Cyber Insurtech Under the Microscope in CB Insights’ Q4 2018 Insurtech Briefing

CB Insights and Willis Towers Watson released their quarterly insurtech briefing for Q4 2018 earlier this month. This quarter’s industry theme was about how incumbents in the insurance industry can make sense of the ever-evolving cyber threat and how to maximize the opportunities this new market offers them.

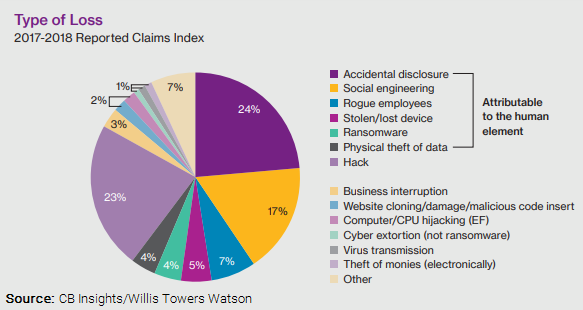

One important point made in the briefing was that the many faces of cyber threats today, as depicted in the chart above, mean that no one single incumbent can confront it alone—and this is where insurtechs come in. Startups, due to their nature, are inherently able to provide “deep technical expertise on very specific pieces of the overall puzzle,” according to the report. For example, each of the companies in the graphic below is attacking a different problem in the cyber space, empowering insurers, insureds and brokers.

To highlight this, the briefing spotlighted a handful of innovative companies in the cyber space, including Corax and Guidewire/Cyence, two companies The Council has had the opportunity to interact with before. We hosted Corax at our 2018 Legislative & Working Groups Summit, and sat down with Cyence’s CEO, Arvind Parthasarathi to discuss his view of what cyber security should be.

Corax is one of the world’s largest sources of cyber exposure data and loss analytics for the insurance industry, assisted by its AI-enabled platform and automated discovery tools that ingest and analyze a number of third-party data sets. Used by (re)insurers, MGAs, and wholesale and retail brokers worldwide, its cyber risk analytics tools help the industry design, price and sell better cyber insurance products.

Guidewire (Cyence) “combines economic/risk modeling, cybersecurity and big data analytics to create an economic cyber risk modeling platform.” Using a process they call “data listening,” Cyence collects vast amounts of public data, open-source data, proprietary data and third-party data, and then applies machine-learning techniques to curate and package it all into something useful for its customers. Through a cloud-based application, Cyence customers can glean insights about accumulation risks and cyber threats, based on real breach data.