Rewinding to a year ago and trying to see the world through pre-COVID-19 eyes feels unbelievable.

Looking back at our expectations and analysis of the circumstances prior to the global pandemic is rather eye-opening. Consider some of these statements from MarshBerry’s 2020 article titled “M&A Utopia,” which looked back on 2019.

“…there is possibly no better investment in the world than to own an insurance brokerage. We are experiencing a confluence of circumstances that has helped create incredible value and wealth across the industry. It is like we are living through an industry utopia.”

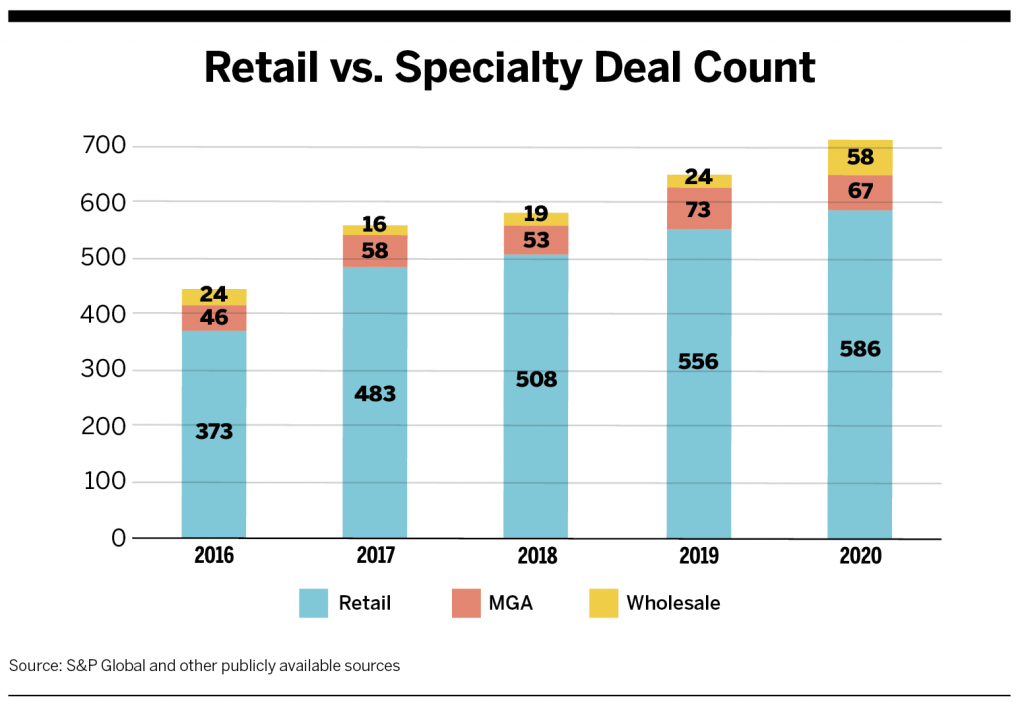

Despite the pandemic, M&A activity in the brokerage industry set a record in 2020 with 711 total deals announced.

Valuations also exceeded the all-time highs of 2019, and they trended upward throughout the year.

With concerns over potential increases in capital gains taxes and ongoing economic uncertainty, many doubt valuations can go much higher.

“Average organic growth is up, deal counts are up, the number of firms acquiring is up, and private capital demand to enter the insurance brokerage marketplace is up…we are seeing market conditions more favorable than we can ever remember seeing.”

“We expect deal activity in 2020 to far exceed our prior years. We will likely have north of 700 announced transactions…”

2019 came to a close with an aggressive pace of deal activity: 648 announced U.S. transactions. This was a significant increase from the previous two years. Expectations were high as the momentum continued until March 2020, when the pandemic hit and the economy halted.

Throughout 2020, the industry experienced changes in expectations at a breakneck pace. For instance, the credit markets froze for several weeks in the spring of 2020, which limited the amount of financing buyers could borrow to complete new acquisitions within insurance distribution. With such a significant amount of uncertainty around the future impact of the pandemic, buyers were forced to conserve cash. At that time it was unknown whether the pandemic would be a disruption that lasted three months or three years.

Initially, we expected announced transactions in 2020 to drop to approximately 500 deals. But just like everything else in 2020, what we expected was thrown out the window. And, in the case of deal count, this was a silver lining during uncertain times.

By the end of 2020, the industry set a record of total deals announced with 711 transactions. The government stimulus in June helped stoke financial markets, and activity began to accelerate. This acceleration continued throughout the balance of the year, pushing considerably more activity than expected. By the end of the fourth quarter, the market exceeded the first quarter’s deal-making pace.

As “unprecedented” became the word of the year, so too, was it used to describe announced transactions.

Valuations also exceeded the all-time highs of 2019, and they trended upward throughout the year. During the fourth quarter of 2020, valuations on top-rated platform firms were approximately 10% higher than in the first quarter. Average valuations realized during the pandemic were higher than they were pre-pandemic, which is another trend not anticipated. Platform firms are typically larger agencies with a well-established territory, brand recognition, seasoned professionals, and a scalable infrastructure, among other attributes, and buyers are usually looking to establish a presence in a specific region or niche.

As it did during the Great Recession, the insurance industry has proven its resiliency. More investors continued showing interest, which created demand and drove more activity. Existing buyers renewed their acquisition appetite, while new entrants who were impressed with this resiliency jumped into the buyer pool. Additional buyers and heightened demand inevitably drove valuations higher. Will this continue? No one really knows. With concerns over potential increases in capital gains taxes and ongoing economic uncertainty, valuations are not expected to increase much more.

Even after the roller coaster of 2020, expectations of this industry are the same, albeit refined with some nuanced wisdom. Consider this last quote, again from our article “M&A Utopia,” written pre-pandemic in the first quarter of 2020: “It remains critically important that you as owners and leaders have a sense of what you are trying to accomplish—a vision and a purpose. Be aware of how good market conditions really are today and what changes to our economy, insurance rates, interest rates, tax rates, government leaders, or even your own health and wellness could do to your business. Today’s M&A environment creates the ultimate contingency plan for tough circumstances, but I implore you not to leave your future up to fate.”

