In 1769 a group of insurance underwriters from Lloyd’s Coffee House decided they didn’t like the way underwriting was done there.

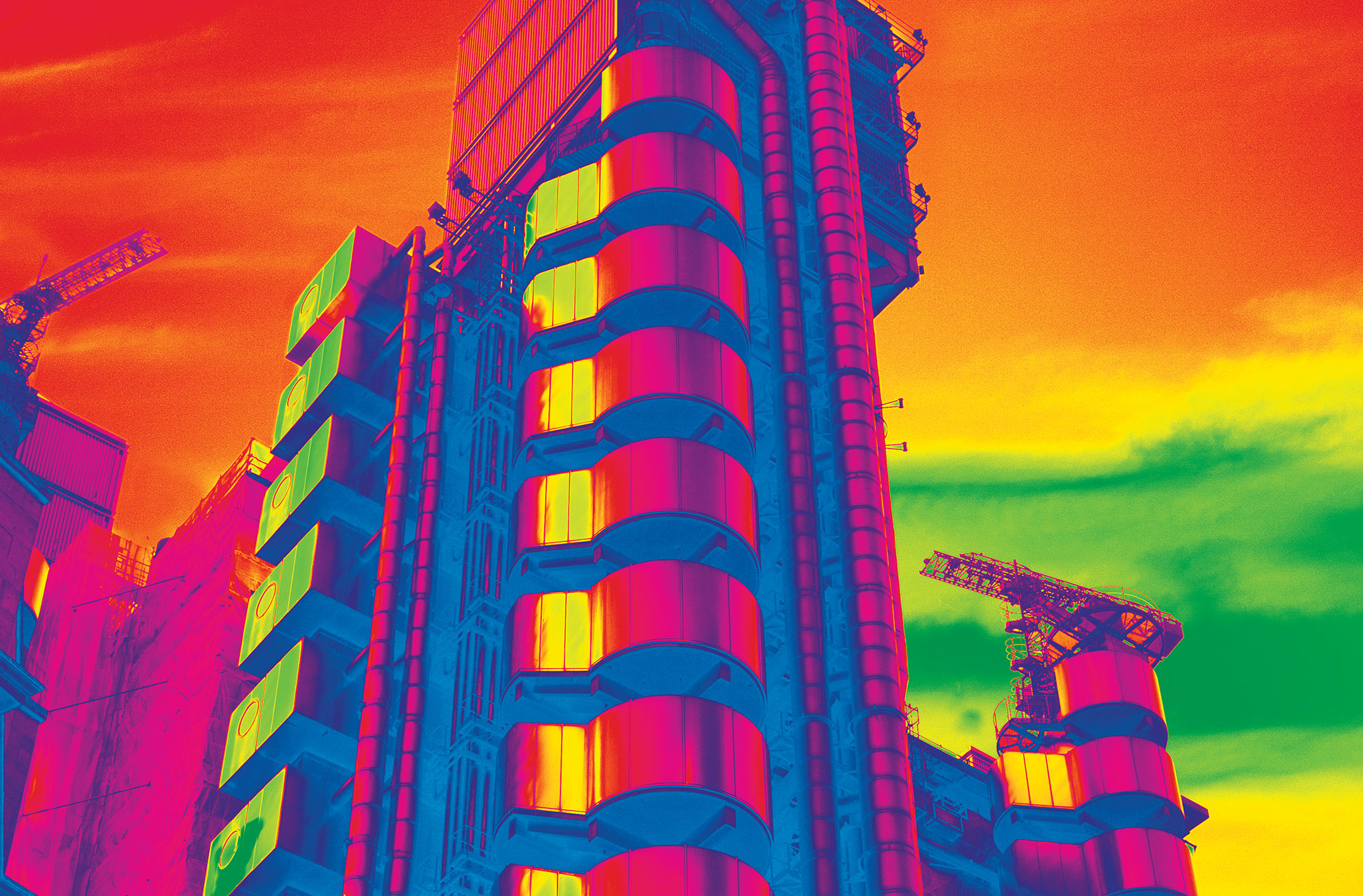

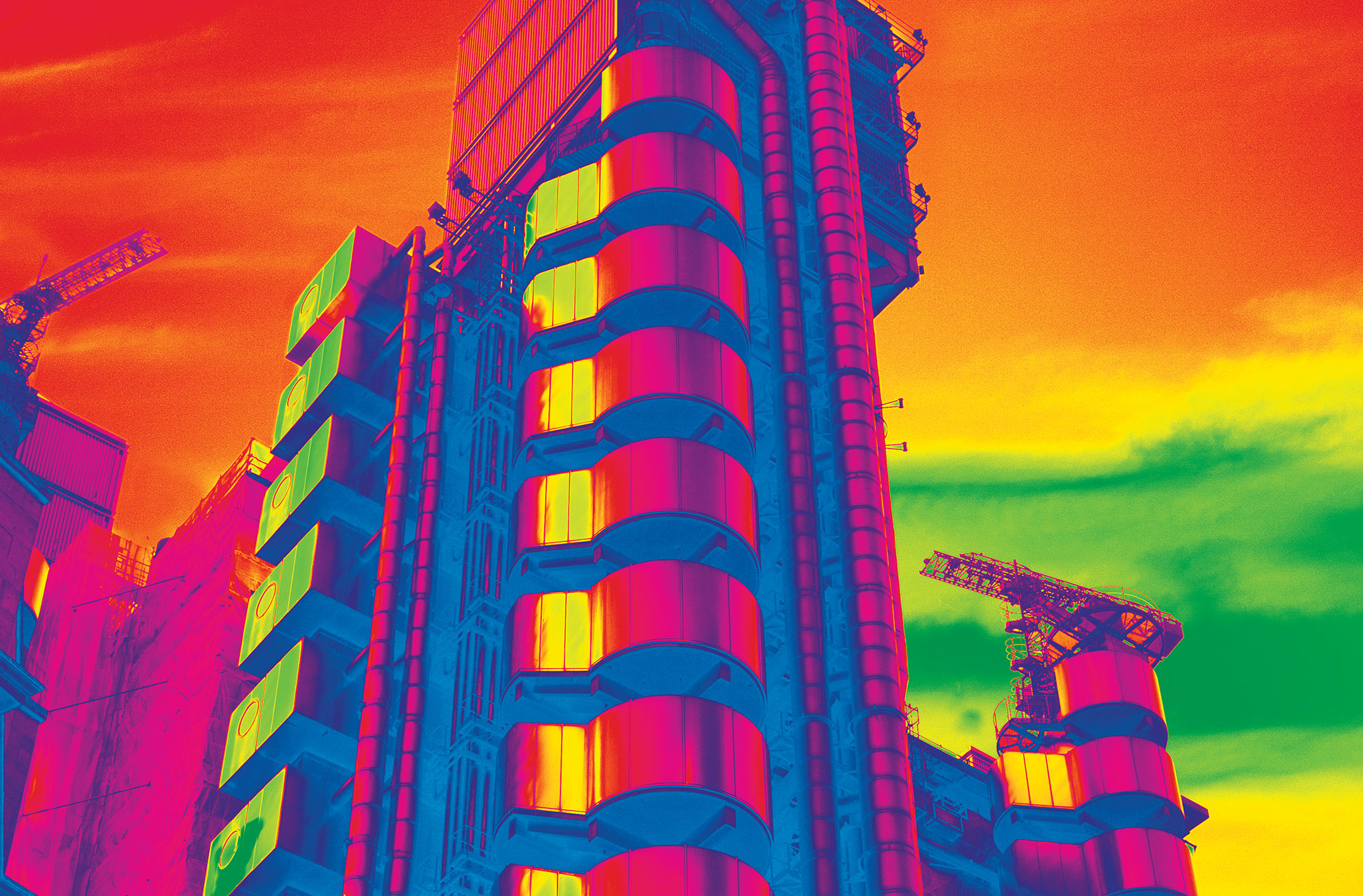

They split away to launch a new insurance market, moved to a place across the street, and called it simply New Lloyd’s. Their venture evolved into today’s Lloyd’s of London. Precisely 250 years later, under a strong, fresh leadership team, Lloyd’s is being reinvented again. Brokers’ role as the only route into Lloyd’s will be maintained—for now at least—as the rumblings of Lloyd’s reform are felt around the world of insurance.

