Insurance Brokerage M&A Looks Toward a Rebound in 2024

As the book closes on 2023, the year will be looked back upon as one that was filled with bated breath amid conflicting economic projections and challenging headwinds carried over from 2022.

Buyers and sellers in the insurance brokerage merger & acquisition (M&A) world were not immune. Entering the year there were concerns as to which buyers would have capital to continue acquiring. It was unclear whether there was enough capital to continue to acquire and meet the cash flow demands driven from earnout payments due to successful growth by firms who sold two to three years ago.

Ultimately some buyers stayed very active, others become more active, and some pulled back. The market saw more debt capital raised in 2023 than in 2022 which has created capacity for continued consolidation. Some firms recapitalized their private equity sponsor, others added preferred equity to their capital stack, and NFP announced their pending combination with Aon—moving one of the private-equity backed acquirers from one buyer category to another (public brokers). It is anticipated that NFP will continue to acquire as they have in the past once the Aon transaction is complete.

Momentum increased in the fourth quarter of 2023 with sellers and buyers seemingly building more pace in the deal process. It is expected that demand will continue to outpace supply in 2024 and valuations will remain at the plateaued levels this industry has enjoyed for the past three years. While valuations continue to go up slightly for platform type firms, the average valuation continues to hold steady across the industry.

Ultimately 2024 will likely be defined by what the Federal Reserve decides to do with interest rates, the outcome of the November election, and any potential discussion or scare around potential federal tax increases. Any or all of these macro events will have an impact on the psyche of buyer and sellers and will likely determine the volume of M&A activity in 2024 and 2025.

