective pricing for coverages.”

Talent

MGAs have overcome some of the disincentives for technology professionals to work in insurance and have proven to be an attractive site for underwriting and tech talent. Their success in attracting IT talent contrasts with established insurance carriers. According to a Deloitte survey, such carriers find it hardest to recruit experts in data science and analytics, machine learning, and cyber security.

The entrepreneurial-like culture that many MGAs offer allows talented insurance individuals to build their own scope, instead of being constrained by legacy platforms or outdated techniques. This is specifically true for underwriting specialists, who can develop new underwriting techniques for specialty risks, and for tech experts, who find MGAs organized in a way that puts technology at the forefront of the business.

For traditional brokerages, acquiring MGAs is also an opportunity to acquire talent they may not be attracting on their own.

“Talent is definitely a byproduct of acquiring MGAs, as acquiring talent helps us develop and attract further talent,” Millwater says. “From our perspective, we’re an entrepreneurial company, and we’ve been a very good home for entrepreneurial talent. This sets us apart from the competition, and it is why these MGAs get attracted to selling their businesses to us. In return, that helps us create underwriting talent for diverse risks and provide multiple different paths for that talent to go down.”

New Partnership with Clients

Some MGAs have also outpaced dominant insurance brokerages in client service by maintaining constant relations with their customers. Normally, only a small proportion of clients engage with their insurance brokers while their coverage is in force—and generally only when they need to make a claim. Some MGAs, particularly in the cyber market, have constant opportunities to prove their value to clients by providing actionable risk-management advice. Many offerings, like constant monitoring of cyber defenses and adjusting swiftly to the emergence of new attack vectors, help forge a strong customer relationship based on highly responsive, technology-enhanced service and constant collaboration that improves efforts to manage risk.

“We’re constantly looking at how to understand and analyze specific risk elements that an insurer might not want to write because they’re considered too risky,” Millwater says. “In our vision, if there’s a gap in our client’s coverage, we need to find a solution for it. The ability to use our MGA platforms to manufacture product is a huge strategic advantage.”