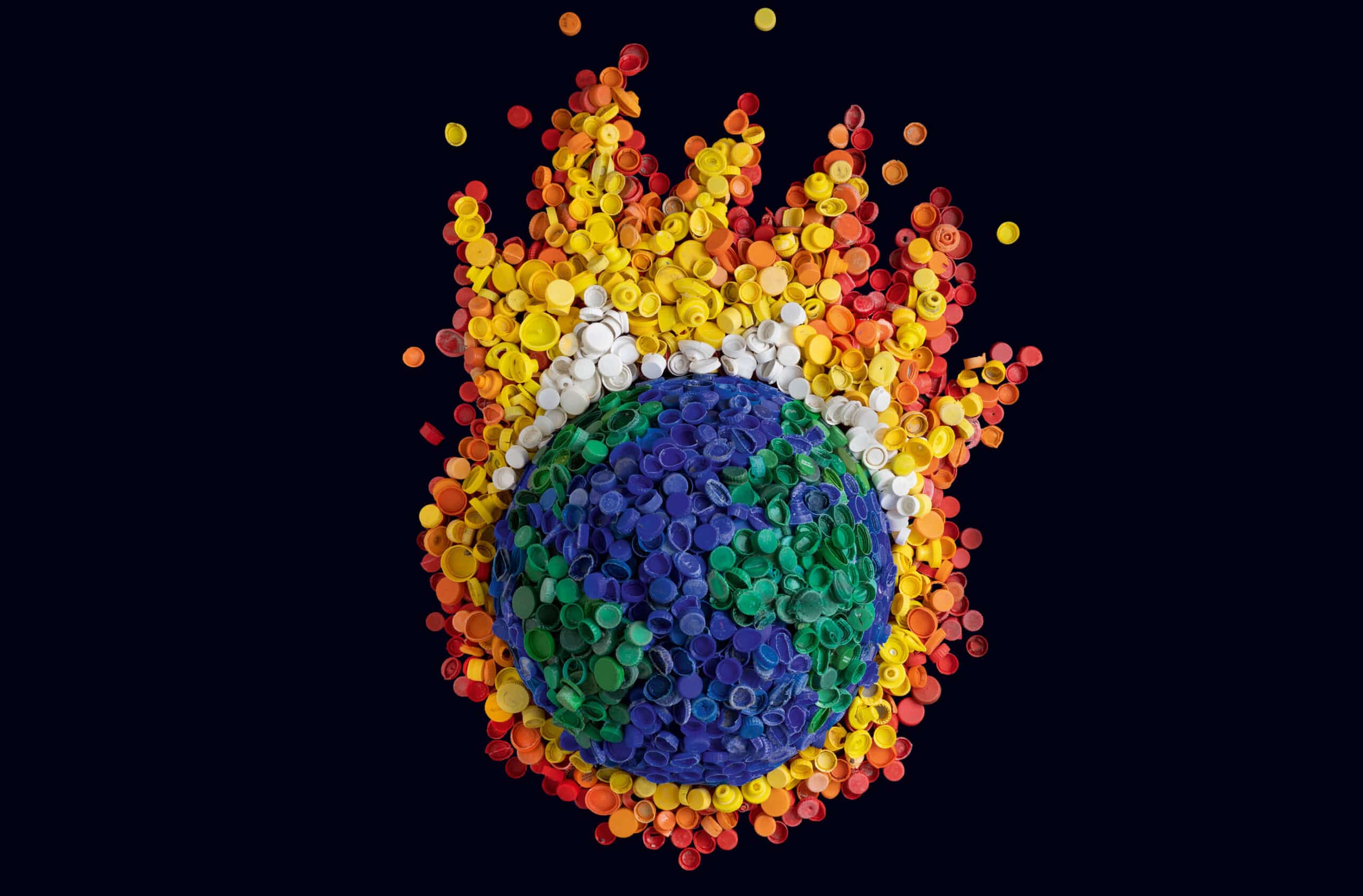

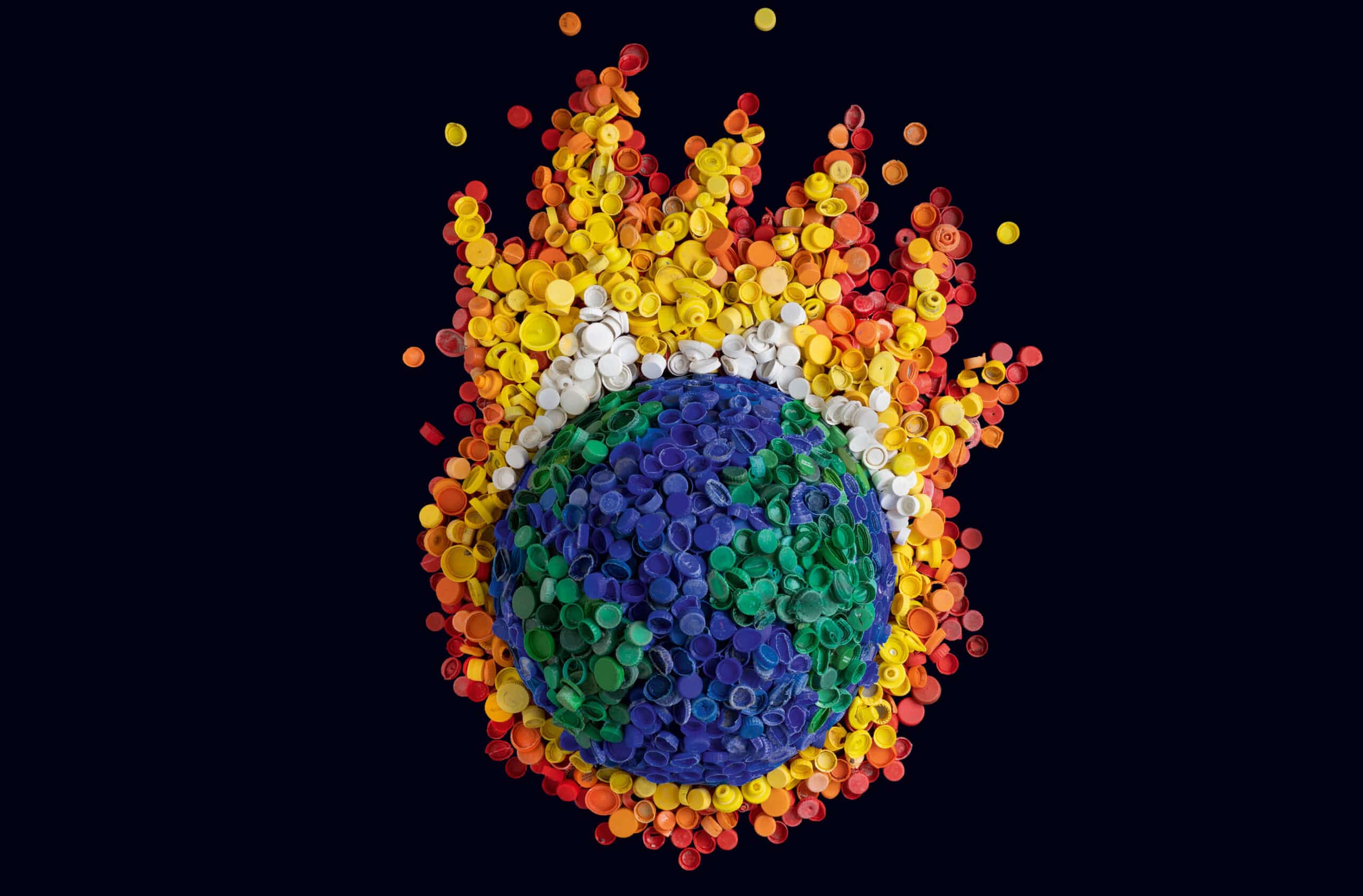

Global Hotspotting

Houthi militias in Yemen resumed attacks in March, ending a two-month pause by firing missiles at U.S. warships and at Israeli territory and threatening commercial shipping passing through the Red Sea and Gulf of Aden. In response, the United States launched airstrikes on the militias.