Underwriting Performance Scrutinized

Efforts to improve the financial performance of the market began in 2018 with a dramatic central intervention into the underwriting choices of the insurers that trade at Lloyd’s. Until last year, they were left pretty much to their own devices in terms of their risk appetite. Underwriting policy was only occasionally imposed from the center onto the market’s “syndicates,” alongside a strong dose of oversight. Impacts were typically minor. But Lloyd’s profits had been deteriorating for years (albeit from high levels), as insurance prices around the world slid to unsustainable levels. Under the burden of its high cost rate, Lloyd’s combined ratio rose relentlessly, and it moved into the red.

Last year remedial actions imposed from the center of Lloyd’s effectively revoked the near-complete underwriting autonomy that syndicates had historically enjoyed. Today the “managing agents” that operate syndicates (these days owned and financed primarily by familiar international insurance companies) must submit to much greater central oversight and control of the business they write. Market chairman Bruce Carnegie Brown and John Neal, the chief executive officer Brown appointed, upshifted from the relatively minor interventions made by their predecessors. Performance management director Jon Hancock has implemented a much tougher approach to limit and control syndicates’ underwriting.

Brokers’ role as the only route into Lloyd’s will be maintained—for now, at least—as the rumblings of Lloyd’s reform are felt across the industry.

The new management team has set about modernizing the fundamental processes by which the market operates.

A dramatic reform prospectus is summarized in a document known as The Future at Lloyd’s.

In Lloyd’s December 2018 Market Oversight plan, Hancock declared, “Lloyd’s will focus on active portfolio management with closer oversight of syndicate remediation activities and detailed Key Performance Indicators. This will encompass syndicates’ progress with their Portfolio Review and Decile 10 performance improvement plans.” However, no one had expected the tough measures that had immediately preceded this statement. “Decile 10” was a deep review of the bottom-performing 10% of each syndicate’s book of business. Another measure was a change to the annual planning process. Lloyd’s scrutinized managing agencies’ business plans more closely than ever and sought major changes when it didn’t like them.

As a result, at least two syndicates threw in the towel and left Lloyd’s. Some underwriting units were prevented from expanding or were forced to reduce their capacity (the premium acceptance limit) in specific classes of business. Others were forced to exit certain lines altogether. Consistent money-losers, including marine hull, cargo, yachts, professional indemnity, international auto, power, and direct and facultative property, were closely targeted. For the first time ever, Lloyd’s announced it would intentionally shrink its top line in 2019.

The effects were almost immediate. Lloyd’s entered the year with a much-reduced appetite for these kinds of risk, and global prices rose, sometimes dramatically. American E&S carriers repatriated much U.S. property business. Meanwhile, as insurance companies around the world followed suit and began to exit or pull back in these and other lines, the upward pricing trend became a global phenomenon. Lloyd’s central effort to improve performance has been a success.

Market Reform

With the immediate challenge of underwriting profitability addressed, the new management team has set about modernizing the fundamental processes by which the market operates. A dramatic reform prospectus, based on extensive consultation, is summarized in a document known as The Future at Lloyd’s. It’s set to be implemented under a plan called Blueprint One. The old institution is embarking on a complete overhaul.

Sheila Cameron, CEO of the Lloyd’s Market Association, which represents the managing agencies, called it “the beginning of a once-in-a-generation cycle of change for Lloyd’s, which will be as profound as the Reconstruction & Renewal process of the 1990s,” a reference to the market-saving 1996 reform that allowed corporate insurers to enter and finance the market for the first time in its 300-year history. “Just as R&R saw changes to some of the fundamental ways in which Lloyd’s operates, the current cycle of change also requires root and branch review of the embedded ways we do business,” she says.