Maybe everything has changed, but upon deeper reflection, perhaps it’s all the same. MarshBerry’s advice still stands. There is always an element of unpredictability in what we do. Take control, lead toward a clear vision, and don’t leave it up to fate.

U.S. Economy

Unemployment

The unemployment rate in early 2020 was at its lowest point since 1969, registering at 3.5% in January and February. Once the coronavirus pandemic spread to the United States and state and local governments began issuing stay-at-home orders in March, unemployment began to rise to 14.8% in April, its highest point since the U.S. Bureau of Labor Statistics began tracking unemployment in 1948.

Through the remainder of 2020, employment improved as businesses adapted to the new conditions and state orders were eased. By the end of 2020, the 6.7% unemployment rate was better than what many forecasters had originally expected but was still well above the Congressional Budget Office’s estimated natural unemployment rate of 4.5%. The labor force participation rate ended the year at 61.5%. This rate reflects the number of adults in the labor force between the ages of 16 and 64 years who are employed or unemployed but looking for a job. It remained relatively unchanged since June, when it recovered from a low of 60.2% in April, but still lists short of February’s level of 63.4%.

GDP

Real GDP for 2020 decreased 3.5% from 2019’s annual level. The year began with an annualized decline of 5% for the first quarter as state governments began issuing stay-at-home orders in March. During the second quarter, with stay-at-home and shutdown orders fully in effect, GDP declined at a record 31.4% annualized rate. In the third quarter, while shutdown orders were eased, many businesses reopened or adapted to the new environment. Some activities restricted by previous shutdown orders resumed, and as a result, GDP grew an annualized 33.4%. The year finished with annualized gains of 4% in the fourth quarter. Growth in the fourth quarter reflected increases in exports, non-residential fixed investments, personal consumption expenditures, residential fixed investment, and private inventory investment. Declines in government spending at all levels restrained further growth, as did an increase in imports.

Market Conditions

Net Premium Written

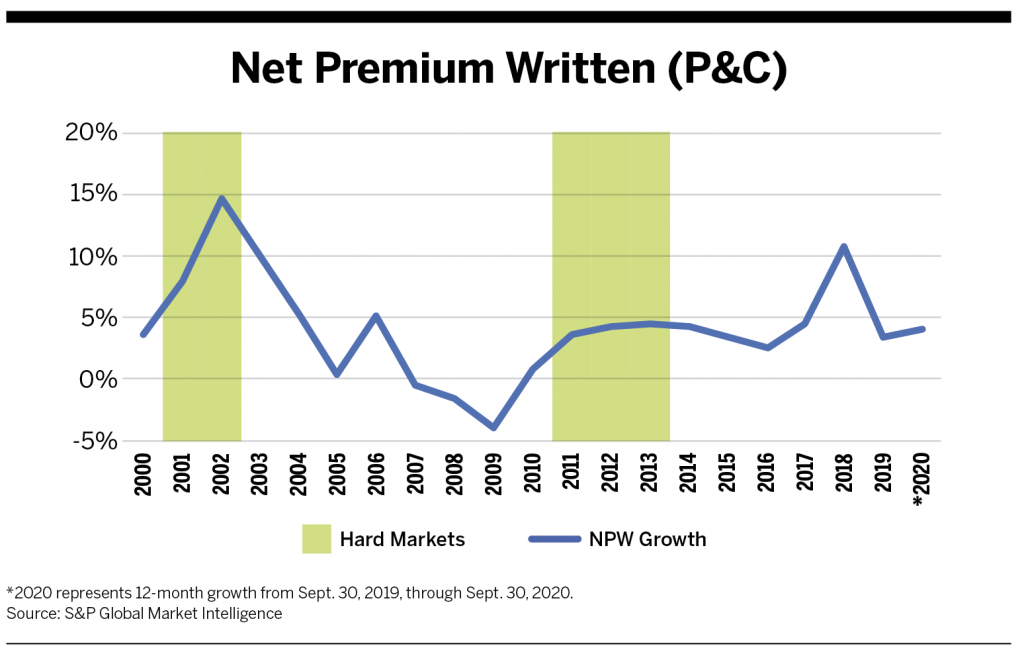

Net premium written (NPW) increased 4% during the 12 months ending on Sept. 30, 2020, with rising premium pricing driving increases versus an rise in exposure units or volume. Net premium income for the health insurance industry grew at an annualized 7.3% in the first nine months of 2020. Member months (the number of individuals participating in an insurance plan each month) grew only slightly in this period, and rate increases along with the return of the Affordable Care Act (ACA) fee provided the primary backing for health premium growth.

Hardening Market

As 2019 was coming to a close, many experts pointed to signs of a hardening market. In 2018, property and casualty (P&C) NPW had risen 10.7%, and the early excess and surplus market data indicated strong growth over the year. However, 2019 finished with NPW growth of 3.4%, meaning that the P&C industry was not experiencing a hard market, which we believe begins when NPW growth rates increase by three percentage points and the increase is sustained for at least two years.