It was a fresh reminder—not that one was truly needed—that the Middle East remains a highly volatile and risky place to do business. The conflict has had a major effect on insurance markets as well: since the attacks began in late 2023, insurers have tightened underwriting for shippers and dramatically increased prices, sometimes 100% to 300% above previous levels, says Laura Burns, senior vice president and head of political risk, North America, at WTW.

That forced shippers moving goods to and from Europe to make a hard choice: route their tankers and cargo ships away from the Red Sea and the Suez Canal and make a much longer trip around the Cape of Good Hope, or pay significantly higher costs for coverage. They continue to lean toward the former option.

Acute geopolitical tensions across the globe, from missile attacks on cargo ships in the Red Sea to contested elections on multiple continents, are heightening insureds’ awareness of risk and consideration of coverage and mitigation.

Insurance companies have tightened underwriting in areas affected by unrest, including lowering policy limits, excluding certain events, and allowing for coverage cancellation on short notice.

But P&C markets including terrorism, cyber, and marine are also expanding, and brokers are well placed to help their clients manage today’s risk environment.

Geopolitical risks like these extend well beyond the Middle East. Companies are grappling with increased risk around the globe, from the Americas to Asia-Pacific and from Africa to Europe.

In response, insurers have implemented exclusions, tightened policies, and scaled back coverage in some areas, but the risks are also sparking more demand for a range of insurance products.

Brokers, meanwhile, are fielding more questions and concerns from clients about the rising risks. They’re offering mitigation advice, putting together panels of insurers for full coverage, and stress-testing policies, using scenario analysis to identify potential coverage gaps arising from geopolitical risks.

There are many such risks. “This is probably the first time since the Cold War when you can pick any region of the world and there is some level of significant geopolitical shift going on,” says Adam Carrier, head of crisis management consultancy for Gallagher. “It doesn’t matter where you throw the dart on to the map.”

“We are witnessing a rise in acute social and geopolitical risks that are contributing to the complexity of the insurance landscape,” AXA Deputy CEO Frédéric de Courtois said in a recent report. Those risks, he added, “affect everything from financial markets to regulatory aspects and our ability to operate.”

Many companies are considering these hazards in ways they have not for the past two to three decades, Carrier says. In this environment, brokers and insurers, as well as their clients, need to know what’s covered and what’s not—and make sure those risk levels are controlled through careful underwriting and prudent risk mitigation.

Today’s geopolitical risk-linked insurance needs go well beyond political risk coverage, that specialty line that can cover developments such as expropriation, nationalization, license cancellation, political violence, and forced abandonment. “It’s not just the political risk insurance market,” Burns says. “That’s a very well-defined space. There is also a much broader geopolitical risk market, if you will, which encapsulates things like terrorism, cyber, and marine.”

Monitoring Hot Spots

Political risk and its tangential effects are widespread across the globe, with multiple hot spots for insurers and global business leaders to monitor.

China is tied to many geopolitical risks, including still-evolving tariffs and trade wars with the United States and long-running tensions with Taiwan, the self-governed island that Beijing claims as its territory.

Insurers are increasingly cautious around China: only a handful of the 60 carriers that handle political risk insurance are taking on new business there now, Burns says. “And those that are may want to limit it to just one year,” rather than writing a multiyear policy.

Companies that do find coverage are paying for it: WTW research last year found political risk insurance rates climbing as much as 50% in China, depending on the business sector.

Russia’s 2022 invasion of Ukraine, and the war the two countries have fought since then, have brought many new wrinkles to businesses and insurers.

For instance: Before the invasion, Western companies had leased several hundred jets to Russian airlines. After the invasion, many lessors canceled the lease agreements to comply with Western sanctions against the Putin government. But Russia enacted laws to prevent their return, essentially expropriating them. By some estimates, more than 400 aircraft worth about $10 billion were involved.

Aircraft owners filed claims, but the complexities around the cases also led to multiple lawsuits, many against insurers including AIG, Lloyd’s, Chubb, and Fidelis, as the lessors sought to recoup losses. Some of the claims and suits have been settled while others continue to grind on in the courts, especially in London and Dublin.

