Making More Out of Less

A couple years ago, AIG was trying to figure out what to do with its high-net-worth homeowners line, which was seeing more and increasingly expensive catastrophe claims while struggling to gain approval for rate increases—factors that resulted in losses and volatility for the insurer in a number of states.

As a partial solution, the company began exiting the admitted personal property homeowners market in California and a few other states.

The market for “asset-light” insurers, which serve policyholders but hold little capital at risk, is growing rapidly.

Asset-light businesses have moved into risky markets such as California and Florida, where weather-related damages have led traditional insurers to limit their exposure or exit the market entirely.

These models face existing and developing challenges, including MGAs’ reliance on capacity and the likelihood of increased regulatory oversight.

The carrier landed on a more complete fix in early 2023, striking a deal with private equity firm Stone Point Capital to form a new managing general agent (MGA) called Private Client Select Insurance Services, which became the home for AIG’s Private Client Group business. The new arrangement means the business is backed by capital from another firm, not AIG’s balance sheet, but still benefits from AIG’s risk-management skills and product knowledge. It also helped to significantly decrease volatility on AIG’s balance sheet.

In establishing the MGA, AIG joined an industry trend of using a fast-growing business model to serve policyholders that requires little capital on the firm’s balance sheet—a style characterized as “asset-light.”

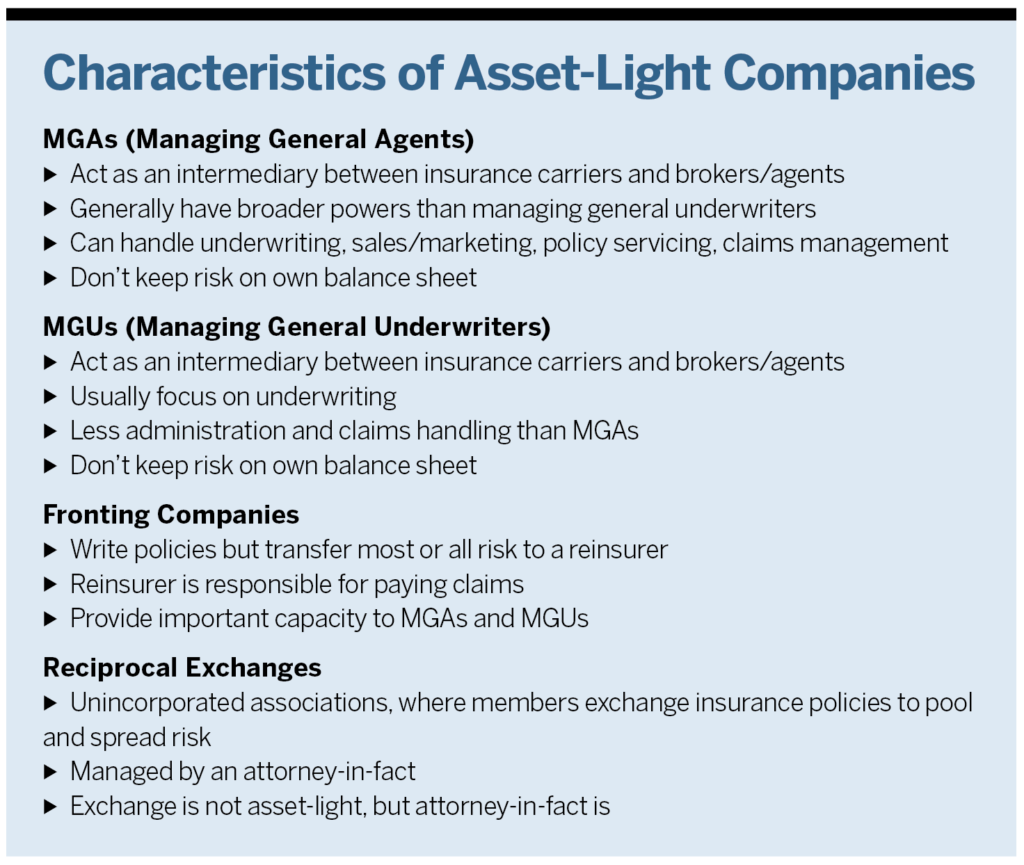

Asset-light models, including MGAs, managing general underwriters (MGUs), and fronting companies, have become increasingly popular and visible across the industry in recent years. There are well over 1,000 estimated to be in operation worldwide.

MGAs and MGUs can write and bind policies on behalf of an insurer without retaining the risk. They often have expertise in specialized or non-standard lines of insurance or specialize in niche customer segments. They’re known for having an entrepreneurial mindset, for developing their own products, and for more adroitly employing technology than traditional insurers.