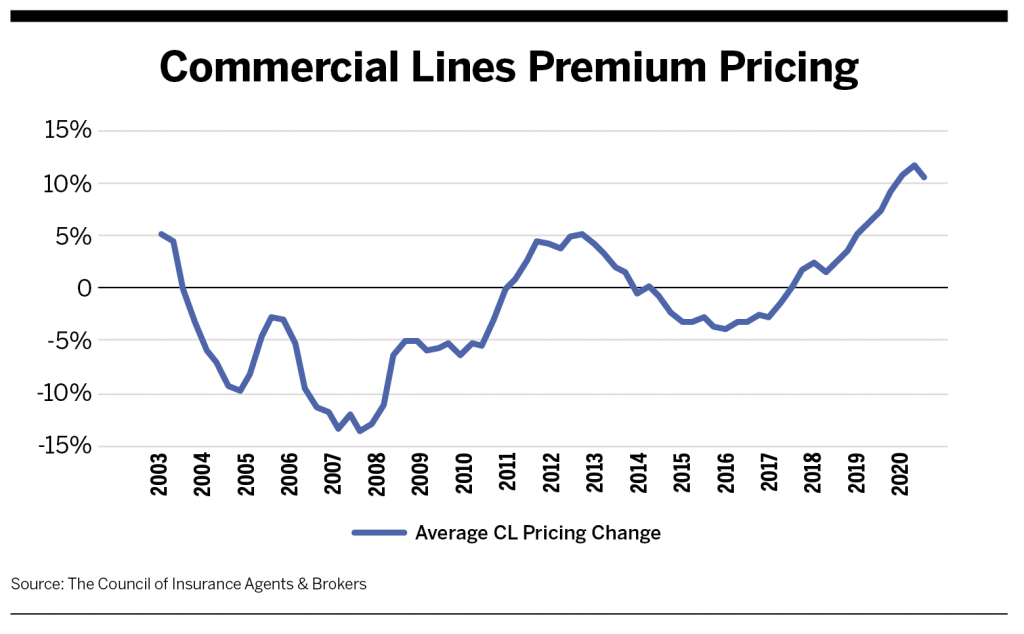

In contrast, data from The Council of Insurance Agents & Brokers’ Market Index Surveys shows that average commercial lines premium pricing for all accounts has been rising at a rate greater than 3% since the first quarter of 2019. Since the third quarter of 2019, pricing increases have been led by growth in premiums for large accounts (those with commissions and fees greater than $100,000). While prices have been increasing since Q4 2017, uncertainty surrounding the coronavirus pandemic has provided further fuel for that trend, with the last three quarters of 2020 all seeing average pricing growth over 10%.

P&C and Health Premium Rates

P&C rate increases during 2020 were driven primarily by premium increases in umbrella, directors and officers liability, commercial property, business interruption, and commercial auto. Results from The Council’s survey point to broad contractions in underwriting capacity as carriers have become increasingly cautious when writing new business or renewals in all of these lines.

For example, catastrophe related claims registered at $47.1 billion in the first nine months of 2020, up from $21.5 billion in the first nine months of 2019. Catastrophes contributing to these claims in 2020 included wildfires in California, Oregon and Washington, as well as a record number of severe thunderstorms throughout the country.This corresponds with The Council’s report of increased caution on the part of carriers concerning commercial property policies. The Council also reports carriers have been hesitant to write umbrella and D&O policies due to a rise in “nuclear verdicts,” with more class action suits, expensive judgments and high settlement costs than anticipated.

Health premium rates continued to rise in 2020 in response to increasing medical cost trends and required coverage expansions and rating limits, according to research presented in a CVS 10-K filing. Additionally, the return of the ACA fee on all medical health insurers with aggregate new written premiums over $25 million, which was suspended in 2019, returned in 2020 and was mostly passed through to insureds, further increasing premiums, according to ALIRT Research.

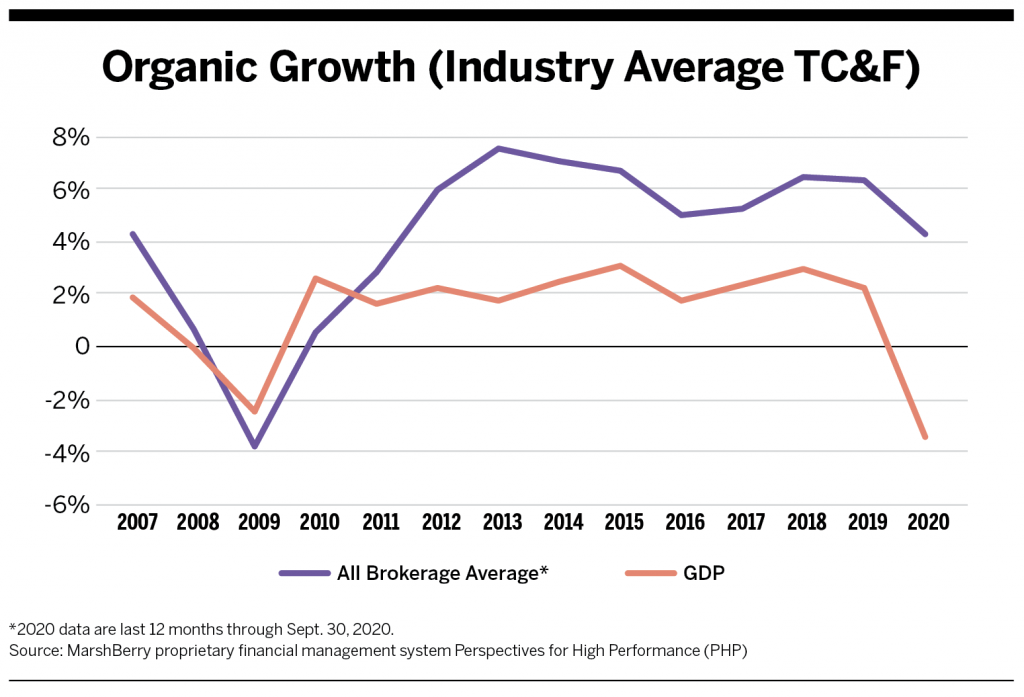

Organic Growth

In 2020, brokerages’ organic growth continued at an average of 4.2% (trailing 12 months through Sept. 30, 2020) despite the overall shrinking of the economy over that year, as illustrated by a 3.5% decline in GDP for 2020.

2020 Transaction Review

In the midst of the pandemic, deal activity essentially came to a complete halt. As of April 20, 2020, there was a 31% decrease in year-over-year deal activity. Following the brunt of lockdowns and transitioning to a work-from-home environment, the market continued with the same appetite and force we had seen in 2019 and the first quarter of 2020. The result was the most active year observed to date in terms of overall market activity.

Based on MarshBerry’s 2020 data, the 711 announced M&A transactions in the United States are an 8.3% increase from the record numbers seen in 2019. These numbers are yet another testament to the resiliency of the insurance industry and bode well for the marketplace. Anticipated deal activity is likely to continue at a similar pace as transactions are being completed from start to close with little to no in-person interaction with more regularity.