The Future at Lloyd’s, published on May 1, sets out six key propositions. First is the creation of a platform for complex risk that makes it easier and cheaper to do business and innovate at Lloyd’s. Second is the creation of a Lloyd’s “Risk Exchange” to provide a simplified, automated process for brokers to buy cover for more common risks. Third is the simplification of ways for capital to enter the Lloyd’s market, and fourth is the proposal that new underwriting entities may also enter the market more easily. Fifth and sixth are proposals to take claims performance to the next level and to create a services hub within Lloyd’s that encourages innovation, offers better solutions to the full breadth of customers’ risks, and creates an inclusive and innovative culture.

John Neal, Lloyd’s chief executive, explained some of the justification behind the proposals. “When I came into the role a year ago, I spent time in the U.S. asking friends and foes what they think of the Lloyd’s market,” Neal tells Leader’s Edge. “They said three things: sort out performance, deal with the cost of doing business, and show some leadership.” He says they “universally” agreed that they saw huge value in a Lloyd’s that was successful in commercial, corporate and specialty insurance and reinsurance. “We were in the throes of walking into a strong performance review, which we distinctly needed to execute,” Neal says. “It’s a three-year program of change, not once and done, so we are probably roughly about halfway through.”

Challenges Ahead

Market feedback on The Future at Lloyd’s has generally been extremely positive, but the challenge of implementing such far-reaching change is not underestimated and is widely acknowledged. “These are ambitious proposals, some of which may stretch the boundaries of possibility, but it is nonetheless essential that we support that ambition,” says Dominic Kirby, managing director of ArgoGlobal, which operates Argo Group’s Syndicates 1200 and 1910 at Lloyd’s. “Streamlining operations and allowing flexible capital into the market are vital for the future of the corporation and the companies that participate in the market. And expense ratios need to fall if we are to remain viable.”

Stephen Cross, head of strategy and innovation at the new transatlantic broker McGill & Partners and a 17-year veteran of Aon, is another supporter who sees challenges ahead. “In my mind,” Cross says, “The Future at Lloyd’s has conceptually hit most of the major pain points in the way the market currently operates.” But he adds: “Frankly, the concept of innovating in a market that has many vested interests in remaining as-is presents significant challenges…. The number of those who have a default position of ‘no’ or ‘can’t’ by far outweighs those that say ‘perhaps,’ ‘interesting,’ or even ‘mmmm.’”

Follow-up to The Future at Lloyd’s proposals came swiftly in the form of Blueprint One, a 146-page document that puts some flesh onto the skeleton of reform. “Blueprint One is deliberately ambitious,” Lloyd’s chairman Carnegie Brown states in its foreword. “You told us to be bold. You said this is Lloyd’s best opportunity to build a relevant and successful market for the future—and that we must seize it. You also told us to maintain a high level of ambition while making sure the plan is achievable.” He described a staged delivery, beginning immediately with a six-month “transition and planning phase” which began on Oct. 1, when Blueprint One was published. An execution plan has been promised for delivery at the end of February 2020. “I have no doubt we have the ambition, the plan, and the commitment to succeed,” Carnegie Brown concludes.

The vision described in Blueprint One is of a “customer-obsessed” market. The details are very largely a proposal for digitization of Lloyd’s so that “everyone working with the market will be able to plug into its platforms to trade simply and efficiently.” It will deliver, Blueprint One promises, “better solutions, simplified processes, reduced cost, and an inclusive and innovative culture.” All that will be supported by “underwriting performance, data, technology, modern syndication of risk,” plus the market’s “culture and people” and “a refocused Corporation of Lloyd’s.”

Complex Risk Platform A digital, end-to-end platform that complements face-to-face negotiation to submit, quote, bind, issue, endorse and renew complex risks for insurance and reinsurance business. This will evolve over time from a “document-plus-data” to a “data-first” solution.

Lloyd’s Risk Exchange A Lloyd’s digital exchange that connects to existing systems or provides a new user interface and enables instant search, quote, bind and issue for less complex risks, improving the speed of placement and customer experience.

Claims solution A digital solution that triages and routes claims, automates decision making for the simplest claims, and assists complex claim handling, underpinned by a new claims orchestration platform, therefore delivering an improved customer experience.

Capital solution A new end-to-end journey for investing at Lloyd’s with simpler, nimbler rules and processes and new structured investment opportunities, supported by a new capital platform, improving the experience of existing members and attracting new alternative capital providers.

