Lifestyles of the Rich and Risky

With high-priced assets and often risky activities that pose increasing financial dangers, many high-net-worth individuals and families are underinsured—whether by inattention or design or due to a tight market for personal lines at that level of affluence, insurers say.

Hub International highlighted this issue in its recently released “2024 Private Client Outlook and Insurance Market Rate Report,” which found that climate change, regulation and litigation are driving up premiums and tightening the market for high-net-worth (HNW) coverage. At the same time, responses to a Hub survey contained in the report suggest that HNW individuals are perhaps not fully considering the severity of their risks and the likelihood that their assets are insufficiently protected.

A new report from Hub International indicates that many high-net-worth individuals are underinsured even as their potential exposure to devastating weather events, cyber attacks and other threats grows.

This comes as some insurers are partly or fully withdrawing from certain particularly risky markets or even entire states.

Insurance carriers are using new technologies and other resources to better assist their HNW clients, who also can use non-admitted carriers and other insurance options.

In September 2023, Hub surveyed 200 high-net-worth individuals, advisors and wealth managers on the issues affecting affluent families and strategies to safeguard wealth. While close to 90% of respondents said their risk management program was sufficiently comprehensive, Hub found that:

- Only 16% of affluent families surveyed had recently revised their risk management procedures

- One out of five respondents was seeking to lower risk via higher limits or layered policies

- Fewer than one third believed they had adequately protected themselves from cyber threats

- More than half did not have a risk mitigation protocol for travel, and only 13% had purchased kidnap and ransom policies.

Meanwhile, available coverage is drying up, particularly in places where HNW individuals tend to congregate and locate their assets, increasing the concentration of risk.

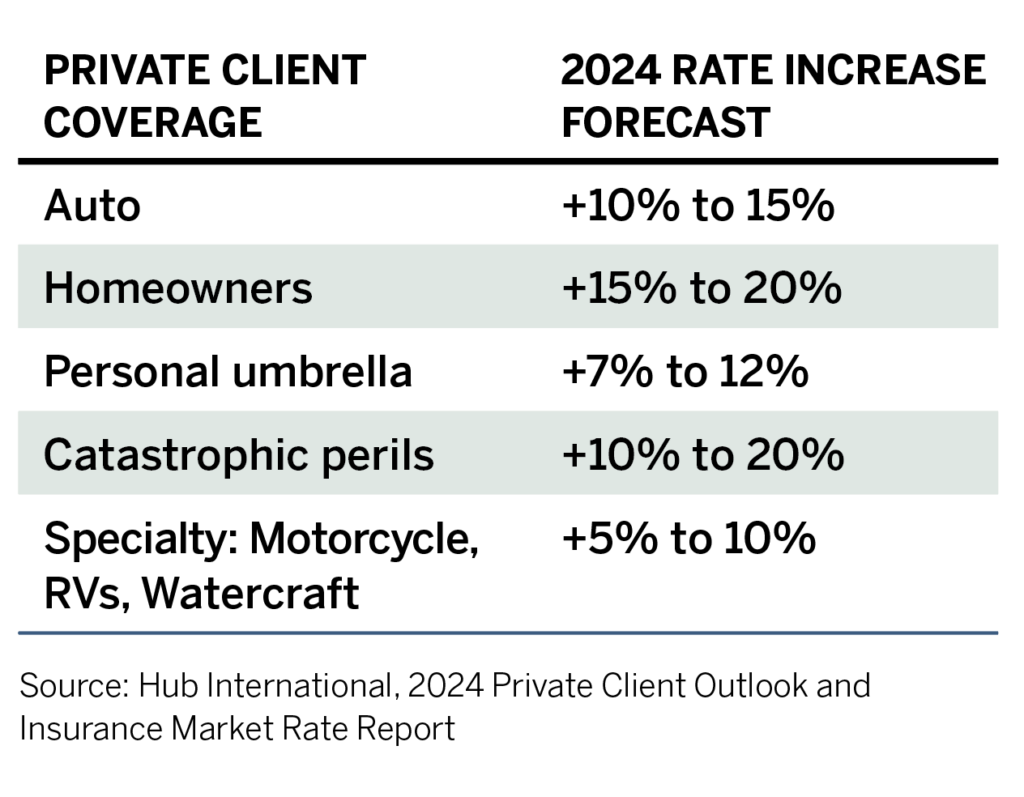

“A growing number of increasingly destructive weather events and a rise in litigation and cybercrime has made personal insurance more expensive and coverage less available,” the report says. “Premiums are rising, insurance limits are declining and insurers are demanding more conditions on policies.” Hub predicts rate hikes in 2024 in many lines affecting HNW individuals.

