Tax Increase Jitters

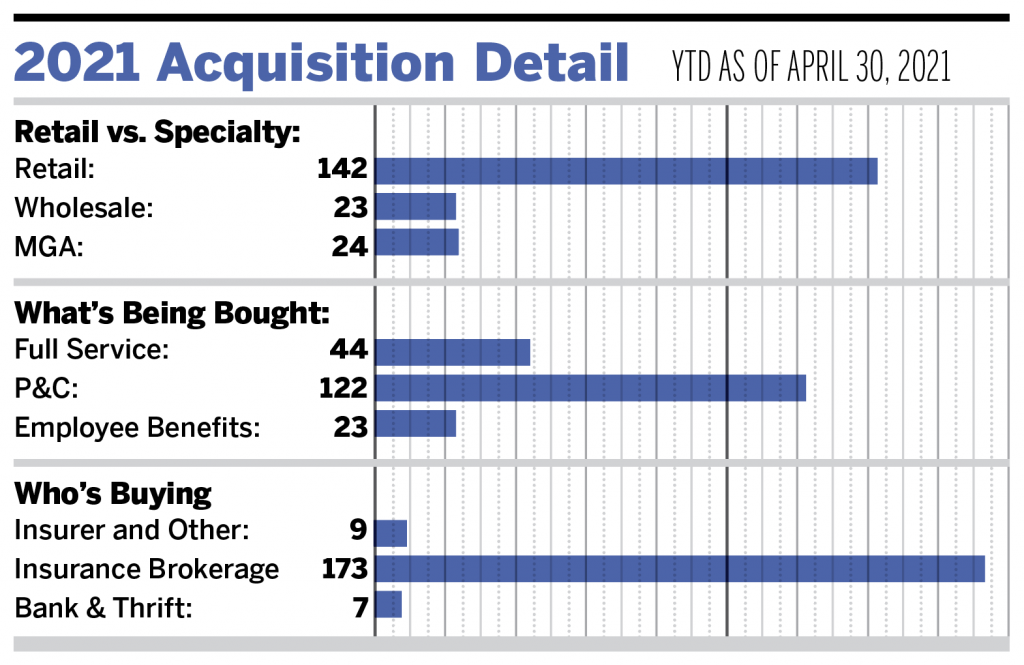

As of April 30, 2021, there have been 189 announced merger or acquisition transactions among the broker community in the United States.

The 189 transactions announced so far in 2021 represent a 15% increase compared to the number of deals announced this time last year. We expect this pace of deal activity to continue, or potentially even increase, as concerns about an increase in federal capital gains tax rates drive many firms to explore an external sale. Tax increases at the state and federal level continue to be a catalyst driving the supply up. We believe there could be a record level of deal activity in 2021 if taxes do indeed go up.

Private-capital backed buyers have accounted for 131 of the 189 transactions (69.3%) through April, while independent agencies made up 19% of the total. Deal activity within these buyer segments is in line with what we observed in 2020 at this time.

We have also observed a significant increase in deals involving specialty distributors in 2021. The 47 deals involving sellers in the specialty arena is nearly triple the amount of transactions announced at this time last year.

