Retaliation Continues…Slowly

The past decade has been witness to a handful of social movements which have not only played a role in a changing workplace and society, but have also impacted both employment practice liability (EPL) claims and the size of EPL compensatory awards.

Surprisingly, however, the COVID-19 pandemic seems to have decelerated these trends, despite causing many issues for the labor market.

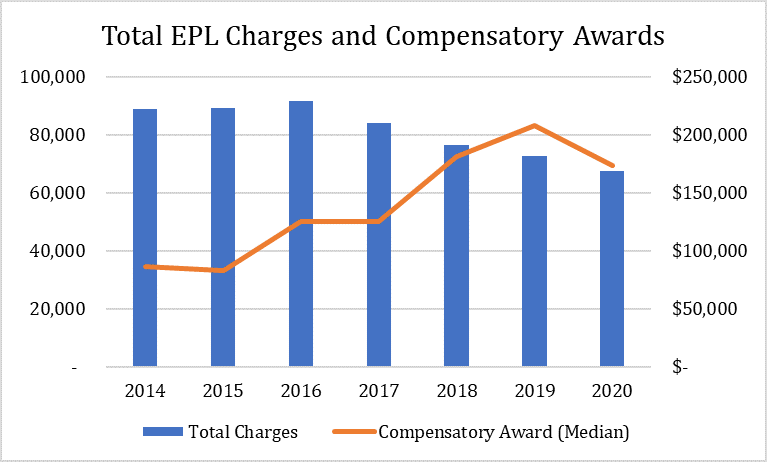

Data from the U.S. Equal Employment Opportunity Commission (EEOC), which enforces federal laws that make it illegal to discriminate against an employee, show that the total number of employment practice liability charges—claiming any type of discrimination in the workplace—have decreased 26% from its 2016 peak. Similarly, data from Thompson Reuters shows that the median compensation award for EPL claims peaked in 2019 at $207,856, while the 2020 median number decreased by 14%.

Retaliation claims, which are a subset of EPL, have been increasing from 44.5% to 55.8% during the same time period. With the labor market, and consequently the EPL market, being constantly affected by economic and social movements, Leader’s Edge spoke with Chris Williams, employment practices liability product manager at Travelers, to provide some clarity on the ongoing trends.

In terms of EPL insurance overall, the coverage is designed to respond to claims brought by former or current employees who allege some form of wrongful conduct by their employer; for example, wrongful termination, discrimination, sexual harassment or retaliation.

Specifically, retaliation charges are claims made by an individual alleging that adverse action (or retaliation) was taken against them after alleging discrimination based on a protected status (such as a workers comp claim or an EEOC charge). For example, if an employee files an EEOC charge and is subsequently terminated, they may allege they were retaliated against for filing that charge.

Other examples of retaliatory actions may involve the duty to report financial numbers, in which an employee refuses to disclose fraudulent numbers and they are retaliated against. Or, perhaps, an employee discloses (or threatens to disclose) an alleged violation of the law to a superior or a governmental agency and thereafter faces retribution from their employer for these actions.

For retaliation claims to be successful, the individual doesn’t necessarily have to be terminated but they could face an adverse action, like a demotion, or simply be subject to less favorable treatment in the workplace.

I think there are many aspects to consider when looking at this upward trend:

First, there is a wider pool of potential plaintiffs and claimants out there as nearly everyone can bring a retaliation claim. Unlike a discrimination claim, in which the individual needs to be a member of a protected class, retaliation claims can be brought by any person, regardless of race, national origin, age, etc.

Second, retaliation claims tend to be very difficult to defend. In fact, it’s often difficult to get a court to dismiss a retaliation claim on a motion for summary judgment; so, the employer is more likely to face a jury in those cases. In addition to that, retaliation claims can often have merit—or win—even if the underlying claim (age discrimination, for example) has no merit.

Third, the U.S. Supreme Court decision in Burlington Northern & Santa Fe Railway Co. v. White from 2006 established that an employee doesn’t have to show they were demoted or terminated to prevail on a retaliation claim. They merely have to show that they were subjected to adverse treatment as a result of bringing a complaint. This has made it easier for plaintiffs to prevail on retaliation claims.

And finally, the attorney fee—or financial— component. If a claimant prevails on a retaliation claim, or a discrimination claim, they’re entitled to their attorney’s fees. This provides a certain incentive to the plaintiffs’ lawyers to bring these types of claims.

Employers can mitigate their exposure to these claims in a couple of ways. Consulting with an employment lawyer is the first crucial step. Before taking any adverse action against an employee, employers should talk to an employment lawyer to make sure the employer is well positioned against the possibility of a retaliation claim. We’ve seen situations where an employer claims to have fired an employee for just cause and not in retaliation to a complaint. However, when looking at the personnel file, the employee received glowing reviews over the past few years and received merit increases and bonus awards. An employment lawyer would help identify situations that can increase a company’s exposure to retaliation claims.

Having an anti-retaliation policy in place is also extremely important, as it encourages employees to report unsafe practices or unethical behavior in the workplace. It helps develop a company culture that values a safe and ethical workplace; but it also provides an open and protected environment for employees to report unsafe, unethical or unlawful behavior.

Finally, having an EPL policy in place is very helpful because, in addition to offering protection against adverse employment verdicts that have become increasingly costly to defend and resolve, many EPL carriers offer risk management resources to further mitigate potential exposures.

The law firm Jackson Lewis has a “COVID-19 Employment LitWatch” dashboard that tracks complaints filed in federal and state courts nationwide that allege labor and employment law violations related to COVID-19. As of December 2021, only 21% of the COVID-19 EPL claims allege retaliation or whistleblower allegations. Those claims are usually in regard to an employee who complains of an unsafe workplace (in terms of COVID-19 prevention and protection plans) and is later terminated.

In terms of the vaccination requirements, most of the claims we’ve seen involve requests for accommodation based on religious beliefs or for disability reasons. For instance, an employee requested a vaccine accommodation based on those issues, but their request was denied, and the employee was later terminated for requesting that accommodation or declining to be vaccinated. Depending on how the claimant brings the claim, this scenario could also lead to a retaliation claim as the employee was retaliated against for requesting accommodation.

It’s an interesting trend. Historically, EPL claims tend to be somewhat correlated with the unemployment rate. So, if the unemployment rate goes up, you see EPL claims go up. In fact, as the unemployment rate dropped below 5% in 2016, the amount of EPL claims also decreased. However, you’d expect more EPL claims in 2020 as the unemployment rate spiked due to the pandemic.

So, why weren’t there more EPL claims or EEOC charges filed at that point in time? There are a couple of aspects to consider. On one hand, enhanced unemployment benefits provided financial resources to folks who didn’t feel the need to pursue a claim against their employer and who probably thought they’d be called back eventually—if they were laid off in the short term. On the other hand, working remotely may have resulted in fewer discrimination and sexual harassment claims overall because there was no face-to-face interaction. In fact, the most severe sexual harassment claims usually involve face-to-face environments such as work dinners or business travel and conferences.