Syndicate in a Box A new way to bring innovative new syndicates into the Lloyd’s market and give them the best chance of success.

Services hub The services hub is at the center of Lloyd’s future value proposition, building on existing capabilities and providing new, innovative services that offer value to market participants and customers and competitive advantage for Lloyd’s.

Data A single source of structured, standardized data that captures risk information and acts as the basis of a modern, digital and efficient marketplace, universally available to those with the necessary permissions.

Technology The Future at Lloyd’s technology will enable the creation of a modern, digital, easy-to-access marketplace, improving market and customer experience, driving innovation and ensuring the seamless flow of information across the end-to-end value chain.

Modernizing the way risk is syndicated Modern, efficient and digitally empowered ways of working will enable risks to be syndicated by leaders operating to accredited world-class standards, with followers who trust them.

Culture and people Lloyd’s will be a marketplace of high-performing people with a diverse range of skills and experiences, working with pride in an inclusive and trusting environment.

Source: The Future at Lloyd’s Blueprint One

Brokers Remain Key

Brokers are central to this vision, Neal says. “100% of Lloyd’s business is brokered, 78% is wholesaled,” he says. “I don’t see either of those changing at all.” To use Lloyd’s, brokers must be accredited. “So the fear that every retail broker in the U.S. is going to arrive at Lloyd’s can’t happen—they are not allowed. I don’t see the structure changing.” For the more complex placements, Lloyd’s will provide a modern technological infrastructure that allows accredited brokers and carriers to connect using each party’s own systems, with “pure API connectivity,” Neal says.

By the end of 2020, according to Neal, brokers will be able to enter risk data directly into their own systems for seamless transfer into a Lloyd’s repository and distribution to the market’s insurers, as well as to the Lloyd’s messaging and policy issuance systems. Neal says Lloyd’s is “open-minded” about who will pay for broker connectivity but has pledged to provide support, “whether that help is technological, financial or resource.” Such decisions will be made once the solution and its implications have been determined to create the “baseline.”

McGill’s Cross says the connectivity approach “intuitively” makes sense. “The system design needs to be compatible with other risk repositories and developed in a way that the ingestion of the data is flexible.” Put another way, he tells Leader’s Edge, “the system needs to be able to vacuum the data from multiple sources rather than expect to be the end receiver of a package of data that fits their system. Done correctly, this could be on the money and is a very encouraging development.”

Digital Risk Exchange

For commoditized business underwritten through coverholding managing general agents, Lloyd’s Digital Risk Exchange will provide what Neal describes as “digital lifecycle management,” which will include functions such as compliance checks, auditing and processing. “Where there is frictional cost in that business, you can just take it out,” Neal says. “If the underwriter is saying, ‘I trust the broker with my capital to do that business,’ then the cost structure should be the same [as for risks written directly by syndicates]. The underwriter should have adjusted their costs down because they are doing less work, for which they compensate the broker.”

Neither of those cost adjustments have happened, Neal observes. “The broker is getting compensated for inefficiency in the system, and the underwriter is still thinking, ‘I need to manage that inefficiency.’ We can just strip that out.”

Neal concedes that means brokers will have to change, too. “If there are wholesale brokers who are charging for the inefficiencies of the Lloyd’s market saying, ‘We’ll have to go there for you, and we’ll have to charge you for it, or we will process bordereaux for you,’ we are going to take that out.”

Cross describes the Lloyd’s Risk Exchange as “genius” and “a great investment in the future.” He explains that, if the Risk Exchange is able to attract a larger spread of relatively generic risks to Lloyd’s and drive a dynamic pricing process within the system, premium volume will grow, and unnecessary costs will be driven out. “It is imperative that proper controls and oversight are in place on the algorithms,” he warns, “as getting these wrong can also lead to a systemic risk in the system.”

Argo’s Kirby sees challenges. “The market has struggled to create sufficiently sophisticated analytical tools and data in the past for binders and bulking facilities because of the vast array of data quality and transfer mechanisms,” he says. “But if we can provide underwriters with the granularity they need through very effective digitization, we can create an exchange for the bulk of homogenous risk. … I see this as an opportunity for Lloyd’s to become a one-stop, easy-to-access market for simple risks.”

