As an ocean wave glides toward the shore, the peak of the wave—the crest—gets higher. Today’s brokerage valuations are riding one of these waves.

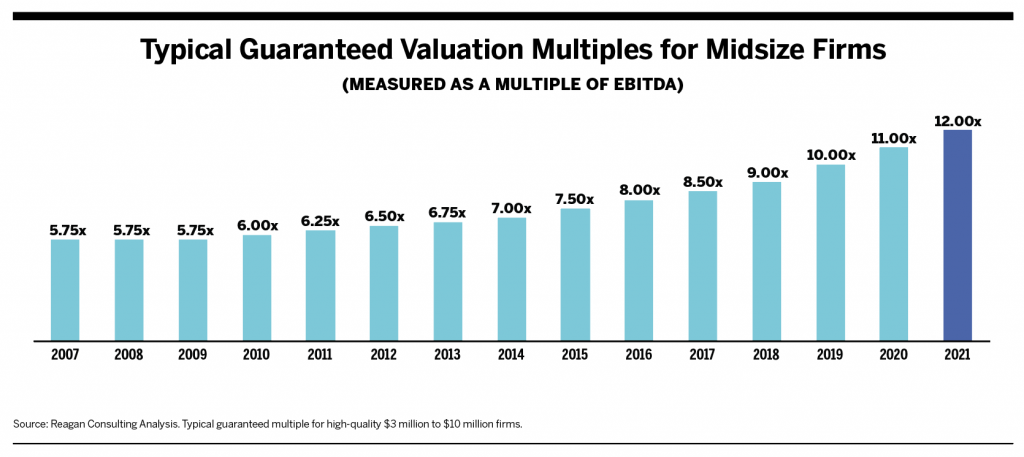

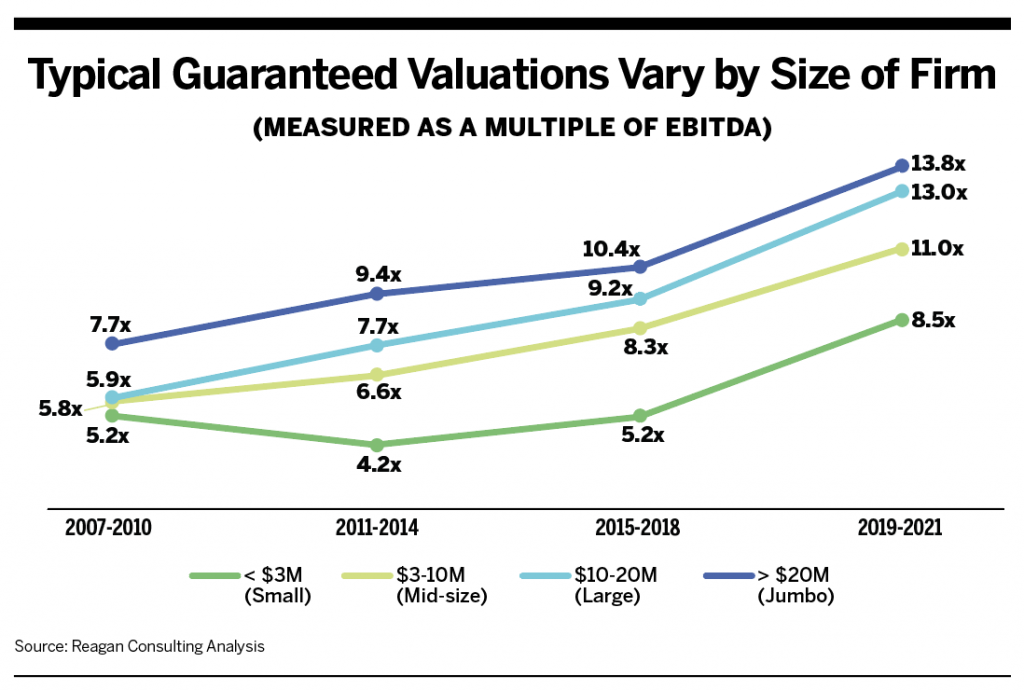

Each year over the past decade, we’ve watched a new valuation record replace the one from the prior year. Since the Great Recession, M&A valuations for insurance brokerages have risen at an incredible pace. In fact, across nearly all brokerage size categories, brokerage valuations have roughly doubled over the last dozen years.

