Protection Money

How do you turn a roomful of free-enterprise insurance executives into advocates of government intervention?

Drugs.

To be precise, specialty drugs—a rapidly growing category of treatments for a range of conditions. These drugs treat everything from chronic illnesses such as cancer, HIV and multiple sclerosis to hepatitis C and rheumatoid arthritis to high cholesterol and even toenail fungus.

Although they’re used by only 1% to 2% of the population, specialty drugs now make up 37% of U.S. drug spending and are expected to reach 50% by 2018.

Spending on specialty drugs jumped 17.8% last year alone, according to Express Scripts, the nation’s largest pharmacy benefits manager. Double-digit increases have become the norm. By decade’s end, annual expenditures on specialty drugs are expected to hit $400 billion, up from $87 billion in 2012.

There’s little agreement over what constitutes a specialty drug—the method of processing, the way it’s administered, the rarity of the disease it treats, or some other definition. But the operative word seems to be “expensive,” preceded by the adjective of your choice.

A single tablet of Harvoni, a cure for hepatitis C, sells for $1,125. A month’s supply of Copaxone, used to treat multiple sclerosis, is $6,000. A course of Xtandi, which treats prostate cancer, goes for $129,000.

As members of the Council of Insurance Agents and Brokers try to help their clients manage these costs, many are concluding a long-term solution won’t arrive by way of free-market competition or insurance industry innovation.

Den Bishop, president of Holmes Murphy & Associates, says the frustration over specialty drugs was evident at a Council advisory board meeting earlier this year. “We found ourselves saying that, without federal government intervention on pricing of these drugs, we didn’t see a great answer,” he says.

Christopher Nadeau, area president of the Northeast region for Arthur J. Gallagher & Co., echoes that sentiment. “Complex issues have complex solutions,” Nadeau says. “This is going to take a lot of years and a lot of players, and unfortunately it’s going to take government intervention.”

Nadeau got a full introduction to specialty drugs a few years ago when a client, a small manufacturing company in New Jersey, began receiving medical claims for the infant child of an employee.

The child had been diagnosed with a rare epileptic disorder—West Syndrome—that would require extended treatment. Everyone assumed the obvious: claims would be higher than normal for a while. It happens.

But the assumption took an unexpected turn when a bill for $300,000 arrived for a drug no one had ever heard of—H.P. Acthar Gel.

“Within a month, it had grown to over a half-million dollars,” Nadeau says.

The baby was responding well to the treatment, but with no end in sight for a medicine costing $28,000 a dose, the company began to fear for its own survival. The Affordable Care Act, then in its early days of implementation, required unlimited lifetime coverage for employees, but stop-loss policies like the one held by the company hadn’t been revised yet to reflect unlimited care.

Nadeau and his client tried to negotiate a better price with Questcor, the maker of the drug, but the efforts went nowhere. They learned that Questcor charged New Jersey’s Medicaid program considerably less for Acthar Gel—a little over $1,000 a dose—but the employee couldn’t get that price unless he was no longer eligible for group benefits, i.e. terminated or reduced to part-time hours. That wasn’t an option.

According to Nadeau, the company contemplated eliminating its insurance plan and giving employees a raise to offset the cost of buying their own coverage. Ultimately, the client chose to sell its New Jersey division to another company that was fully insured. By then, the bill for Acthar Gel was $700,000.

Nadeau says he never learned whether a sale was part of the company’s long-term plan anyway, but the claims were clearly a factor. “You hate to see companies make a business decision based on an inability to control pharmacy spends,” he says.

Despite the ACA’s push to lower healthcare spending, Nadeau says, the episode made clear the absence of regulations preventing Questcor or other pharmaceutical companies “from charging whatever they want.”

The Ugly, Dirty Truth

Questcor’s story is illuminating. It bought rights to Acthar Gel for $100,000 in 2001 from a company that reportedly didn’t want to make factory upgrades to address Food and Drug Administration concerns about quality control. The drug, made from the pituitary glands of pigs, was developed by a division of the meatpacker Armour & Company in the 1950s and had never been a big moneymaker for it or later owners.

