Internal Perpetuation Under Pressure

For more than a decade, headlines in the insurance industry have been dominated by mergers and acquisitions.

Since 2011, the industry has averaged 565 announced transactions each year. Roughly half of M&A transactions are announced publicly, so the deal total probably actually averages around 1,100 annually. Within a universe of roughly 37,000 agencies and brokerages, that is an industry consolidation rate of about 3% per year. That’s not exactly the consolidation landslide many believe. Furthermore, Reagan Consulting estimates that the 3% industry consolidation rate is almost entirely offset by the number of newer, smaller players that emerge each year.

Internal perpetuation remains the most common method to transition agency ownership.

Agency profit margins have failed to keep up with appraised valuations, challenging internal buyers,’ while owners are enticed by external sale valuations.

There are various options to overcome these obstacles to internal perpetuation, including buyers securing longer-term financing and sellers improving profitability to help bridge the valuation gap.

And yet, the persuasive narrative regarding the M&A feeding frenzy is captured perfectly by a recent comment from the CEO of a large, privately owned, regional brokerage: “What am I missing? Are we going to be the last broker standing? Am I going to be left alone to turn out the lights?”

The reality regarding industry consolidation is far different from what many, like this CEO, believe. To be sure, many of the largest and most prestigious private brokerages have been sold, but the size of the industry has remained remarkably static.

If only 3% of the industry is gobbled up annually, what about the other 97%? Most of these firms have generations of shareholders constantly entering and exiting. How are they managing their ownership and internal equity transfers if they are not selling to third-party buyers?

They’re remaining privately held and perpetuating internally, even amid growing stressors to this approach in recent years.

Internal Transfer Preferred

Using the internal perpetuation strategy, agency shareholders transition ownership internally from one generation of owners to the next. Conversely, external perpetuation involves the sale of the agency’s equity to an outside investor.

Today, more perpetuation options are available than ever before. Nonetheless, the 3% annual industry consolidation rate confirms that most agencies prefer to remain private and perpetuate ownership internally.

And why wouldn’t they? Private ownership remains an unparalleled option for many reasons.

As private equity (PE) has discovered, agency ownership produces remarkable economic returns. The equity opportunities to build personal wealth in a privately held firm will be attractive to young talent looking to build a life and family. By remaining private, owners can craft the work/life balance they desire for themselves and their employees.

Even as many mega-brokerages are sold to outside investors, other large brokerages are 100% committed to remaining independent. And they are excelling while doing so. These firms demonstrate that structural impediments to remaining independent can be overcome.

Growing Perpetuation Friction

Still, two opposing financial realities today are plaguing agencies pursuing an internal ownership perpetuation strategy: agency equity is viewed as either too expensive (by many internal buyers) or not expensive enough (by many internal sellers). Without able buyers and willing sellers, an agency will find its internal perpetuation strategy dead on arrival.