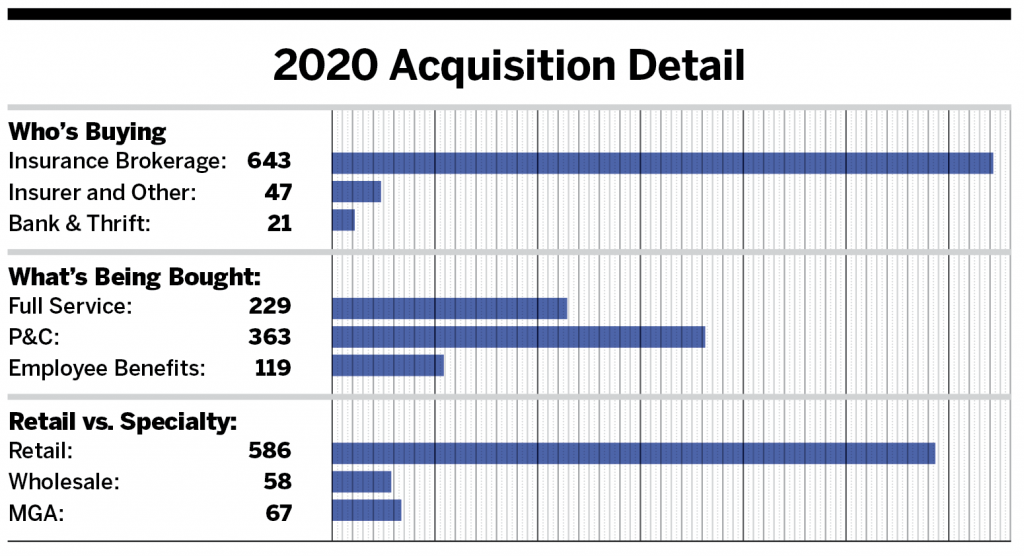

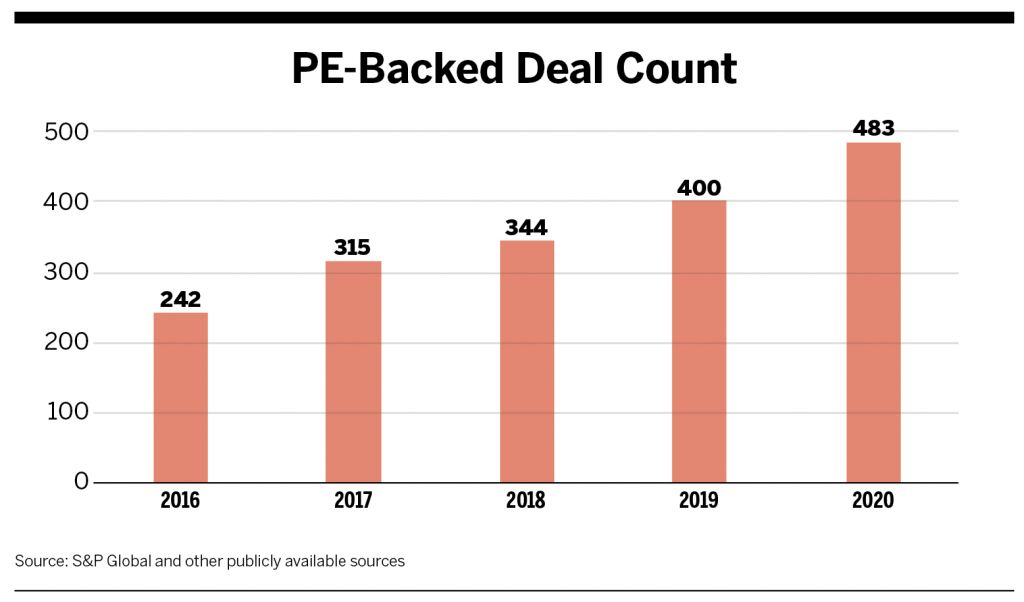

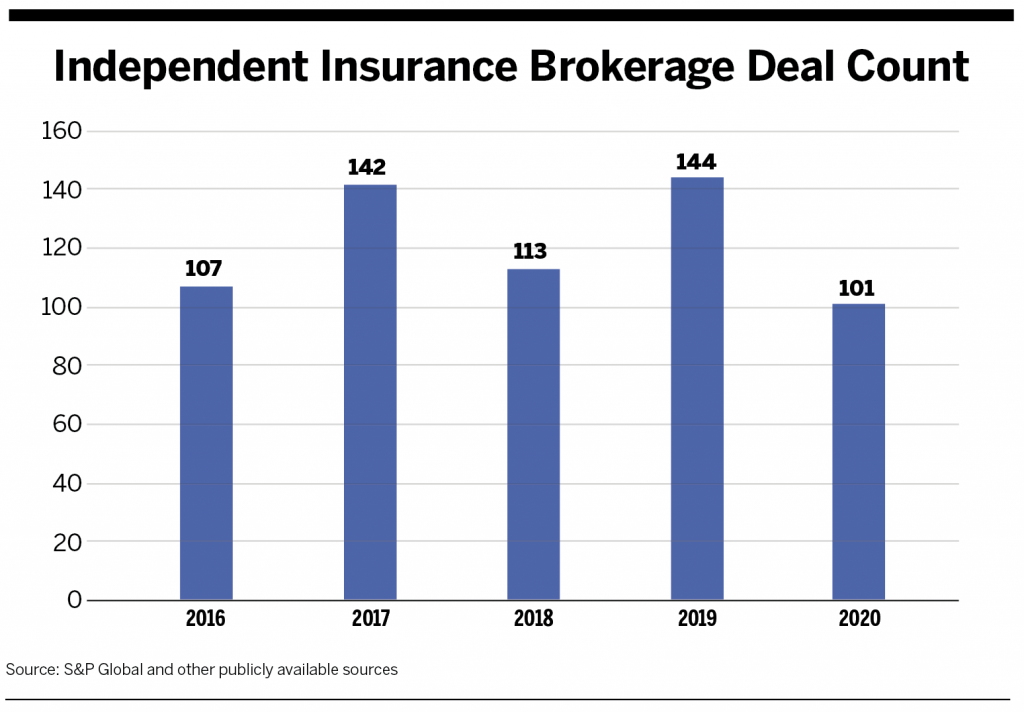

2020 ended with the same trends regarding buyer types and their respective market shares. Private-capital backed buyers accounted for 483 of the 711 transactions (67.9%) in 2020, while independent agencies made up 14.1% of the total. The number of deals completed by independent agencies in 2021 is anticipated to increase compared to last year, as spending restrictions ease up and business continues to normalize.

