Smaller Lines, Bigger Profits

New data from ALIRT Insurance Research shows that smaller lines of business have produced the strongest underwriting profitability in the last 25 years within U.S. property and casualty insurance, while larger lines are often closer to breakeven. This data can help in anticipating insurance rates going forward.

Smaller lines with particularly strong results included earthquake insurance, some accident and health lines, coverage for boiler and machinery, and warranty and fidelity insurance, highlighting the potential benefits of niche markets. Larger lines that did not fare as well encompassed commercial and private passenger auto liability and allied lines.

A new study on P&C profitability by line of business shows smaller niche lines like earthquake, accident and health, and coverage for boiler and machinery were especially profitable, suggesting potential value in niche markets.

Results demonstrate that despite pressure from social inflation and natural catastrophe volatility, larger lines like commercial auto liability and allied lines remain stable due to their commodity-like nature, highly competitive markets, and wealth of data to enable quick pricing adjustments.

This data can help insurers anticipate market direction and make underwriting and exposure decisions, and help agents and brokers develop distribution strategies and have more informed discussions with insured clients.

The “bread and butter” lines for an insurance agent or broker—i.e., private auto, homeowners, and workers compensation, among others— can be expected to report near break-even profitability over time. While these lines carry the greatest amounts of premium and policies written, they are also highly competitive, which pushes down profitability.

Smaller lines of business in the U.S. property and casualty (P&C) sector have generated the strongest underwriting profitability over the past quarter-century, while larger lines often land nearer to breakeven, according to recent data from ALIRT Insurance Research.

These findings, among others, are incorporated in a new study that teases out P&C profitability by line of business over almost 25 years.

In a period in which personal lines, especially homeowners insurance, have come under pressure in a growing number of jurisdictions—together with recent concerns over the reserve quality of some commercial lines of business—understanding where insurers may have encountered both underwriting success and challenges in the past can aid in framing current pricing discussions with insureds.

While past experience does not necessarily guarantee future results, a glance across underwriting cycles helps elucidate where our industry performs well and not so well over time and provides a road map for how pricing may adjust in coming years.

Key Takeaways

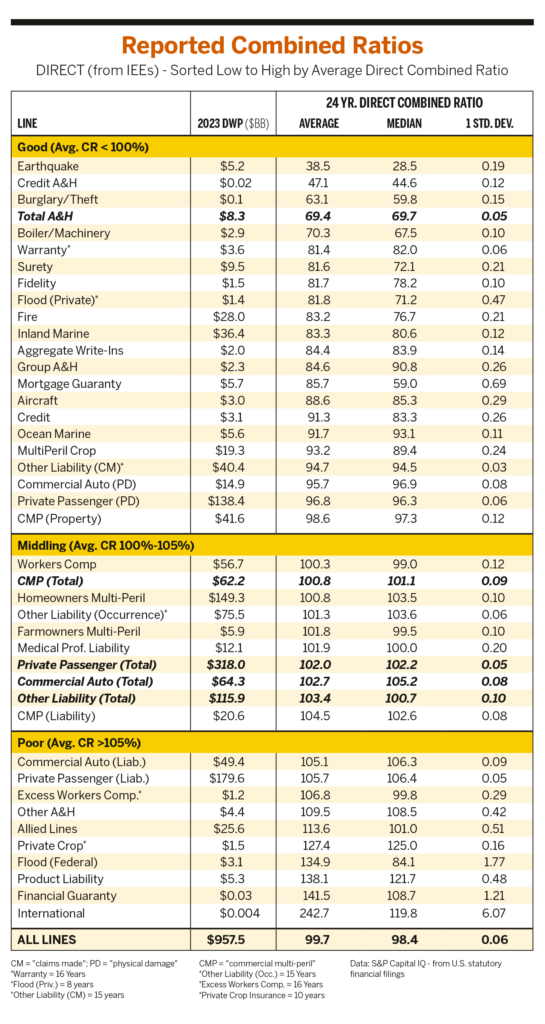

The industry’s strongest historical underwriting profitability (a combined ratio under 100%) is generally found in smaller lines of business, with most reporting 2023 direct written premium of under $10 billion. As shown, these include earthquake insurance, various accident and health lines, coverage for boiler and machinery, and warranty and fidelity insurance, among others. This demonstrates the advantage of such niche strategies, offset in part by their inability to generate large amounts of premium.

Several important exceptions to that finding include the physical damage element of private passenger auto, one of the country’s largest lines of business, which generated a combined ratio of approximately 97% over the past quarter century. Other liability business on a claims-made basis (95%) and the property element of commercial multiperil (CMP) (99%), both reporting around $40 billion of premium in 2023, have also proven profitable over time. Lastly, the fire and inland marine lines of business have reported very strong 24-year combined ratio averages of approximately 83%.

In contrast, lines of business reporting near break-even combined ratios historically (of around 100%) include a number of the industry’s largest, specifically workers compensation, commercial multiperil, and homeowners insurance. The 24-year underwriting results for three of the other largest lines of business, private passenger auto, commercial auto, and other liability, also fall within this “middling” underwriting range, with historical combined ratios of 102%-103%.