A dose cost about $50 at the time of the sale, and Questcor quickly raised it to $700, then increased it again and again as the company began marketing the drug for treatment of multiple sclerosis and a rare kidney disease.

Two years ago, Nadeau encountered the drug again with a second client, and by then the price had been raised to $34,000, or roughly a third of what Questcor had paid for rights to the drug. “You would think it has to be illegal, right?” Nadeau asks. “How can you increase a dose charge from $50 to $34,000 and nobody does anything about it?”

Questcor officials have said they needed to raise the price to keep the drug on the market. But the increase was difficult for employers and insurers to accept because the company had spent little on research or development for the drug and production costs were estimated to be only 1% of every dollar charged.

The company experienced pushback for its rapidly escalating prices. Tricare, Aetna, Cigna and some state Medicaid programs started to restrict access. In 2014, amid concerns among some medical professionals about the efficacy of the drug and a 20-fold jump in Medicare spending on Acthar Gel, a competitor acquired Questcor for $5.6 billion.

“That’s the kind of stuff that absolutely drives me crazy,” Nadeau says.

It’s a reaction shared by many in the brokerage community as other stories emerge about companies jacking up prices of drugs without clear justification.

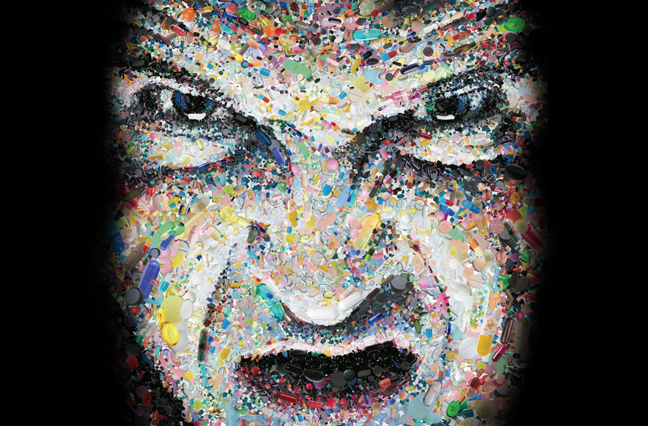

One of the most notorious cases involved “Pharma Bro” Martin Shkreli, the 33-year-old CEO of Turing Pharmaceuticals, who engineered the purchase of an antimalarial drug that’s also used to treat HIV patients. Turing immediately raised the price from $13.50 a pill to $750 a pill. “Our shareholders expect us to make as much money as possible,” Shkreli said at a health industry event in December. “That’s the ugly, dirty truth.”

Another company, Valeant Pharmaceuticals, drew similar scrutiny for raising the price of 22 drugs by more than 200% between 2014 and 2015. It also faced questions about its relationship with a mail-order pharmacy that, among other things, allegedly changed doctors’ prescription codes to substitute higher-priced drugs for generics.

While those examples are egregious, even standard drug increases are eye-opening. In January, Pfizer raised prices on more than 100 drugs, with some going up 20% (this occurred before Pfizer abandoned plans to merge with Ireland-based Allergan in a move to cut its U.S. tax bill). Double-digit price increases aren’t unusual.

Industrywide, prescription drug prices rose nearly 11% in 2014, with brand-name drugs going up 15%.

“What industry on average gets to increase its drug by 15% a year, and the Department of Justice does not take action?” asks Mitchell Andrews, a partner in the Plexus Groupe. “If a hospital raised its costs 15% a year, would the Department of Justice not take action?”

The cost of oncology drugs further illustrates the situation. The last 10 cancer drugs approved before mid-2015 had an average annual price of $190,217, according to a study by the Memorial Sloan Kettering Cancer Center. They won’t stay at that amount long; The New York Times reports the price of top-selling drugs routinely goes up by 10% or more annually, significantly higher than the rate of inflation.

