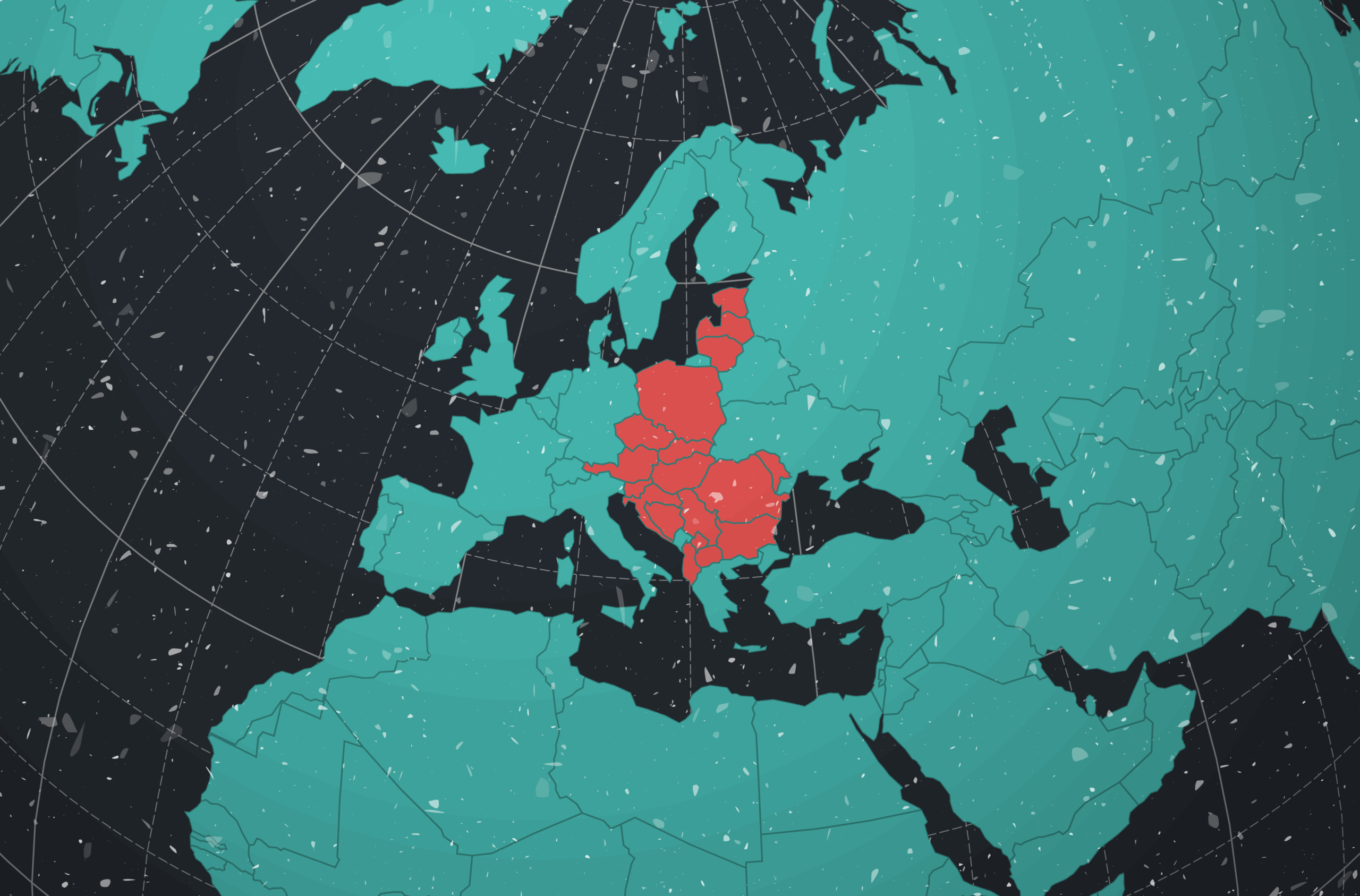

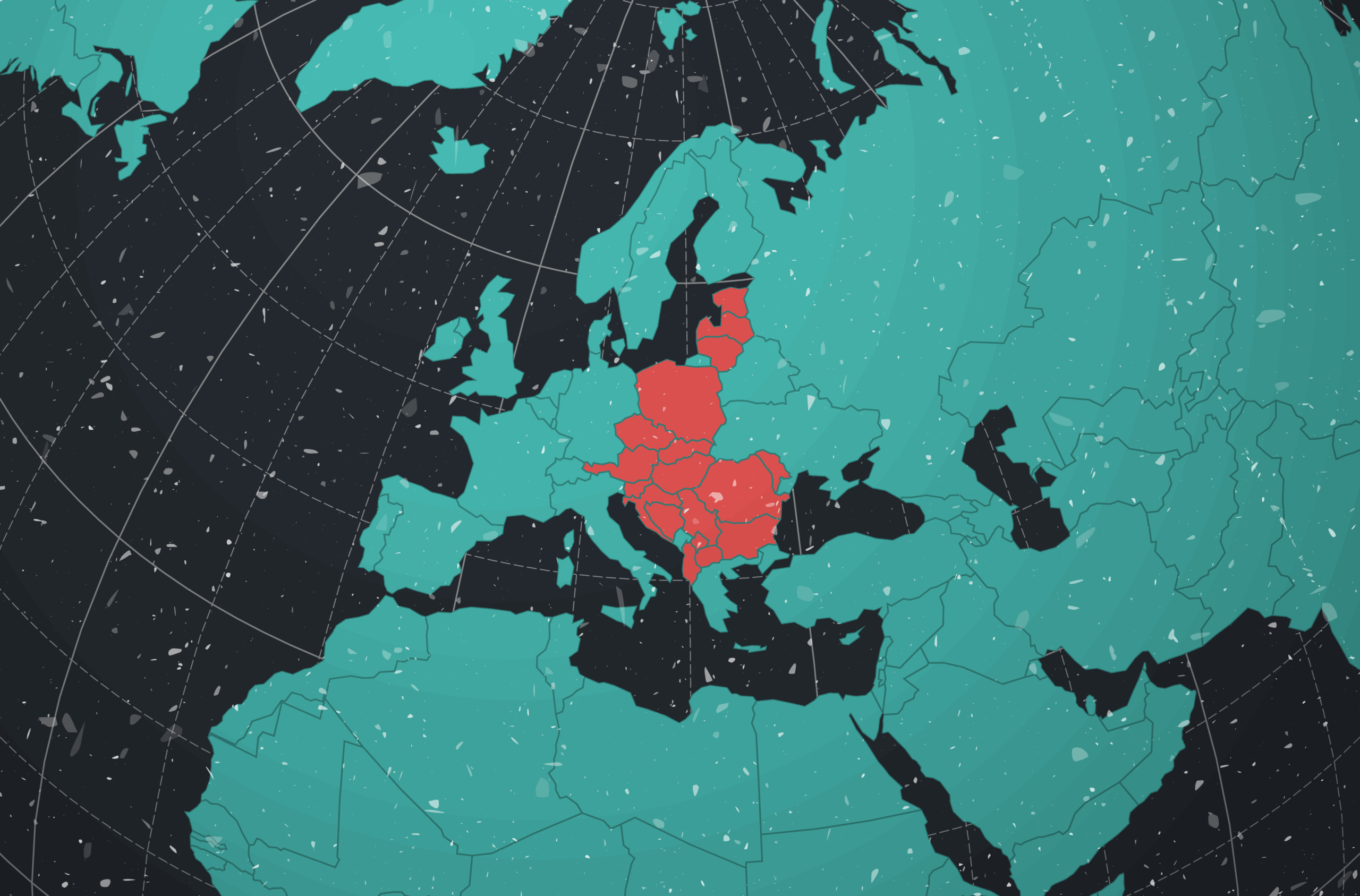

Central and Eastern Europe: Diverse Markets in a Diverse Region

While Central and Eastern Europe (CEE) can be thought of as one large region, treating it as a single entity would oversimplify the distinctiveness of each nation’s insurance and distribution markets.

For this report, we define the scope of CEE as the belt stretching from the Baltic states in the north down to the Balkans. The countries included are Poland, the Czech Republic, Austria, Slovakia, Hungary, Romania, Slovenia, Croatia, Bulgaria, Serbia, Bosnia-Herzegovina, Kosovo, Albania, Estonia, Latvia, Lithuania, North Macedonia, and Moldova. Together, they comprise roughly 160 million people.

Insurance penetration in the region remains around 2.5%, lower than in the United States or Western Europe. Combined with ongoing economic growth, this creates significant opportunities for further development. Total gross written premium (GWP) grew by 12% in 2024, exceeding 55 billion euros (up from 49.3 billion euros in 2023).

Since 2020, premiums have risen steadily by double-digits in major markets, aligning with the broader trend of inflation. Property claims spiked after severe flooding in fall 2024 from Storm Boris in Poland, the Czech Republic, and Slovakia, with estimated insured losses of 2.3 billion euros and economic losses reaching 9 billion euros.

Early signs of selective softening are appearing in 2025, particularly for financial coverage in the region. For lines such as directors and officers (D&O), professional indemnity, and cyber, premium rates have dropped by an average of 10%–15% at renewal, with carriers willing to deploy higher capacities.

There are about 250 insurance companies operating across CEE in total, along with thousands of brokerages. Each market hosts a substantial number of insurers, including strong local brands. However, regional groups dominate most markets in both life and non-life segments.

The markets are also well connected to Western Europe. For example, it’s possible to get a quote from German or Swiss insurers or reinsurers even if they have no regional presence, thanks to their proximity and knowledge of the area. Poland, the largest country in the region with a population of 36 million, has more than 60 registered insurance companies and approximately 4,400 insurance brokers. The CzechRepublic, with a population of 10 million, has around 30 insurance companies registered with the national regulator, as well as over 800 independent brokers.