Issue 1: Affordability—Empower Buyers

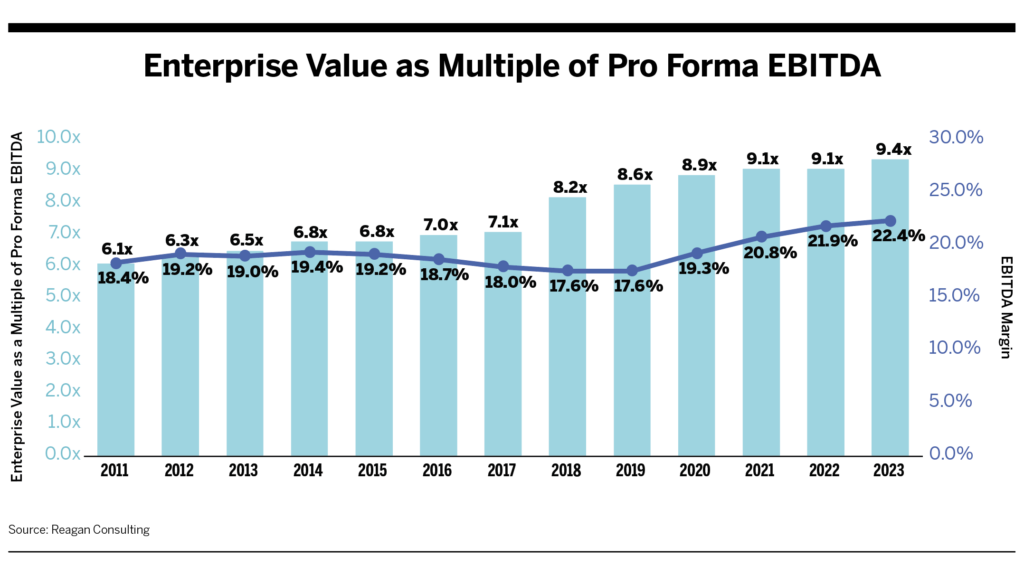

Appraised agency valuations that are used to price internal equity transfers have skyrocketed in recent years, alongside exploding valuations for third-party transactions for insurance agencies and brokerages. Since M&A consolidation began in earnest in 2011, appraised agency valuations have increased by 53.4%, from a 6.1x multiple of EBITDA (earnings before interest, taxes, depreciation and amortization, or pre-tax cash flow) to a whopping 9.4x multiple of EBITDA in 2023.

Since valuation is essentially a function of growth in profitability, one would think that a comparable increase in profitability might have accompanied this 53.4% spike in value multiples. But profit margins increased by only 21.7% over that period.

As it turns out, external factors accounted for much of the increase in agency valuation.

- Investment capital flooded the industry from various sources, most notably private equity.

- Hungry acquirers intensified competition.

- Tax laws changed.

- Public brokerage equity markets surged.

- A booming U.S. stock market emerged from the Great Recession and COVID-19 pandemic.

Remaining independent requires internal transfers of ownership. Most internal equity purchases are funded with debt. Buyers rely heavily on their profit distributions to fund this debt. If an agency’s value increases significantly faster than its marginal profitability, profit distributions to service debt become smaller, relatively speaking. This forces buyers to fund more of their purchases out of pocket, rendering equity purchases less affordable.

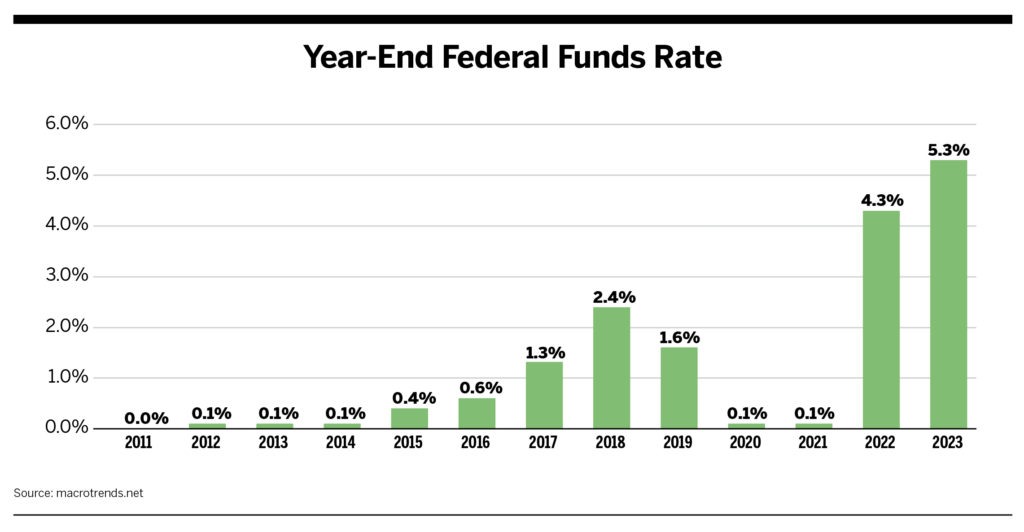

It gets worse. Affordability is being further pressured by interest rates, which are at their highest levels since before the Great Recession. When coupled with the marginal slowdown in profitability relative to value, these interest rate increases put severe pressure on buyers.