Manufacturers say those prices are needed to fund the search for new drugs, but the Times found only 17% of revenue for major pharmaceutical companies actually goes to R&D. Bigger chunks go to marketing and profits.

Many brokers are questioning the profits. “Making a profit is fine, but making an unreasonable profit on the backs of employers and employees?” Andrews says. “You have to scratch your head and wonder why.”

Tough Decisions on What to Cover

Andrews and others readily acknowledge many of these drugs are changing lives for the better—in some cases, even providing cures. “It’s not like these are make-you-feel-better drugs,” Bishop says. “They are life-or-death drugs, and they work.”

Brian Ball, national vice president of health cost solutions at USI Insurance Services, says there are cost benefits for employers and insurers in many of these drugs. Claims for physician visits and hospital stays are reduced when a specialty drug cures a condition like hepatitis C or eases the severity of a disease.

But Ball and others also note that not every specialty drug fits that description—and that not every available drug should be covered.

Jublia, a drug used to treat toenail fungus, is an oft-cited example. It costs $300 a month. “Is it the obligation of an employer to cover that drug?” Ball asks. “Is it necessary?”

That question isn’t going away anytime soon. In 1990, only 10 specialty drugs were on the market. By 2015, the number jumped to 300, and today nearly 700 more are being developed.

“To what extent does our health plan need to cover every health problem that an employee has?” Andrews says. “Is it endless? Because if it’s endless, we may not be able to afford it.”

The average annual cost of a specialty drug hit $53,384 in 2013, according to the AARP Public Policy Institute. That’s more than the U.S. median household income, double the median for Medicare recipients and more than three times the median for Social Security recipients. It’s also 18 times higher than the average for brand-name prescription drugs and 189 times higher than generics, the study found.

Patients generally pay a fraction of the full cost, of course, but the rest is picked up by employers and insurers, who pass some of that cost back to patients in higher premiums and co-payments.

“It used to be microcosm of our problem with our healthcare system, and now it’s more of a key driver,” Nadeau says.

Bishop points to a line in a 2015 Express Scripts report: “Specialty trend will slow to more sustainable levels, averaging 22.1% over the next three years.” In a post for his company’s blog, he criticizes that assessment as indicative of a disconnect within the pharmaceutical industry. “I don’t think many CEOs, CFOs or heads of HR believe that annual inflation of 22.1% is either slow or sustainable,” he wrote.

“I think we’re starting to see the tip of the iceberg,” says Austin Madison, senior vice president at The Crichton Group.

For some businesses, Madison says, “It’s not just whether we’re able to cover pharmacy drugs; it’s whether we’re able to offer healthcare to our employees.” Or, as Nadeau’s client quickly learned, it’s whether the business itself can survive.

Sarah Martin, a vice president at Lockton Companies, has been involved in pharmacy consulting for six years. In the past couple of years, she’s noticed a big increase in CFOs and other top executives attending meetings on drug benefit plans. They’re worried about the trend and focused on finding the best management strategies they can.

Sometimes that means risking the appearance of being cold-hearted. “They’re looking at things, realizing that they’re going to make things more difficult for their employees, but the inflation rate is not something they’re willing to absorb,” Bishop says.

“I think employers are going to have to start making some pretty tough decisions,” Andrews adds.

The high cost of specialty drugs for hepatitis C is drawing particular attention, according to Bishop. “We have seen customers say a person has to present with complications before they’ll cover it,” he says. “That’s really harsh, and those are hard decisions for an employer to make.”

Formulary exclusions are growing more commonplace, particularly for growth hormones, cholesterol, fertility, hepatitis C and multiple sclerosis, according to a survey by the Pharmacy Benefits Management Institute.

More than a third of employers said they’re planning to set up a separate cost-sharing tier for specialty drugs. Almost half utilize step therapy, requiring patients to try less expensive drugs first.

“Some employers are very aggressive and OK with excluding some drugs from treatment,” Martin says. “Some are more paternalistic and rely on us to negotiate the very best prices available and to make sure that there are no barriers in place” to prevent employees from accessing treatment.