Brokerage valuations have roughly doubled over the last dozen years.

Valuations for midsize firms have jumped a full multiple of EBITDA each year since 2018.

Five primary factors explain the current swell.

The causes behind this trend, and whether it will continue, are hotly debated topics across the insurance distribution system.

To understand how valuations have changed over time and how they are influenced by key attributes of the target firms, we reviewed hundreds of M&A transactions, including data from our proprietary database and from publicly available sources.

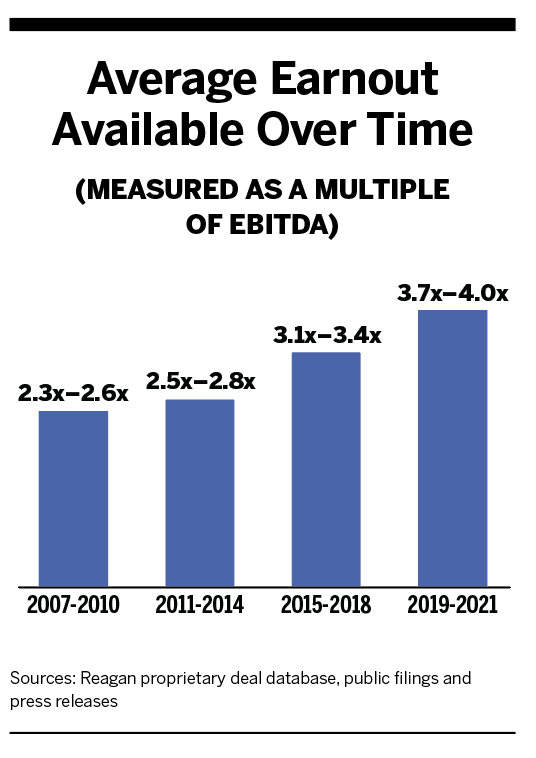

For the most part, we focused on the guaranteed portion of the valuation—the upfront portion funded at closing (the guarantee) versus the earnout, which is paid later based on the performance of the acquired firm after closing. By focusing on the guaranteed piece, we get a more comparable metric (earnout structures and magnitudes vary widely from buyer to buyer) and a purer look at how our industry has been valued over time. We measure guaranteed valuations using the most widely accepted method in the industry—the EBITDA multiple.

Below is a 15-year look at EBITDA multiples for acquired firms in the most active acquisition size category, those with annual revenue ranging from $3 million to $10 million.

The chart at the top of page 86 shows the changes in valuation over time and, in particular, the acceleration in valuations over the last three years. The wave is moving faster. The typical valuation multiple increased by 21% from 2007 to 2014 but then jumped by 71% from 2014 to 2021. Valuations for these midsize firms have jumped a full multiple of EBITDA each year since 2018.

Why Is This Happening?

“The breaker wave you are surfing on,” wrote Richard Seymour for the Scripps Institution of Oceanography, “which seems like one wave, is really the combination of many smaller wavelets that happened to arrive at the same time.” Ocean waves are built of component parts, and the insurance brokerage valuation wave is no different. We can point to five primary factors to explain the current swell: (1) public brokerage valuations; (2) low corporate taxes; (3) the return of a hard market; (4) a favorable interest rate environment; and (5) the rise in well capitalized buyers.