The Middle East remains another area of great political uncertainty. The epicenter is Israel’s war with Hamas, which began after the October 2023 terror attacks on the nation and which brought many insurance issues in the region into sharp relief.

Early on, post-Oct. 7, there was close analysis of how much exposure in aggregate risk insurers had in the region, says Ben Tomlinson, assistant underwriter for crisis management at Aspen Insurance. Some of that exposure was “streamlined” by reducing aggregate limits as the conflict continued, Tomlinson adds. Now, he says, a key question is “whether insurers will be keeping as close an eye on that aggregate risk moving forward, and whether or not these insurers would be willing to expand their books in a region where they had previously been quite confident and comfortable.”

That could depend greatly on the peace negotiations between Israel and Hamas, according to Tomlinson. A ceasefire collapsed in March as Israel launched new strikes on Gaza. The two sides are reportedly considering a new ceasefire proposal from Egypt.

In the meantime, the war has hit shipping and aviation companies hard, with many airlines suspending service in and out of Tel Aviv amid security concerns and higher insurance costs. Insurers have matched their higher risks with higher premiums and stricter underwriting terms, including the introduction of cancellation clauses into certain policies, coverage restrictions in areas at higher risk of attack, and lower limits for some political violence policies.

There’s also been changes to business interruption policies, with some insurers excluding Israel and other countries in the region, including Jordan, Lebanon, and Egypt, from event cancellation policies soon after the war began.

Meanwhile, the various points of friction between Mexico and the United States on immigration and other matters could cause issues for foreign companies doing business in Mexico.

Just one example: In January, President Donald Trump started the legal process of designating certain drug cartels, particularly those based in Mexico, as “foreign terrorist organizations.” It’s already illegal to provide “material support,” including financing, to such groups. The designation is meant to be another weapon against the smuggling of illegal drugs into the United States and could lead to sanctions or the seizure of cartel-linked assets in this nation.

But, Carrier cautions, “This may potentially have some significant unintended consequences.” One issue is that some Mexican cartels are “very well politically connected, and they’re very connected with the significant economic drivers of the Mexican economy,” he says.

What happens, theoretically, if a foreign company with Mexican operations has a board member or high-ranking executive connected to a cartel?

“Does that now mean that some of the funds going through that company are now considered to be terrorist financing?” Carrier says. “It’s probably going to mean, at the least, a lot more compliance headaches for U.S. and Western companies that interact with commercial entities in Mexico, and for insurers trying to de-risk.”

Another emerging issue is elections. While elections themselves don’t signal geopolitical risk—in fact, a country holding regularly scheduled elections may signal stability—many recent elections around the world have been followed by social and economic instability, triggering demand for more political risk insurance from clients and more caution from insurers when underwriting policies.

Javier Milei winning the Argentine presidency in 2023 brought sharp shifts in economic policies, leading companies to look at business interruption and political risk coverage in the country. Elections last fall in Mozambique, meanwhile, were followed by widespread social unrest, protests, and violence that led to business interruptions and property damage, including disruptions to shipping and at the huge Mozal Aluminum smelter. Insurance claims followed.

Beazley found in a 2024 survey that 70% of business leaders around the world are worried that elections will impair their international operations and ability to trade. And 30% say the biggest threat they face today is political risk.

Tighter Terms and Lower Limits

The geopolitical turmoil has sparked change within political risk insurance lines.

Political risk coverage typically will provide companies with cover for things like expropriation and nationalization, breach of contract by a government agency, or political violence, which can include losses from war, insurrection, terrorism, or abandonment of assets over security concerns. The exact coverage and limitations vary based on factors including the country where the policy is operational.

Coverage is still available, but growing risks are leading to changes in what’s offered. “Underwriters are generally keen on the class, but they want to limit their line size on any specific transaction,” Burns says. “So instead of covering, say, $100 million on a mine in Africa, they’ll proceed to write it, but they’re only going to offer, say, $30 million.”