M&A Market Update

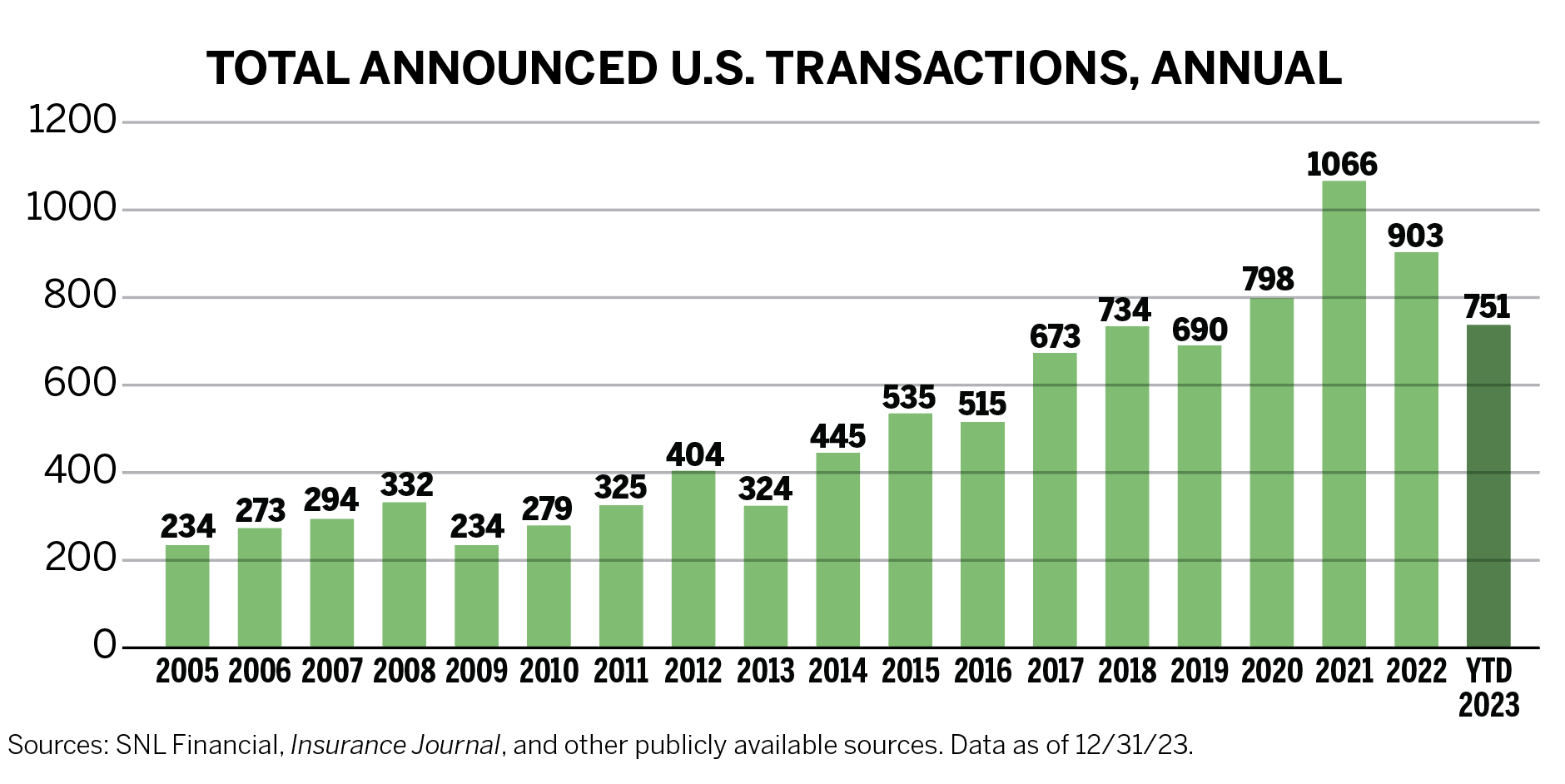

As of December 31, 2023, there were 751 announced M&A transactions in the U.S. However, when the dust settles and all transaction announcements are made, 2023 will likely post the third highest announced transactions total in the history of the industry.

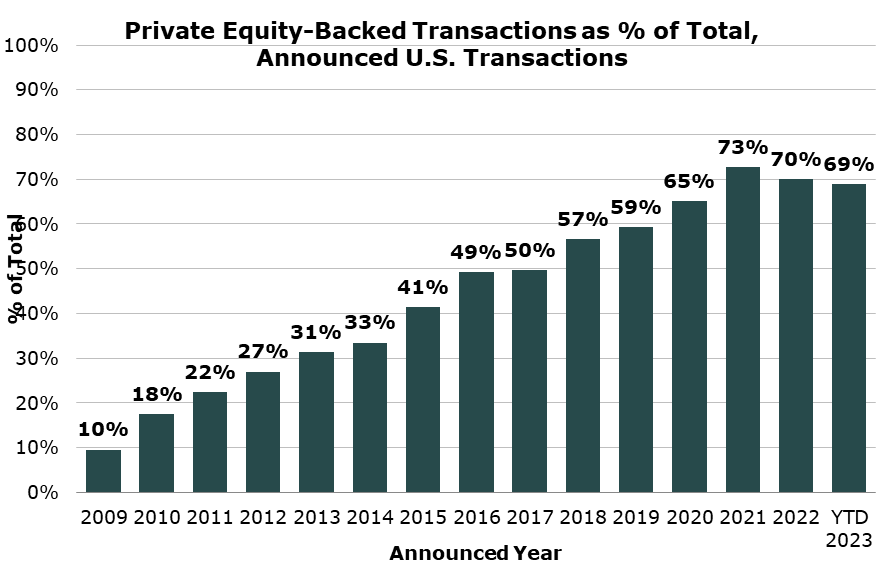

Private capital-backed buyers account for 518 of the 751 transactions (69.0%) through December. Total deals by these buyers increased at a Compound Annual Growth Rate (CAGR) of 6.1% since 2019, with a marked increase after the onset of the pandemic.