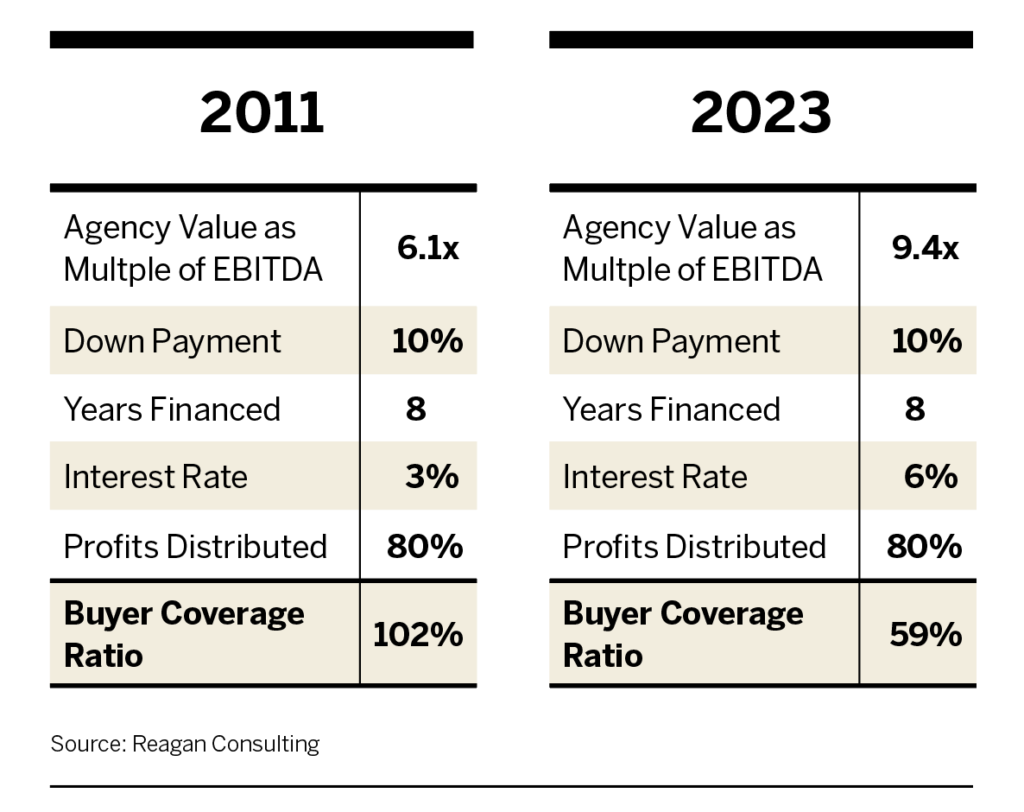

Reagan Consulting’s buyer coverage ratio (BCR) metric can help frame the affordability question for internal-equity agency buyers. The buyer coverage ratio is the percentage of a buyer’s first principal and interest (P&I) payment covered by the buyer’s shareholder distribution. A buyer with a $10,000 P&I payment and a $10,000 distribution has a 100% BCR. If the distribution totals $8,500, the BCR is only 85%. The buyer must make up the 15% shortfall out of pocket.

Reagan Consulting considers a 100% or higher BCR the fundamental benchmark to qualify an equity purchase as generally affordable. A BCR below 100% introduces affordability issues for buyers.

Due to the run-up in agency valuations and increased interest rates, many agencies’ BCRs are down materially. In the following example, an agency with a BCR of 102% in 2011 would generate a BCR of only 59% today—that’s a 42% decrease in affordability.

