Focusing on the ‘Why’ Before the ‘What’

Are minority investments in insurance brokerages becoming more prevalent?

The short answer is yes—private equity has shown increased interest in minority ownership of top-performing firms.

For many firm owners, investment from a capital partner may seem like a short-term solution for challenges with perpetuation. However, in some cases, owners may accept an investment without truly understanding the longer-term implications of a minority partnership.

The Evaluation Process

Private equity firms or family offices have a process through which they analyze a new investment. In addition to looking at the terms of the initial investment, they also assess exit options. They consider what the market may look like in three years or in five years and the potential outcomes of an investment, and they forecast the likely base case, stretch case, and conservative returns for a given investment. This step seems to get overlooked by brokerages taking on capital.

Business owners need to make a similar long-term evaluation when considering taking on a partner. Most owners focus heavily on the short term when raising capital and have no plan for dealing with the partnership as their business evolves. In addition to thinking about what a potential exit looks like, those looking to partner with an investor should consider how they will retain a comfortable level of control of the business and negotiate those provisions in the partnership agreement.

It is important to understand what will happen during an exit. Can the capital partner block a sale if you want to restructure? Does the capital provider require an annual minimum return that accrues if it is not hit? What does that ultimately mean to common shareholders when you consider a future transaction? It is crucial to run through a potential “next” transaction when considering the first.

An Intriguing Trend

Minority investment from capital partners is attractive to owners because it allows the business to grow without giving up operational control of the company. But owners often make decisions on capital structures without having firm alignment on their strategy or a clear understanding of how a capital partner will help them. It also could mean that they are not in a position to control their eventual exit, either.

Taking on a minority partner may solve today’s problem, but it also may create more challenges down the road. It’s not that minority partners or private equity investors are a bad option. And it’s not that taking on debt is a bad option. They’re all good possibilities in the right circumstances. But it’s important that owners ask themselves what they are trying to accomplish with their business and which capital solution supports that. You need to imagine the next five years and consider if this partner will help you accomplish your future goals and not just your current challenges.

M&A Market Update

As of April 30, 197 insurance brokerage M&A transactions have been announced in the United States.

Private-capital backed buyers accounted for 142 of the 197 transactions (72.1%) through April. This represents a significant increase since 2019, when private-capital backed buyers accounted for 59.3% of all transactions. Independent agencies were buyers in 32 deals through April, representing 16.2% of the market, a slight increase from 2023, when acquisitions by independent agencies represented 15.6% of the market. Bank buyers have recorded only two transactions in 2024.

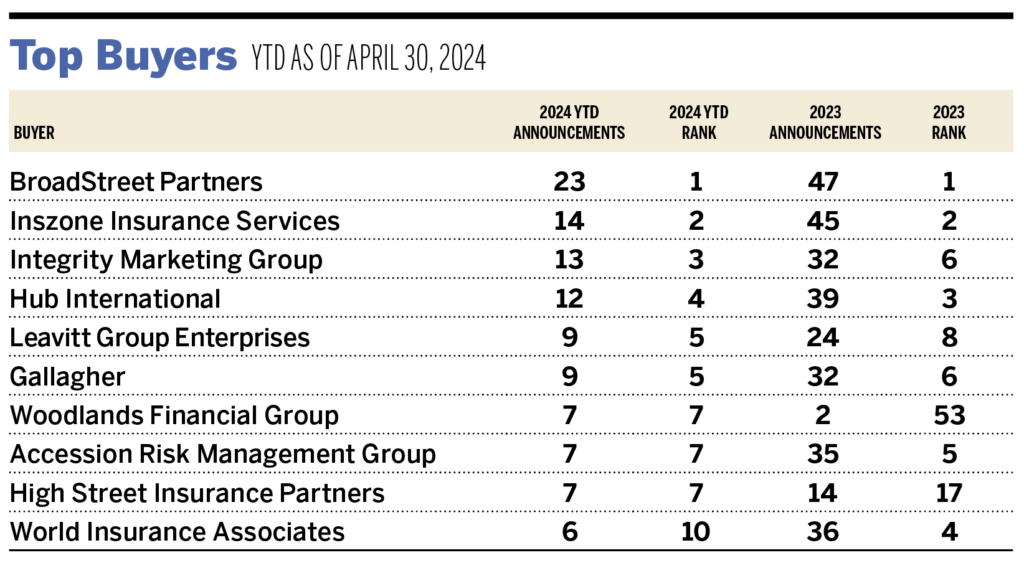

The top 10 buyers accounted for 54.3% of all announced transactions through April, while the top three (BroadStreet Partners, Inszone Insurance Services, and Integrity Marketing Group) accounted for 25.4% of the 197 deals.

Notable Transactions

- April 3: Hub International announced the acquisition of Lakeland, Florida-based Sale Insurance Agency. Sale Insurance has operated in Central Florida for over 70 years as a family-owned boutique independent insurance agency, offering commercial insurance for businesses and high-net-worth personal insurance. Following the acquisition, Sale Insurance will operate as Sale Insurance, a Hub International company.

- April 11: Alera Group announced the acquisition of HealthSure, a Texas-based company founded in 1998 by Barry Couch. HealthSure specializes in risk consulting and insurance solutions for rural healthcare organizations.

- April 15: Higginbotham has acquired Eagan Insurance of Metairie, Louisiana, establishing a partnership with a strong local reputation and extensive regional presence in Southern Louisiana and Gulf Coast Mississippi. Eagan Insurance, founded in 1954, offers a range of insurance services, including personal lines, commercial property and casualty, and employee benefits. It has over 90 experienced team members.