Brokers Deploy New Pharmacy Strategies

No other single area in healthcare in the last decade has created more affordability issues for employer-sponsored insurance plans and patients than drug price increases, which have been frequent and wide in scope.

As we enter 2023, the Inflation Reduction Act will introduce major new reforms in Medicare to rein in pricing, constituting the biggest shake-up of drug pricing regulation in decades.

To understand the impact of transparency efforts in the complex and opaque pharmacy supply chain, we interviewed seven of the leading benefits consultants around the United States. In particular, we focused on pharmacy strategies and capabilities being brought forward by benefits brokers and consultants to help clients. Here is a summary of their collective responses.

One broker commented, “We just attack the spend in every case,” indicating that clients are sometimes apprehensive to make drastic changes to their plans. Still, once you show a client that an individual uses three different specialty medications to manage blood pressure ($2,500/year) and one change to a single generic drug can lower costs to $800/year, people begin to evaluate trade-offs logically.

One broker added, “If claims are going down, that is technically considered a win. Still, it’s difficult to measure return on investment, so we are making investments around measurement and asking ourselves how the programs we are implementing give us desired outcomes. Getting our data to work for us as opposed to us working for our data will help with this.”

On the pharmacy analytics side, many brokers “can snorkel but aren’t scuba diving yet,” as one respondent put it. Larger brokerages are bringing this function in-house to enable more control over data quality and integrate other data sets to create a fuller picture for clients. However, more than half of the brokers surveyed still do not have a separate budget explicitly earmarked for pharmacy data and analytics.

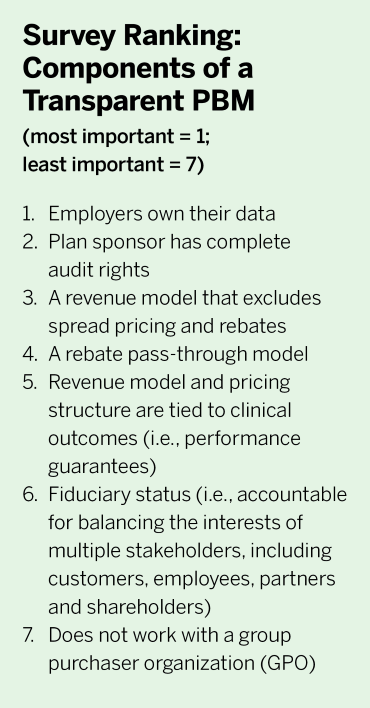

Another area cited is creating firm-wide guidelines to assist with decisions on working with new “transparent” pharmacy benefit manager (PBM) market entrants. One broker said, “On a state, regional and national basis, PBMs and other pharmacy solutions are coming out of the woodwork.”

Another broker commented, “If you aren’t in it every day, it’s easy to forget pharmacy is the most frequent and repeated health benefit with direct ties to every step in a patient’s medical care journey. Yet the pharmacy benefit is arguably the most opaque and complex, so someone might pay $5 for Atorvastatin, and her neighbor pays $350 for the same drug. The fact that prescription drugs are commodities—coupled with the widespread lack of information on costs and alternatives—makes pharmacy an ideal starting point for employers’ transparency initiatives.”

Multiple brokers speculated whether or not the new price transparency measures in the Consolidated Appropriations Act and Transparency in Coverage regulations can reconcile the information asymmetry that has plagued the pharmacy benefits space. The general consensus was not anytime soon. Price transparency on the medical side is only beginning to take shape. There are inherently more components and variables in pharmacy benefits, more data sources to integrate, and many involved parties across the spectrum of care. As another broker stated, “We need further data standardization and multiple layers of data transparency.”

2) Inflation Reduction Act: Significant drug pricing reforms to Medicare begin to take effect in 2023, and all eyes are on whether the provisions will cause cost shifting in the commercial market. The major provisions include penalizing drugmakers that raise prices above the rate of inflation, capping annual out-of-pocket costs to $2,000 and, for the first time, handing the government the power to negotiate some of the most expensive brand-name drugs covered under Medicare Part B and Part D.

3) Gene Therapies: There is a lot of concern in the benefits market over gene therapies and medications coming to market in the next two to three years. Stop-loss carriers, brokers and employers are worried about how to build programs to manage utilization and anticipated costs. For example, on Nov. 22, the Food and Drug Administration approved the first gene therapy for hemophilia B. Hemgenix will have a list price of $3.5 million per use, making it the most expensive single-use gene therapy ever. However, as a rare disease, hemophilia B afflicts only about 6,000 people in the United States, and a smaller subset would be eligible for this new treatment. CSL Behring, the manufacturer, contends that financial exposure for payers will be somewhat limited.

The specialty pharmacy market is projected to continue growing by 8% per year through 2025, according to Evernorth. Growth will be largely driven by new-to-market drugs, which are anticipated to cost $62 billion. As more new drugs come to market, customized clinical strategies that address unique population risks will be a large area of focus.