“Management of the costs is unique for each customer, so our job is to educate them on their options,” Andrews says. Those discussions involve the exclusion of some drugs from the formularies, with attention to the question, “What’s the impact on your culture for making that decision?”

The Near Term: Look to Your PBM … but Watch Out for Your PBM!

Pharmacy benefit managers can help zero in on costly growth. CVS Health Corp., one of the nation’s largest management companies, now monitors trends daily. Last year it dropped coverage for anti-aging and pain treatments made by a pharmacy after noticing a spike in use. The treatments hadn’t received FDA approval and were costing clients millions of dollars. Jublia, the toenail fungus drug, also was added to step therapy to curb costs.

Nearly three quarters of employers are utilizing prior authorization, according to the Pharmacy Benefits Management Institute survey. Martin says there’s some pushback from employees awaiting approval, but the frustration tends to fade once they start receiving treatment. “I think most of them understand the need for the checks and balances,” she says.

Prior authorization carries risks if the pharmacy benefits manager conducting the check is also filling the prescription. “It’s a little bit like the fox watching the henhouse,” Martin says. Madison agrees. “A lot of PBMs own their own distributors, own their own specialty pharmacies, so they can potentially benefit from the specialty drugs,” he says.

The safeguard, Martin says, is to monitor the data as close to real-time as possible and ensure treatments are working. Ball thinks the solution is to send prior authorization to third parties that don’t have a financial stake in the outcome. “It’s a budding part of our business,” he says.

To curtail waste, Martin says companies are limiting specialty drugs to 30-day supplies and eliminating automatic refill shipments because of the likelihood a patient will have to shift to another medication. There are also more follow-up conversations with patients to ensure they’re actually taking the drug and that it’s effective.

Among pharmacy benefit managers and insurance carriers, Madison says, there’s growing interest in setting up programs with pharmaceutical companies to return money for treatments that aren’t working. “The question is whether the PBM or the employer gets that money back,” he says.

Shopping around for a PBM is also important, Madison says. He recommends employers look at 10 to 12 PBMs for comparison and examine closely their existing PBM and insurance carrier contracts.

“It’s kind of like buying a car,” he says. “You think you’ve struck a great deal, but it’s very, very difficult to tell, to follow the money trail.”

Madison helps clients take more control of their pharmacy spending by analyzing their data and resisting any efforts by PBMs and insurance carriers to withhold data. “The employer owns the data,” he says, “and they should have a right see it.”

Martin’s firm, Lockton, uses predictive modeling to help clients examine specialty medications and determine how new drugs in the pipeline will affect future pharmacy spending.

The information provides data for employers to make a number of decisions, including stop-loss rates. Nearly all small employers and close to two thirds of larger employers now have stop-loss policies, according to the PBMI survey. “If your stop-loss rate is $75,000, a hepatitis C drug could meet that,” Martin says.

Co-pays and deductibles are also on the rise. “The day of the $10 co-pay is gone,” Nadeau says. “What you’re going to see more and more is that members are going to have a lot more out-of-pocket exposure on each drug they are prescribed.” Nadeau estimates most plans will have a deductible ranging from $2,000 to $5,000.

The higher upfront costs may cause patients to ponder the necessity of some of their medicines. “That may stem utilization,” he says. “It would certainly cause employees to ask more questions of their doctors.”

The increase in co-pay isn’t occurring without some pushback. More than a dozen states have enacted limits on out-of-pocket costs, ranging from $100 a month in Vermont to $3,500 a year in Maine. The interest in those and similar measures appears to be growing. “I expect very soon I’ll need to be an expert in every state’s law,” Martin says.

The Long (Not Too Long) Term: Controlling Costs

There are many factors in the rapid rise of specialty drug costs, but one well-worn trail leads directly to the Affordable Care Act.

