Property & Casualty Hard Market Turns 6

ALIRT Insurance Research has been studying the U.S. property and casualty insurance market for more than 30 years, and we have never seen a hard market quite like this.

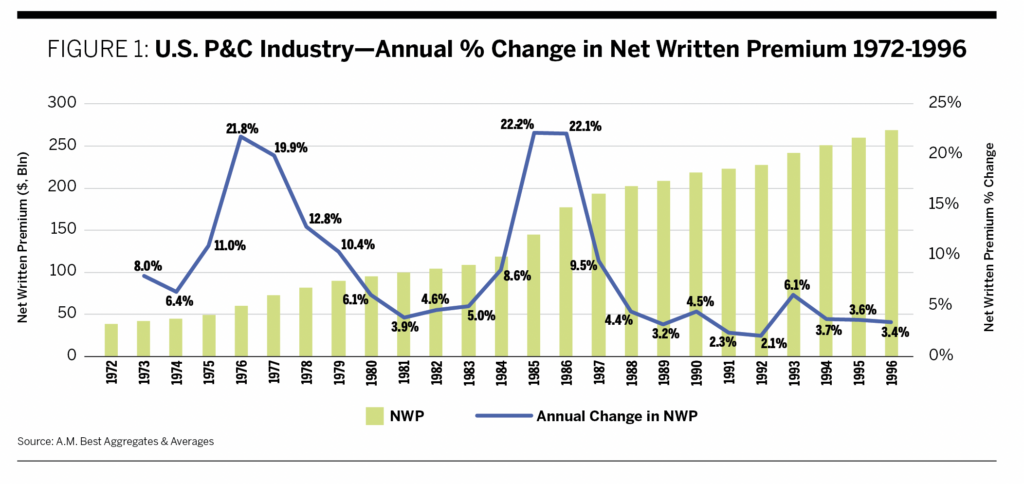

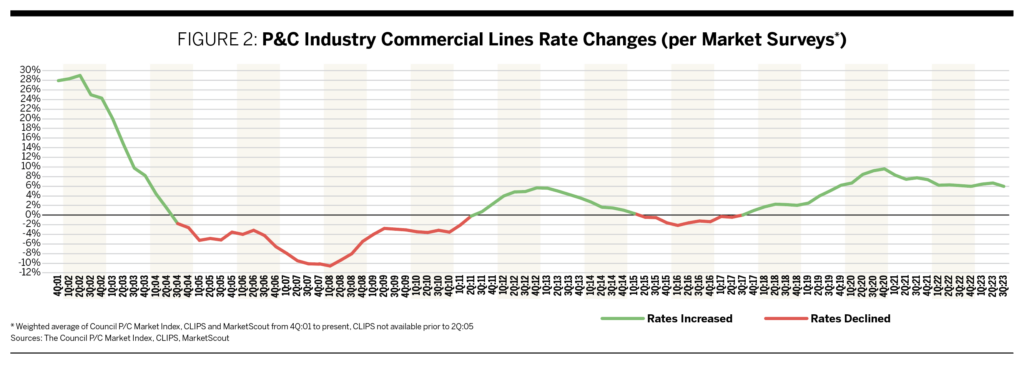

The first quarter of 2024 will mark the 25th consecutive quarter of firming pricing for the U.S. commercial lines market; we have now crossed the six-year mark of cumulative year-over-year rate increases (not to mention changes to policy terms and conditions, which act like rate). That contrasts with average hard-market lengths since the 1980s of roughly three to four years. What’s more, the prior three hard markets (in the mid-’70s, mid-’80s and early 2000s) displayed sharp upward spikes in pricing followed by equally sheer declines as insurers battled for market share amid improved profitability and increased capacity, bringing the inevitable soft market (Figure 1). In the absence of broker surveys before 2000, Figure 1 shows the change in net written premium as a proxy for rate.

