The Complex, Changing World of Specialty Insurance

Specialty insurance has become both increasingly important and increasingly challenged in recent years, as new exposures have led to the development of more specialized insurance protection.

A significant and growing number of agencies find themselves struggling to serve their specialty customers due to challenges including market fragmentation, siloed account selling and a need for greater efficiency.

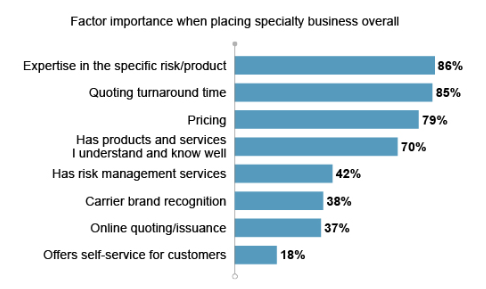

In an effort to explore the risks and opportunities in the specialty insurance market, The Hanover Insurance Group partnered with Zeldis Research to survey over 300 independent agents and brokers. With the help of Bryan Salvatore, executive vice president and president of specialty at The Hanover, Leader’s Edge dug into some of the important trends revealed in the company’s “State of Specialty Insurance Report.”

Specialization: A Key Priority for Brokers

Over the last decade, industry experts have touted the benefits of agencies’ and brokerages’ building product and industry-focused specialization amid an increasingly competitive specialty distribution landscape and complex risk environment. According to The Hanover’s “State of Specialty Insurance Report,” how that specialization translates within an organization varies. The survey shows the majority of agencies do not report having separate divisions for specialty lines products. Conversely, the survey shows approximately half of agencies report having separate practice areas for specific industries.

Whether a brokerage forms a separate division for specialty insurance depends on the composition of the brokerage, says Salvatore. “Large brokers have established specialty practices around highly complex lines, such as D&O. We also see most agencies aligning by industry, like construction, healthcare, manufacturing and technology.”

It’s clear that, even though the development of distinct divisions for specialty insurance is less frequent than for industries, many are committed to implementing specialization strategies to help facilitate agency growth.

Fragmentation: The Core Issue

A core finding in the report was the widespread fragmentation in the specialty insurance market, where a commercial account may have several different policies across multiple agencies or policies from multiple different markets. This core finding was particularly surprising, as the survey also found that 96% of agents are doing double-duty and selling or placing both standard and specialty insurance. Splitting policies across multiple carriers not only adds work for the agencies involved, as they are required to coordinate between each other and between several different carriers, but also introduces confusion and risk for the customer.

“Fragmentation continues to be a recurring theme,” says Salvatore. “This can be challenging for agencies, as it can lead to missed opportunities and increased confusion, resulting in risk for customers and operational inefficiency. We recommend that agents partner with carriers that have comprehensive product portfolios and coordinated practices that respond to a wide variety of risks. Taking a coordinated approach to placement by operating across lines of business and partnering with carriers that have similar specialized capabilities reduces fragmentation while positioning agencies for future success.”

But finding those carriers can be difficult for agencies, Salvatore admits, pointing to a perception that highly specialized products reside exclusively with specialty carriers. “The level of specialty expertise, capabilities and service varies greatly across carriers. Given the number of carriers, combined with the variability of offerings, it can be challenging to know where to turn. That’s why a relationship with a true specialty carrier can be a game changer,” he says.

The ramp-up in agency mergers and acquisition, while often described as a trend that can negatively impact broker and carrier relationships, may in fact offer new opportunities in the specialty space. “Consolidation certainly can bring some challenges as agents work to integrate the acquired books, but we’ve found that the best agents and brokers are using it as an opportunity to better align with carriers for more customer efficiency,” Salvatore explains. “These agents are looking to partner with trusted carriers that can support their growth by having a national presence with a broad range of capabilities. As a result, I think it will improve the selling and placing of specialty policies for agents looking to grow this business.”

Looking Ahead

Salvatore predicts the specialty insurance market will continue to grow in the coming years. “Companies will have more complex and sophisticated exposures,” he says. “The need for specialty coverage will increase, especially as customer demands increase. Businesses are operating in a more complex, post-pandemic environment amid ever-evolving legal, regulatory and technological risks.”

In his view, addressing those customer demands will require brokers and carriers work hand in hand. “It’s important for brokers and agents to partner with carriers who take the time to understand businesses’ specialized coverage needs,” he explains, adding that, at the same time, “it’s imperative that such carriers offer a broad set of capabilities to align with the ever-changing risks prevalent today.”

Ultimately, Salvatore expects that the “desire” for specialty insurance will evolve into an outright “need” for many businesses. As this market develops, he says, it is crucial that brokers and agents take a customer-centered approach while delivering greater operational efficiency. At the same time, carriers must “invest in building holistic relationships with their agents and brokers to clarify what is available and simplify access to such capabilities.”