How Important Is Brand Identity After Acquisition?

In mergers and acquisitions (M&A), the future state of the acquired firm’s brand identity is a frequent topic of discussion by both buyer and seller.

But how important is “brand” once a deal is done? (Spoiler alert: not as important as you might think.)

Brand is sometimes oversimplified as a company’s name and logo. But brand is more about the intangibles—a company’s reputation, its unique products and services, the customer experience, and its personal connections.

Many sellers believe their brand (or company name) represents their identity to clients, and there is often a lot of emotion and anxiety about it during deals. Whether the acquired firm’s name changes or stays depends heavily on the strategic intent behind the acquisition, the strength of the acquired brand, and the buyer’s integration philosophy.

Some buyers believe strongly in retaining an acquired firm’s brand, it being perhaps the primary differentiator in deciding which company to pursue. In these cases, buyers deploy a decentralized brand integration strategy, allowing acquired firms to continue operating under their existing name. This is a strategy for maintaining local brand equity and customer relationships. But back-end operations— technology, services, systems—are fully integrated.

Other buyers take an even more decentralized, co-ownership approach to integration, allowing sellers to not only retain their local names and brand identities, but also to operate relatively autonomously, sometimes never even announcing the deal.

However, some firms that historically operated in a decentralized fashion have shifted strategically to a more centralized approach—telling agency partners to rebrand under the national or global name in order to strengthen brand viability and customer experience. Interestingly, many agency partners also express a desire to align under the holding company brand, perhaps realizing the business value of being recognized as part of a larger, international organization.

Most buyers today operate in a hybrid fashion, balancing local brand equity with corporate identity. They typically retain an acquired firm’s name but add a suffix (i.e., “an XX company”) to strengthen the firm’s credibility and maintain a unified brand umbrella.

In MarshBerry’s experience working with buyers and sellers, the question “What will happen to my brand once we’re acquired?” is one of the most discussed topics during negotiations. In most cases, that’s just an emotional connection to the brand, not something that truly matters to the business’s future success once partnered with another firm. At the end of the day, clients mostly only care about whether key contacts, relationships, and services are going to continue at the same (or better) levels under the new ownership. As you enter into a potential sale, evaluate whether your brand is important to your ability to drive growth post-closing. Ultimately, your acquiring partner will drive the brand strategy; if you have a strong opinion on the future of your brand, make sure to understand the approach of the buyers you negotiate with.

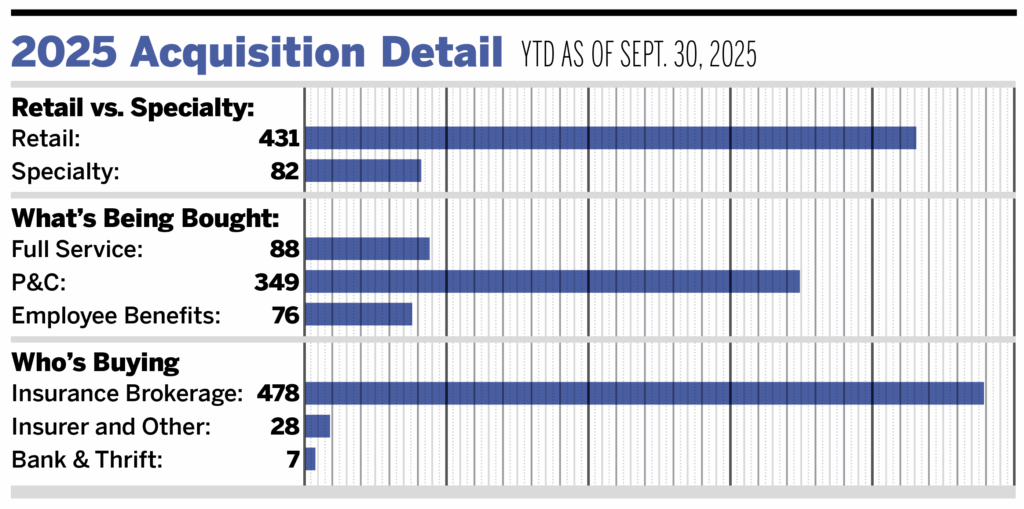

M&A Market Update

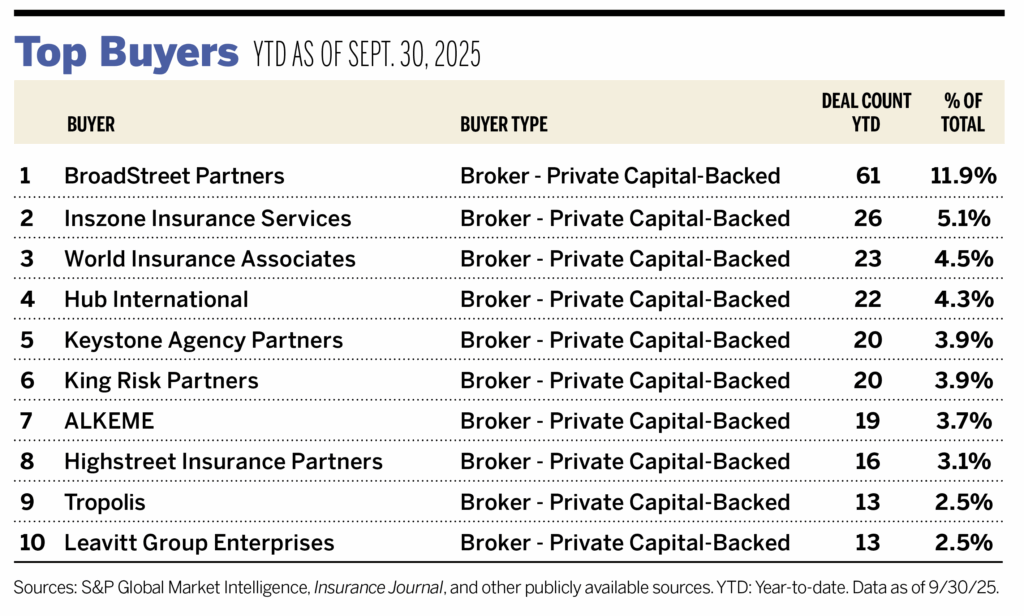

As of Sept. 30, there were 513 announced insurance brokerage M&A transactions in the United States in 2025. Private capital-backed buyers accounted for 370 of the 513 deals (72.1%) through September. Independent agencies were buyers in 73 deals, representing 14.2% of the market. There have been seven announced transactions by bank buyers in 2025. Deals involving specialty distributors as targets accounted for 82 transactions, about 16% of the total market, continuing the trend of low supply of specialty firms.

Ten buyers accounted for 45.4% of all announced transactions year to date, while the top three (BroadStreet Partners, Inszone Insurance, and World Insurance) accounted for 21.4% of the 513 transactions.

Notable Transactions

- Aug. 22: Relation Insurance Services acquired the assets of Joseph M. Wiedemann & Sons (JMWS). Based in Arlington Heights, Ill., the fourth- generation, family-owned insurance agency offers a mix of personal and commercial insurance lines, with a focus on property and casualty and employee benefits. MarshBerry served as advisor to JMWS on this transaction.

- Sept. 24: McGowan acquired Limit, a leading AI-enabled digital wholesale insurance brokerage, through an asset purchase agreement. Limit operates two divisions: Limit Wholesale, which specializes in cyber liability and technology E&O; and Limit AI, which offers AI-driven risk management tools for policy comparison and client communications. MarshBerry served as advisor to Limit on this transaction.