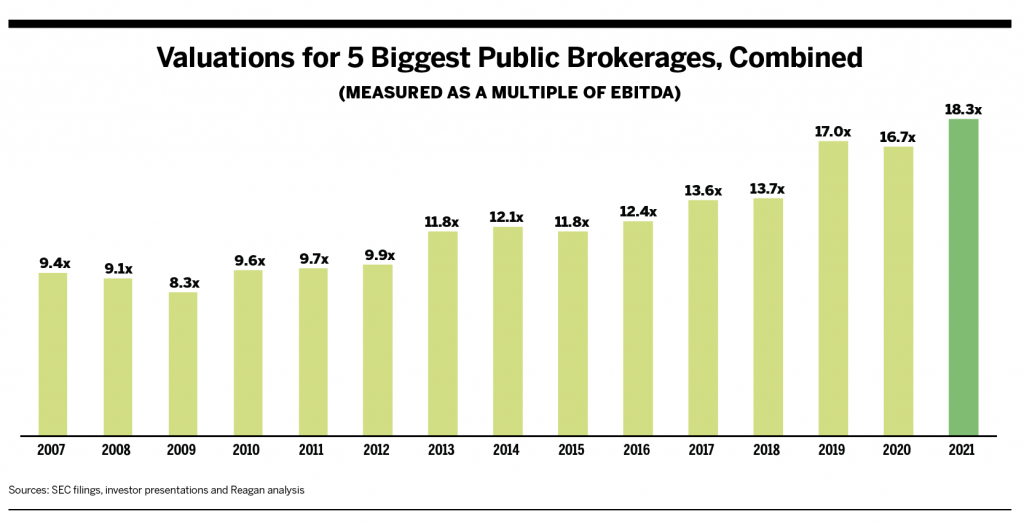

- Public brokerage valuations lead the way. Valuation multiples of the five biggest public brokerages—Aon, Gallagher, Brown & Brown, Marsh McLennan and Willis Towers Watson—increased from 8.3x in 2009 (at the tail end of the Great Recession) to 18.3x in 2021, representing an increase of over 100% in 12 years. The three newest publicly traded brokerages—Goosehead, Baldwin Risk Partners, and Ryan Specialty Group—only augment this trend. They have entered the scene over the past three years—all at multiples loftier than the averages shown above. Public brokerage valuations serve as bellwether valuations in the industry, heavily influencing the price that buyers—public and private-equity backed—are willing to pay for acquisitions. The higher the multiples for the buyers, the more they can pay to prospective sellers and still do accretive deals. As Doug Howell, CFO at Gallagher, noted in a recent earnings call discussing 2021 results, “The [M&A valuation] multiples ticked up a little bit but not as much as what our multiple has. So there’s still a terrific arbitrage there.”

- Tax cuts unlock new valuation levels. The Tax Cuts and Jobs Act (known as the Tax Act) took effect on Jan. 1, 2018. In the Tax Act, federal C-Corporation taxes were reduced to a flat rate of 21% (from 35%), producing more available cash flow and thus a higher value for buyers, who are primarily taxed as C-Corporations.

- A hard market arrives. From 2014 through the end of 2017, according to The Council’s P&C Market Survey, the industry showed declining commercial P&C rates for 14 consecutive quarters. Since then, commercial P&C rates have accelerated, producing one of the hardest markets in recent memory. In 2018, the average rate increase was 1.8% across all commercial P&C lines. The average rate increase was 5.9% in 2019, 10.6% in 2020, and 9.1% through the end of September 2021. With rising rates, average organic growth has risen to 8%-10% for brokerages, supporting more aggressive valuations.

- Interest rates nosedive. At the end of 2018 and throughout 2019, the Federal Reserve lowered the 10-year Treasury yield as global growth slowed and a trade war with China ensued. The moves by the Fed were intended to keep interest rates low, ensure credit remained widely available, and encourage businesses and consumers to remain confident. The decline accelerated in early 2020 with the Fed lowering rates to 0.50% as the COVID-19 pandemic wreaked havoc on the world’s economy. Since that time, rates have stayed at historically low levels. As interest rates decline and capital to fuel acquisitions gets less expensive, values increase.