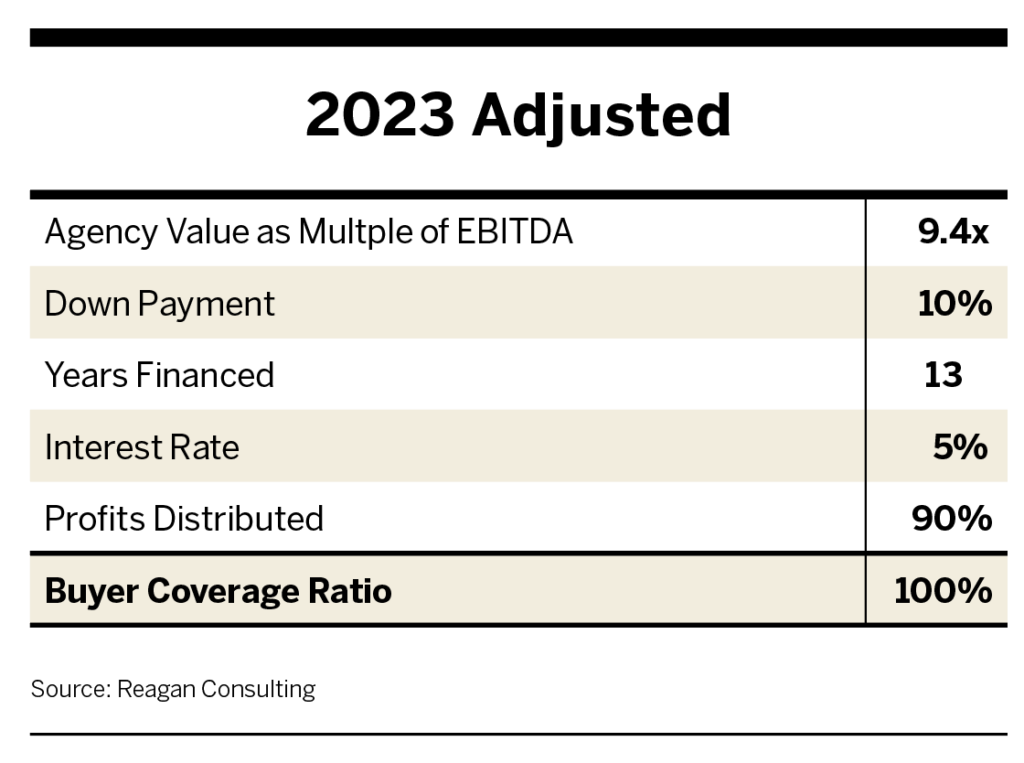

Without a clear understanding of what’s happening to affordability and what can be done about it, agencies risk having their pool of able buyers dry up completely. Fortunately, there are several levers to help alleviate this affordability issue. Applying these three strategies to the above example returns BCR to 100%.

1. Secure or provide financing over longer periods. Rather than eight years, aim for 10+ years. Many industry banks now provide much longer-term financing than was previously available. Internal financing can also be extended to enhance affordability.

2. Reduce interest rates to Internal Revenue Service approved minimums on agency- or seller-financed notes. Or consider interest-only loans for a period of time.

3. Increase profit distribution percentages to shareholders, helping ease buyers’ cash flow worries. Tread carefully when increasing distribution levels, as an agency still must make necessary growth investments.

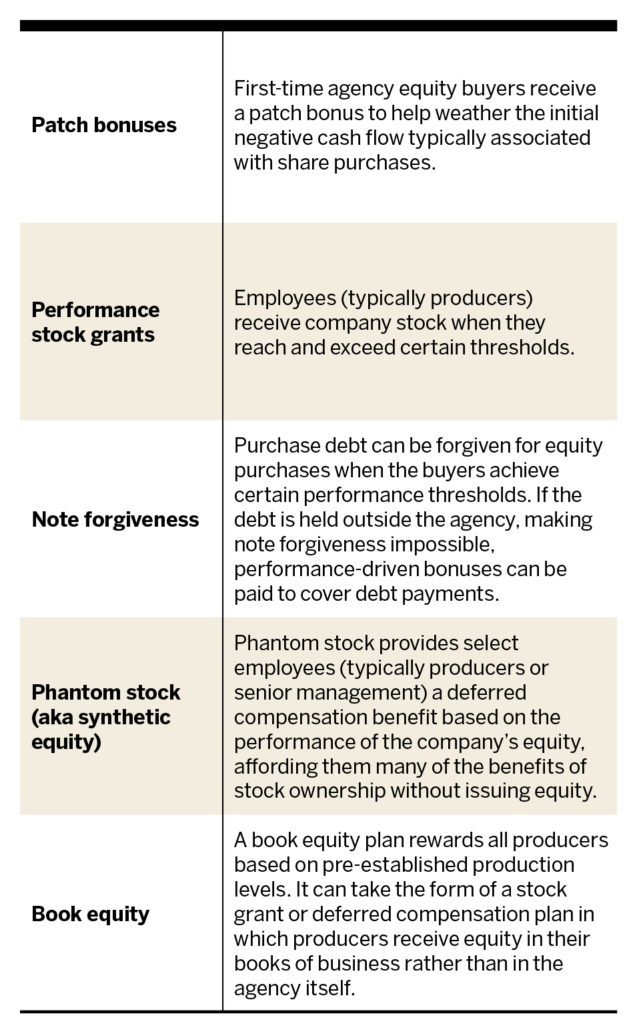

In addition, a handful of equity affordability techniques and alternative equity solutions can significantly improve the affordability of internal equity vehicles for key employees and/or buyers without materially impacting a firm’s existing shareholders. By doing so, half of the buyer-seller equation in an internal perpetuation transaction is well served.

