Connecting the Dots

Vikram Mansharamani is an author, business advisor, global trend watcher, and lecturer at Harvard University. He is the author of Think for Yourself: Restoring Common Sense in an Age of Experts and Artificial Intelligence (Harvard Business Review Press, 2020) and Boombustology: Spotting Financial Bubbles Before They Burst (Wiley, 2011).

Mansharamani is an advisor to Fortune 500 companies navigating business uncertainty and is a frequent commentator on issues driving disruption in the global business environment. Mansharamani hosted a panel of industry heavyweights during The Council’s virtual Insurance Leadership Forum in October 2020. Here, in an interview with Leader’s Edge, he follows up on his predictions from that conversation and dives further into some of his insights on topics including the crosscurrents of the world economy, U.S. politics, technology, cyber risks and healthcare. The interview has been edited for length and clarity.

Mansharamani talks five-year forecast on the global economy, U.S. politics, technology, cyber, and healthcare. Listen here.

I think you hit the nail on the head. What I was talking about were these four—what I think are real mega trends—that are affecting virtually everything in the world. And the bottom-line summary of those four trends is, in fact, that the world has too much supply and not enough demand. The first trend I talked about was a transition that was under way in China, that China had led the economy as an investment-led story and was moving toward a consumption-led story. The result was China was revealing to the world a lot of excess capacity in things like lead, steel, copper, zinc, construction workers, etc. So that was number one—an excess supply that was being unveiled. And, frankly, China’s trying to use that extra supply and extra capacity in programs and projects like the Belt and Road Initiative.

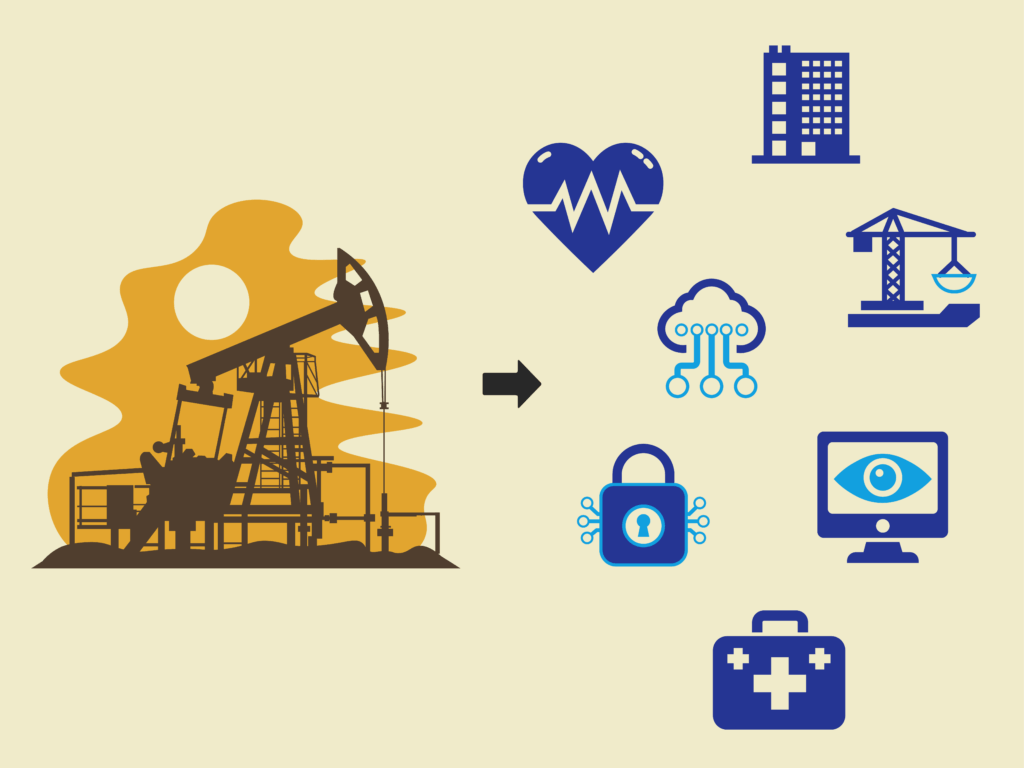

The second development was something we all are highly aware of, that technology is enabling us to do more with the same or fewer inputs. The result is more supply, all else equal. The third dynamic I talked about was what was happening in the energy industry. And I’m not just talking about alternative energy and the advancements in solar, wind and other alternative energies. I was also talking about what was happening with fracking and shale and the emergence of new hydrocarbon available sources. The net there is energy supplies were dramatically being expanded. Again, summary: more supply.