“We are two and a half years into a very challenging market for personal lines insurance,” says Katherine Frattarola, executive vice president and head of Hub’s Private Client, High Net Worth Practice. “High-net-worth and ultra-high-net-worth homeowners like to live in risky areas where the earth burns, the ground shakes, and the wind blows.”

Chubb, one of the leading HNW insurers, reached similar conclusions in its December 2023 “The Wealth Report: Closing the Perception Gap in a Time of Increasing Risk.” The document, based on a survey of 800 HNW individuals in September and October 2023, found a growing gap between “what people value and how they choose to protect it against a myriad of risks through appropriate insurance, risk management, and loss control programs.” As an example, 92% of respondents expressed concern regarding the amount of potential penalties in a liability lawsuit, but just 36% possessed excess liability insurance.

The personal lines insurance market has endured significant “macroeconomic volatility, severe weather and elevated catastrophe losses, and more persistent property inflation than anticipated,” says Dan Halsey, senior vice president of personal lines at The Hanover. That has led certain carriers to stop underwriting new policies or to exit markets or entire states, particularly California and Florida, reducing consumers’ insurance options. For instance, State Farm’s homeowners insurance provider in California announced in May 2023 that it would no longer accept new applications, including those for business, personal and casualty lines. In July 2023, USA Today reported that four insurers, including Farmers Insurance, had taken steps toward partial or complete pullouts from the Florida market since the preceding year.

Brokers and agents catering to HNW customers must approach risk analysis and coverage for these individuals with even greater care than in the past, brokers and carriers say.

Understanding the HNW Client

There are no hard and fast rules for what constitutes high net worth, which is usually based on the level of insurable assets. As a rule of thumb, HNW is usually $3 million and above, and ultra-HNW is $20 million and above, Frattarola says. This can vary by region, as someone who is considered very wealthy in the middle of the country may not have to spend $5 million to afford an opulent house.

“In general, we look at HNW clients as those who have substantial insurable assets. Typically they are going to have multiple homes, large collections, aviation and watercraft exposures, and a need for higher limits of umbrella or excess liability,” says Tim deRosa, chief operating officer for private client services at brokerage Risk Strategies.

High-net-worth individuals need insurance coverage and risk management services that are fundamentally different from the average American’s.

Many insurance agents can write a policy for a house worth $3 million, $4 million or even $10 million, deRosa says. “But when you talk about true risk management, do they address what I refer to as the red flags of HNW risk management?” he asks. “Are clients thoroughly screening their domestic employees? Do they travel to exotic locations and have a need for travel, accident, or kidnap and ransom insurance? Are their many trusts and LLCs adequately reflected on their insurance policies? Those are just a few of the things that the vast majority of insureds don’t think about unless the subject has been broached by their respective agents.”

High-net-worth individuals may experience structural underinsurance due to the limitations of mass market policies, which may not adequately address their specialized needs, says Diane Delaney, executive director of the Private Risk Management Association (PRMA), a nonprofit educational organization comprising more than 5,000 high-net-worth private risk and insurance management professionals.

“When I was working on the carrier side several years ago, we estimated 75% of high-net-worth individuals were insured with mass market or direct writers,” says Delaney. “The challenge of underinsurance still persists. Limitations in coverage, especially in areas like excess liability, which may cap around $5 million for certain carriers, may not meet the realistic needs of individuals in this category.”

Local insurance agents without a complete understanding of wealthy clients’ lifestyles could fail to ensure their full insurance needs are met, says Spencer Houldin, president of Ericson Insurance Services. “It’s quite common to see someone with a net worth of $10 million relying on a million-dollar umbrella policy for coverage. And when it comes to valuable items like wine collections, jewelry and fine arts, the assets aren’t insured properly, and there’s often a gap. For instance, I have a client with a multimillion-dollar comic collection, and insuring it properly becomes a very specialized task.”

Risk Drivers

The Hub report identifies certain risk drivers for HNW individuals, some that affect a broader population in the United States and others that are more likely borne by those with elevated income levels. They include:

- 23 U.S. weather events from January through mid-August 2023 with losses exceeding $1 billion

- $53.1 billion in 2022 personal injury liability payments

- Fine-art losses due to vandalism and severe weather

- Rising repair costs for watercraft, ATVs, motorcycles, etc.

