Expanding in the Midsection

The wave of mergers and acquisitions that has crashed across the insurance brokerage landscape for the better part of the past decade has left its mark.

Brokerage valuations are at or near all-time highs, private-equity backed firms are now material players in the industry, and capital structures are changing for brokerages of all sizes. But another impact is being felt, though it is more subtle. That impact is the scale being built in the middle-market segment. The larger firms are getting larger.

The middle market is a growing point for brokerages.

Size may have little advantage when it comes to specialized expertise.

Scale can be found in networks instead of M&A.

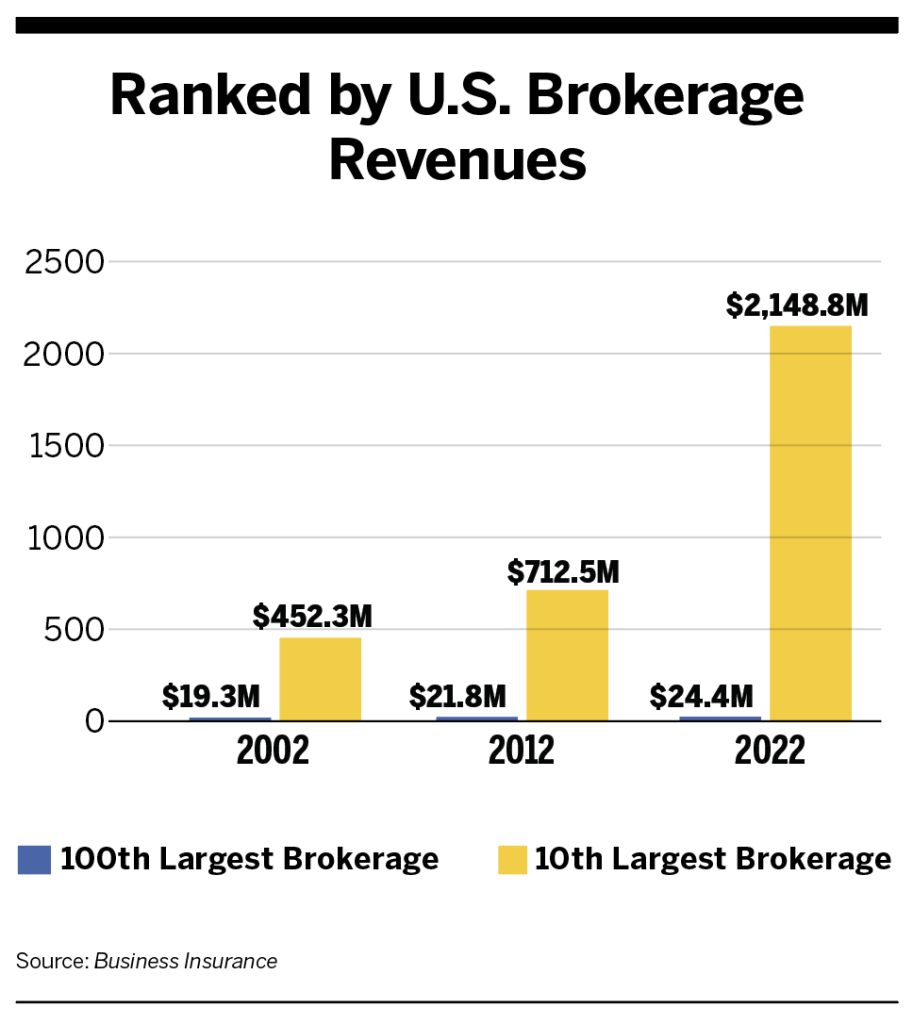

The Business Insurance Top 100 List from 20 years ago shows the 100th largest firm had $19.3 million in revenue. Fast-forward to the most recent Business Insurance list, and the 100th largest brokerage has $24.4 million in revenue. Has the 100th largest firm materially changed? That firm likely has the same carrier clout, the same capacity for client-facing resources, and the same geographic reach that it had in 2002. In short, that firm is not evolving. Or at

least it isn’t evolving nearly as fast as its larger brethren on the list.