The fourth trend I talked about was the aging of the world’s largest economies. The United States is aging, Europe is aging, China is aging, Japan is aging, Russia is aging. What we find is that, when individuals move to fixed incomes, effectively enter retirement, they spend less and that is a negative-demand story.

When we put these four key trends together, what we have is more supply, more supply, more supply, and less demand, the result of which is deflationary pressure, not inflationary pressure. That creates complications for the world, many of which stem from that fundamental problem of too much supply relative to demand. Why does that create problems?

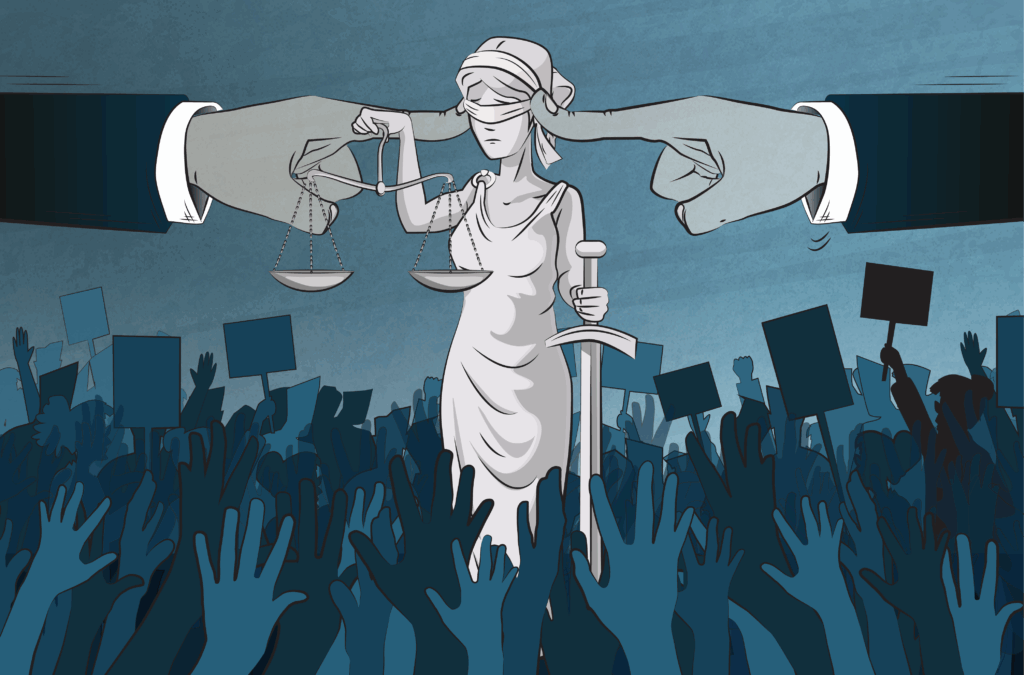

Well, fundamentally, it causes issues such as a fertile political ground that lays the groundwork for populism and nationalism to rise, because the middle class gets left behind, greater inequality comes to bear, and people want to blame someone. The political leaders that are opportunistic, perhaps—I don’t know if that’s a fair word, but they’re opportunists—they jump forward and say, “Hey, you know what, it’s not your fault, Mr. Middle Class. It’s their fault.” And who’s they? It’s another country. So globalization goes in reverse, protectionism shows up. Or they turn around and say, “You know what, it’s not your fault, Mr. or Mrs. Middle Class. It’s their fault.” And they point the arrow upwards within the country. And we call that populism, where we go after the elites in the top 1%.

My argument was these four key trends produced a deflationary pressure that resulted in a lot of political and social dynamics that led to the world we’re in today. And those trends were all in existence before COVID-19 entered the scene. My argument was COVID was really an accelerator and intensifier of some of those dynamics. Not to overly belabor the medical analogy, but we had preexisting conditions before the virus arrived. And these preexisting conditions entailed populism, protectionism, nationalism, deglobalization, deflationary pressures, etc. I think COVID just makes a lot of that stuff more intense.