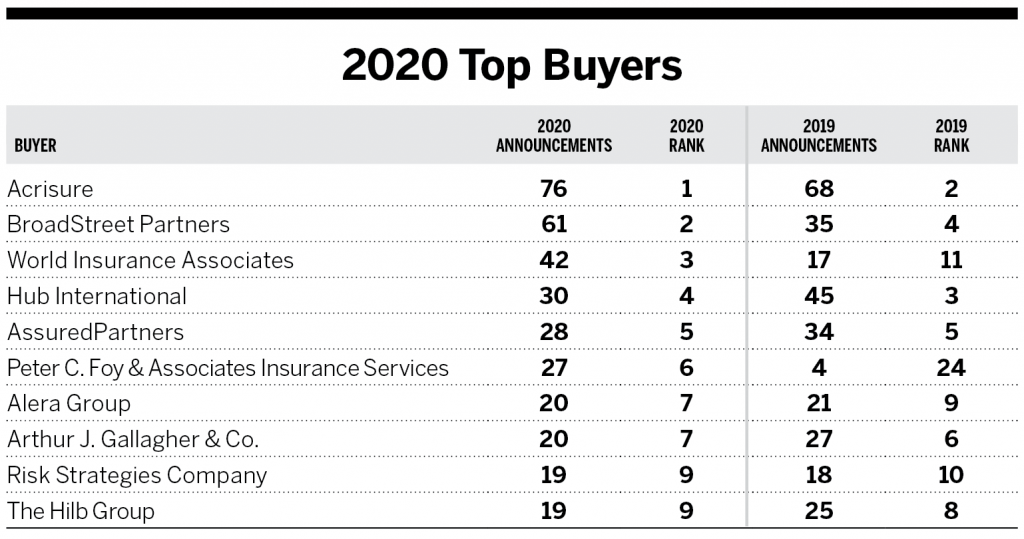

Acrisure, BroadStreet Partners, and World Insurance Associates were the top three most active buyers in the United States at the end of 2020, contributing a combined 25.5% of the 711 total transactions. The top 10 most active buyers completed 377 of the 711 transactions (53% of total).

Following are some notable transactions involving some of 2020’s most active buyers and top 100 brokerages:

- March 9: Aon and Willis Towers Watson announced that they agreed to combine entities to accelerate innovation on behalf of clients. The agreement for the all-stock transaction has an implied combined equity value of approximately $80 billion.

- April 1: Marsh & McLennan Agency acquired Assurance Holdings. Assurance is a top 100 brokerage based out of Schaumburg, Illinois, providing business insurance, employee benefits, private client insurance and retirement services. Assurance will operate as MMA’s Midwest regional headquarters under Anthony Chimino, CEO of Assurance.

- Nov. 5: BRP Group announced an agreement to acquire all of the outstanding equity interests of Insgroup. Based in Houston, Insgroup is the 87th largest insurance brokerage in the United States and represents BRP Group’s largest partnership in the firm’s history. Insgroup generates approximately $38.5 million in annual revenue; the transaction closed Nov. 30.

- Dec. 1: Alera Group acquired Lighthouse Group, a Midwest-based employee benefits and P&C firm. Lighthouse Group completed 40 acquisitions in its 25-year history and now serves clients in more than 20 verticals, with specialties including construction, manufacturing and retail.

- Dec. 17: four premier retail brokerages announced that they would combine to form Oakbridge Insurance Agency. The four firms are Founders Insurance, Hutchinson Traylor Insurance, McGinty-Gordon & Associates, and Waites & Foshee. Oakbridge received a strategic investment from Corsair Capital as a part of the transaction and will be one of the country’s top 100 agencies.

Who’s Buying?

A total of 169 unique buyers announced they completed transactions in 2020, down from 202 in 2019. This is interesting, considering 57 firms completed two or more acquisitions in 2020, compared to 49 buyers with multiple transactions in 2019. New buyers also entered the space through private equity. These results could indicate that fewer independent firms are buying due to continuing COVID-19 concerns while established buyers took full advantage of a hyperactive M&A market.

Private Equity: Still in the Driver’s Seat

Last year was no exception to the multiyear trend of private-equity backed buyers dominating the insurance distribution M&A market. Despite traditionally staying away from financial services, private equity continues to have a strong interest in insurance distribution because of the industry’s notable resiliency. In addition, new investors in the private equity space looking to diversify their portfolios led to the influx of more capital.

This group of buyers included 48 unique insurance brokerages, plus 14 “other” types of private-equity backed buyers, namely investment firms. Compared to 2019’s 33 unique brokerages and 11 “others,” 2020 saw a significant increase in private equity buyer count. Notable private equity sponsor transactions include:

- April 1: PCF Insurance (27 transactions announced in 2020) sold a majority position to HGGC, a leading middle-market private equity firm. HGGC has invested behind other firms in the insurance industry, including Davies Group and Integrity Marketing Group. Management, employee owners and exiting investor BHMS Investments have retained minority stakes in PCF.

- June 30: Sunstar Insurance Group (one announced transaction in 2020) announced that it completed a majority recapitalization with BBH Capital Partners (BBHCP). LNC Partners, the private equity firm that previously invested in the Memphis-based firm in 2015, will remain a lender to Sunstar, as it continues to focus on the Southeast and lower Midwest and accelerate long-term growth.

- July 1: Inszone Insurance Services (seven transactions announced in 2020) accepted a material investment from BHMS Investments. Inszone has grown rapidly by acquisition, expanding throughout California and to Arizona and Nevada. BHMS’s investment will be used primarily to continue Inszone’s acquisition growth.

- Nov. 16: OneDigital Health and Benefits (11 transactions announced in 2020) announced that it received a majority investment from Onex Corporation. Onex acquired a majority ownership position from New Mountain Capital. While OneDigital has a reputation as a leading strategic advisory firm focused on delivering health, retirement/wealth and HR solutions for its clients, Onex’s investment and expertise can help the firm expand into adjacent insurance and financial services verticals. The transaction values OneDigital at $2.65 billion.