Experts say conditions are right for them to flourish further, innovating and expanding coverage in numerous markets while attracting private equity dollars and helping the industry retain forward-thinking professionals. Investment management firm Conning estimated late last year that the global MGA premium exceeded $110 billion in 2022 and continues to grow at a rapid pace.

MGAs have a significant presence in several international markets as well, including in the United Kingdom. The Managing General Agents Association trade group represents more than 200 U.K.-based MGAs that write over £6 billion (US$7.6 billion) in premium each year.

“The growth in MGA business has been very strong and will continue to be so,” says Jerry Sullivan, chairman of Los Angeles-based MGA GJS Reinsurance. “As traditional carriers withdraw from many standard lines of business, MGAs with access to other carriers will get the business.”

“We simply focus on lines of business where traditional insurers are either tightening up or are totally withdrawing,” he says.

That includes the California homeowners insurance market, where wildfire damages have surged in recent years. Risk assessment firm Verisk estimates that 1.7 million properties in California are at high to extreme risk for wildfire—over half of the U.S. total. The largest aggregate wildfire loss in the state was $14 billion in 2017, according to the company’s 2023 wildfire risk report for California.

Many admitted carriers now say they can’t adequately price for those elevated risks. Several insurers, led by State Farm, have said they will no longer write new homeowners or business policies in the state.

“The admitted homeowners’ market in California is currently uncongenial for both carriers and MGAs due to its inflexible pricing environment,” according to a 2023 report on MGAs and other asset-light models from broker Howden Tiger. “But in the E&S [excess and surplus] market, a number of MGAs have developed wildfire models to price wildfire risk at a far more localized level than was previously possible.” That allows insurers to set more appropriate pricing and coverages for the policies they write.

GJS works with homeowners associations (HOAs) to create self-owned pure captive insurance companies, which can write policies and access reinsurance. In this arrangement, the MGA can pair the HOA with fronting companies, reinsurers, actuarial consultants, and even experts to help assess and mitigate wildfire risk.

The United Kingdom’s nascent fronting industry today features just a handful of companies, but it’s growing quickly.

One of the newest companies, Bridgehaven, started operating just last summer. A hybrid fronting company, it holds on to 10% of the risk itself.

“We’ve seen the growth of hybrid fronting organizations [in the United States] over the last five to six years,” Bridgehaven CEO Paul Jewell says. “We looked at the U.K. market and said, ‘We think there are similar opportunities here.’” The United Kingdom’s addressable market for MGAs is estimated at $40 billion—and growing at 20% a year—versus $100 billion in the United States, he notes.

As in the United States, Jewell says, MGAs’ ongoing growth will be key to growth for fronting companies like his own. “MGAs like capacity that could be there for the long term,” he says.

Bridgehaven works with three MGAs now, but as it builds out its own staffing, that number will increase. Jewell plans to add 10 more this year.

“Our expectation is somewhere in excess of £250 million of gross written premium this year, and we have an expectation, over the next five years, to reach somewhere closer to £1 billion of gross written premium,” Jewell says. “These are aspirational rather than fixed numbers, but the opportunity window here is significant.”

And the U.K. market is becoming more crowded. Markel’s State National began operating there early this year.

“The U.K. MGA market is underserved, and we’re intent on building a leading program services division in the U.K.,” State National CEO and president Matt Freeman said in the announcement of its U.K. expansion. The company sees “a meaningful growth opportunity supporting the creation of a program services platform in the U.K. that will address strong demand associated with local MGAs and more broadly across the globe,” he said.

State National’s arrival indicates, to Jewell at least, that Bridgehaven is on to something. “There’s going to be much more interest in this model in the future,” he says.

Fronting Companies Expand MGA Capacity

Crucial to the growth of MGAs are a specific type of asset-light entity—fronting companies, which will write a policy but transfer most or all of the risk to a reinsurer. The companies, as the Howden Tiger report put it, play “a critical and expanding role in the broader ecosystem of asset-light insurance vehicles.”

Fronting companies wrote over $13 billion in premium in 2022—more than double the amount posted just two years earlier, according to Conning. “There has been a limit to the capacity that the traditional carriers have been able to provide to the MGA market,” says Steven Webersen, managing director at Conning, which co-wrote the Howden Tiger report. “Fronting companies have helped to fill that void by providing capacity with a dedicated focus on the MGAs and their clients.”

