Insurtechs Prioritize Profitability over Growth

M&A in the insurtech space has been on the decline since its peak, going from 186 deals in 2021 to 146 in 2022 and down to 112 in 2023.

Despite that decline, investment in insurance technology isn’t evaporating; substantial deals have taken place.

This pattern signals a shift to focusing on the financial bottom line rather than business growth. Some providers have even indicated their strategic focus on profitability over growth through 2024. However, the increase in tech startups looking for a buyer creates opportunities to invest in digital solutions without a hefty price tag.

Technology spend during 2023 was mixed, with strategic investments from property and casualty carriers continuing against the backdrop of restructuring, lower public valuations, and reduced private capital flowing into the insurtech sector. During the year, the decision to build, buy or partner continued within an ever-changing landscape of new entrants and legacy firms.

Four Key Trends for Insurtech Deals

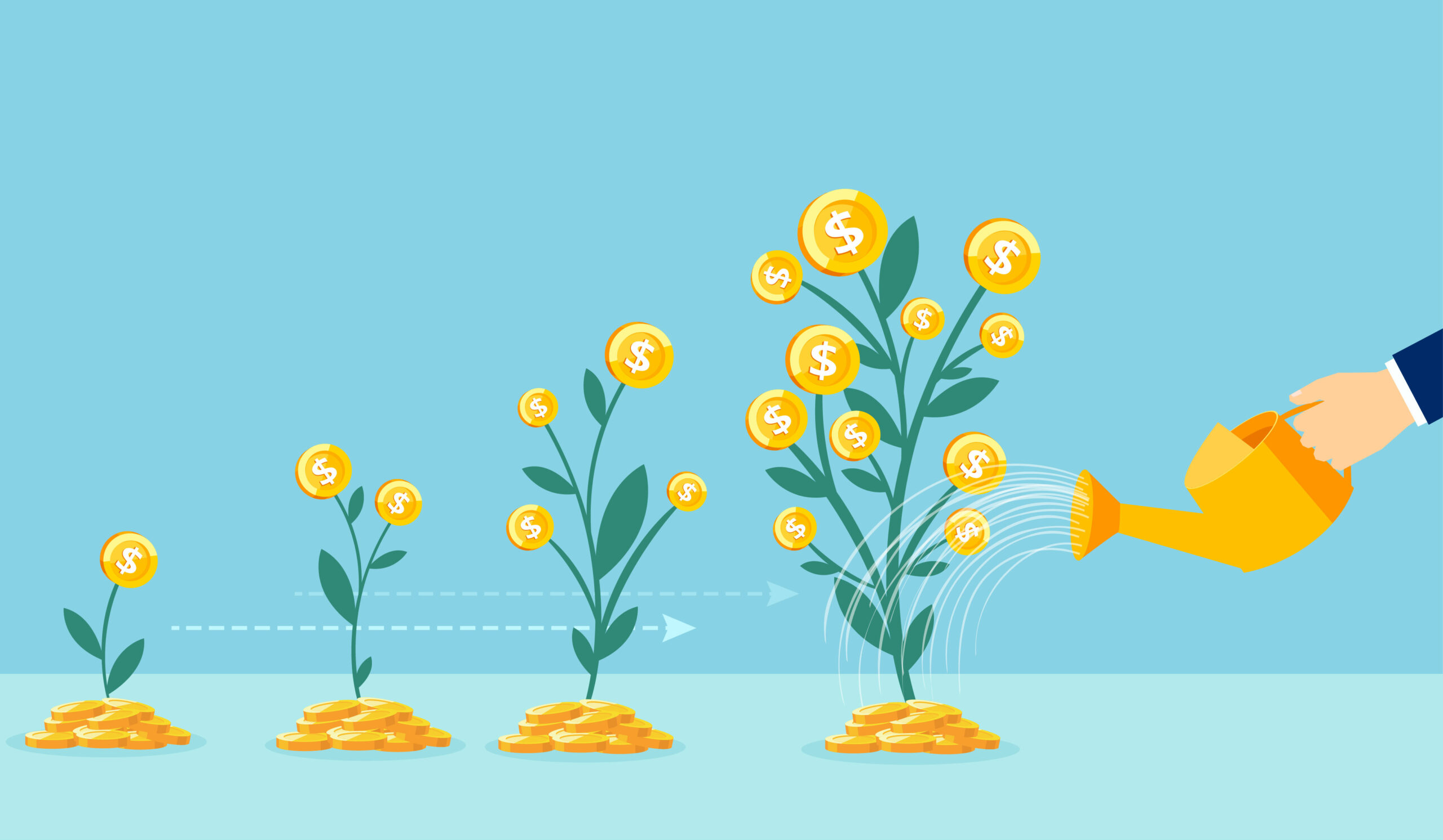

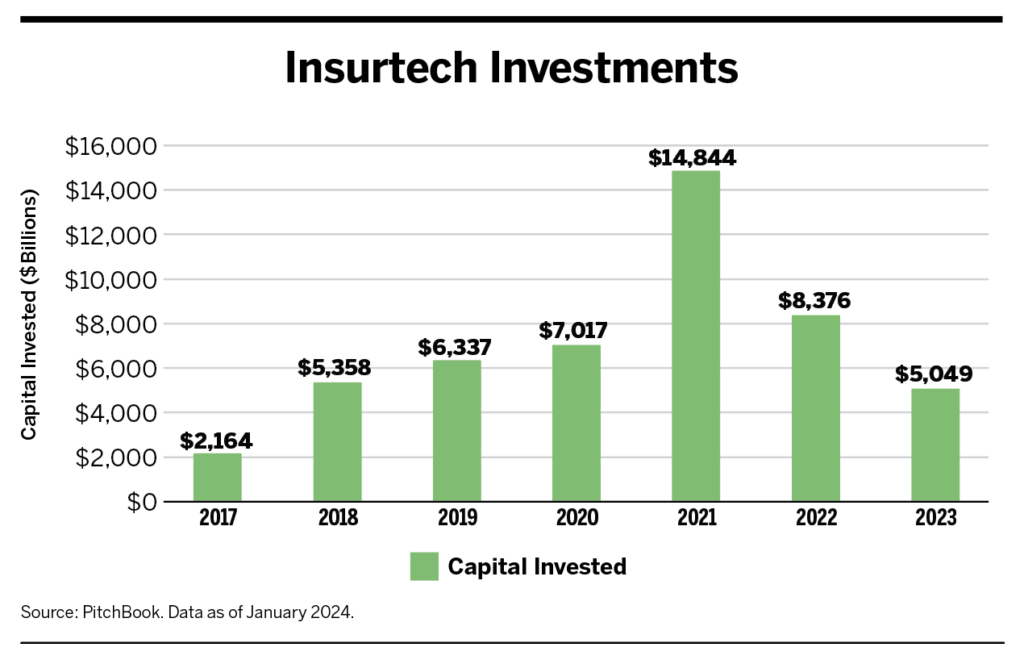

1. Shift in funding: While overall funding and deal counts were at their lowest levels since 2017, there was a clear flight to quality: venture capital funding to later-stage companies was down only 22.5% versus the overall funding decrease of 39.7%. This allowed more mature companies to reinvest organically as well as to consolidate.

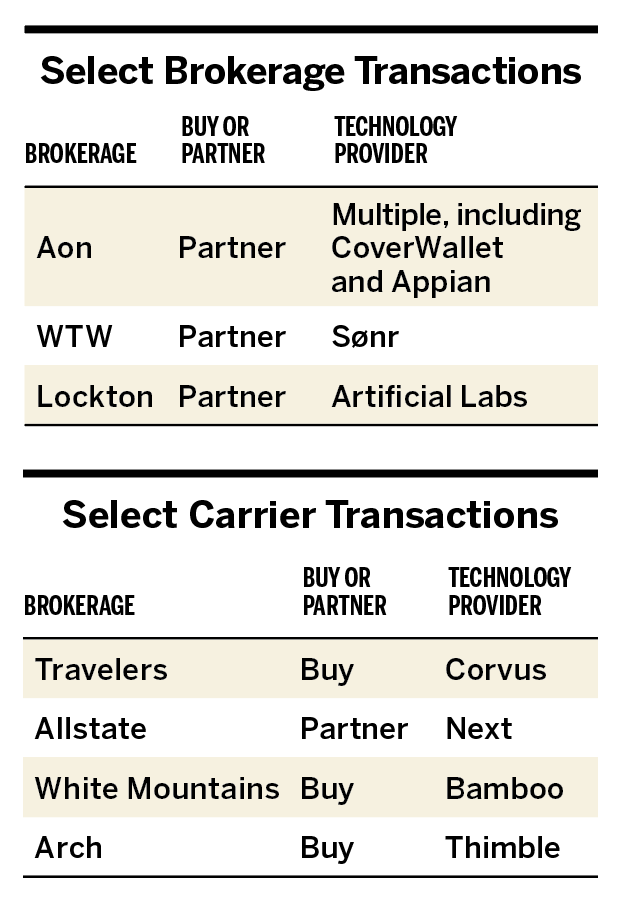

2. Buy versus partner: Strategic brokerages, carriers and technology providers sealed multiple acquisitions and partnerships in 2023. Some notable deals:

Insurtech companies also acquired and partnered with other insurtechs in 2023. Firms including Boltech, Obie, Hexure (formerly Insurance Technologies), Guidewire and Boost all made multiple acquisitions or announced partnerships during the year.