Independent Firms: Casting a Wide Net

Nearly 70 different independent firms without known private-capital backing announced transactions during 2020, which is a significant decline from 2019, when more than 110 firms of this group announced transactions. In 2020, this group’s 101 transactions accounted for 14% of deal activity (down from 24% in 2019). Fifty-nine of these acquirers completed only one transaction during the year, indicative of the breadth of firms this category covers—a trend that has remained in place for many years. MarshBerry’s database indicates there have been at least 650 unique buyers in this segment during the last 10 years, and it’s likely that this is only the tip of the iceberg for this segment, as many local transactions are not announced.

In contrast to the private-equity backed segment of the market, where the top five acquirers represent nearly 50% of the transactions within that segment, the top four buyers in the non-private equity backed segment represent only 21% of the deals announced in this category.

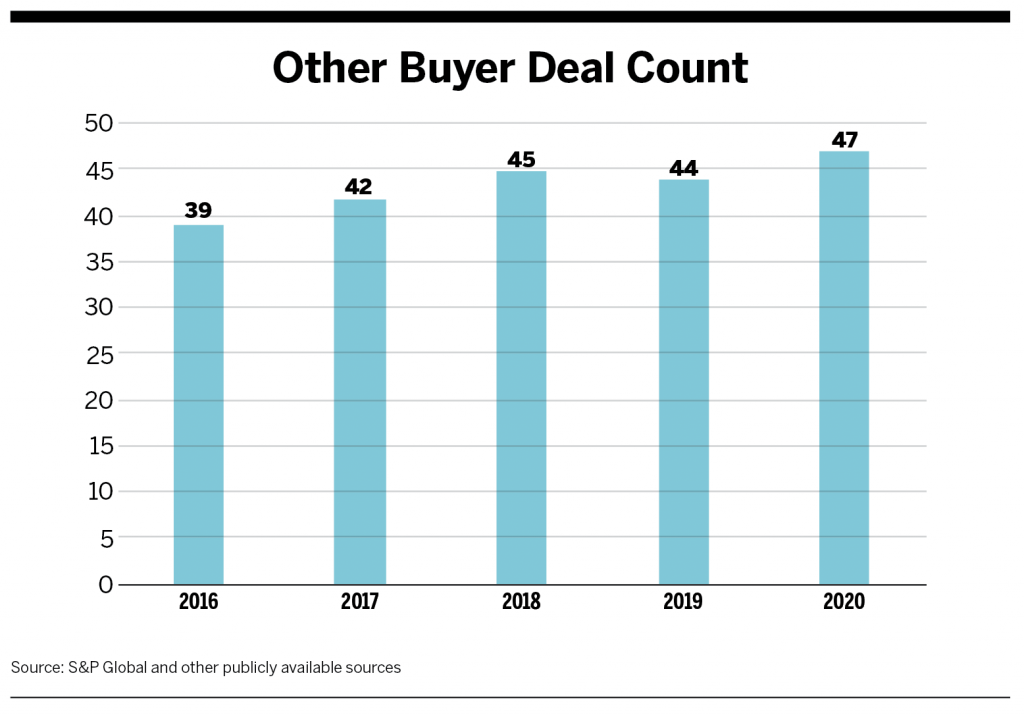

Other Buyers: An Assorted Group

This buyer segment includes private equity groups (not their portfolio companies), underwriters, financial technology firms, financial institutions, specialty lenders, and other unclassified private investors and buyers. Activity within this buyer group increased from 44 transactions in 2019 to 47 transactions in 2020. This segment represented only 7% of the transactions during the year, up slightly from 6% in 2019 and trending flat over the last several years. Last year only four firms in this category completed more than one transaction during the year, while eight did so this year.

The most active acquirer of this segment was Truist Financial Corporation with five completed transactions. On June 29, 2020, BB&T Insurance Holdings, a subsidiary of Truist Bank, announced a rebranding as Truist Insurance Holdings. This came on the heels of the creation of Truist Financial Corporation in late 2019 from the merger of BB&T and SunTrust. Other active buyers in this category include:

- Trean Corporation (3 transactions)

- Eastern Bankshares (2 transactions)

- Massachusetts Mutual Life Insurance Company (2 transactions)

- Reliance Global Group (2 transactions)

- Sompo Holdings (2 transactions)

- Tokio Marine HCC (2 transactions)

- Trustmark (2 transactions)

