Taxes

Brokerage Ops

De-Risking M&A

Insurance today is not a secondary consideration in corporate dealmaking, but a ...

September 30, 2025

Industry

The Good, the Bad, and the Ugly September

The Big, Beautiful Bill made permanent tax provisions that are important for Cou...

August 30, 2025

Industry

Social Security Must Be Taxed

Freeing Social Security benefits from taxation seems good in the short term, but...

May 28, 2025

Industry

Congress Mulls Tax Breaks for Disaster Readiness

Two bills to promote home fortification for natural catastrophes have earned bip...

April 1, 2025

Health+Benefits

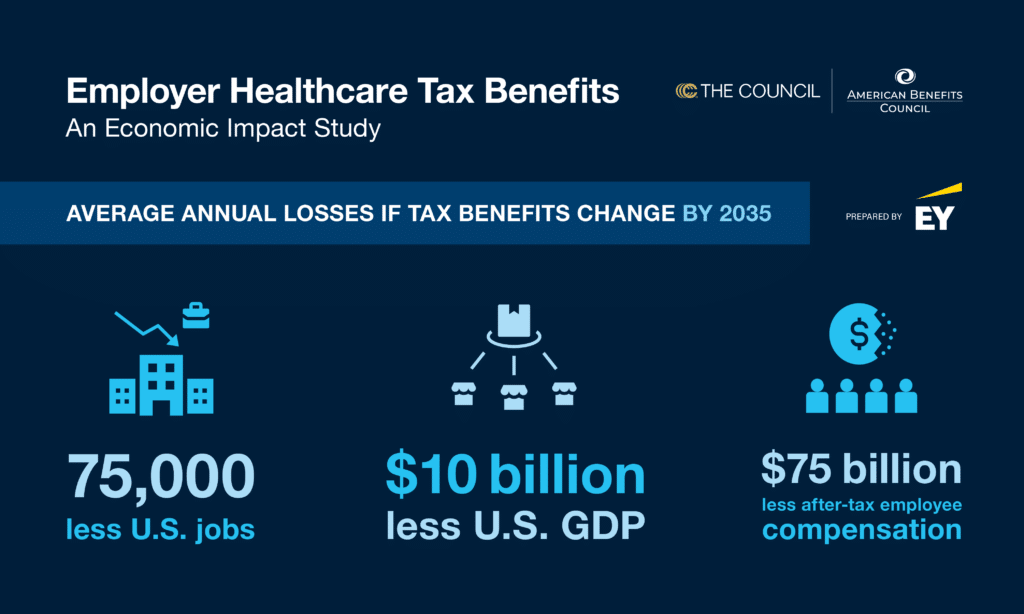

Modeling Shows Drastic Effects of Limiting Tax Exclusion for Employer-Sponsored Insurance

Increasing the tax burden for employer-sponsored insurance would significantly w...

March 19, 2025

Industry

Tax Reform and Reconciliation

Republicans will lean on the reconciliation process to reauthorize the 2017 Tax ...

March 3, 2025

Industry

The Election Is Over. What Happens Next?

The waiting game is officially underway to see what policies Donald Trump will p...

December 2, 2024

Industry

New Presidential Nominee, Same Questions

With Vice President Kamala Harris’s presidential nomination, what potential ta...

August 28, 2024

Industry

Politics and Taxes Poised to Weigh on Broker Business

The industry could face a bruising political tax battle in 2025.

August 28, 2024

Health+Benefits

No Risk at All

The rise—and inevitable fall?—of health “screening” group indemnity poli...

March 1, 2023