Ultimately, access to the Risk Exchange could be made even wider. “Way down the line, maybe a customer could look into a Lloyd’s portal and see what options might be there for them,” Neal says, “but certainly in the meantime it is a broker tool rather than a customer tool.”

Leaders and Followers

Already the market has approved capacity increases for leading syndicates for 2020, in part to take advantage of rising market prices, but Lloyd’s leadership expects the proposals will lead to even greater growth overall. That could require new capital investments in new syndicates—a process to be simplified under the current plans—as could maturing proposals to reform the model for “following” underwriting. Currently, “leading” underwriters work with brokers to set the pricing, terms and conditions for large risks and to manage claims. “Followers” accept those decisions and take a share of the risk to bring coverage up to the desired total but through an active underwriting process. The system is effective but far from efficient since it requires much duplication of effort. Some believe a passive approach to following could both be effective and efficient.

“Expert underwriters leading complex risk facilities with follow capacity provided on pre-agreed terms could increase both efficiency and capital flexibility,” says Argo’s Kirby, but he notes several caveats: “Lead-follow facilities would have to be organized in a way that made them impervious to abuse. There are plenty of examples of these arrangements going wrong in the past. Long-standing clients, used to a broader panel of established markets on their large and complex risks, might also feel uncomfortable about narrowing the number of close partners.”

Such passive following already occurs with underwriting through broker facilities and consortium underwriting. In 2018 one Lloyd’s managing agency, Beazley, established a special syndicate just for the purpose of following. Syndicate 5623 accepts only business underwritten through broker facilities—and, therefore, targets increased efficiency—as well as slightly lower returns. Several similar passive syndicates are thought to have been in the planning stages, but Lloyd’s 2018 performance review held up their launch. They could soon become much more common.

The Future at Lloyd’s includes plans for the creation of a streamlined syndicate admission process, dubbed “Syndicate in a Box.” Crucially, these new syndicates will not require a physical presence in the market. This bit of the reform is the most advanced of the entire process. Lloyd’s surprised everyone during its launch of Blueprint One by announcing that Munich Re, which already has a large presence in the Lloyd’s marine market through its Syndicate 457, is to be the first organization to launch a syndicate under the new rules. Munich Re said the business will focus on “the design, launch and incubation of innovative insurance products within Lloyd’s,” including weather risks with parametric triggers. A giant player with an established Lloyd’s presence was an unexpected choice for the first Syndicate in a Box, which was presumed to offer an entry route for newcomers and fresh investment, but it is seen as a vote of confidence in the system.

“Asta sees the attraction of new capital as a key initiative that will increase both competition and product innovation, whilst delivering greater value to customers by enhancing existing coverage and protecting against new and emerging risks,” says Keith Nevett, head of business development at Asta, which manages third-party syndicates and MGAs. However, he argues, “True transformation will happen only through automation that improves customer service, accelerates processing and reduces operating costs. The Syndicate in a Box initiative is another key part of the proposals designed to address these issues.” It could be valuable, he says, “for MGAs who see Lloyd’s as the ideal platform to enable faster growth through diversification, wider distribution, and reduced reliance on third-party capital.”

Execution Challenges

In the end, the success of The Future at Lloyd’s will come down to delivery. “I am very confident that we will execute, and I am not stressed by the technology,” Neal says. But he cautions, “Change management will be the issue.” Teams from the world’s giant consulting firms are currently investigating ways forward in advance of the promised delivery of detailed execution plans in late February, and Neal appears confident. “You put transformation programs out, then you execute. That’s just the way grown-up businesses behave.”

But given Lloyd’s poor track record for delivery of major technology solutions over the past 20 years, few are as confident as its chief. “Blueprint One targets the areas that managing agents agree need strategic attention,” says Paul Davenport, finance and risk director at the Lloyd’s Market Association, “but it is essential that Lloyd’s does not repeat the experience of multiple earlier projects, when benefits did not materialize.”