By way of illustration, the 10th largest firm is now over $2 billion in revenue, up from approximately $450 million 20 years ago. Due to its expanded size and scale, this is an entirely different firm, with stronger carrier relationships, extensive client-facing and talent acquisition resources, and greater technology spend. This firm is evolving—developing capabilities, expanding its reach. So are many of its peers at the top end of the market.

The notion of scale in our industry isn’t entirely new. The large, global, publicly traded firms have always had scale, but that scale and the resources that accompany it were focused primarily on business in the Fortune 500. What is novel about this new scale is that these larger firms are focused squarely on the middle market.

We believe that there are now 18 brokerages with revenues over $1 billion dollars. Of those 18 firms, the majority have their sights trained on middle-market business. Even the largest brokerage of all, Marsh & McLennan, has ridden this M&A wave to new heights in the middle-market with Marsh & McLennan Agency, which Marsh advertises as the seventh largest agency in North America. And there are many more right behind those 18, chasing $1 billion and a scaled middle-market brokerage platform.

It’s More Than Just Size

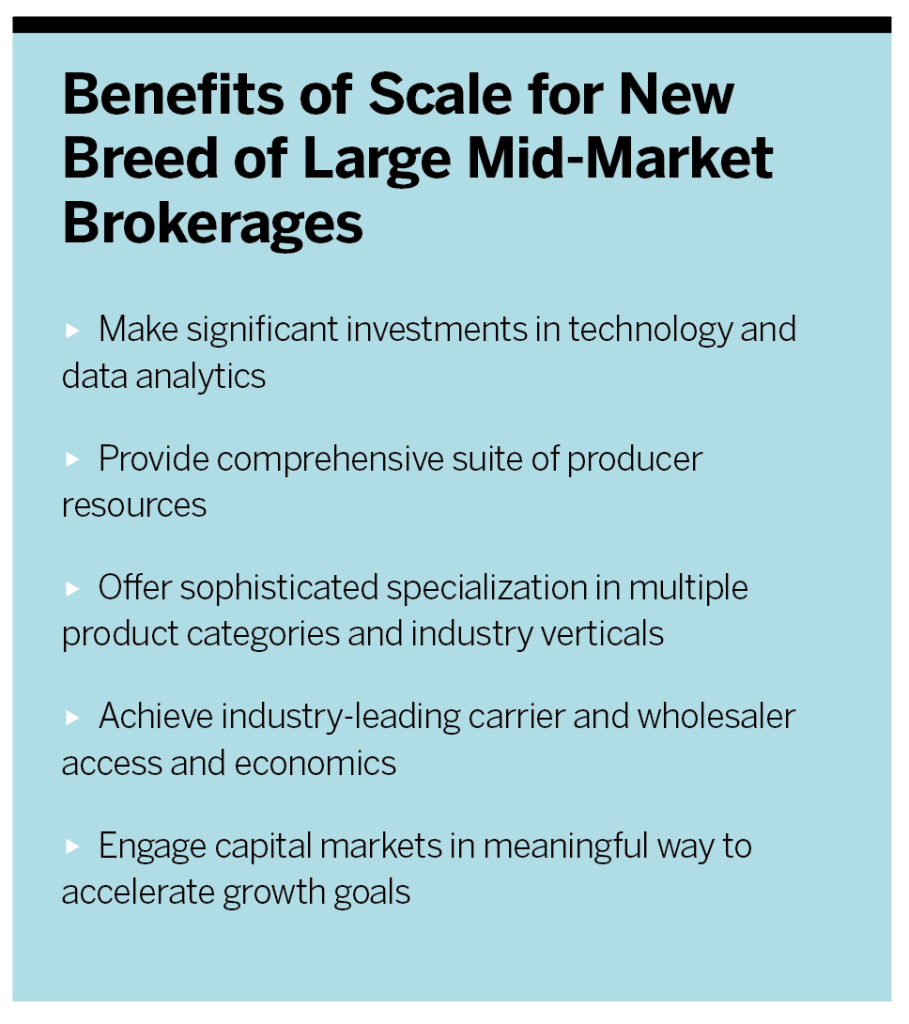

But it isn’t just size—measured by premium volume—that elevates a brokerage’s capabilities and competitive position. Only when that volume is properly channeled is a true and formidable competitor created. What if this new breed of middle-market brokerages could fully harness the power of their scale? Could they aggregate their premium volume to achieve industry-leading carrier economics? Could they leverage the capital markets to support and accelerate their growth? Could they invest in technology and harness their data to create outcomes and products—both in benefits and P&C—that are proprietary and better than what currently exists? Could they marshal their pockets of industry concentrations into robust specialty practices?