Part of the challenge is that many HNW individuals are drawn to the same beautiful and risky places in the country, such as exclusive areas of Florida and California. And risks can compound. For example, an individual with an art collection on a yacht moored in hurricane-prone Miami Beach risks exposure of the art collection to water damage, the yacht to damage or destruction, and possible liability claims from the crew.

“Many wealthy New Yorkers moved to Palm Beach County, Florida, during the pandemic, and for those who already lived there, they decided to move their art down because they’re spending more time in Florida now,” says Houldin. “All of a sudden, their million-dollar artwork is floating down to Florida, and they add a couple cars. So now you have a 10-by-10-mile concentration of wealth around Palm Beach where, if a Category 5 hurricane ever hit it, it would be a really bad day. Then came [Cat 5] Hurricane Ian in 2022, and it was a $60 billion event and not even a home property event. It was an automobile and a boat event. All these expensive condo buildings were built with the garages underground, and they all flooded and every car was totaled. These insurance companies just can’t take on any more risk down there.”

Risk concentration is spreading beyond the most common HNW watering holes into other areas such as the Carolinas, Texas, and Long Island and Manhattan in New York, Frattarola says.

Some HNW individuals need their activities insured as businesses, given their scope. “Somebody living in New York during COVID decides, ‘I want to buy a ranch and own some cattle,’” Frattarola says. “Then that person begins to have aspirations of becoming a domestic producer of Wagyu beef.”

Farm activities that many HNW individuals pursue on their properties, whether for personal satisfaction or income, present a panoply of risks: machinery, animals, and lots of hard labor by employees. Ericson Insurance’s Houldin cites a client who owned a tractor for farming but also occasionally allowed a neighbor to use it for plowing fields. Houldin advised the client regarding the significant liabilities involved in allowing an inexperienced user to drive the tractor outside of the client’s premises. As a solution, they implemented a specialized tractor liability policy to address the unique risks associated with this activity.

Cybersecurity

Cyber attacks present the fastest-growing threat for HNW individuals, Hub says. “A quarter of all affluent families have experienced a cyber attack within the past two years. The United States is the most targeted country for cyber attacks, and one in two Americans had an online account breached in 2021—losing an estimated $6.9 billion mainly from online investments, romance scams and compromised email,” the report states, citing studies by AAG IT and Barclays. “As the rate of cyber attacks accelerates, insurers are demanding more stringent cybersecurity measures, including professional security scans, payment processing safeguards and multifactor authentication,” the report says.

Personal cyber lines can be challenging because they lag commercial policies in sophistication, deRosa says. “With the internet of things and the diverse exposures these days, the cyber carriers on the personal lines side are far behind their commercial brethren in that we’re really only seeing in the last few years the rollout of true [personal] cyber policies,” he adds. “I think they’re probably still in their infancy, and I think they will sort of morph over time.”

Personal cyber lines are primarily intended to offer families financial protection for cyber losses rather than covering them for liability or acts that may injure other parties, says Will Van Den Heuvel, senior vice president of personal lines at Cincinnati Insurance, one of the largest HNW carriers in the country.

Liability

Liability is a significant area of exposure for HNW individuals, and umbrella coverage particularly is chronically underinsured. Hub said that, while 53% of HNW respondents to the survey said they think they adequately covered liability risks, “a significant number of affluent families fail to purchase umbrella liability coverage that covers their net worth.”

And risks can come from unexpected quarters, from a teenage son’s drunk-driving accident to higher-risk activities like piloting small aircraft.

“The one that terrifies me is multi-family buildings such as co-op buildings in New York City and condo buildings in Miami,” Houldin says. Houldin states that, in such scenarios, the risk extends beyond personal liability to potential repercussions from events within the building. In the event of a water or fire incident, every insurance company covering damages for their clients in the building would seek reimbursement, underscoring the importance of comprehensive coverage in such situations, Houldin explains.

In addition, business, philanthropic and lifestyle activities may not be adequately covered under general policies. Hub recommends that members of corporate or philanthropic boards check on their liability protections under directors and officers policies.

Some traditional HNW carriers offer policies with broad coverage, encompassing most risks, Houldin notes. “The contracts are very, very broad when they come off the assembly line, unlike your typical ISO contract that requires endorsements,” he says. “For the most part, the contracts get you 90% there, and customization is needed at the end based on specific needs. With HNW carriers, you can add coverages for specialized jewelry or fine arts and excess liability, then adding on top of that excess uninsured motorist coverage. This flexibility allows for tailoring coverage while benefitting from a comprehensive policy as a foundation.”