One of the first things I suggest is that we all, to navigate the uncertainty that plagues our world, need to be thinking about connecting dots across disparate domains. It’s not OK to just look at the world economically. You have to look at it politically. It’s not OK to look at the world just economically and politically. You need to think about what’s happening in technology and other science and engineering fields. It’s not OK to just look at those three.

You have to pay attention to what’s happening in social or demographic dynamics. My main message here is that, to navigate uncertainty, it’s really important to focus on connecting dots, particularly since so many of us for professional success have been guided toward a focus on generating dots.

Sometimes it’s OK not to be super deep and focused on developing that unique, domain-specific insight. Sometimes taking a step back and looking at the big picture and connecting dots can actually be more useful. I think that’s the first thing. The second thing is to just embrace the uncertainty. Understand, you can’t get rid of it. When you get comfortable with that, you start doing things like thinking probabilistically.

For business managers that are running P&Ls, for example, and are trying to estimate particular dynamics, I would suggest right off the bat, if you embrace uncertainty, you no longer develop estimates of what the future is going to have. You don’t have point estimates that it’s going to be 32.6%. What you’re going to say is, “We’re going to have between 30% and 40% growth.” Or you’re going to give ranges, because ranges, by nature, present that uncertainty. Whereas a specific data point has the risk of presenting a sense of false precision. And that can delude people into thinking it was better than expected or was worse than expected. Well, the reality is in the band of what we should have reasonably expected uncertainty would have allowed to transpire.

The fundamental reality is that we’re seeing technological change happening in virtually every industry. I mean, it would almost be imprudent to suggest that it’s going to happen very dramatically in one area and not another. But given the sort of prevalence of thinking around public health and pandemics and sort of what we’ve seen transpire here recently, it’s very obvious to me that we’re at a step-function improvement in our capacity to deal with health issues, particularly public health issues.

I think that the COVID-19 tragedy has proven to be an opportunity and stimulant for innovation on a whole bunch of other levels. Whether it’s in rapid vaccine development capability, whether it’s the ability to use different vaccine development platforms to generate a know-how that can be applied to different diseases, you can see a real step-function forward in the use of technology applied to public health matters, with real, positive impact on human life. And it may be a combination of the machine learning and artificial intelligence, the ability to rapidly go through data and spot patterns and determine things. It may be the CRISPR technologies that allow us to actually decompose the genetic code of particular organisms and determine what’s causing what, where. So healthcare generally, I think, is going to be really impacted by what’s happening technologically.

The way I respond to that is it’s not either/or. Right? I mean, these are presented as binary choices—I have to be either in the data or my instinct. Why can’t we use both?

My recent book was called Think for Yourself. The message that I’m trying to deliver is pretty straightforward. We have become too extreme in our complete dismissal of experts. And when we dismiss experts, that’s not good. But we also go to the other extreme and blindly defer to experts. That’s also not good. I’m suggesting a middle ground. The phrase I use is, “Keep experts on tap, not on top,” which means, “Let’s utilize the inputs. Let’s not dismiss big data and analytics.” That’s useful. But let’s also contextualize that data because we understand that data analytics, the big information flows, they don’t have meaning. Those are just data sets, right? We need to provide context to those silos of insight…We have to see where they fit, how they fit, and decide their value.

If we think about what’s been transpiring with capitalism, it has allowed inequality to flourish. I don’t like using the positive sense of the word “flourish,” but it’s true. Inequality has blossomed under capitalism. And in fact, the two are highly correlated in the sense that capitalism provides incentives and the incentives for disproportionate gains are what support innovation and progress. It has been an enormously positive influence on the world. Capitalism has improved the lives of billions of people. However, the inequality can go too far. And not to depress readers here, but this is what Karl Marx was worried about. The communist logic was return on capital would go through the roof, return on labor would get pinched, workers of the world unite, overthrow those who put the bonds on you, etc. And eventually, actually, Marx and Engels wrote, “from each according to their ability and to each according to their needs.” So that is an attempt at getting rid of the inequality.

Now, I don’t think we’re anywhere near that risk, but in order for capitalism to continue, we have to accommodate and make sure that those who are left behind from capitalism are given some basic level of dignity and life, if you will. That is what I’m talking about.

Businesses can do that in numerous ways. The first is, you’ve seen companies such as J.P. Morgan, Amazon and others that proactively raised their wages above the minimum wage for their hourly workers. Why did they do that? Well, at some level, it makes sense. You want your workers to be able to pay for the goods you’re producing. So there’s some value and logic in that, and maybe you can say it’s just the largest companies that would feel empowered to do that, but I would suggest to you that, if everyone thought in those terms, it could be business that was leading this charge to save capitalism.