We believe that this is exactly what these scaled middle-market brokerages are doing. We further believe that the results, if successful, will create market-leading insurance experiences for customers.

But these competitive middle-market brokerages won’t instantly exist just because a bunch of acquisitions have closed. The work, though, is underway. And the rationale for doing the work is compelling.

Regionals Can Compete

Despite this trend and these prognostications, many smaller, privately held brokerages are currently unimpressed. They see these large aggregators acquiring volume and then changing very little. Or worse, they change the culture and key elements, like producer commission rates, meaningful equity opportunities, and service models, which contributes to an exodus of talent and clients back into the marketplace and hurts their own cause. Today, the privately held brokerage sees the middle-market aggregator as a vulnerable target in transition as much as they see a feared competitor.

Despite these doubts, smaller, privately held firms can continue to boost their own position, and we think there are six key actions they can take to do so.

Specialization > Specialization is the most powerful weapon. Specialization has many advantages over generalist business, including faster revenue growth, quicker producer validation, and a more efficient service model. However, the biggest advantage in this post-consolidation world is that specialization is the most effective way to compete against size.

Being specialized gives smaller, privately held brokerages scale in the areas that matter to their clients, leveling the playing field and diluting the size advantage that the billion-dollar firms can bring. A specialized brokerage can focus on the client’s industry and bring to bear its relevant experience and influence in that industry. Why does an insured need a billion-dollar brokerage when the smaller brokerage is an expert in the client’s industry, complete with client-facing resources and a résumé of comparable experience? Without this dynamic, though, the conversation can too easily revert to a generic discussion about size and resources—a much harder battle for the smaller, privately held firm to fight.

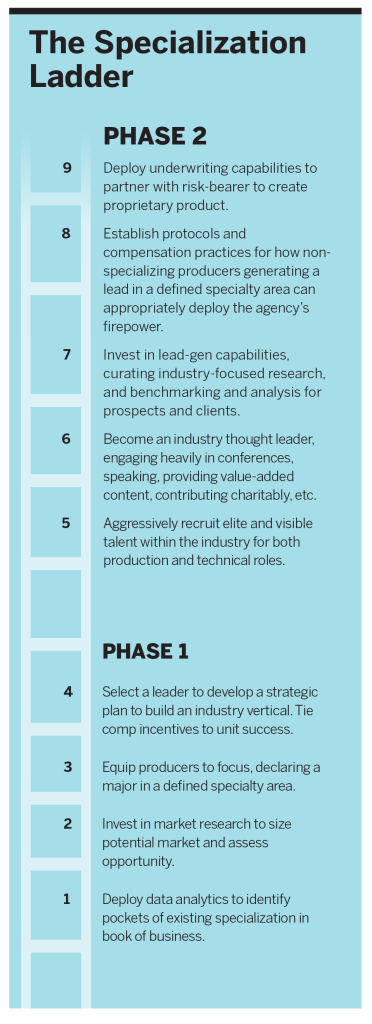

Specialization is a process, with the most specialized brokerages always seeking to advance the ball up the specialization ladder. The specialization ladder graphic highlights common steps along the path to greater specialization. It is important to note that businesses don’t go from zero to the top rung. In fact, brokerages are likely to have some specialty concentrations that are closer to the top and other specialty concentrations that are closer to the bottom. The goal of the smaller, privately held brokerage—and really of all brokerages—should be continuing to climb the ladder. Each rung creates an increased competitive advantage and a greater ability to battle scale.

Team selling > The large brokerages often show up in full force to a client or prospect meeting, bringing to the table a breadth of expertise and personnel far beyond merely a producer. This message—that the scaled brokerage can harness a large, experienced team on behalf of its clients—is a powerful message for a potential insured. How can smaller brokerages compete, other than shrugging off the team that large brokerages bring as nice for the pitch but hard to access afterwards? Regional and local, privately held brokerages are using team service structures as well—the teams just tend to look a little different. Should the producer bring the account executive? What about an internal claims or loss control leader? How about the wholesale broker assisting on parts of the account? Team selling is an effective tool for many reasons, but smaller brokerages should focus on their client-facing teams in order to position themselves favorably against the billion-dollar brokerages. To effectively deploy team selling, though, requires a cultural commitment. An effective team selling and service model—one that works and is not just for show—requires an institutional approach.