In contrast, annual price percentage increases in the current hard market are less steep but more protracted. Annual price boosts in this commercial lines cycle peaked at the end of 2020, and over the last five quarters, the increases have leveled out at the mid- to high-5% mark (Figure 2 reflects actual broker rate surveys). This suggests that typical hard market competitive dynamics are occurring on the margins only; i.e., price discipline is holding across most business lines.

Even more interesting, the U.S. personal lines sector—which is historically less prone to pricing cycles given the relatively short tail of its homeowners and personal auto liabilities—has experienced its own hard pricing cycle for nearly two years with no clear indication of easing. In fact, in recent months, insurers have sought double-digit rate increases in a growing number of states. And where personal lines insurers feel they cannot charge an adequate rate (often due to regulator non-approvals), they are either exiting those geographies, substantially cutting back exposures and/or altering policy language to curtail coverage. Anecdotal evidence also points to some insurers taking a much more aggressive approach to handling claims.

What Is Behind This Atypical Hard Market?

Any student of the insurance sector is likely aware of the “quadruple threat” confronting underwriting profitability across the industry. These are, collectively:

- Persistent economic and social inflation that has produced much higher losses and loss adjustment costs than anticipated by pricing actuaries

- Greater insured losses from weather-related events across a broader swath of the United States, again unanticipated and still seemingly impossible to model

- Much more expensive and scarce reinsurance protection, especially for property coverage

- A 15-year run of historically low interest rates (note: investment income historically accounts for the lion’s share—if not, at times, all—of P&C operating profitability).

These factors present a real and ongoing challenge. Uncertainty around their future development has bred conservatism in the industry as it seeks to defend (or improve) returns on capital investment.

That said, insurers are resilient and will find a way to price and select risk given this “new normal” risk/loss environment as long as insurance regulators approve necessary price adjustments and policy alterations. Commercial and personal lines risks that cannot be written on admitted paper will continue to migrate to the burgeoning excess and surplus lines sector, which faces no such price or policy restraints.

