The Alera Group

It was June 2015 in Philadelphia, and the time had come to fish or cut bait. The conversations, the questions—the possibilities—had been murmured about for years.

Even as the Benefit Advisors Network had grown, every time the group gathered, someone else had sold. Consolidators had continued to approach. Challenges for individual firms had ramped up.

From the very start in 2002, the point of BAN had been to share best practices and collaborate for mutual benefit. But that day, a whole new level of collaboration was on the table. The 20-odd people in the room were committing to merge their firms, even while maintaining a sizeable ownership stake, and to collectively take on a private equity partner to grow their companies.

The invitation had been open to all, but those gathered had committed to step up—and step together. One by one, they stood to say why.

“The men and women there spoke to the interest of improving their firms, of working at a much deeper level with the peers they had held in such high regard and admiration and collaborated with already,” says John O’Connell, president of C.M. Smith Agency. “I think it was Alan Levitz who said, ‘Holy smokes, no one said they’re here for the money.’… It was an incredibly inspiring moment, because it set our true north.”

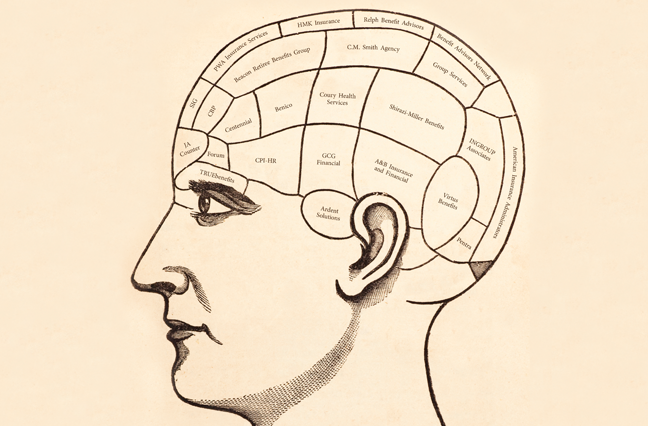

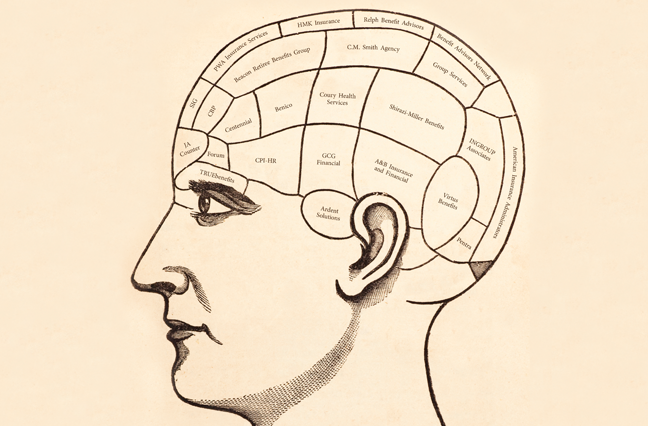

The compass had landed on what would become Alera Group, a brand-new employee benefits, property-casualty, risk management and wealth management firm with investment from Genstar Capital. Composed of 24 entrepreneurial insurance and financial services companies from across the country, Alera came out of the gate in January as the 14th largest privately held multi-line insurance brokerage and seventh largest privately held employee benefits firm in the country. Levitz, who was CEO of GCG Financial, has taken the helm as Alera Group president and CEO.

“To draw the distinction, this was the absolute opposite of an exit strategy or sellout,” O’Connell says. “It was critical to our decision-making process as a group that we needed to be focused on really building a great new company, and not just having some sort of monetization event and fading into the mist.”

The landmark partnership addresses many issues agency owners face, from perpetuation concerns to risk. And in the bigger picture, O’Connell says, “as the market gets more sharp and pointed in its demands, just as in any other industry, having scale and scope and a DNA of innovation is critically important.”

An Open-Book Process

It’s essential to note that BAN continues on. Earlier this year, in fact, some 300 BAN members gathered in San Antonio, and Alera owners took part. It’s not a replacement in any way, but rather, as Levitz puts it, “a logical evolution.” BAN began as a study group and became a shared services platform. Next, there was some sharing of financial compensation. The Alera deal, however, includes accountability around using the services that are on the platform and continuing to build together.

