Commercial P/C Market Stable in Q4 2024

The fourth quarter of 2024 rounded out the year with not much change in market conditions compared to the previous quarters.

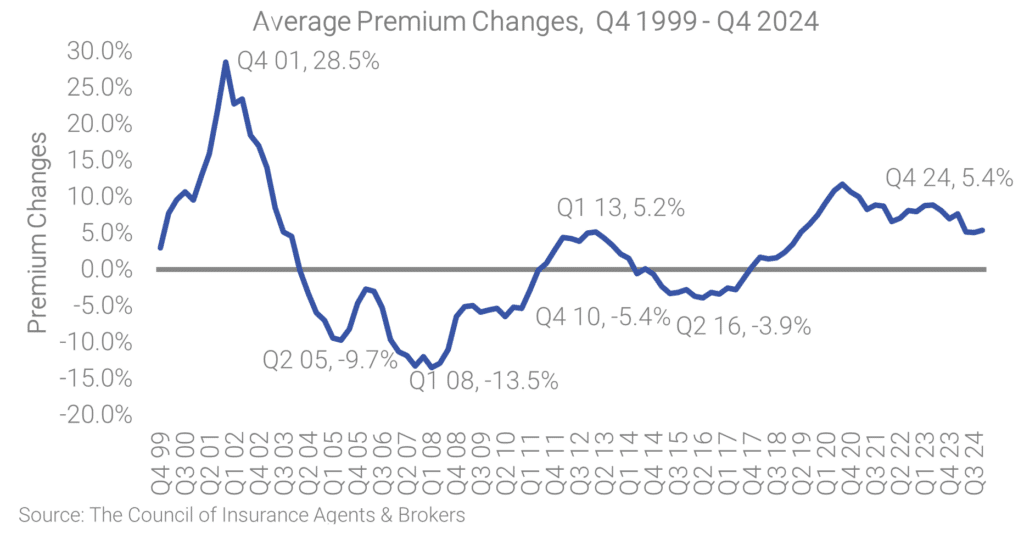

Premiums across all account sizes rose by an average of 5.4%, commensurate with Q3 and Q2 increases. That represented the 29th consecutive quarter of rising premiums across all account sizes.

The average increase across the five major lines of business—commercial auto, commercial property, general liability, workers compensation, and umbrella—was also 5.4%, down slightly from 5.7% in Q3 2024.

In line with that result, most lines of business recorded premium increases generally equal to or lower than the previous quarter, with the exception of commercial auto and umbrella. Auto premiums increased for the 54th consecutive quarter at an average of 8.9%, up from 8.5% in the preceding quarter. Research from sources including AM Best showed claim frequency and severity for the line increased due to driver shortages, repair costs, and supply chain issues.

Umbrella was not far behind, with an average premium increase of 8.7%. But that was up minimally from 8.6% in Q3.

Cyber premiums fell further this quarter, at an average of -1.8%, a record decrease for the line. The increase in number of carriers underwriting the cyber line of business in the United States may have pushed down premiums. Additionally, industry sources showed that cyber loss ratios have been trending down to 42% in 2024 from 67% in 2020 and 2021 even as the number of ransomware incidents spiked higher in 2023 and 2024. That indicates insured resiliency may have also contributed to premium relief for the line.