Issue 2: Bridging the Valuation Gap—Satisfy Sellers

At the other end of the spectrum, many sellers sense that equity is too affordable.

In today’s marketplace, a large, high-quality insurance brokerage might sell for a 100% premium (or more) above its internal appraised value. We refer to this internal-versus-external valuation difference as the valuation gap. No wonder many agency owners today are feeling heartburn: selling internally has always required agency owners to sell at a discount to the open market, but that discount is higher today than ever before.

Firms that remain private have always received lower valuations than they might have secured in the open market. Prior to the Great Recession, a third-party valuation could typically exceed internal valuation by as much as 40-50%. Today, with many PE-backed buyers tripping over themselves to buy quality brokerages, supply and demand have pushed third-party valuation multiples ever higher. As a result, the traditional 40-50% valuation gap has grown for many agencies to as much as 100% or more.

What if an agency could close the valuation gap to levels that were typical in the past? Would internal perpetuation feel more reasonable to sellers? Probably, and it can be done.

Two primary factors produce the valuation gap: (1) internal versus external valuation multiples and (2) internal versus external profitability levels.

As previously noted, internal valuation multiples are much lower than external valuation multiples. An agency’s internal valuation multiple is a function of actual and projected earnings growth on an as-is, stand-alone basis. Any attempt to arbitrarily increase the internal valuation multiples to close the valuation gap without a supporting improvement in operations will hurt equity affordability.

External buyers’ appetites, competitive pressures and economic engines will dictate what they can and will pay for a quality insurance brokerage. The average agency can do little, if anything, to close the gap in valuation multiples.

In addition, the profit levels against which the multiples are applied are generally much higher in a third-party transaction.

Why would an agency’s profitability be higher in a business sale? For a large, high-quality brokerage set to receive a 16x EBITDA guaranteed valuation from an outside buyer, there are precisely 16 reasons why this would be the case: the agency can generate $16 in additional purchase consideration for each dollar of additional profit. A seller is incentivized to strip fat from its operations at these high multiples. Once sellers understand this “valuation multiplier” math, they go to work to identify and eliminate unnecessary expenses.

Why not take the same approach internally to begin closing the valuation gap? Agencies that find they could operate more profitably under third-party ownership (and they all do) can just as easily improve their internal margins and valuations. By eliminating excess perks, non-essential personnel, out-of-market compensation and benefits, and unnecessary expenditures, agencies can generally operate internally at the same margins they could in the event of a sale to a third-party buyer.

The same valuation multiplier math works internally. For example, let’s assume an agency has a 9.5x valuation multiple on an appraised basis. Every additional dollar of profit will translate into an extra $9.50 in appraised value.

Run the business as if someone else owned it and the valuation will reflect it. By aligning actual profitability with potential profitability, an agency can typically shrink its valuation gap to a far more manageable level, in line with historical norms.

A word of caution: to optimize profitability, focus on eliminating out-of-market compensation and unnecessary expenses; don’t eliminate necessary growth investments. For agencies committed to internal perpetuation, the best place to start to close the valuation gap is to focus on improving profit margins.

Other strategies may be worth exploring for agencies wishing to close the valuation gap even further.

- Adopt a C-corp share grant model. The C-corp share grant model takes advantage of lower tax rates for C-corps and focuses heavily on profit retention (rather than distributions). The corporation retains profits to fund shareholder redemptions and service debt. Individual share purchases are largely replaced with a share grant program. Agencies adopting this model are typically valued closer to third-party market valuations.

- Raise minority capital from an outside investor (a large agency strategy). By selling a minority interest to an outside investor (typically a private equity partner), an agency can reset its value to closer to full third-party market valuation. As with the C-corp share grant model, this hybrid approach generally replaces individual share purchases with a share grant program. Agencies that take this route are still technically independent, but it does introduce outside capital and influence.

Although both these strategies will help shrink an agency’s valuation gap, they will also have material implications for its overall perpetuation methodology and should be considered only after careful consideration with a qualified valuation and perpetuation advisor.

Although internal equity transfers today are more challenging than in past years, the upside remains compelling for most agencies. The right mix of perpetuation strategies will enable agencies to maintain independence and thrive. The future of internal agency perpetuation is bright but only for agencies adapting to current realities.