The process, says O’Connell, who serves as BAN’s vice president, “was very open-book. It was not selective in any way. What I mean by that is, we didn’t handpick firms that might have been a little better performing or higher growth. It was open, and anyone who chose, they could learn all the way through.” And Alera still promotes partnership opportunities.

BAN includes roughly 70 firms. Those that chose not to become part of Alera had their reasons. Some firms have multiple owners or strong internal perpetuation strategies; others weren’t interested in looking at an alternative capital structure. Some had an employee stock ownership plan. And still others thought it might be a daunting project, requiring much time and energy. (And that last subset in particular was right.)

“But overall, of the 24 firms that are part of Alera Group, 20 of them were initially part of Benefit Advisors Network, and they had a history of working together through their owners, through their salespeople, through their account executives, very closely over the last 12-plus years,” says Rob Lieblein, Alera’s chief development officer. “Not only was there trust involved, but they thought about the world and business and strategy the same way. So when the opportunity came about to consider coming together as one, there really was a strong foundation in place.”

As for the other four firms, they were all firms Lieblein had been in relationship with while working with consulting and investment banking firm MarshBerry.

Throughout BAN, however, “I think there was a curiosity,” Levitz says. “A skepticism, certainly. Concern. And on the other side, an optimism and a wow factor to the whole set of discussions. To pretend that all of us weren’t someplace on that spectrum at some point during the conversation would be a mischaracterization. We all went through the process of trying to understand it, what it meant to us as people, what it meant to us as firms, what it meant to our people, and what it might mean within the industry.”

And they all went through the process of wondering just how long it would take.

Time and Intensity

Back in 2014 the board of the Benefit Advisors Network, as a member-driven organization, first approached Lieblein about coming up with an alternative business model for firms to join. He had strategies ready to present at the start of 2015. It took about six months, Lieblein says, for the individual firms to grasp what Alera would be, how the private equity firm would be involved, how debt could be used and what ownership would mean. Next up was the process of building vision, strategy and objectives, followed by six months’ worth of due diligence, legal agreements and conversations with lenders.

Because the move was unprecedented, because so many firms were involved, and because none of those firms had been through any venture of this scale, wheels turned slowly. Most initially believed the process would take months rather than years.

“It was a challenge keeping everybody enthused,” Lieblein admits. “It was a major time commitment for every single person in each firm to stay together for two years and give 100% effort to this, as well as 100% to their businesses. To their credit—and I think this is an important point—the 24 firms, between 2015 and 2016, grew 8%, which is almost double the industry average. It was a herculean effort by everybody involved.”

Those who made that effort speak of intensity, of complexity, of trenches, and calls and talks and work groups and meetings. But they also speak of community, like-mindedness and a culture of collaboration that pulled them through.

“What was a pleasant surprise for me … was the ability of all of the owners, who are great entrepreneurs, to check their egos at the door to get a deal done,” says Peter Marathas, Alera’s chief legal counsel. “I don’t think I’m overstating it to say we never had any type of issue where we had to reign anyone in. Everybody had a singular view and worked together to get there, to a great result.”

Alera aims to create a national platform, administered regionally, deployed locally. As such, each firm retains its local brand equity, but can use the Alera name to bring national presence and heft. Collaborative opportunities among peers have increased. “We have evidence of a ton of sales activity just since we all came together,” Levitz says. “What’s been really great is the number of collaborative sales—I can’t say have been made, but are being talked about—within the firms, where one firm might have a prospect that’s in another firm’s sweet spot. And we’re already working much more closely than even as a BAN firm we would have done, just because of the accountability.”

Yet, so far, not much has changed on a day-to-day basis for many of the employees of the individual firms. “Other than the fact that now we’re allowed to dream a little bigger,” says Bill Brown, a partner at Ardent Solutions and one of eight Alera steering committee members. “Whenever we would have a great idea before, it would fall on someone locally to either develop that expertise or find that funding. Now we have a greater opportunity, just because of the experience and the resources financially, to build it.” The way of the past might have been to temper creativity with too much reality, he says, but the way of the present is to talk about building something bigger than the individual firm, and bigger than Texas. “Let’s tackle the biggest questions, and not necessarily just our community or local issues.”