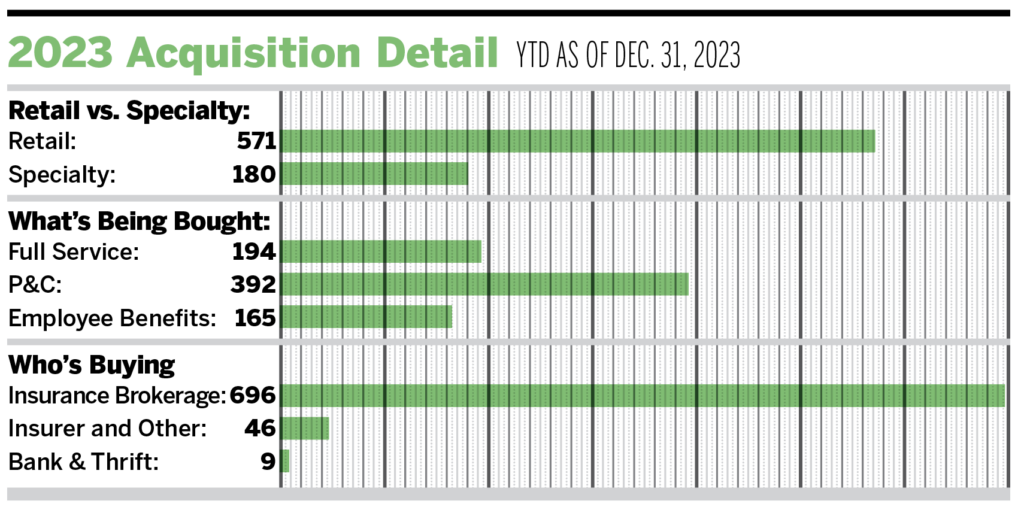

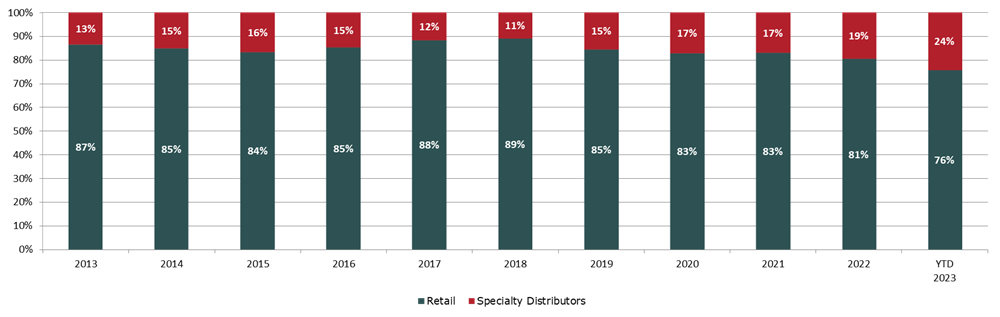

Deals involving specialty distributors as targets account for 180 transactions (or 24.0%) of the total 751 deals in 2023. Specialty firm deals increased by a CAGR of 17.9% from 2018 through 2023, a trend that is anticipated to continue as traditional retail brokers expand into the wholesale and delegated authority space. Through December, independent agencies as buyers accounted for 129 transactions (or 17.2%)—in line with 17.2% in 2022. Bank and thrift as buyers accounted for nine announced deals (or 1.2%)—down from 2% in 2022.

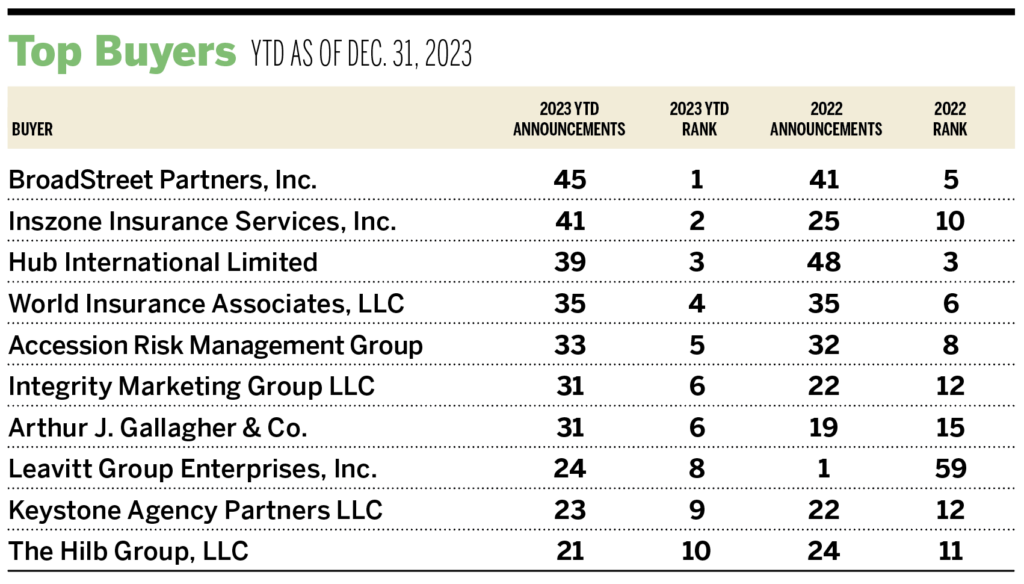

Deal activity from the marketplace’s most active acquirers has remained strong in 2023. Ten buyers accounted for 43.0% of all announced transactions, while the top four (BroadStreet Partners Inc., Inszone Insurance Services, Inc., Hub International Limited, and World Insurance Associates) account for 21.3% of the 751 total transactions.

Notable Transactions

December 5th: Hub International Limited announced that it has acquired the assets of Professional Financial Specialists. Professional Financial Specialists is a full-service Colorado-based broker specializing in healthcare. This transaction marks Hub’s 39th acquisition of 2023 and their first announced transaction in Colorado.

December 14th: AUB Group (ASX: AUB) announced that it has made a strategic investment in Miami-based reinsurance broker Mexbrit. AUB Group, which acquired UK-based broker Tysers in 2022, is an Australian general insurance broking network operating in 570 locations globally and placing AUD $9.5 billion in insurance premiums. Mexbrit is an independent reinsurance intermediary specializing in the Latin American and Caribbean markets. This investment also includes Forte Underwriters, a specialty underwriter with a focus on the Latin American insurance market. This is AUB Group’s first investment in a United States broker.

December 20th: Aon (NYSE: AON) announced that it has acquired NFP, a leading middle-market provider of risk, benefits, wealth, and retirement plan advisory solutions, from funds associated with Madison Dearborn Partners and HPS Investment Partners for a purchase price estimated to be $13.4 billion at closing. This transaction expands Aon’s presence in the middle-market segment, with an opportunity to enhance distribution through Aon’s Business Services platform. NFP will continue to operate as an independent but connected platform, “NFP, an Aon company.” The transaction is expected to close in mid-2024.