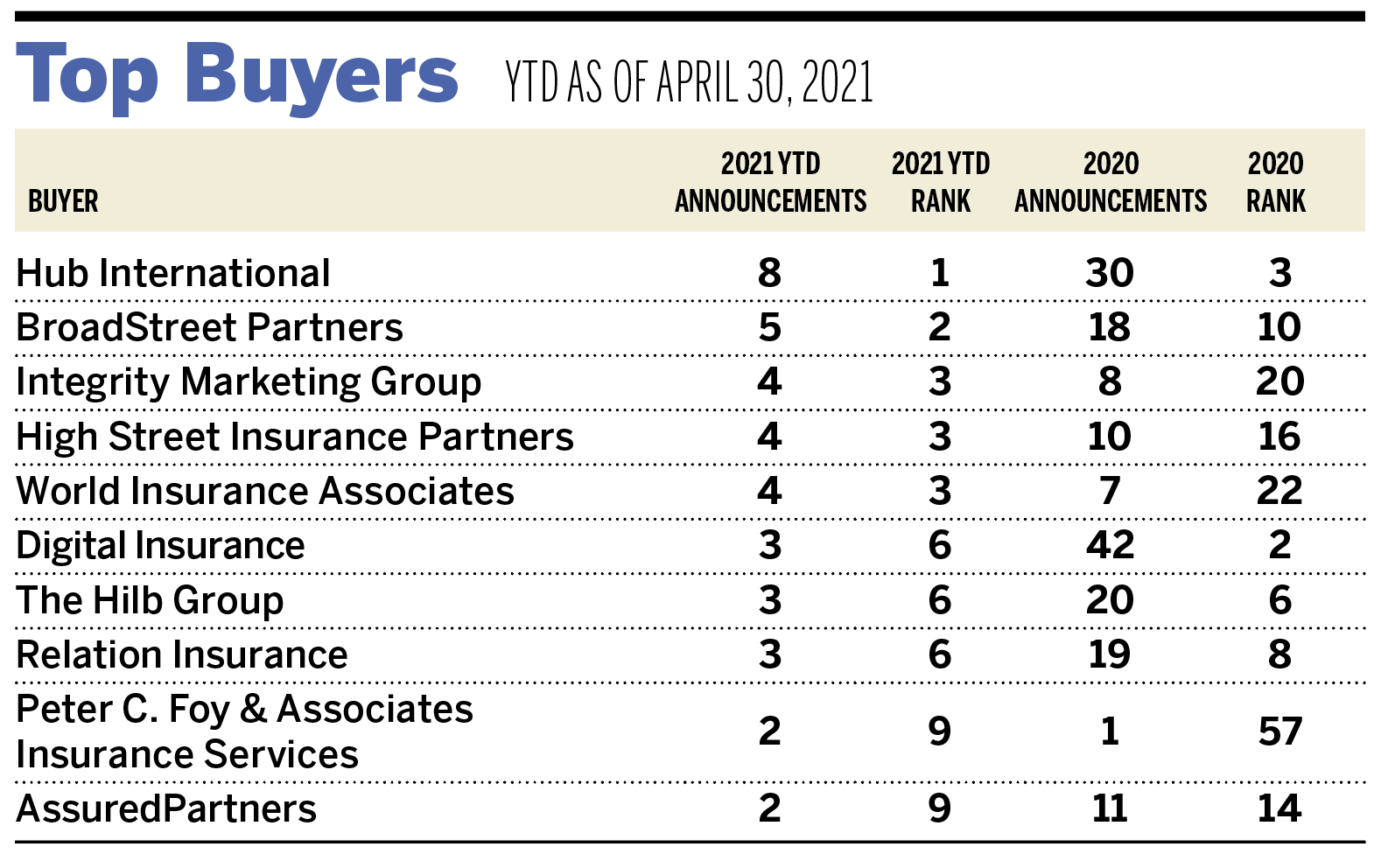

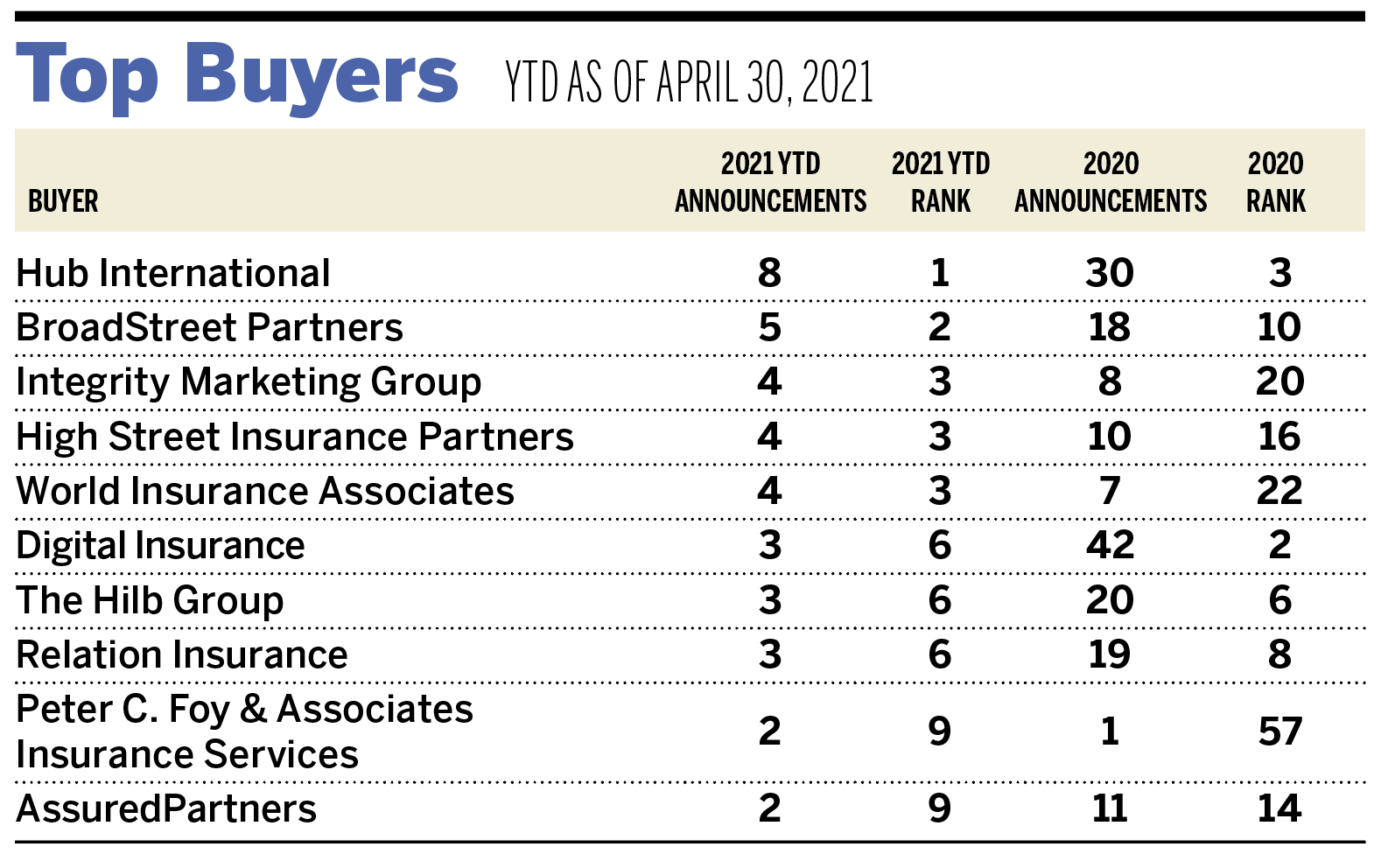

Hub International, Broadstreet Partners, and Integrity Marketing Group are the top three most active buyers in the United States in 2021, comprising a combined 22.8% of the 189 total transactions. The top 10 most active buyers completed 94 of the 189 announced transactions (49.7% of total).

Two large acquisitions to highlight:

- Marsh & McLennan Agency announced on April 5 that it has acquired PayneWest Insurance. Based in Missoula, Montana, PayneWest has 26 locations across the Northwest and employs over 700 people. PayneWest will operate as Marsh & McLennan Agency’s Northwest regional hub under PayneWest’s CEO, Kyle Lingscheit.

- On April 7, Hub International announced it had acquired the assets of Wyoming Financial Insurance (WYFI). WYFI is the largest independently owned insurance agency in Wyoming. The firm specializes in the construction, healthcare, hospitality, and transportation industries.

Investment banking services offered through MarshBerry Capital, Inc., Member FINRA Member SIPC and an affiliate of Marsh, Berry & Company, Inc.