According to Nation on the Take: How Big Money Corrupts Our Democracy and What We Can Do About It, by Wendell Potter and Nick Penniman, Pharmaceutical Research and Manufacturers of America, the powerful industry trade group, spent $26 million on lobbying efforts during the 2009 debate over healthcare reform.

“Individual companies within the pharmaceutical and health products industry spent millions more on top of that,” the authors wrote. “In fact, at $275 million, the industry’s federal lobbying expenditures in 2009 stand as the greatest amount ever spent on lobbying by one industry in a single year, according to the Center for Responsive Politics.”

The contributors got a good return on their investment, according to many brokers. The law closed the donut hole—the coverage gap in Medicare Part D—but it did nothing to address drug costs or even provide for more transparency in pricing. Former U.S. senator Kent Conrad, a Democrat from North Dakota, has said the failure to include long-debated negotiating power for Medicare in the deal is “probably my single greatest regret.”

Nadeau says the ACA achieved a lot in expanding coverage and getting more people insured but failed on a key expectation. “It didn’t do anything to control the cost of healthcare,” he says. “That’s the most frustrating thing for me. Nobody seemed to want to do that on either side.”

The pharmaceutical industry has to pay an annual fee to help fund the act—$3 billion this year. “To use the Chicago term, that would be protection money,” Bishop says, calling the fee based on market share “horribly distasteful.”

It was a tradeoff engineered by lawmakers to win support for passage of the ACA. “We’re now paying the piper for needing an ally for legislation early in the process,” Nadeau says.

There was nothing in the reform plan to prevent drug companies from trying to recoup that money elsewhere. “I would be surprised if that wasn’t carte blanche for them to raise prices,” Ball says.

Major fixes are in order, according to brokers. “It doesn’t really matter what we do with the Affordable Care Act, whether we repeal or keep it or go to single payer, unless we control costs,” Madison says.

Among the first things he’d like to see lawmakers address is the Cadillac Tax on more expensive benefits plans. “If employers are having to spend more on their plans and have to pay more taxes because they’re having to spend more, that’s a double whammy,” Madison says.

Brokers also point repeatedly to a need to address vast disparities between prices in the United States and abroad. “Our country continues to subsidize research and development for the rest of the world, and we as consumers are footing the bill,” Madison says.

A 30-day supply of Nexium costs $215 in the U.S., but $42 in England, Bishop says. Humira is $2,246 per script in United States, but $1,020 in England.

“Pharmaceutical companies charge different prices in different countries. Why? Because they can,” Bishop wrote in a blog post for his company.

In their book, Potter and Penniman write: “[W]e pay almost 40% more than Canada, the next highest spender on drugs, and twice as much as many European countries, including France and Germany. In 2013, we spent exactly 100% more per capita on pharmaceuticals than the average of the 34 countries that comprise the

Organization for Economic Cooperation and Development, of which the United States is a member.”

Some brokers would like to see the next president and Congress address importing drugs from Canada or European countries. Others are concerned about the loss of quality control if that happens. Andrews points out we import food from other countries with relatively little problem. He says simply offering that choice for medications “will bring down the cost.”

Government Takes the Lead (and That’s OK), Brokers Call for Transparency

The Obama administration is preparing to test six ways to slow growth in Medicare spending for medicine—including specialty and other prescription drugs—with hopes that some of the changes will lead to broader cost reductions for consumers. The government (Medicare in particular) has long been a testing ground for innovation and change in healthcare that eventually spreads to the private sector. So looking to the administration for guidance on this issue would not be a complete departure from history.

The proposals include testing reference pricing, which would set a standard rate for similar types of drugs. Other tests would base payments on how well the treatment works.

Another development that might have an impact on pricing is a $15 billion lawsuit filed by Anthem, one of the nation’s largest insurers, against Express Scripts. The suit alleges the PBM charged prices higher than competitors, failed to provide services in a “prudent and expert manner,” and pursued an “obscene profit.” The suit could crack open PBM negotiations with the pharmaceutical industry and provide more transparency.