The involvement of Genstar, naturally, helps make that a possibility. Brown—who, like the others, never doubted for a moment that Alera would come to fruition—says that of all the equity partners the group met with, Genstar was the one that caught the vision and the enthusiasm.

“Whenever we started talking with Genstar, everyone was on the front of their seats,” Brown says. Other potential partners still viewed the individual firms as “24 separate companies,” he says, “and they just could not understand that we had already built a culture and were now building a company.”

When others brought up the challenges of integration, Brown says, “we kept saying that it wasn’t a big issue, and here’s what we’ve done, and here’s who we are, and here’s how we think…. Genstar believed us.”

It wasn’t that the company would come first and the culture second. The culture—one of collaboration, openness, and the desire to positively impact clients and communities—was already well in place.

Ryan Clark, president and managing director of Genstar, says by the time his firm came on the scene, the culture and shared vision was evident.

“At our first meeting, we had a dinner with principals from maybe half of the companies, and you could tell the common sense of spirit, the camaraderie, the mutual respect they had for one another, the engagement that comes only from working with each other through BAN over a number of years,” Clark says. “It was clear to us that this was something special, and if any group of companies could pull this off, there was that spirit in the room that first night, at that first dinner. And in the meeting the next day, it was palpable that this group of people could do it.”

The Shared Vision

Part of the shared vision was a belief in the distributive equity model. Many who were not owners in the individual 24 firms became owners in Alera Group. There are people in almost all of the firms that now have equity interest, Levitz says, and will share in the upside of any appreciation. “The bottom line is that the current owners of the new firm in total own 40%,” he says. “While certainly there was a financial transaction where Genstar was buying 60%, we are heavily invested in the new company, and we think the vast majority of our compensation from doing this deal will come from whatever we can do over the next five years, rather than what we did in the past.”

Because the large majority of the firms had already worked together through BAN, there was no need to immediately integrate computer platforms or other technology. The partnership with Genstar, however, means firms that might not have been able to invest in building their business in the past will likely have greater opportunities in the future. Alera’s level of accountability and trust means if the group collectively decides to implement a shared platform, for example, once the discussions end and the decision is made, there will be 100 percent buy-in, Levitz explains.

Levitz and GCG got involved in 2015, adding weight and validation to the effort. (As Levitz became CEO of Alera, his brother, Rick Levitz, who has been GCG’s president of wealth management, became the firm’s managing partner.) It didn’t take long for the group to recognize Alan Levitz was the natural choice to lead Alera. Besides his ability to “wrangle” the entrepreneurs and make every meeting productive, as Brown puts it, Levitz had a different perspective with experience in benefits, p-c and wealth management.

“I think, even to this day, many of the benefits firms are still a little myopic around benefits,” Levitz says. “They’re having to remind themselves we’re going to be much more than just a benefits company…. I was involved in running a business as opposed to running a practice.”

Alera certainly could have been just a benefits company. “But I don’t think we ever really considered it, to be quite honest,” Levitz says. “We already have $25 million, in round numbers, of p-c revenue.”

Adds Lieblein: “I think the market is still coming to grips with 24 firms coming together as a single entity versus just being loosely tied together in some way…. Some of the smartest people in the industry have tried to do this for so many years and never have. So why would this small group of people—many of them they may not even have known—be able to pull this off? A lot of times I find myself, particularly in talking with industry consultants, explaining what happened, and it’s like, ‘OK. Now I get it. It’s not what I thought was taking place.’”

One other thing that didn’t take place: 24 individual deals. “That probably would have created a lot more of the challenges we were afraid of all along,” says outside legal counsel Mike Harrington of Harrington & McCarthy. He represented Alera Group firms with Genstar’s legal team of Ropes & Grey.

