Life After the Deal: Autonomy vs. Integration

Independently owned insurance agencies and brokerages that are considering a potential strategic partnership are shifting their perspectives on the integration proposition of potential partners.

Considering how they want their business partners, colleagues and clients to interact after a transaction is an important factor in determining the best fit. While it is unrealistic to think that there will be no change, the level and speed at which that change occurs will vary based on the partner they choose. Understanding the benefits at different levels of integration should factor into that ultimate partner decision.

While some firms offer a full integration model and others promise a higher level of autonomy, all strategic partnerships require some level of coming together in order for the selling firms to gain access to and use of the tools and resources of a buyer. These connection points allow business owners to improve operations, provide a full range of offerings to their clients, and continue to invest in future growth.

In many cases, smaller firms will employ a more autonomous acquisition strategy but are then forced to evolve their business model to incorporate higher levels of integration as they grow. In recent years, there has been a trend among brokerages that reach the $1 billion revenue range toward more regional or centralized infrastructure and consolidated leadership models.

Illustrative of this trend, Acrisure, having traditionally operated with a decentralized, stand-alone acquisition strategy, recently announced the initiation of a process to unify operations under a single brand and adopt structures for regional consolidation and a standard operating platform structure. Firm leadership emphasized that the decision to pivot was driven by a goal of enhancing its client offering, noting that services will go beyond insurance to include things like cybersecurity, payroll, payment processing and real estate. The success of rolling out these products will require a higher level of control and coordination across hundreds of acquired agencies. As a testament to business owners adopting a positive view of consolidation, Acrisure disclosed that, in internal discussions, a large majority of those polled were supportive of this transformation.

More broadly, buyers are facing an increasingly challenging operating environment with slowing growth and rising capital costs. More integration on a shorter timeline will allow them to realize higher margins on their investments and provide a more attractive growth profile for potential investors and partnerships as they seek new sources of funding.

Awareness of these shifting dynamics and understanding how they will impact the ability of sellers to meet their short- and long-term goals will be key to finding a successful partnership. As the marketplace evolves, the perspectives on the balance between autonomy versus integration must shift.

Remember that the word integration is not always a bad one. It is important that you do your research and ask a lot of questions to be sure you understand what it means (e.g., degree and timing) to integrate with one partner over the other.

M&A MARKET UPDATE

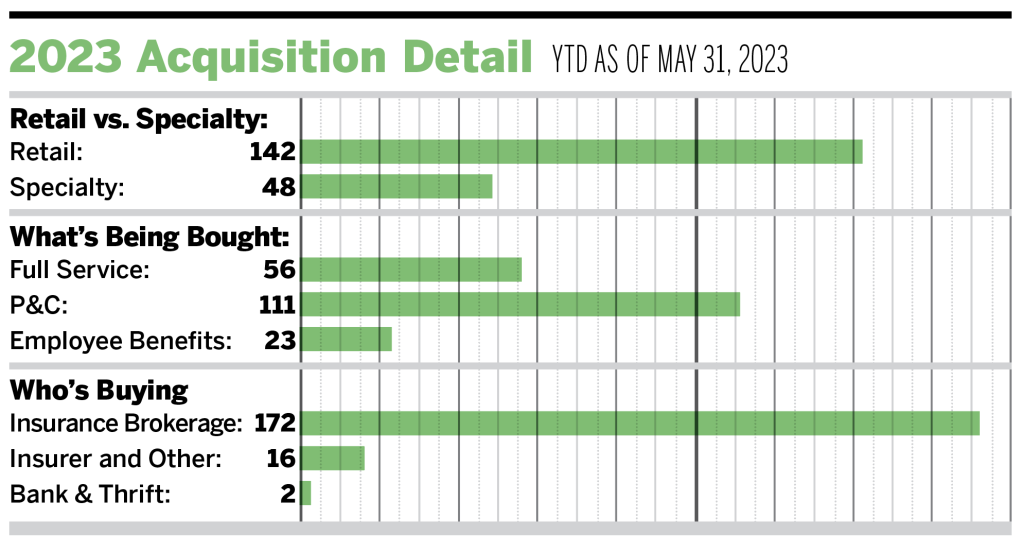

As of May 31, 2023, there were 190 announced insurance brokerage merger and acquisition transactions in the United States. Activity has increased by 16.6% compared to 2022, with 163 transactions being announced through this time last year.

Private-capital backed buyers accounted for 138 of the 190 transactions (72.6%) year to date through May, with 20 deals (10.5%) completed by independent agencies and 14 deals (7.4%) by public brokerages. Of the 190 total deals, 48 of them (25.2%) involved

specialty brokerages.

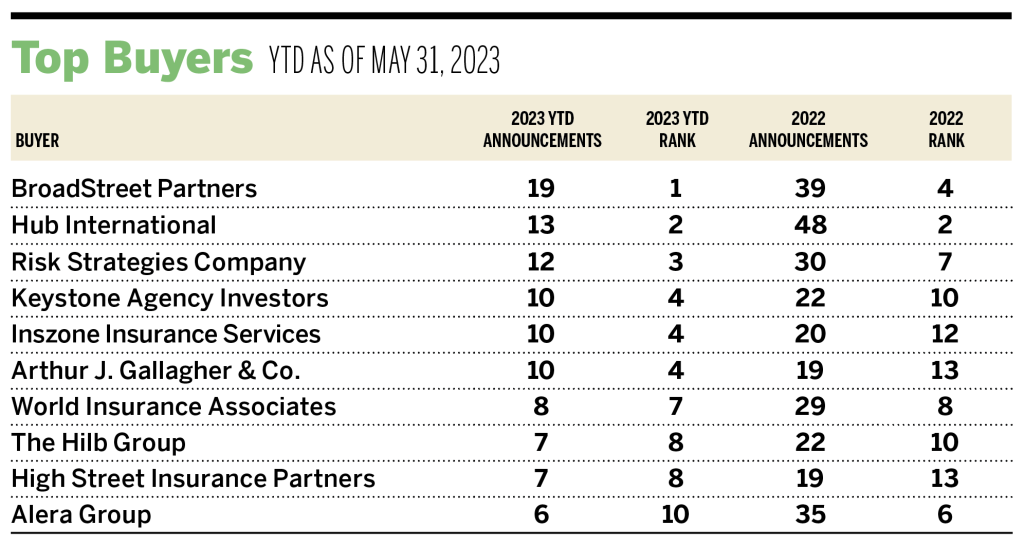

Deal activity from the marketplace’s most active acquirers has remained strong in 2023. Ten buyers account for 53.7% of all announced transactions, while the top three (BroadStreet Partners, Hub International and Risk Strategies Company) account for 23.2% of the 190 total transactions.