That growth has come as Lloyd’s—historically the largest single provider of capacity to MGAs in the United States—has been “moderating” its business through the MGA channel, Howden Tiger noted. In fact, in 2021, MGAs overall received more capacity from fronting companies than they did from Lloyd’s, and that trend has continued.

As fronting companies have grown their business, they’ve attracted significant investor attention. That started in 2017, when Markel acquired State National, the biggest and one of the oldest fronting companies, for more than $900 million. In mid-2022, Mitsui Sumitomo Insurance said it would pay $400 million to acquire another big fronting company, Transverse, which was founded only in 2018. The deal closed in early 2023.

Such interest from deep-pocketed investors and MGAs’ growing need for capacity have sparked the launch of other new fronting companies. Since the State National deal, more than 20 have been started, according to Howden Tiger.

It has not been entirely smooth sailing, though. “There have been some growing pains for fronting companies, with a few minor hiccups and some major hiccups,” Webersen acknowledges.

In late 2022, fronting company Trisura took an $81.5 million write-down of reinsurance recoverables due to a contract dispute.

A much larger problem involved fintech startup Vesttoo, which offered a platform to mediate between insurers, investors, and fronting companies. It emerged last summer that some of Vesttoo’s transactions were backed by fraudulent letters of credit as collateral; the company’s board eventually fired two of its founders, and Vesttoo declared bankruptcy in August 2023.

The scandal shook the fronting industry, which depends on properly vetted letters of credit for many transactions. As an example, hybrid fronting company Clear Blue, which had repeatedly used Vesttoo for reinsurance capacity and reportedly received a fake letter of credit, had to replace the Vesttoo-linked capacity and raise $25 million in capital to limit the long-term impact.

Such issues are expected to generate additional scrutiny from ratings agencies and regulators. That and other issues like the rising cost of capital will pressure the fronting company model, experts say, and could lead more of them to increase their net retentions.

There’s also concern that all this could reduce availability of fronted capacity, which could hurt MGAs’ growth—though the Howden Tiger report said it’s “likely that the fronting model will weather this challenge and continue to grow its share of total MGA business.”

Reciprocal Exchanges; Popular with Investors, Floridians

Reciprocal exchanges are another key part of the insurance ecosystem helping to solve MGAs’ capacity needs. These are unincorporated associations in which members pool and spread risk. The members, or subscribers, legally own the exchange but pay an attorney-in-fact to manage it.

The exchanges comprise about 7% of the total surplus of the property and casualty (P&C) market in the United States, according to Howden Tiger. There were 57 reciprocal exchanges in the United States as of 2020, the Howden Tiger report said. By late last year, 73 were either authorized or waiting for regulatory authorization.

A reciprocal exchange is not per se an asset-light vehicle. But the attorney-in-fact that manages the exchange has reduced capital requirements, which tends to make the attorney-in-fact a popular target with investors, both private money and publicly traded companies.

As the Howden Tiger report noted, an MGA that is backed by a reciprocal exchange that it controls “will be assured of durable capacity that cannot be withdrawn. And recent experience has shown that these entities can generate significant value for founders and other investors,” the report added.

In 2019, Tokio Marine bought Privilege Underwriters, which manages Privilege Underwriters Reciprocal Exchange (PURE) for $3.1 billion, which was about 33 times the exchange’s expected profits the following year.

And at the end of last year, private equity manager Gallatin Point Capital announced that it had paid $1.25 billion to acquire majority ownership of the attorney-in-fact for Trusted Resource Underwriters Exchange (TRUE). P&C carrier American Family Insurance created TRUE in 2020 to insure homeowners in Florida and elsewhere.

In January of this year, Kin Insurance, which runs a pair of reciprocal exchanges that operate in Florida and other markets, raised $15 million from private equity firm Activate Capital in a fundraising round that valued the insurer at more than $1 billion.

Florida has proven fertile ground for these vehicles because of the state’s desperate need for more property coverage. Greater storm claims costs, along with burdensome litigation, have resulted in higher risk levels and unbearable premiums, and many insurers have gone insolvent or pulled out of the market.

The state legislature and regulators have made changes to stabilize the market, including tort reforms, creating a program aimed at allowing insurers to get reinsurance at lower rates, and adjusting timelines for claims. But as a spokeswoman for the Florida Office of Insurance Regulation says, “The impact of these reforms will take time.” So the state has been actively encouraging new insurers to enter the market, giving MGAs and reciprocal exchanges a warm welcome.