It will be necessary to keep market participants fully engaged throughout design and implementation. “Leaving too much of the detail to consultants with no investment in the outcomes is unlikely to create solutions with any greater suitability or longevity than previous modernization projects,” Davenport says. He calls for the creation of a cooperative body to manage the change. “Both Lloyd’s and the LMA’s members [the managing agents] must rise to the challenge of developing an in-market, world-class change management capability, comprising empowered experts with market experience who instinctively seek market input and relentlessly pursue market-optimal solutions.”

Davenport says managing agents are “willing to contribute the resources and skills necessary” to make the reform program a success.

After 250 years, Lloyd’s has again set out to reinvent itself. Back then, charismatic leaders like John Julius Angerstein were critical to convince the entire market to abandon old practices and opt for renewal. In time, they succeeded. Carnegie Brown, Neal, and Hancock—today’s new leaders of Lloyd’s—face an even greater challenge, but they are very much determined to get it right this time. Much of the market seems ready to help ensure their efforts are a success.

Lloyd’s CEO dismisses complaints about the corporation’s move to shed its worst-performing business, most of which was U.S. E&S risk.

The volume of U.S. excess and surplus lines risks placed into Lloyd’s of London was reduced dramatically in 2019 after the market took hard-line central action to cut back on unprofitable business. But John Neal, the market’s chief executive, says curbing unprofitable underwriting was essential. “Like everything in life, sometimes you take half a step back to take two steps forward,” Neal says. “Lloyd’s is the biggest E&S lines underwriter by some way in the U.S.”

In the underwriting syndicates’ 2019 business plans that Lloyd’s signed off on 12 months ago, Neal adds, “We said there was roughly $5 billion of business that shouldn’t be in there, and we want that taken out. But at the same time, there was roughly $8 billion of new business that could be written.”

In real terms, he says, like-for-like business adjusted for foreign exchange is down 6%. When further adjusted for changes in pricing, “the underlying business is about 2.5% less.”

Neal was making reference to the so-called “Decile 10” review, which saw the market’s central regulating authority, the Corporation of Lloyd’s, require the businesses that manage the underwriting syndicates to shed the worst-performing tenth of their portfolios. It placed particular focus on seven lines of business: marine hull, cargo, yachts, professional indemnity, international auto, power, and direct and facultative property. Much of the business Lloyd’s wrote in these classes comprised U.S. E&S risks.

Since last summer’s bruising round of syndicate business plan approvals, Neal says, Lloyd’s has “signed off about a billion of incremental plans” for the balance of this year. “So, in reality, 2019 will be similar to 2018 in terms of size.”

Neal says Lloyd’s is “agnostic” about the market’s top line in 2020, as long as adequate pricing is restored. “We want to see that a plan meets our expectations in terms of performance,” he says. The corporation has already approved some very large 2020 capacity increases for blue-chip syndicates that wish to increase their premium income as rates rise.

The simple facts are that some risk carriers—insurers in Lloyd’s and elsewhere—had been accepting risks they were unqualified to accept. Many have now pulled back, reducing the number of competitors, and the field is now clear for more experienced underwriters to charge rates more commensurate with the risks they assume. Speaking at S&P’s recent insurance conference in New York, Brian Duperreault, CEO of AIG’s General Insurance unit, reportedly said: “Between us and Lloyd’s, we’ve moved the market.”

The withdrawals by Lloyd’s and others from unprofitable risk classes have been a boon for domestic and international writers of E&S risks and for the Lloyd’s businesses that continue to write them. One underwriter says the trickle of proposals typically received has become a flood. His team is struggling to keep up, and he has had to hire new underwriting assistants.

The corrective action taken by Lloyd’s does not indicate a retreat from specific classes or geographies, only from unprofitable business, according to Neal. Referring to complaints about the planning process and commentary on the market’s shrunken top line, he says, “A lot of it is noise, and where the noise is loudest is where we shouldn’t be writing anyways.” Lloyd’s does not intend to withdraw from any lines of business, Neal insists, but will “respect people’s capabilities” by preventing syndicates from perpetuating unprofitable activities. “Some obvious lines of business are trickier to do well,” he says, “and if it is not really your skill set, you shouldn’t be doing it.”