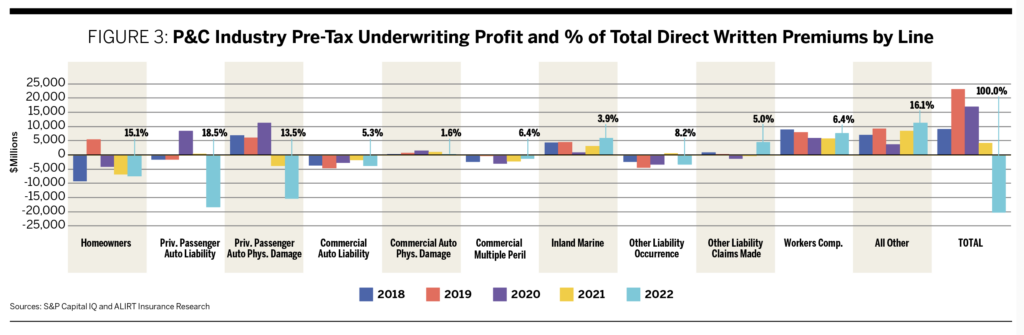

Outperformers and Underperformers

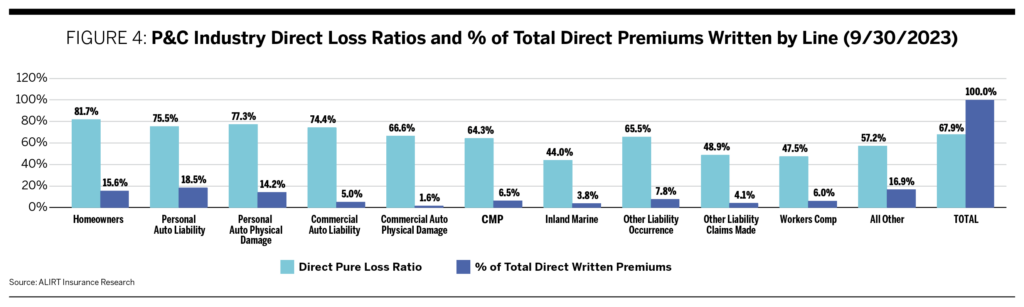

To help handicap how long this hard market can persist, we’ll look at underwriting earnings from 2018 to 2022 for the U.S. P&C industry’s major business lines as reflected by their share of industry direct written premium (DWP) in 2022. As the corresponding data for 2023 will not be filed until late April, we also show the direct loss ratio for the same lines as of the nine-month 2023 reporting period to give a sense of the underwriting experience last year (Figures 3 and 4).

This can indicate where cracks in current hard market pricing may become most apparent, potentially leading us out of the cycle. Conversely, it also shows which business lines continue to rack up losses, potentially sustaining firm pricing.

Agents and brokers who have been active in the market in recent years will know that the largest losses have arisen from the personal lines sector, which traditionally produces almost half of industry DWP. The homeowners line reported progressively larger losses from 2020 to 2022, while losses for the two personal auto lines (liability and physical damage) spiked in 2022. Together, these three business lines produced underwriting losses of $41 billion in 2022, or approximately double the overall industry loss of $20 billion (the $41 billion was offset by gains in other lines). As indicated in Figure 4, these three personal lines—long with commercial auto liability—reported direct loss ratios well above the industry average 67.9% through nine months of last year. In short, these continue to be problematic lines in need of remedial action on rates, terms and conditions, and likely retrenchment from certain geographies.

Other contributors to industry underwriting losses over the five-year period include commercial multiperil (with both the liability and property elements contributing to those losses), as well as pure liability lines, such as commercial auto (liability) and other liability occurrence-based policies, with both of those lines adversely impacted by social inflation (large-loss lawsuits). Taken together, these three lines represent approximately 20% of 2022 and nine-month 2023 DWP.

Conversely, inland marine and workers compensation, which represent an aggregate 10% of industry DWP, have reported five consecutive years of underwriting gains (and remained strong through nine months of 2023), while liability policies written on a claims-made basis improved markedly in 2022 and reported strong profitability through September 2023. All other lines, representing an aggregate 17% of industry DWP, have also reported solid underwriting results over the past six years.

What Happens Next

When discussing the U.S. P&C pricing cycle, remember that the industry is not monolithic. Given the approximately 40 different coverage categories tracked in statutory financial statements, it is inevitable that some business lines will outperform others from an underwriting perspective, leading to discrete pricing subcycles.

But because insurers ultimately measure their success on overall returns on equity, certain business lines may subsidize weaker-performing sectors. In sum, not every business line must improve before we revert to broadly softer market conditions. But enough must do so, and this clearly remains a work in progress.

While the fourth quarter of 2023 was fairly benign on the catastrophe-loss front, insurers remain unsettled by the surge in weather-related property losses over the past five years. Moreover, insurers are growing concerned about reserve deficiencies in their commercial lines portfolios, which took several large charges in the fourth quarter.

Still, there are reasons for optimism that price easing is on the horizon.

Economic inflation is moderating for a second consecutive year, and economic conditions remain stable, which should bode well for demand over the coming year. What’s more, the broad interest rate environment is much improved since early 2022 when the Federal Reserve began raising its key federal funds rate to rein in inflation. Higher interest rates across the yield curve equate to greater investment income to insurers, easing pressure on underwriting earnings to meet target returns. Lastly, there are signs that high reinsurance rates are peaking (especially for property risks) as much more capacity entered the market as of the critical Jan. 1, 2024, renewal period.

Taken as a whole, we believe that broad P&C rates will remain firm throughout 2024 and likely 2025, though at a slowly moderating pace. What happens afterward will prove most important: do rates soften substantially (as in past cycles), or do subsequent higher rate levels reflect a new industry baseline? Whatever the final exit date and subsequent pricing behavior, this will certainly remain a hard market for the record books.