Safeguarding HNW Clients

There are about a half dozen major HNW carriers, according to sources interviewed. Risk managers specializing in the field are often part of a team that also includes wealth managers and tax, trust and estate advisors, Frattarola says.

High-net-worth risk management tends to be a field in which brokers and agents need specialized training, particularly for understanding and approaching the lifestyles of HNW individuals that are often very different from those of the insurance professional, Delaney says.

High-net-worth risk advisors distinguish themselves from standard market agents and brokers by offering a more comprehensive and sophisticated approach toward their clients’ risks, Frattarola says. Generally, private client risk advisors assist clients with wealth management more than in the past. “It’s less transactional and much more comprehensive in taking into account family and life goals,” she says.

Agents should take a holistic view of the risks facing HNW individuals rather than treating component risks in an à la carte fashion, Frattarola says. That encompasses understanding the risk profile of an existing or prospective client, along with their risk tolerance, family situations that could affect the risk profile, and any upcoming lifestyle changes.

“Importantly, not only will they be familiar with what’s going on in the marketplace, they’ll also understand that, if you put a plan in place when you were in your 20s, your lifestyle in your 50s is likely more complex and you will need to make different choices to inoculate yourself against risk,” Frattarola says. “It is also understanding not just the dollar amounts but the contractual language that lays out the policy details, which is where relying on the expertise of a good risk advisor becomes very, very important.”

An increasing number of risk analysis tools are available for HNW brokers, says deRosa. As an example, he cites the mapping software Risk Meter, which enables users to identify a specific property in order to analyze its elevation and flood exposure. Risk Strategies has a loss control team, including structural and civil engineers, that can assess properties’ exposures for both personal and commercial lines. “I think a lot of firms have started to bring in people that are risk management folks, either from the carriers or elsewhere, that will help put together a different view of what a person’s risk or exposure might be, whereas 10 years ago, none of that existed.”

The 16% of respondents to the Hub survey who said they had recently adjusted their risk management plans were likely acting on the guidance of a risk advisor, deRosa says. That provided an opportunity to identify add-on coverages or loss control practices that the client might not have realized were available, he adds.

Risk mitigation is also important, and efforts vary. “An insurance contract has always existed between the carrier and the consumer, and that contract has consistently shared risk mitigation responsibility with the end customer,” says The Hanover’s Halsey. “In order to keep insurance accessible to individuals and families, the way consumers think about home insurance must evolve from thinking of insurance as a policy you look at once a year to understanding their risk mitigation responsibilities as part of the contract.”

Carriers are pushing harder in this area to help consumers actively protect their property in partnership with and supported by their agent and carrier resources. There have been significant technological advances for protecting important assets in homes, Halsey says, citing water and electrical sensors, systems for automatically shutting off water, and others.

Another key area for risk management is household staff.

“When hiring domestic staff, it’s essential to approach conversations with nannies or housekeepers just as you would with corporate employees,” Delaney says. “Regular reviews are necessary, and if performance is inadequate, clear communication is key. Documenting everything becomes crucial for legal reasons, providing a substantial resource when decisions lead to court proceedings. Independent agents play a vital role in advising individuals on such plans.”

Some carriers offer background checks before clients hire staff. Ensuring adequate workers compensation for employees and employment practices liability insurance to protect the HNW employer is also important.

In general, carriers are working to help mitigate and address clients’ risks better. “There’s more emphasis in the market now to work with clients and with agents and brokers to mitigate loss and to provide advice and consultation,” according to Van Den Heuvel. For example, some agents and brokers will check homes for insurability with Cincinnati Insurance to make sure they can be insured before buying a property, he says.

Responding to a Tight Market

For admitted carriers, regulators in many states are adjusting rates more slowly than the increase in risk, Frattarola says. That is leading many agents serving HNW individuals to procure some or all coverage in the non-admitted market at a higher cost.

“There has been an industrywide trend to address portions of the property market on the E&S side of the business, in addition to the admitted side,” Van Den Heuvel says. “On the non-admitted side, you have more flexibility in terms of rate and terms and conditions. We see that as not a temporary trend but more of a permanent shift as the markets struggle to provide capacity.”