Collective Power > A big advantage of scale is carrier access and economics. Brokerages with large premium volumes can much more easily obtain carrier appointments and can also achieve better commission and contingent arrangements with those carriers. Smaller, privately held brokerages, though, aren’t helpless in this area. The emergence of agency networks across the industry can provide a potential solution here. Agency networks—or aggregators—are groups of agencies that come together to harness their collective volume to provide better carrier access and economics to their memberships.

Insurance Networks Alliance, a trade association of insurance networks, estimated in its “2022 Insurance Networks Study” that there are approximately 150 separate agency networks in the United States. This study also says that agency networks count over 22,000 agencies as members and account for over 10% of all P&C premiums written in the United States. These networks provide an intriguing solution for smaller, privately held agencies, allowing them to leverage the benefits of size while maintaining their employee ownership structures.

The best agency networks can take the concept one step further. Some networks have moved beyond just carrier access and economics to provide best practices benchmarking, resource sharing, and market intelligence among the membership. Networks could increase in importance as the consolidation trend continues.

Technology > The insurtech space gets a lot of attention, and the evolution of insurtech from disruption to collaboration offers the opportunity for brokerages to explore, evaluate and select solutions to help them become more tech-enabled. Obviously, with size comes the ability to do this faster, and this is where smaller, privately held brokerages need to make sure they are paying attention. If the scaled middle-market brokerages are able to—through technology investment—create improved user experiences, they will gain a marketplace advantage. Brokerages that don’t keep up will be left behind. That doesn’t mean that all brokerages need to become technology companies, but it does mean that brokers should be keen observers, engaging potential technology partners and ultimately adopting key solutions that are proven in the marketplace. The evolution of insurtech has made it much more likely that successful solutions will be broadly available. However, it is up to the brokers themselves to make sure that they are aware of the potential solutions and that they are continually innovating to provide market-leading experiences for their insureds.

Relationships > A key asset that smaller, privately held brokerages have in the marketplace is their personal connection to insureds. It will be important to maintain the emphasis on this asset in the face of increased competition from scaled middle-market brokerages. Smaller, privately held brokerages are an intimate part of the fabric of their community and have a track record of being consistently engaged with and available to their clients. Without the increased bureaucracy that can sometimes accompany larger organizations, smaller, privately held brokerages can be culturally aligned with their communities and reliably nimble in meeting clients’ needs. This competitive advantage will be even more critical as scale advances.

Equity and Talent Development > While equity opportunities in larger firms might be lucrative from a return perspective, they are not as compelling when it comes to influence and having a voice or a seat at the table. Smaller, privately held firms can use this equity opportunity as an advantage, especially as it pertains to attracting and retaining talent. Being able to offer a current or future employee equity in a smaller, privately held brokerage is a differentiator, as it can couple a powerful wealth creation opportunity with the chance to be a more significant part of the decision-making and development of the firm.

Talent is the most critical element of prosperity—for all brokerages—and smaller, privately held firms need to work to deliver this message of equity opportunity in the battle for talent. The billion-dollar brokerages can make significant investments in recruiting and development—and in many cases already have. Smaller, privately held brokerages need to ensure that they are similarly proactive.

The competition is about to get more intense. The middle-market powerhouses being built have the potential to be formidable but only if constructed correctly and thoughtfully. Of the new breed of scaled middle-market brokerages, only those that employ their size to advance their clients’ experiences will gain the full competitive advantage. Simply having size, or aggregating premium, won’t do the trick.

Some smaller, privately held brokerages are going to struggle with an increasingly competitive environment and will not be able to keep pace with the investment made by the newly scaled middle-market brokerages. But others will succeed, leveraging their unique strengths and specialized revenue streams to provide market-leading experiences for insureds. The winners, at the end of the day, will be the clients themselves, as competition drives better products and more user-friendly solutions. The insurance distribution system is big enough to accommodate agencies and brokerages of all sizes, but the balance of power in the universe may be shifting.