“These were individual deals packaged together as a single deal, and we were lead transaction counsel,” Harrington says. “We also had the assistance of a bunch of the firms’ trusted advisors as well, to deal with the individual situations on a case-by-case basis. The deal terms were largely the same, but that was the way we settled upon it, as far as the challenges and numbers. That was really the way to do it. All the facts and the history that goes along with each of the individual firms were different, obviously, but we settled upon a process where we could look at these in very similar—if not the same—light in terms of a legal acquisition and sale document.”

Leaving a Legacy

Looking back now, O’Connell says the process has afforded an opportunity to see things from a different macro perspective—including that of an investment thesis. Learning the pros and cons of the industry overall, he says, “was very, very eye-opening.”

“In that context, there’s plenty of room across the continuum of the business for big players, medium players and small players,” he says. “But I think we’re seeing a sharpening of competition and focus within the advisory space.”

The practice of simply providing a renewal and a spreadsheet to clients once or twice a year has long been dead, he says. Small boutique firms that hope to succeed must have very deep and narrow areas of focus. But multi-line firms must be bigger and stronger, with a “very broad array of tools and outcomes to deliver to a client. If you don’t, then the market is very punishing.” Alera, then, is right on trend, and those involved say they wouldn’t be surprised if others see how it works and decide to follow suit.

As for Levitz, he speaks of the biggest surprises so far: the level of support for each other, for the overall effort and for him—as well as Alera Group’s ability to pull Lieblein to “the other side.” Until March of last year, Lieblein was executive vice president at MarshBerry. (Billy Corrigan, the former chief financial officer for the international division at Marsh, rounds out the Alera leadership team as chief financial officer.)

“All of us have an aspirational goal, and mine was to leave a legacy,” Lieblein says. “I left a great career to join the other side, and it’s really, really exciting.”

There was no “other side” for chief counsel Peter Marathas, the managing partner at Marathas, Barrow & Weatherhead. His new role is similar to what it has been for many years. “Just more concentrated,” he says, “and a hell of a lot more fun. The first Benefit Advisors Network meeting I ever attended, there were seven members jammed into a small conference room down in Florida. The invitation to me was, ‘Come hang out with us, make some friends, talk about what’s going on in the industry, but don’t expect to be paid because we can’t pay you.’ But I met with those folks … and it became a wonderful relationship for me.”

As an employee benefits attorney, Marathas’s role has long been to provide compliance support. But his counsel has gone far beyond insurance issues to include guidance on a wide variety of business issues. “So when serious discussions began about a group of BAN members forming together to become one, I was part of those discussions from the very beginning,” he says.

Brown, meanwhile, at age 38, talks of the tremendous mentoring relationship that Levitz has offered, and the benefits of working so closely with others he admires. As the entrepreneur—and the son of an entrepreneur—he’s always had multiple mentors and a love of business in general. “But I don’t know that I appreciate yet what it means to not be the owner,” he admits. “That’s probably going to be learned…. There will be some tough times ahead and there will be some lessons learned, but for the time being it feels like all 24 of us got exactly what we hoped for. Sometimes that’s bad, and sometimes that’s amazing. Be we just couldn’t be more excited to share our story.”

So far, those involved say that, when sharing that story, they’ve received support and encouragement from firm members and clients alike. Granted, there will always be those who will “wait and see” how it all shakes out but Levitz points to two already-present positive signs: organic and inquisitive growth. Both, he says, have been “phenomenal.”

In terms of acquisitive growth, Levitz says the sheer number of conversations Alera is having with other firms is “tremendous.”

“There are people who are interested in what we’re doing,” Levitz says, “and there are people who are interested in making it successful internally.” As for the clients, he says, “They’ve just heard nothing but great things. They like this national platform that we can all draw from, yet still get the same local service that they’ve all been used to.”

And at Alera’s core, that’s what it’s really all about: “I knew I was in the right place, and doing the right thing, when ultimately, at the end of the day, this was about better serving clients and transforming the client experience,” Levitz says. “When there’s clarity in vision, success is not far behind. I think that’s the place that we see opportunity. We don’t have to work at deciding what we’re going to be or what we’re going to look like. We know what that is. Now, the market will move things, but in general, we know what we’re going to look like. Now we just have to go about the business of making it happen.”

Soltes is a contributing writer. [email protected]