Buying Low, Selling High

Buy low. Sell high. Over centuries of investing and unlimited lessons learned, this single catchphrase still reigns supreme.

Valuations for agencies during 2020 and into 2021 show there is still plenty of appetite for M&A in our industry.

At Patra, we look at the acquisition market through the lens of digital innovation, transformation and operational efficiency. Companies that have embraced tech-enabled services to position themselves as operationally efficient can demand a higher valuation on the sell side. Likewise, those efficiencies can be directly calculated for buyers into their valuation model so they can see the immediate revenue to their bottom line.

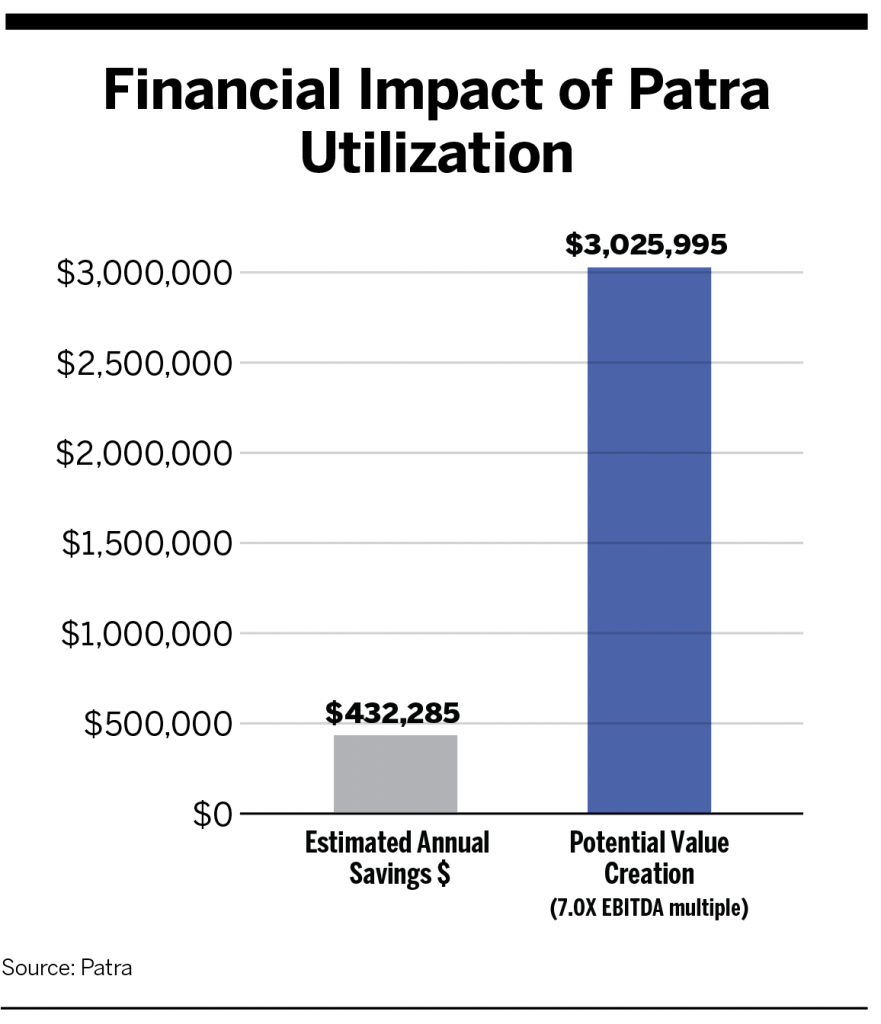

We recently met with the CEO of a large national agency who, during the most recent fiscal year, saved approximately $432,000 in expenses by leveraging various Patra services. “That number is very valuable,” he said. “We could put that figure back into the firm’s valuation and increase not just our value but access to capital for growth and acquisitions.” With EBITA multiples trading as high as 8 to 10x, agencies create future investment capital and enhance the overall value of their company itself, as illustrated below.

Cost savings through tech-enabled operational efficiencies are a crucial part of the acquisition conversation. We have witnessed both sides of the equation when it comes to acquisitions, and it has been proven that agencies that partner with a tech-enabled services provider bring ROI from that partnership to the table.

Why? Because there is a proven services methodology in managing operational tasks and ensuring that producers are doing just that: driving revenue.

A few communal areas in the agency/tech-enabled service partnership drive this increased value.

- Data management: This can be a major obstacle in any merger or acquisition. Having a process for and experience with how data are transitioned from one system to another is one area of cost savings. The ability to migrate agencies on a standard agency management system and build a centralized service operation will bring instant relief to the acquired assets. Ongoing conversion support, a proven and scalable method to deal with consistent data management, and monitoring of special projects are also important.

- Centralized support for processing-level tasks: A centralized service center eliminates the need to recruit and train unfamiliar staff during the M&A process. Scalable service centers can support agencies with acquired assets needing certificate issuance, policy checking, employee benefits eligibility processing, printing, mailing services, etc. For personal lines, small commercial, and small groups, we help drive profitability, as our resources can be found across all 50 states. There is no limit to geolocation hiring challenges. The turnover rate can be 50% lower than that of in-house service centers.

- Documented workflows: As fleshed out by a tech-enabled partner, documented workflows ensure increased efficiencies with both the new staff taking on the agency and seasoned agency staff who have become accustomed to de facto workflows.

- Producer development: It has often been said that one successful producer can increase the value of an agency by over $1 million, so why would anyone want to split the producer’s time to both managing the agency and growing it? A partnership can ensure that producers are 100% focused on producing.

If a firm can highlight an annualized ROI of $500,000 in savings due to a partnership that combines technology and human power, that provides tremendous value for the buyer. Knowing that the partnership between the agency and services provider can extend the ROI, further scale can be applied as new acquisitions are brought onboard.

Shannon Mahoney is SVP of business development at Patra.