First of all, it’s all part of the same logic that I’ve been discussing. If you think about what is Brexit, Brexit was the outgrowth of a desire for people to effectively blame others for some of these trends, which is, “Hey, we’re not going to listen to Belgium. We’re going to prioritize Britain. Make Britain Great Again.” I mean, you could have had that tagline, right? That was the logic that sold it. And by the way, it wasn’t just Make Britain Great Again, it was Make America Great Again, Make the Philippines Great Again, Make India Great Again. You can go around the world. It’s not Britain-specific; these are global trends. In fact, one might even go so far as to say, what’s next for Europe? I mean, either Europe has to turn into the United States of Europe, where European countries give up some degree of sovereignty to a central authority and all live within their means, or it’s likely you see a fragmentation and maybe you see “Italexit” and other exits. Is that possible? I don’t know if 2021 brings that. But it’s something on my radar screen for a three- to five-year view that you could see countries other than Britain leave the system.

Fundamentally, you’ve had economic union without political union that’s lasting because economics and debt levels and public spending are all political dynamics. How do you combine economic dynamics but not political dynamics? They’re interconnected; this is part of what I was saying earlier, connecting the dots rather than just generating dots. And using multiple lenses rather than just one. That’s how I think about what’s happening over in Europe.

In terms of what’s happened here in the U.S., one of my predictions in my annual set of five-year-forward predictions is that we’ll actually see the emergence of a third political party. People are finding the polarization just too extreme. I think there’s a large swath of American voters that are saying, “We want a party that just puts the national interest first and tries to move forward on a reasonable basis to help us all achieve our potential.” And that really feels primed for something like a third political party to emerge and actually get traction. The interesting thing is even the emergence of it, whether or not it gets traction, it may cause more reasonable behavior on the part of the other existing parties. The very threat of a third party may bring them more toward less-polarized perspectives.

In terms of the vaccine development, I think that’s just another indicator of what’s happening with science technology progressing rapidly forward. A real success to develop a vaccine so quickly. I know there’s some questions about its efficacy at some level about mutations that are transpiring. So it may not have been the absolute perfect silver bullet, but it’s an indication of things going in the right direction, a real success of science technology and actually a partnership with government and the private sector and public sector working together to achieve something in a rapid time frame. I think that’s a big win and one we should view as positive.

I think 2021 is likely to be another year of lots of uncertainty, a handful of crosscurrents economically, politically. I think we’ll see more technology innovation. I worry about big tech being broken up as political pressure rises. I worry about cyber risks. There’s a whole bunch of things that I worry about.

I do. In fact, it’s one of the predictions I put out there this year. I’m very disturbed by what we can call the surveillance capitalist logic of U.S. big tech. It’s not just that Google is reading your emails. It’s that Google also has your Fitbit data and can connect the dots between, ‘Oh, your heart rate went up when you were reading that email. That’s interesting. We have a timestamp. So now we know what your emotional state is.’ ‘Oh, we know that you went on to your Gmail on your phone. And then you went to Twitter, and you looked at this thing, and then you went to Amazon and bought that thing.’ OK, clearly, whatever you read and went to influenced you to buy that thing. So now they can connect the dots to what may be forcing you to make decisions. Then we also have Nest. So now they know when you got home and when you left home and what your behavior is when you’re at home versus before you were at home. They can connect some dots in interesting ways there. You put all this together—big tech and big data can combine to individually customize the worldview each of us gets. And suddenly, you have to ask yourself, what is reality? This is part of the reason why I think big tech does need to be regulated. But it’s also part of the reason why I insist people use multiple sources for every data point they rely on and they try to triangulate.

Using an example that a lot of people will recognize, if you are a devoted follower of CNN, please also watch Fox News. If you’re a devoted follower of Fox News, turn on MSNBC. Every single lens, every single perspective is biased and incomplete. It’s structural. And as such, if you want to have any hope of seeing a reality out there, you need to use multiple lenses to connect dots. I really believe that. And I think surveillance capitalism enables these filter bubbles to happen, where the world you see in your feeds on your computer that you think is representative of the real world is a biased perspective that will be different than me sitting next to you on my laptop. I could be sitting next to you and the same sites will serve different information. That’s problematic.