Underwriters must educate themselves on political risk and how much they are willing to allow in their policies, experts assert.

“You don’t have to be an expert in every corner of the world, but I think if you’re going to be writing business in certain regions, how is it that you can offer adequate cover and an adequate product for the client if you don’t really understand or appreciate what it is that they’re looking for coverage against?” Tomlinson says.

Companies have traditionally found coverage for many risks through marine, cyber, or property policies, and underwriting in those areas has been growing strongly. Cyber coverage globally, for instance, totaled nearly $17 billion in 2023 after posting double-digit annual growth rates for the previous several years; growth in the coming years is forecast to be solid, if not quite as strong. Marine insurance premiums surpassed $30 billion globally in 2023 and are forecast to grow by more than 4% annually for the rest of this decade. The number of incidents covered by these policies has grown as well, Burns says.

While energy and marine policies may provide some war cover, those typically can be canceled within seven days, Burns says. After recent events including the war in Ukraine and the Houthi attacks, underwriters are “increasingly” including notice periods of less than seven days, as little as 48 hours in some cases, Burns says.

Meanwhile, underwriters are becoming stricter about the political coverage they offer in lines such as property, which already include a standard “War and Hostile Acts Exclusion.” Underwriters in some cases are now excluding strike, riot, and civil commotion (SRCC) coverage due to a recent rise in events and losses, according to Burns.

“We’re seeing more instances of property brokers telling me an underwriter is excluding, for instance, an event that happened in Sudan,” Burns adds. “It’s really bringing into focus that exclusion in the property policy—of war or hostile acts or the political risk exclusion—that the underwriters don’t have the intent to pick up any of those things and are drawing a wall around political risk because they can’t afford to insure it and they’re not specialists in it.”

Charlie Howard, head of terrorism crisis management at Gallagher, says he sees carriers “constantly assessing their appetite for SRCC coverage within property all-risk policies, leading to a growing trend of exclusions, particularly in Latin America.” This isn’t yet widespread in the United States or Europe, although he adds that there were “indications of concerns” along these lines in Spain in late 2023 amid civil unrest after the ruling party indicated it would support a program of amnesty for Catalan separatists.

“If carriers do begin to withdraw SRCC coverage more broadly, it could create a significant coverage gap, as the political violence and terrorism market is unlikely to have the capacity to fully absorb these risks,” Howard says.

Candid Client Communication

As insurers adjust to address changing risk conditions, policyholder communication is crucial—particularly when it comes to ensuring the insured knows how their policy applies, or doesn’t apply, to certain events. “It’s so important for clients to really understand what the perils are that they’re buying [coverage for], and how their coverage responds to certain situations,” says Tim Strong, Aspen’s head of crisis management.

“Markets have to consider how they communicate their strategies,” Tomlinson says. “We certainly made an effort to communicate effectively to reinsurers, to make sure they understood where and what we were underwriting, and, also with our clients, to make sure they understood our capabilities and how we could help them in order to maintain our relationships.”

That candor needs to extend to talking about rates. Aspen found this vital when the conflict in Gaza erupted in late 2023. The company had to balance its commitment to long-held relationships with clients in the region with the necessity of setting rates that accurately reflected risks there, Tomlinson says.

For the most part, clients doing business in these areas understand that risks must be properly priced. “They’re very aware of just how tumultuous it can be in that particular region,” Tomlinson says. “It was really helpful being able to work with our brokers, who performed an excellent job communicating our strategy and our capacity and our appetite to the clients—and then also our clients, in turn, understanding what was realistic.”

Creative Policy Solutions

Beyond just communicating carrier appetites and strategies to their clients, brokers can also work with carriers in the admitted and E&S markets to find creative policy solutions.

For coverages that are seeing tighter terms or limits, brokers can bring in more syndication.

“There’s more pressure on brokers to bring bigger panels of underwriters together to achieve these placements,” according to Burns, saying this extends from WTW’s book of business and across the political risk insurance market.