Regarding the poorest-performing lines of business (those with average combined ratios of over 105%), commercial and private passenger auto liability are by far the largest. Allied lines—with $26 million of direct premium written in 2023—reported a 24- year combined ratio of 114%, reflecting the ongoing impact of weather-related losses given the volatility of its targeted risks.

All of the other poorest-performing lines of business report minimal amounts of premium, with federal flood insurance supported by a government program that reinsures all of the direct premiums generated here.

Underwriting Profitability By Line

The table titled Reported Combined Ratios shows the average and median underwriting profitability of 37 lines of business over 24 years, from 2000 to 2023, as reported in the statutory financial statements of U.S. insurers. (Data from 2024 was not available at the time of writing.) We break those lines down by good, middling, and poor results over time. For several lines of business we also break out subcategories (such as property and liability results) along with the overall performance (the latter bold and italicized).

These results are on a direct combined ratio basis (i.e., before reinsurance) to better illustrate the ultimate profitability or loss of each category. In addition, we show 2023 direct written premium (to reflect the relative size of each category), as well as a first standard deviation, which indicates the relative volatility of each line over the period in question. Lastly, as by-line reporting conventions have expanded somewhat since 2000, we have made the necessary adjustments to ensure that we are reflecting an apples-to-apples comparison over time. These include breaking out certain liability lines of business on an occurrence versus claims-made basis and the wholesale enlargement of reported health insurance lines.

A final appraisal indicates that most of those bread and butter lines of business—private auto, homeowners, commercial multiperil, commercial auto, workers compensation, and general liability—are likely to report near break-even underwriting profitability over time (from 100%–103%). This makes sense as these sectors reflect the largest amounts of premium and policies written, which in turn provides substantial data to better understand and price risk. Conversely, these are also the most competitive lines of business— given the large amounts of premium at play—which tends to put downward pressure on profitability as insurers often make certain underwriting concessions to retain accounts.

Cyclical Versus Secular

A question often arises regarding cyclical versus secular change in the industry’s underwriting profitability: how do underwriting results compare over various time periods? To address this, we compare average direct combined ratios for the industry’s major personal and commercial lines over five-, 10-, and 24-year periods.

The results are interesting: X Within the two major personal lines (homeowners and personal auto), the average direct combined ratios do not deviate appreciably over the three time periods, remaining remarkably stable at just over breakeven.

- Allied lines (which include coverage for wind, hail, and water exposures) have clearly underperformed over longer periods of time, reflecting massive losses in 2001, 2005, and 2017 especially. This is a notoriously volatile line of business, so it is difficult to read any particular cyclical trend into the result—major catastrophes strike somewhat randomly.

- Profitability for fire insurance, while remaining strong, has deteriorated over the two most recent periods, given some of the poorest results historically in six of the past seven years (with California fire losses having an outsized impact since 2017).

- Regarding underwriting profitability over time for the major commercial lines, commercial multiperil and other liability (occurrence-based) profits have eroded progressively over the five- and 10-year periods. Commercial multiperil’s flagging performance is largely due to the line’s liability element and can be attributed, in part, to the adverse impact of social inflation.

- Commercial auto profitability has also deteriorated over the most recent periods but appears to be gradually improving within the five-year window. Professional medical liability’s direct combined ratio has spiked over the past five years (in fact, the line’s combined ratio came in at over 100% in seven of the past 10 years).

- Lastly, the workers compensation line remains an anomaly as its five- and 10-year performances are substantially better than over the longer term. After a period of underwriting losses between 2008 and 2013, the workers comp line has seen 10 years of sub-100% combined ratios (with some of the best underwriting profitability reported in 2022-2023). This is all the more interesting given that this business’s rates have been flat to somewhat softening through most of the current hard market cycle.

Understanding Historical Profitability

The results of our study are not unexpected: the largest of the U.S. P&C market’s business lines (homeowners and personal auto) are remarkably stable and report near break-even profitability over time given their commodity-like nature in a competitive market, combined with the ability to adjust pricing relatively quickly based on large amounts of real-time data. We are seeing an example of this currently, as auto and home insurers have boosted pricing and tightened terms and conditions across the country after several years of poor results.

The largest of the commercial business lines (other liability, commercial multiperil, and commercial auto) also show relatively consistent underwriting results over time, though there is clearly more volatility given the longer-tail nature of some of this coverage and therefore exposure to more secular changes, such as new sources of liability (e.g., forever chemicals) and the rise in social inflation trends.

Volatile performance over differing time periods tends to occur in those lines directly impacted by outsized weather-related losses (such as allied lines and, to a degree, fire insurance), which occur largely at random. We also note the somewhat aberrant, though positive, performance of workers compensation, which may reflect ongoing improvements in workplace safety.

Understanding historical profitability ranges for different sectors of the U.S. P&C market can help distributors anticipate rate direction. For instance, if an insurer partner’s current underwriting results are above or below historical means, one may have a better sense for why certain pricing or exposure decisions are being made.

In addition, agents and brokers can use this knowledge to shape internal distribution strategies, have more informed discussions with insured clients around cyclical market trends, and become more sympathetic partners to your insurer markets.