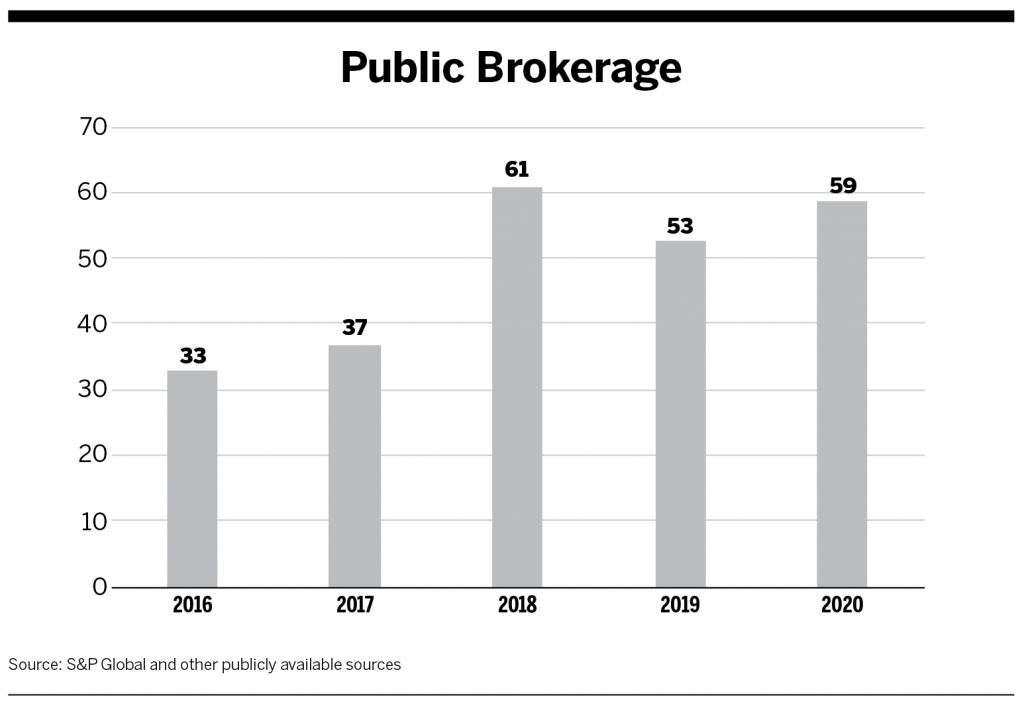

Public Brokerages: Steady as They Go

Public brokerages announced 59 deals during 2020, or roughly 8% of the total transaction count (same percentage as 2019). Arthur J. Gallagher & Co. was the most active within this group, with about one third of the announced transactions from this group (20 of the 59). Brown & Brown completed 15 transactions during 2020. Following Baldwin Risk Partners’ initial public offering in late 2019, it made a big splash with 13 announced transactions in 2020.

In March 2020, Aon and Willis Towers Watson announced their intention to combine in a strategic merger. The combined company, named Aon, will maintain operating headquarters in London. The combination has not yet closed as of this writing.

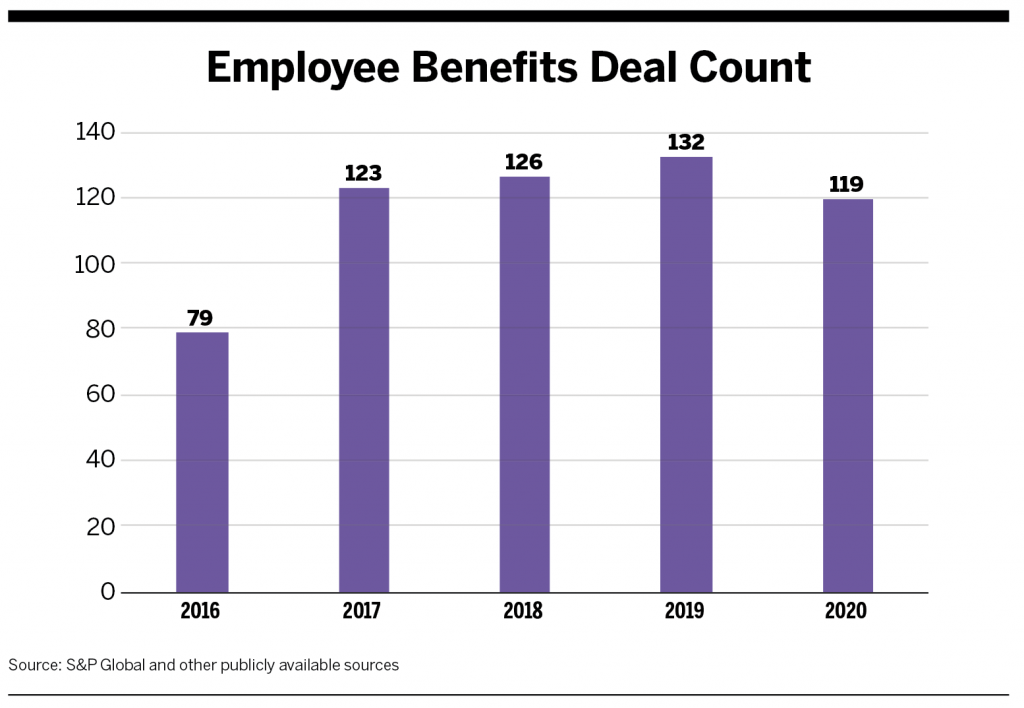

Employee Benefits: Demand Remains Strong

With 17% of transactions involving traditional employee benefits (EB), multi-line and consulting, we see these sectors continue to be a priority for many buyers. While the 119 transactions in this group is fewer than 2019’s 132 transactions, the data from 2019 include the creation of Patriot Growth Insurance Services (which accounted for 23 transactions that year). Transaction activity in 2020 shows a continued interest in employee benefits firms—particularly those who take a more consultative approach to their clients, providing support and expertise beyond the pricing and renewal of health plans.

Two firms completed more than 10 transactions with EB-only firms during 2020:

- Alera Group (11 transactions) continued to be a top-10 acquirer in the marketplace since its founding in 2018. These 11 transactions of EB-only firms represented more than half of its 20 overall announced transactions in 2020.

- OneDigital Health and Benefits (11 transactions) continued its focus on EB-only firms in 2020. With its new investor, Onex, it is eyeing the possibility of diversifying its acquisition appetite into complementary lines of insurance business.