Nearly three dozen insurance providers have formed in Florida since 2017, according to Howden Tiger, and many have been MGAs or reciprocal exchanges. As of early February 2024, 23 reciprocal exchanges operated across the state. Florida regulators in November approved the entry of Orange Insurance Exchange and of Condo Owners Reciprocal Exchange, a new exchange sponsored by HCI Group, which has other subsidiaries in Florida.

The global market for cyber insurance took in roughly $13 billion in gross direct premiums in 2022, according to the Swiss Re Institute—triple what it was five years earlier. Howden Tiger thinks the market could hit $50 billion by 2030.

Managing general agents, with their nimble and entrepreneurial mindset, are often credited with helping to develop the space. “If you look back 15 or 20 years, cyber is a really good example of a market in which MGAs have had a very significant role in developing what had been a very niche and new area,” says Rob Crossingham, a partner in the global insurance practice at Clyde & Co. “MGAs had access to the specialist knowledge and skills that were necessary to identify and understand the risk, to design a product around it, and to put in place a claims/service solution.”

Often using real-time data and security scans to both underwrite and mitigate risk for clients, tech-enabled MGAs have taken hold in the cyber market. In 2022, Leader’s Edge reported that four of the eight fastest-growing MGAs cited cyber as their main business line.

A good example is CFC, which started out in the 1990s under the name ClickForCover.com. It has since grown into one of the biggest MGAs in the world, with its own syndicate and 800 employees in offices globally in addition to its London headquarters. The company has posted annual premium growth rates of 20% to 30% in recent years and now handles a reported $1.5 billion in premium each year.

Similar growth trajectories can be seen in companies like Coalition, which was founded in 2017 as an MGA specializing in cyber insurance. It launched its own cyber captive in 2021 and early last year opened a full-stack cyber carrier called Coalition Insurance.

Cyber is attracting the attention of legacy carriers like Travelers, which last fall paid $435 million to acquire another cyber-focused MGA, Corvus.

Consistent Capacity Is Key

Securing adequate and durable capacity is a key challenge for MGAs, making relationships with reliable insurers a top priority.

Some MGAs have “struggled with not being able to maintain consistent capacity, and that is a really important issue for an MGA,” says Rob Crossingham, a partner at Clyde & Co.’s global insurance practice. “They do not want to be moving from one insurer backer one year to another one the following year. They need that long-term relationship.”

However, consistent capacity is becoming less of a concern as the industry matures, he adds. “I think we’re starting to see, over the last couple of years, a maturity in the relationship between the capacity insurer and the MGA, with longer-term relationships becoming embedded.”

With new MGAs being launched regularly, competition will increase. “That could drive down rates,” Crossingham says. “But this is an inflationary environment, with social inflation, cost inflation, claims inflation, all of that. So I think there is the potential for a squeeze on profitability.”

Nonetheless, growth across the asset-light space is widely expected to continue, due in part to increasing losses from threats such as convective storms, wildfires and cyber, the latter of which might be exacerbated by still-unknown risks coming from artificial intelligence.

All this growth, and new insurers that emerge to enjoy that growth, will be made possible by the private equity funds that back MGAs, fronting companies, and reciprocal exchanges. And that growth, along with rising valuations, will likely attract still more private equity dollars.

There are challenges. of course, regulations being a major one. Almost universally, MGA officials expect legal and regulatory scrutiny to increase, Clyde & Co. said in a 2023 report on the MGA market. Some observers say this increased attention could tap the brakes on MGA startups and expansion, though the report noted that increased attention has “not dampened the overall mood of the sector.”

Clyde & Co. noted that, while added regulatory attention will increase costs and compliance burdens, “most practitioners acknowledged that increased oversight was improving standards and behaviors and consumer trust in the sector.”

Other challenges are more basic. One of them: “getting access to policyholders that are having issues with obtaining coverage,” according to Sullivan. GJS Re can overcome that obstacle, he says, simply by “making sure that the more traditional brokers or homeowner associations learn of our capabilities.”

The market is dynamic and ever-changing. Fronting companies, for instance, could need to increase retention somewhat, Howden Tiger said. “But they can still add value as relatively asset-light businesses because they are 100% committed to finding capacity solutions for the MGA/MGU market in a way that traditional carriers are not.”

The fronting company model, meanwhile, “clearly has further scope for growth,” the report said, even if fronting companies can’t grow at quite the same rapid pace they have been. The same goes for MGAs and reciprocal exchanges: they’ll be bringing new solutions to the market, and fronting companies will be there to help add that capacity.

As Sullivan put it, “As long as the markets stay difficult, the outlook for growth is excellent.”