Fragmentation among smaller entities leaves room for consolidation. According to a Deloitte study, there were 96 carrier M&A transactions between 2020 and 2024 in the CEE insurance market.

Consolidation has recently become more active in the broker market. One of the driving forces is generational change in companies that were often established around 1990 when the region transitioned to a market economy. Other deal drivers include complex regulation and pressure to be more efficient, both of which are becoming increasingly difficult for small players to meet.

Market Dynamics: Pricing

- Employee Benefits > EB structures differ by country but are anchored in state-regulated healthcare across much of CEE. The mixture of public and private health services, though, varies. In the Czech Republic, the public system works well even for serious treatments, and there is generally no alternative to public insurance in the form of private medical insurance. In Romania, however, you can top up private insurance coverage and receive treatment in private hospitals instead of public facilities. Employer-sponsored medical benefits and well-being add-ons are increasingly popular on top of the standard state-run systems. Wage growth and medical inflation shape renewal outcomes.

- Property & Casualty > The non-life GWP upswing of 2023 reflected the pass-through of higher repair and construction costs driven by inflation. In 2024, severe weather (notably floods) reaccelerated property losses. Expect selective rate firmness, refined flood sublimits, and tighter terms around catastrophe aggregates. Motor remains sensitive to parts and labor cost inflation and frequency of claims. The D&O and cyber markets are softening thanks to a large influx of capital from reinsurers, making them more affordable and underwriting simpler. Increasing offerings for clients and more competition between carriers are pushing down premiums.

Market Dynamics: Underwriting

- Employee Benefits > Demand for healthcare add-ons (dental, maternity, well-being) is rising alongside real wages. But even where supplementary corporate medical cover is offered, underwriting remains cautious on plan richness and high-cost providers.

- Property & Casualty > Selectivity is elevated in catastrophe-exposed property and complex liability; submissions evidencing mitigation and accurate sums insured are favored.

Multinational reinsurance sources are commonly used for underwriting more complex projects, typically through Lloyd’s of London. Compared to Western Europe, insurers often allocate high capacities to exposed sectors such as chemicals and heavy industry. A capacity range of 10%–25% is common for lead lines.

Market Dynamics: Deductibles

- Employee Benefits > Co-insurance/copays for premium providers are increasingly used to manage loss ratios when offering private add-ons.

- Property & Casualty > Historically low deductibles persist in the region; interest in higher deductibles is growing to support sustainable rate and capacity, especially in property and cyber.

Notable Offerings and Consumer Demand

- Cyber & D&O > Adoption remains below Western Europe on average but is trending upward as boards harden governance and reliance on digital systems deepens. The European Union’s Digital Operational Resilience Act (DORA) will further emphasize operational resilience, vendor oversight, and incident management.

- Property > Digital claims and straight-through processing advance in larger markets.

- Industrial Segments > Manufacturing, energy, and automotive remain strong buyers, with an emphasis on contingent business interruption coverage.

- Risks Related to the War in Ukraine > The war has heightened demand for coverage of war risks, terrorism, and sabotage, which is often required by financing banks, especially in the eastern part of the region.

Regulatory Update

The Digital Operational Resilience Act: Effective Jan. 17, 2025, the regulation standardizes ICT risk governance across EU financial entities, including insurers. Obligations include integrated ICT risk frameworks, major-incident reporting, operational resilience testing, and rigorous third-party risk management with specific contractual clauses and an information register.

Notable Differences From U.S.

- Employee Benefits > Employer-provided workers compensation is practically nonexistent in CEE and varies across the region. In general, it is substituted by a combination of general liability insurance, state-designated or state insurers providing basic compensation for suffering and medical care, and private top-ups, which are usually included as part of private accident coverage.

State-run healthcare dominates, with supplementary layers of employer-provided benefits. - Property & Casualty > The market behaves similarly, and similar products are available. From a liability perspective, CEE is cheaper than the United States, with less costly court decisions and resulting compensation. There is also greater market fragmentation.

3 Tips for Doing Business in CEE

1) Don’t treat the region, business- wise, as a single country—prepare for the linguistic, regulatory, and cultural aspects of each. Central and Eastern Europe is a relationship-driven region, where people value affiliation with the region or country. Partnering with local companies or consultants is always helpful to discover more business opportunities.

2) Be ready for a complex regulatory framework. Many countries are part of the European Union, which brings its own regulations across many areas of business. Each country may have additional requirements, so it can be difficult to fully understand the legal, labor law, nature protection, tax, and regulatory aspects of each market. It is recommended to engage a local expert to help navigate this ecosystem.

3) Central and Eastern Europe offers strong technical and digital skills, with people and companies capable of producing high-quality, advanced products (electron microscopes, defense systems, aviation, automotive, etc.). Machinery in general has a long tradition in the region, shaping the skills of the local workforce.