What’s the Deal with Social Inflation?

What do nuclear verdicts, the recent rise in D&O claims, and litigation financing have in common? They are all related to the effects of social inflation, a term used by insurers to “describe the rising costs of insurance claims resulting from increasing litigation, broader definitions of liability, more plaintiff-friendly legal decisions, and larger compensatory jury awards.” Responses to The Council’s Commercial Property/Casualty Market Index survey illustrate an increasing awareness of the impacts of social inflation, ultimately leading to increases in commercial premium pricing, more expensive claims, and increased litigation costs. These effects have been particularly prevalent in two commercial lines: Commercial Auto and Directors & Officers Insurance (D&O).

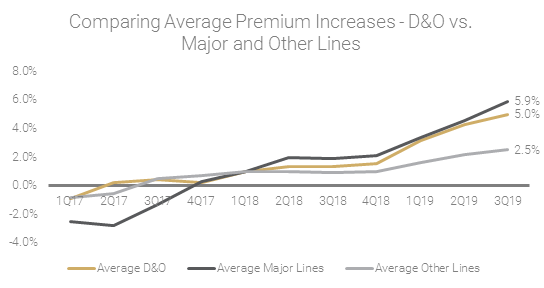

Social inflation looks to be just one more contributor to rising commercial auto prices, which have seen over 30 quarters of premium increases according to The Council’s market index. But when it comes to D&O, social inflation’s influence may be more significant. Respondents identified social inflation as a possible reason for recent price increases in D&O, and the relative size of these increases suggest D&O is being pulled into the hardening market along with some other major commercial lines.

Commercial Auto

One topic raised repeatedly by Council members, both in responses to the Market Index and during meetings of The Council’s Claims & Risk Management Working Group (CRMWG) is nuclear verdicts. Roughly speaking, this term refers to juries awarding larger-than-normal payouts to plaintiffs in an effort to punish companies, which may be partially due to the general atmosphere of anti-corporate sentiment that exists today.

Another factor influencing the size of the verdict is litigation financing, a topic CRMWG has explored previously. Not only does the backing of investors permit the plaintiff to pursue litigation for longer than they normally would, but investors can also exaggerate injury claims by pulling the plaintiff out of the medical system in order to avert health insurance, workers’ compensation, and Medicare, and allow for unnecessary treatments. While all lines of business are vulnerable to litigation financing, Commercial Auto is particularly so, because the frequency of low-impact accidents where businesses are involved, combined with the availability of higher policy limits in that particular line, make it an easy and attractive target.

A possible way to bolster legal defenses against this kind of litigation is to invest in risk management and risk management education. Dashboard cameras could help prove who was at fault in the accident, while collision avoidance systems could prevent accidents from happening at all. Telematics systems could be used to generate reports on the driving habits of each particular driver working for a company, which in turn allows the company to take action when a driver is not adhering to safe driving practices.

Directors & Officers Insurance

The second line commonly associated with social inflation-related trends is Directors & Officers Insurance (D&O). According to a recent report by Milliman, “Three rising trends in D&O insurance,” there was a “staggering” increase in the size of settlements, going from $1.4 billion in 2017 to $2.4 billion in 2018. Linked to that, another report on D&O trends by Allianz highlighted the growth of a “global investment class” related to litigation financing, in particular the funding of group securities class actions, which are now even more tempting for investors after a recent U.S. Supreme Court decision allowing plaintiffs to pursue companies in both state and federal court. Naturally, this all inflated legal costs for companies and, in turn, D&O claims costs for insurers and premiums for insureds.

Recent social trends have triggered an increase in high-profile lawsuits. For example, the #metoo movement inspired a rash of sexual misconduct lawsuits: apart from the convictions of Bill Cosby and Larry Nassar, the Time’s Up Legal Defense Fund has connected over 3,600 people with attorneys to pursue legal action. According to the Milliman report, “D&O insurers expect an adverse shift in the number of future claims and ultimate settlement amounts for these high-profile cases.”

But it’s not just sexual misconduct or gender/racial discrimination that can land a company in hot water. Climate change, or more specifically, the failure to disclose or address climate change risks, resulted in a spate of new lawsuits in “at least 28 countries around the world to date, with three-quarters of those cases filed in the U.S.,” according to the Allianz report.

Other ethical issues, such as “human exploitation in the supply chain,” can result in reputational harm for a company, such as recent criticism of Amazon for its warehouse conditions. Additionally, reputational harm, whether coming from ethical issues, climate change lawsuits, or the impacts of the #metoo movement, can result in litigation from shareholders if it negatively impacts the share price of their company, highlighting how significantly the current public sentiment can influence and shape D&O risk.

So What?

The

reasons for social inflation are admittedly up for debate. Just in the

discussion of how it affects Commercial Auto and D&O, we saw several

possible reasons: anti-corporate sentiment, litigation financing, and a culture

that emphasizes the righting of wrongs (#metoo). But there is no question that

social inflation is a real phenomenon of which brokers and insurers should be

conscious.

And social inflation’s effects are not merely confined to D&O and

Commercial Auto—they also extend into most, if not all other lines. For a

deeper dive into social inflation beyond this primer, keep an eye out in the

coming months for an article in Leader’s

Edge by David Tobenkin, which will not only touch on the effects of social

inflation on the insurance market, but also on what brokers and insurers are doing

to mitigate it, as well as the option of legislative relief via tort reform. Social

inflation is a complex issue with tangible repercussions for the industry, so we

will be keeping a close eye on related developments going forward.