Specialty Market

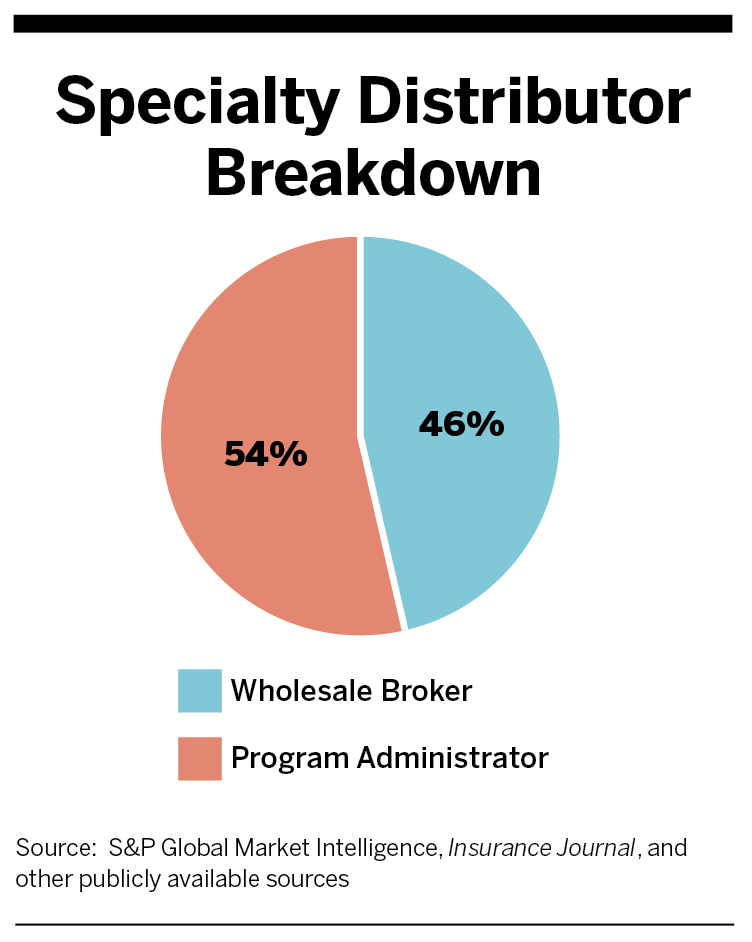

In what was an overall riveting performance on the M&A front for insurance distributors in 2020, specialty firms (managing general agents, managing general underwriters, program managers/administrators, wholesale brokers and general agents) stole the show. Finishing 2020 with 125 specialty transactions, up from 97 in 2019 (a 29% increase), about 6% of specialty distributors were acquired in 2020.

Headline Performances

The largest strategic (broker-to-broker) specialty transaction in a long time came in September when Ryan Specialty Group acquired All Risks. This transaction is estimated to increase RSG’s premium volume by $2.6 billion annually, to $15 billion in 2021. Ryan Specialty also filed for an initial public offering in March 2021.

This transaction is meaningful not only to one of the largest and fastest-growing specialty firms (RSG) but also to the industry as a whole. We calculate that the four largest specialty firms generated more than 80% of the $80+ billion in premium that flowed through the specialty marketplace in 2020. Those firms dominating market share include RSG, AmWINS, Truist affiliates CRC and AmRisc, and Arthur J. Gallagher affiliate Risk Placement Services. As a result of the competition, smaller specialty brokerages and agencies felt an operating strain. While larger specialty firms are not immune, firms of less than $150 million in premium are likely feeling the pressure.

This, along with historically high valuations, are two powerful catalysts that drove the consolidation rate in 2020.

Specialty Market Buyers

Fifty-eight unique buyers made up the field by acquiring 125 specialty firms. The average buyer acquired about two firms, fewer than the average retail buyer acquired, which was 4.5 firms in 2020. This is not surprising given the differentiated nature of specialty firms. It also speaks to the breadth of buyers in the marketplace.

The top six buyers in 2020 are:

- Integrity Marketing Group (15 transactions)

- One80 Intermediaries, an affiliate of Risk Strategies (12 transactions)

- Brown & Brown (6 transactions)

- T4. CRC and AmRisc, affiliates to Truist (5 transactions)

- T4. Risk Placement Services, an affiliate of Arthur J. Gallagher (5 transactions)

- T4. Worldwide Facilities (5 transactions)

Note that on March 5, 2021, it was announced that AmWINS signed a definitive agreement to acquire Worldwide Facilities, the fourth largest wholesale brokerage in the United States.

Private-equity backed acquirers were the largest type in 2020, making up just over half of the specialty transactions announced, with 63. This is up from 41% in 2019. From the top six listing, Integrity, One80 and Worldwide Facilities are private equity backed. Some newer private equity players, like Constellation Affiliated Partners and DOXA Insurance Holdings, also drove meaningful activity in 2020 but did not crack the top-six listing.

Carriers completed 19 specialty market transactions in 2020, compared to 10 transactions in 2019, a 90% increase. This marks the highest level of transaction activity by carriers in this market as tracked by MarshBerry.

Similar to the retail side, independent brokerages did not show up with the same vigor as other buyer classes in 2020. This was the only buyer group to decline in the number of transactions, with 13 in 2020 compared to 24 in 2019. As noted on the retail side, part of this decrease could be related to independent buyers’ being more conservative during the pandemic. Another factor might be that firms previously classified as independent took on capital and moved to the private-equity backed category in 2020, also similar to the retail part of the business.

The interest and rate of acquisition of specialty firms is not slowing down, based on our conversations with firms in the industry and our own pipeline of specialty deals under contract. While the overall population of specialty firms is relatively small compared to the retail segment, the show continues to impress for this group.

2021 Outlook

Calendar year 2020 ended with a landslide of deals, with 251 announced transactions in the fourth quarter of 2020 alone. This breakneck pace of transaction activity has continued into the first quarter of 2021. Today’s demand is greater than pre-pandemic levels. The performance of the average agency through a down economic period reminded the investment community of how resilient the insurance distribution industry can be. The supply of brokerages is holding steady as firms recognize that the world around them is more competitive and they want to partner with a firm that will help them compete. The activity is only pushed further by concerns about potential federal capital gains and other potential state tax increases. The amount of activity is rivaling what we saw in the third and fourth quarters of 2020, and we expect the pace to continue. We believe the industry could eclipse a total of 750 to 800 announced transactions within the retail and specialty insurance markets in 2021.

Firm performance has remained strong, further supporting this level of demand. Trends indicate an approximate average of 5% organic growth and profit margin (or EBITDA) improving by 1%-3% over historic norms. Most of the profit increase is due to a decrease in travel, entertainment, and office related expenses. This performance in both growth and profit is very enticing to financial investors, as the insurance distribution space has weathered the economic storm similar to its performance during the Great Recession.

The greater demand has also propelled valuations in the market. In the fourth quarter of 2020, the valuations of top-rated platforms were approximately 7%-10% higher than in the first quarter. Essentially, valuations realized during the pandemic, on average, were higher than they were pre-pandemic, which is not a trend we were expecting. For some time, the question has been when the valuation bubble will burst. We haven’t seen that day yet, but with concerns over potential tax increases and interest rate changes, we are not expecting valuations to increase much further.

With a tremendous amount of acquisition activity, supported by buyer demand, brokerage performance with sustained growth and profit and healthy valuations, one thing is certain: Activity will continue to be robust as firms look to capitalize on market conditions that favor sellers in a very crowded buyer pool.

Other MarshBerry Contributors:

Courtney Ferrara, vice president

Eric Hallinan, director

George Bucur, director

Matt Brickner, financial analyst

Luke Hickman, senior data analyst