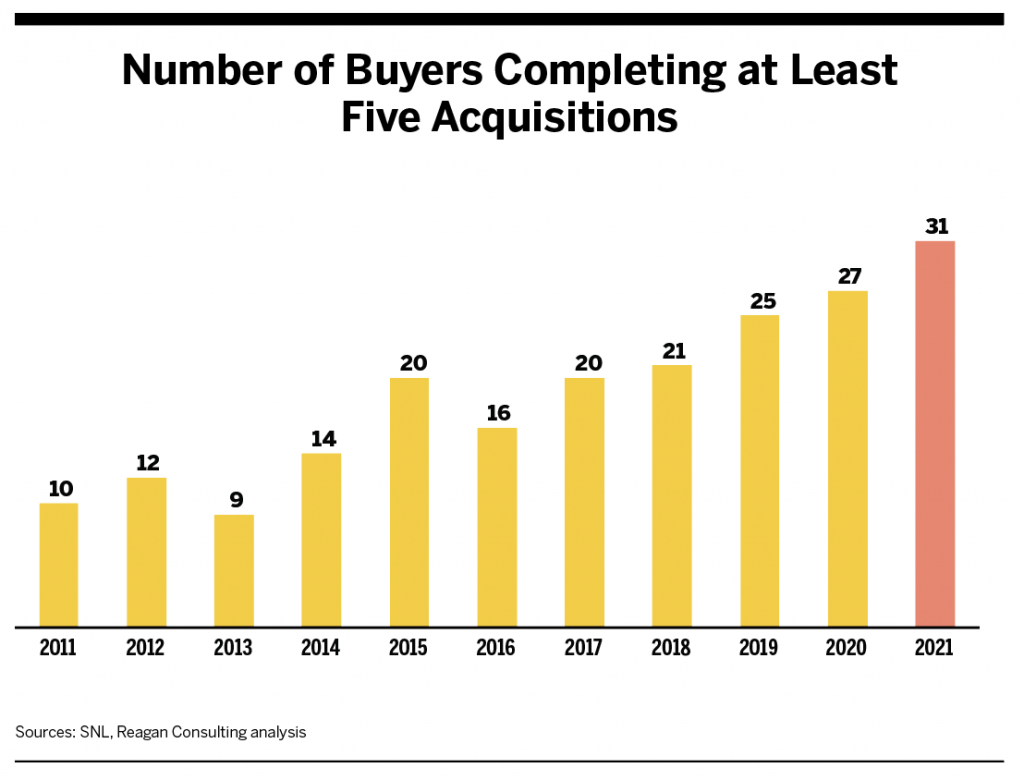

- The buyer universe expands. Private-equity interest in our industry has soared over the last decade following the Great Recession. Investors flocked toward industries that could withstand massive market pullbacks with strong cash flow characteristics. Enter the insurance distribution system. A decade ago there were only 10 buyers in the industry—three of them backed by private equity firms—that completed at least five acquisitions. In 2016, that number rose to 16. In 2021, 31 buyers completed at least five acquisitions, and 27 of the 31 were backed by private equity firms. There are more well capitalized strategic buyers competing for acquisitions today than ever before, driving up the price of admission.

What Attributes Lead To The Highest Values?

While the factors above are helpful in understanding the market’s general trends, each firm is unique in what value the market will see in it.

The old maxim “Beauty is in the eye of the beholder” applies to brokerage valuations—the strategic imperatives of the buyer determine the targets for which it is willing to stretch the multiple. For some buyers, entry into a new geography might cause them to pay more, and for others it might be a specialty capability or product expertise.

But the four attributes most consistently valued by buyers are size, growth, specialization and youth.

Size: The larger the firm, the higher the valuation multiple. This is a dynamic that has held steady over the last 15 years. The wave has lifted all firms, but larger firms sit higher on the wave. All sizes have risen markedly, with jumbo firms (over $20 million in revenue) consistently commanding a 25% premium (or higher) to midsize firms ($3 million to $10 million in revenue).

