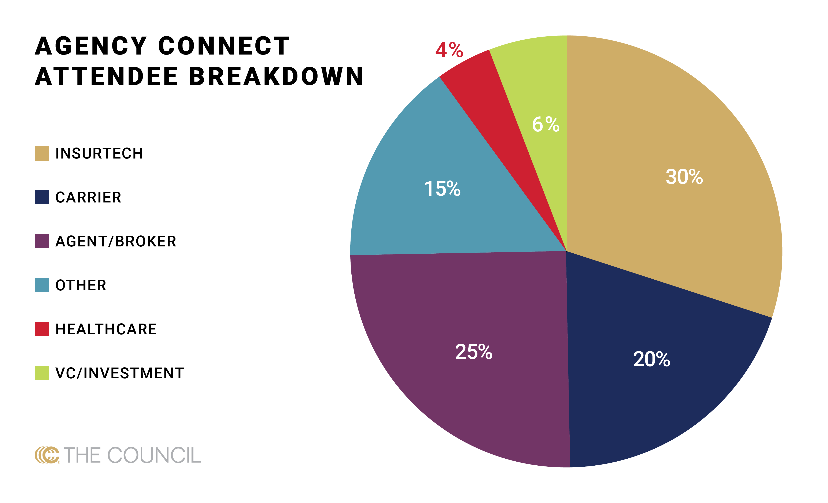

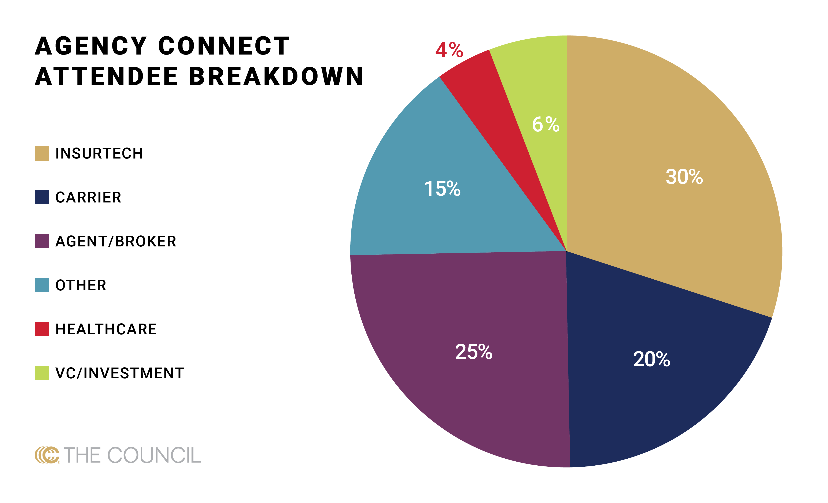

The implementation of new technologies and incentivizing a data-driven culture was also evident at the first-ever Agency Connect, a daylong event solely focused on bringing together the brokerage community and broker-focused insurtechs on the front-end of ITC.

“The grunt work has to be done in the beginning, and you need to get your hands dirty before seeing the benefits,” explained Adem Demos, CEO and co-founder of TowerIQ. “A cultural shift is important here—you’re going to have to change your process before seeing the outcome.”

The Evolution of Distribution Panel

At the first-ever Agency Connect at InsureTech Connect 2019, The Council’s Cheryl Matochik, senior vice president of strategic resources and initiatives, alongside Adam Demos, CEO and co-founder of TowerIQ, Michael Ferber, CEO of Dovetail and Richard Kerr, CEO of MarketScout, took part in a panel focused on how distribution has evolved and will evolve in the coming years. The discussion, moderated by Shannon Goggin, CEO and co-founder of Noyo Technologies, explored the forces driving change in distribution models, and how that change would impact agencies’ value propositions.

Key points:

- Be deliberate in asking/specifying what customer segment is being discussed when having “insurtech” distribution conversations. There is a lot of daylight between a one-location wine store and a multinational manufacturing company.

- To survive the ‘platformization’ of small commercial insurance, brokers need to determine where in the digital value chain they want to play and link their business strategy to a clear technology strategy. The battle for small business customers will be won by those who can best integrate with digital platforms – a different set of skills needed to win in today’s small commercial market. The importance of API usage can clearly be seen in this new paradigm. Best practices around how to plan, design, build, manage and share APIs is a great topic for brokers.

- Brokers have to digitize their culture as well as their services. Everyone is working to get closest to the customer. Brokers are going to have to fundamentally change how they operate and how they go to market.

- Brokers will win customers by turning data into bespoke information and adopting a “predict and prevent claims” operating mentality.