Insurers are also starting to look at enhancing their political violence coverage within their products, “with a focus on more flexible, data-driven policies that align with evolving threats,” Howard says. “Some are introducing expanded coverages, such as broader non-damage business interruption triggers and hybrid products that integrate crisis response services.”

Brokers may also need to get creative. For instance, if carriers begin pulling back from SRCC coverage, brokers may study policy language to determine how that coverage is incorporated within current policies, Howard suggests. “Where necessary, they could explore preemptive measures, such as securing primary coverage through the political violence and terrorism market while utilizing property insurers for excess layers.” That could ensure clients remain covered against risks associated with civil unrest.

Demand has also spiked for specialist political violence coverage, intelligence services, and crisis management support, according to Howard, particularly among global businesses that are concerned about supply chains, business interruption, and “operational resilience.”

AXA’s de Courtois says that, to help meet the evolving geopolitical risks, insurers and brokers need to take a “more comprehensive approach to underwriting and risk management.” That, he adds, may involve “adopting innovative underwriting methodologies in portfolio management,” or extended use of risk management tools like capital and catastrophe models.

Dynamic Risk Management

Given the tumultuous global business environment, more companies are looking to understand broader geopolitical risks, including industries that generally might believe they don’t need guidance in this area, Carrier says.

He points to a recent conversation with one client, a high-end European retailer that wanted to know more about international political risks.

“They were concerned about a number of issues and how that starts to play into consumer sentiment, how it plays into their own refinancing,” Carrier says. “So it’s starting to touch every element of society. That’s positive in a way, that businesses are starting to think about this in a more detailed fashion. It speaks to the changing nature of the world that we live in.”

Demands for greater risk management among businesses may also come from government regulations. For example, a bill currently making its way through the U.K. Parliament would require counterterrorism measures in vast numbers of spaces across the United Kingdom. Experts estimate it will mean 250,000 or more venues and other areas will have to address potential terrorism, which could mean extending existing public liability, property or terrorism policies—or taking up terrorism coverage for the first time—to meet the bill’s requirements.

“Brokers really need to be talking to their clients and to their insurers about risk management being dynamic rather than static,” Carrier says. “It’s about knowing if the risk environment that a company operates in is changing. I think a lot of businesses don’t actually know that until they’re in crisis management mode because something has happened.”

“Clients are placing greater emphasis on working with brokers who can provide not only coverage but also strategic guidance to anticipate shifts in the risk landscape,” Howard says. “This includes horizon scanning to identify emerging threats and helping businesses navigate these challenges through a combination of risk mitigation strategies and tailored insurance solutions.”

In addition, brokers can run stress tests on existing policies, to see how the policy would respond to various scenarios and whether a client might be underinsured or even overinsured in certain areas, according to Carrier.

Not all brokers offer this service, but they should, he adds. “I feel like this is something we do that is fairly unique in the market, but it’s something that more and more brokers really have a duty to their clients to do,” he says. “And they should work with insurers to make sure that those policies are tailored where they need to be.”

Insurers and brokers can also partner with third-party crisis response companies to help clients mitigate their risks or respond to an incident, as Aspen does with a risk management specialist Crisis24. These companies’ offerings include risk monitoring and intelligence services, as well as crisis response, security, and medical assistance after an event.

“Pairing their advice with our insurance products enables a more holistic solution for the client,” Strong says. “And in many cases, that preloss service can help to mitigate, or even prevent, a situation from happening.”

Risk mitigation must be balanced against sustaining access to insurance in many regions, Carrier says. Investment in locations such as Ukraine and the Palestinian territories can grow if investors are confident the legal and insurance mechanisms are in place to safeguard their assets, he adds. “That’s when you can start to move the needle, not just on reconstruction but on reconciliation as well.”

The changing landscape of political risk—and the unknown changes that 2025, 2026, and beyond are sure to bring—should not be viewed with fear, says Christopher Croft, CEO of the London & International Insurance Brokers’ Association. It is, instead, a time for brokers and underwriters to shine.

“A world of heightened risk as we are surely living in should be seen as an opportunity for t he purveyors of risk management services,” he says. “So we should look on this time with genuine optimism.”