The valuation of large firms ($10 million to $20 million in revenue) has risen quickly, reflecting recent market dynamics. Fifteen years ago, we didn’t see much difference between the valuations of midsize and large firms, but a gap recently opened and widened. As the number of available jumbo firms declined, the competition increased for large firms, accelerating the valuation growth in this market sector. We saw the gap between large and jumbo firms narrow over the last three years but widen again recently. Buyers are now upping the ante on jumbo firms, stretching their multiples to new heights. Today, guaranteed multiples for firms over $20 million in revenue can exceed 15x EBITDA. In today’s market, size means rare, which means expensive.

Organic growth: While it’s true that buyers generally consider a prospective acquisition’s size over all other attributes, in some cases buyers regard growth—past and future—as even more important. Brokerages that regularly outperform in organic growth and can tell a compelling story about the growth opportunity going forward are consistently more valuable than similarly sized peers. For example, the average guaranteed EBITDA multiple for jumbo firms that sold in 2020 with double-digit organic growth was a full point higher than the average multiple for jumbo firms with single-digit organic growth.

Further, buyers have devoted a whole piece of the transaction structure to growth—the earnout. Earnouts are a second tranche of purchase price delivered to sellers two to four years after closing, based on the growth of the seller during this time period. Over time, earnouts have gotten larger, but the growth rate required to maximize these earnout payments has also gotten higher. Both in the guaranteed payment and in the earnout, buyers are rewarding extraordinary organic growth.

Specialization: The trend toward specialization in insurance brokerage is present in the M&A market as well, with buyers delivering premium valuations for specialized brokerages. For buyers, specialized businesses carry an extra layer of growth potential, because the specialized knowledge and tool set can be leveraged across a larger distribution platform, accelerating growth for the seller and for various other operations of the buyer.

Youth: Buyers want well balanced teams that have invested in next-generation talent. These firms require less attention and oversight from a buyer and generally possess higher long-term growth potential. The marketplace has shown that brokerages that better prepare themselves to perpetuate internally by developing younger talent are also the firms that are worth most in a sale transaction.

Where Do We Go From Here?

As 2022 approaches its midpoint, the upward pressure on multiples remains. 2022 valuations are on par with late 2021 valuations, or even slightly higher. But opinions vary. Trevor Baldwin, CEO of Baldwin Risk Partners, believes the wave may be moderating. “I do not believe you’re going to see a wholesale shift in valuation in the space,” Baldwin said during BRP’s earnings call on March 1, “but we’ve certainly seen some signs of modest softening in overall valuation.”

Certainly the public brokerages have had mixed market returns early this year. The constant chatter concerning rising interest rates may be another of those signs. But none of the five forces that have caused the run-up in pricing has truly abated. For now, public brokerages are still trading at historically high multiples, and interest rates remain at relative historical lows. The hard market is persisting. Further, according to S&P Global, private equity firms worldwide held a record $1.32 trillion of dry powder (funds raised but not yet invested) as of late 2021.

We think, right now, that the fifth force of competition is the dominant force in the market, and it may be keeping the valuation wave from breaking. The buyer list in insurance distribution has exploded, and all of these firms (many of which were founded in just the last five years) have acquisitive growth as a part of their investment thesis. Everyone is searching for scale. We’re in the middle of a giant land grab, and the buyers and landholders alike realize that many attractive pieces of land have already been claimed. So when a privately held firm in a desirable geography or specialty becomes available, the competition is tremendous.

Buyers competing for the deal know their chances to get into that geography or specialty with speed and scale are limited. If they don’t get the deal, they are often starting over in that geography or specialty. They have missed their chance. In this hyper-competitive environment, what’s an extra turn of EBITDA (or two)?

Brian Deitz is president at Reagan Consulting.

Mark Crites is a partner at Reagan Consulting.