3. Resetting insurtech valuations: Funding shifts and consolidation/partnerships increased partly because insurtech valuations aligned with investors’ expectations, as the investment thesis moved from growth to profitability. While public valuations continued to underperform relative to public brokerages throughout 2022 and 2023, private valuations, as measured by a function of annual recurring revenue, improved in 2023. This is good news following the sharp decline after an all-time high in 2021.

As the table to the right demonstrates, insurtechs showed some signs of hope in 2023, although it is hard to call this a recovery given the significant decline prior to that year. There are expectations that insurtech stocks will continue improving in 2024 depending on consolidation activity and the performance of those companies with the best prospects for profitability.

4. Insurtech collaboration: Recently, an increasing number of partnerships have sprung up across the insurtech ecosystem to enhance collaboration, drive improvements and inspire innovation. These partnerships include:

- InsurTech Association: nonprofit for earlier-stage insurtechs started in 2023

- InsurTech Coalition: nonprofit started by insurtech carriers (Boost, Branch, Clearcover, Lemonade, Root)

- U.S. InsurTech Corridor: first of its kind collaboration between the United States and the United Kingdom.

Insurtech Outlook for 2024

While 2023 was a transitional year (not the boom of 2021-2022 but not a complete bust), the continued underlying trends of the digitization of the insurance value chain are expected to continue in 2024. One recent estimate anticipates the global insurtech market to grow by about 40% over the next decade. The focus on profitability versus growth, partly aided by higher borrowing costs, also appears set to continue throughout 2024. Lastly, legacy carriers are expected to continue buying or partnering with insurtech firms over building home-grown applications.