The Newly Eligible

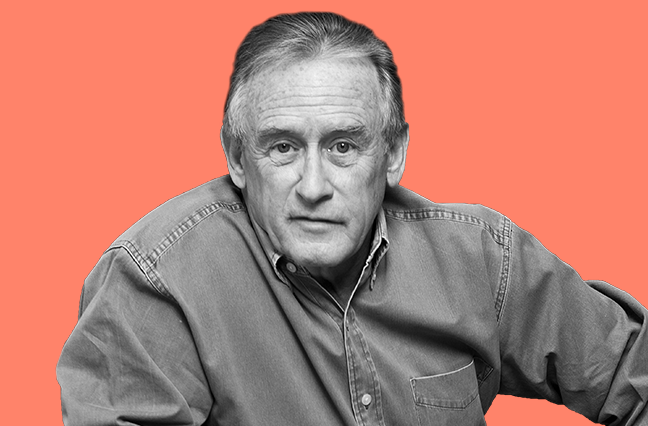

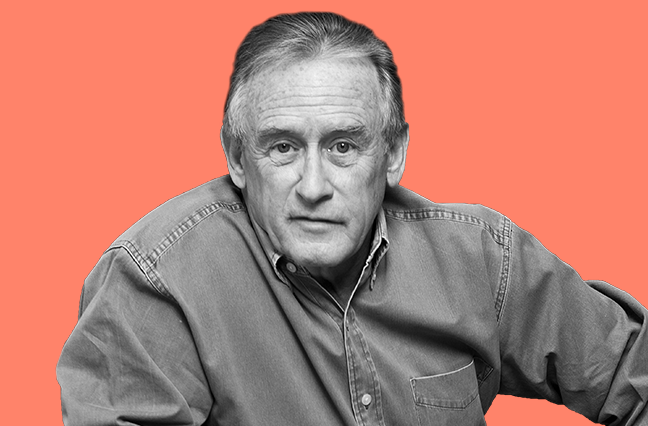

Although the heavy lifting on complying with Obamacare doesn’t begin until 2014, Steve Purkapile believes brokers should be working now to ensure their clients are prepared and understand their options and their risks.

Like many brokers across the nation, Purkapile, vice president of employee benefits at Denver-based Van Gilder Insurance, gets plenty of questions from clients about what the Affordable Care Act (ACA) will mean to them and how it will affect the benefits they provide.

He helps them understand the implications of the shared responsibility rules for employers and the hefty penalties facing companies with 50 or more employees that fail to comply. He encourages clients to prepare now, to determine how they will be affected by the rules, and to consider their options for 2014 and later.

“It could be a shocker for some employers who have folks who have not been eligible for company-provided insurance but will be eligible under the new rules,” Purkapile says. “Anybody with hourly employees needs to determine how they will manage those hours going forward. If they haven’t thought it out, they could have a whole group of newly eligible employees to whom they will need to extend benefits.”

Purkapile says he helps clients make strategic decisions about what their health insurance offerings will look like after 2014 arrives.

He acknowledged that some employers might decide it’s worth paying the annual penalty of $2,000 per employee to send workers to the new public exchanges instead of offering coverage.

“But the broker needs to help his client sort this out,” he says. “That may be a great idea from a financial perspective, but how is it going to affect recruitment and retention of your employees? Companies are still going to have to compete for talent in some industries, and that may not be an easy or wise decision.”

For some companies forced to cover a significant number of newly eligible employees, a better option might be to offer a low-cost basic plan that meets ACA’s requirements.

“Assuming the employer is willing to offer benefits and pay some percentage of the cost of those benefits while being compliant with ACA, you as the broker need to be vetting this out with your client right now so they have time to plan from a financial and administrative standpoint,” he advises.

Another option that might work for some clients, particularly those with a healthy workforce, is self-funding their medical plan.

“I think we are going to see a major push with this, and brokers had better be prepared to talk about it with their clients and provide administration services,” Purkapile says, noting that brokers with expertise in this area will have an advantage.

“If the employer wants to stay in the game, has a healthy population and doesn’t want to be subject to medical loss ratios and the factors that drive premiums up, self-funding might be a viable option for them.”

Another opportunity for both employers that self-fund and those that continue with their traditional plans is to implement a wellness initiative. Employers that provide incentives to encourage workers to be healthy may improve their risk and create opportunities for lower premiums than employers that don’t strive for wellness.

“The only way to help an employer lower his healthcare costs is to improve their risk,” he notes. “If the health of the population doesn’t improve, the cost of healthcare isn’t going down.”

As consultants, brokers are going to have to figure out how best to help clients operate in this new world, Purkapile says. “They are in business to be profitable, and with all of these challenges, we need to find ways to help them.”

Purkapile recognizes that some brokers, particularly those representing smaller firms, have grown discouraged, concerned their clients will drop their insurance plans in favor of sending employees to the exchanges for coverage.

“Our perspective is that there are tons of opportunities as we work through this as long as we get creative,” he says. “We may have to change our entire service model, including our fees and what we are doing for our clients. We are going to have to evolve. But there is plenty of opportunity over the next five years.”

Business, he predicts, will overcome the challenges that result from the increased governmental involvement in healthcare coverage.

“Business owners are typically smarter than most of those in government, and business will always evolve and look for opportunities,” Purkapile says. “So instead of getting discouraged and throwing up our hands, we need to rethink how we are offering benefits and about being true consultants going forward.”