The Obama administration has proposed requiring drug companies to disclose their R&D costs and other details about pricing, similar to legislation introduced but not yet passed in about a dozen states, including California. The federal proposal is not expected to win approval, but Madison says, “We’re starting to see a bigger push in price transparency.”

Ball says he’d like to see more light shed on spread pricing, the difference between the price the PBM negotiates with a pharmaceutical company and what the PBM charges the employer. The spread is charged in lieu of a standard administrative fee, and Ball and others see potential for abuse. “Sometimes you can see a $10,000 drug with a $1,000 spread,” he says.

Many brokers also want more transparency in coupons and co-pay assistance provided to patients by pharmaceutical companies. The money helps make a specialty drug more affordable to patients in terms of out-of-pocket costs—therefore increasing the number of prescriptions—but it does nothing to lower the overall price paid by insurers and employers.

“Sometimes, we think, the rebates can be 30% to 40%,” Martin says.

Martin also would like to see more scrutiny of how drugs are charged on the medical side of plans. “There are a lot of specialty drugs going through medical benefits, and there’s even less transparency there,” she says, noting that it can be “very expensive and very hard to pull out the medical codes” to track those costs.

Clean Up the Waste!

Waste is also a major concern for the insurance industry. A study by researchers at Memorial Sloan Kettering Cancer Center found that Medicaid and private insurers spend nearly $3 billion a year on cancer drugs that are thrown away because the doses are distributed in one-size-fits-all vials that contain more than most patients need.

Velcade, used for the treatment of multiple myeloma and lymphoma, is sold only in 3.5-milligram vials that contain enough medicine to treat a 6-foot-6 person weighing 250 pounds, obviously not a typical patient. The cost is $1,034 a vial. Takeda, the manufacturer, is expected to make $309 million in 2016 on the wasted portions of

Velcade. That’s 30% of overall sales in the U.S., according to researchers’ estimates. In Europe, meanwhile, smaller vial sizes are available, and waste isn’t as profitable.

The study didn’t delve into non-cancer drugs but found that Remicade, an arthritis drug, also was wasted in large quantities, with an estimated $500 million of $4.3 billion in annual sales from discarded portions of doses.

In recent months, various congressional committees have addressed the waste and other factors contributing to the rise in specialty drug costs and use.

“New medical breakthroughs can change lives, but we must make sure that they are available to those who need them,” U.S. Department of Health and Human Services secretary Sylvia Burwell told a Senate committee investigating prices. “For the sake of patients, our healthcare system, and our economy, we must simultaneously support innovation, access and affordability.”

A tall order, but there’s clearly public support for changes in the system. A Kaiser Family Foundation poll last year showed that Americans—whether Democrat or Republican—consider affordability of specialty drugs a top priority. Democratic presidential hopeful Bernie Sanders dragged the topic into the spotlight during his campaign, and his rival Hillary Clinton and the remaining GOP candidates followed suit.

Investors appear to be leery of some drug companies amid scrutiny on Capitol Hill and elsewhere. The Nasdaq Biotechnology Index has been down 30% since Clinton criticized rising drug prices on Twitter last fall.

“It’s good to see the candidates looking at the pharmacy problem, but those are headline splashers,” Nadeau says. “Are any of them really going to take on the pharmaceutical industry?”

Ball is hopeful. “If both parties are identifying pharmaceuticals as a big issue, generally that leads to a recipe to something getting done,” he says.

Bishop says he doesn’t like policy debates to be driven by the demonization of an industry, but he suspects that’s what will happen very soon to pharmaceutical companies, thanks to Pharma Bro and other tales of greed. “That industry is in for a tough go in terms of public opinion over the next six months to a year,” he says.

Bishop says he and other “like-minded free-enterprise capitalists” think the federal government will step in, perhaps through empowering Medicare to negotiate prices—a move that would likely have broader effects on the market.

That move, or something like it, would be welcome by many. “If the Acthar Gel taught me anything,” Nadeau says, “it’s that without government intervention we’re not going to solve this problem.”