Carriers have different risk appetites, deRosa says. “I could take a client’s risks to three insurers, and I could get three distinctly different answers. One carrier would take the risk in the admitted market, one would decline it outright, one would say, ‘I don’t feel comfortable in the admitted space, but I’m able to offer it in non-admitted.’”

Many HNW carriers have their own non-admitted divisions, deRosa notes. And there are specialists. For example: Vero Beach, Florida-based Orchid Underwriters Agency, which was bought by Brown & Brown in 2022, specializes in coastal excess and surplus homeowners insurance. Many wholesalers also offer E&S coverages, deRosa notes.

There is a need for a holistic risk mitigation management strategy that goes beyond traditional, narrower and discrete risk coverages, the Hub report found.

One option is to layer insurance tiers. This can involve using insurance products that are often more common in a commercial setting, such as employment practices liability insurance. Indeed, it can be wise to treat HNW families as one would a business, with policies and procedures addressing their specialized needs and related risk mitigation steps.

“We are importing shared and layered structures that have historically been the domain of commercial lines into personal lines in an effort to build sufficient coverage for their home and all of the things associated with it,” Frattarola says.

Risk Sharing and Self-Insurance

The onus for risk mitigation for assets and property is being placed on clients via measures such as increased deductibles or improved property defenses against extreme weather events, the Hub report says.

“In high-risk markets, policies are being priced at levels that incentivize families to accept high deductibles and/or self-insure in whole or part,” the brokerage says. “In Florida, for example, an estimated 13% of homeowners fully self-insure their properties—about double the national average. Insurers are adding exclusions for catastrophic events like floods, wildfires and named storms, while eliminating coverage for cosmetic damage from weather events.”

There have been increasing discussions over the past half-decade over “alternative risk,” deRosa says. A client might get more selective about insurance coverage, maybe having to exclude winds from coverage and self-insure for floods as rates in that space increase, he suggests.

Much of this is driven by geography, deRosa says. “In Florida, where you have a lot of business being moved into the excess and surplus lines market, you’re less likely to get a true package policy unless one of the high-net-worth carriers feels comfortable with all of it. Years ago, you would have had the ability in most cases to pack everything together, whereas now, because of underwriting appetites, we find ourselves more likely to split accounts. You don’t want to have the insurance carriers fighting over the claims with different contract language, right? Or sending the client to different insurers’ claims adjustors. Our primary goal would certainly be to package as much business as we can. In our space, we can do a pretty good job at that, depending on geography. But it’s becoming more difficult over time.”

The non-admitted market has greater flexibility to address risk more creatively, deRosa says. “In California, if you were to write a piece of business in the admitted space, the ability to put on a wildfire deductible would not exist,” deRosa says. “Whereas if you went to the excess and surplus lines world, you could have exactly the same policy language, but the carrier will be able to add on a wildfire deductible, thus changing their overall portfolio’s level of risk. We have seen a shift into the E&S market and the flexibility of the underwriters with the carriers to underwrite the risk on a more granular basis by adding deductibles, such as wildfire deductibles or water damage deductibles.”

When it comes to self-insurance, which is essentially forgoing a policy and just saving up for potential damage, it is important for HNW individuals and families to understand all the implications, according to the Hub report. “For example, the real value of a home insurance policy is typically about 200% of a home’s insurable value—covering not only the replacement costs of the main house, but other structures such as detached garages and pool houses, outside amenities like swimming pools and spas, contents and debris removal,” the Hub report notes, saying further, “Added benefits of procuring a traditional insurance policy include risk management assessments to mitigate property risks, as well as help managing the incident, such as lining up residential restoration services and debris removal firms. Self-insured homeowners will need a plan for securing such services independently when vendors are stretched thin in the wake of a major event—and be prepared to pay the full cost of the cleanup, repair and rebuild.”

Of course, self-insurance might not be an option for some assets, such as homes that are not owned outright and are required to have insurance by mortgage holders.

Houldin highlights a growing trend in Florida where clients exclude wind from their policies due to the high premiums. “They’re questioning whether they want to spend $3 million to rebuild the house,” he says. “If I’m not insured, I can take a tax write-off for the loss. With a net worth of $30 million, they can afford the $3 million. It’s a calculated risk, given the robustness of their home infrastructure.” This calculated approach extends to other valuables, such as jewelry, where clients choose self-insurance. “They invest in professionally installed safes, employ security measures, and have fireproof storage,” Houldin says. “With significant jewelry holdings, the cost of insurance might be high, leading them to say, ‘I feel confident in my risk mitigation, and I’m willing to take my chances.’”