Unlikely Partnerships

We promise to spare you the history of reinsurance and share only this: reinsurance as we know it dates to the 19th century, spurred by a large fire in Hamburg, Germany.

Industrialization throughout the 1800s created large concentrations of risk and required insurers to diversify their exposures. In response, insurance companies designed new programs to limit liability on specific property and casualty related risks and to stabilize loss experience.

In 2014, a first-of-its-kind reinsurance model was implemented under the ACA. It was designed to offset the high cost of medical expenses.

When that temporary federal reinsurance program came to an end in 2016, carriers began leaving the individual market.

In 2017, with medical insurance prices skyrocketing, states began crafting reinsurance solutions of their own under Section 1332 of the Affordable Care Act.

Today, reinsurance programs are viewed in much the same way—market stabilization solutions that foster competition and reduce the risk of high-cost claims. Until recently, they were used exclusively in P&C markets, with the reciprocal plan on the employee benefits side being stop-loss coverage for self-insured employers who do not want to assume all the liability for plan losses.

Reinsurance solutions were not deployed in the health insurance context until two centuries after their creation. In an unprecedented move, a federal reinsurance model was designed specifically to offset high insurer losses from medical claims. The program was implemented in 2014 under the Affordable Care Act and was intended to help stabilize premiums in the individual market by covering a portion of the risk that insurers would otherwise cover during the first three years that ACA market coverage was available. While it was active, it lowered individual market premiums and demonstrated an entirely new way to stabilize state insurance markets.

But in 2016, that program ended, and carriers started to leave the individual market. Rates increased as much as 50% in some states. Subsequently, in 2017, Alaska, Minnesota and Oregon petitioned the Trump administration under Section 1332 of the ACA to start their own state reinsurance programs. Those were implemented in 2018, and a slew of other states followed.

Though state lawmakers have various options for improving the affordability of individual market coverage, they have most consistently chosen to implement state-run reinsurance programs. These solutions enable states to receive federal pass-through funding to provide additional cover for insurance companies. The funds provide states the flexibility to shore up fragile insurance markets and experiment with alternative coverage models.

With the federal government acting as a backstop, participating insurance companies agree to reduce the premiums they charge consumers. Although there are limitations to reinsurance program effectiveness if state and federal lawmakers are not willing to expand federal partnerships, reinsurance programs represent a significant opportunity to stabilize state individual insurance markets and make unsubsidized coverage more affordable.

Program Design and Funding

States develop and submit their reinsurance programs for federal approval under 1332 waiver authority. To date, 16 states have implemented or have a pending application for a state reinsurance program. Almost all of them follow a claims-based model in which qualifying health insurance companies are reimbursed a percentage of all high-cost claims that exceed a specified threshold (i.e., the attachment point), up to a cap. Alaska is the only state with a conditions-based program in which insurers are reimbursed for the costs of enrollees with specified high-cost health conditions.

Most states currently rely partly on federal pass-through funding and partly on state funding to support their program. The state portion comes from a combination of insurer and/or hospital assessments to finance their obligations, as well as general fund appropriations and premium tax revenues.

Federal pass-through funding provides support toward subsidizing the state market’s premiums by a certain percentage or in a dollar range per person per month. States seek to secure federal pass-through funds in the amount of the federal savings on premium tax credits that would be realized if a reinsurance program were implemented. Savings are calculated using issuer-provided claims data from certain plan years, adjusted to reflect projected plan-year cost levels and enrollment volumes, and they reflect a projected distribution of claim expenses consistent with assumed marketwide morbidity levels.

The Results

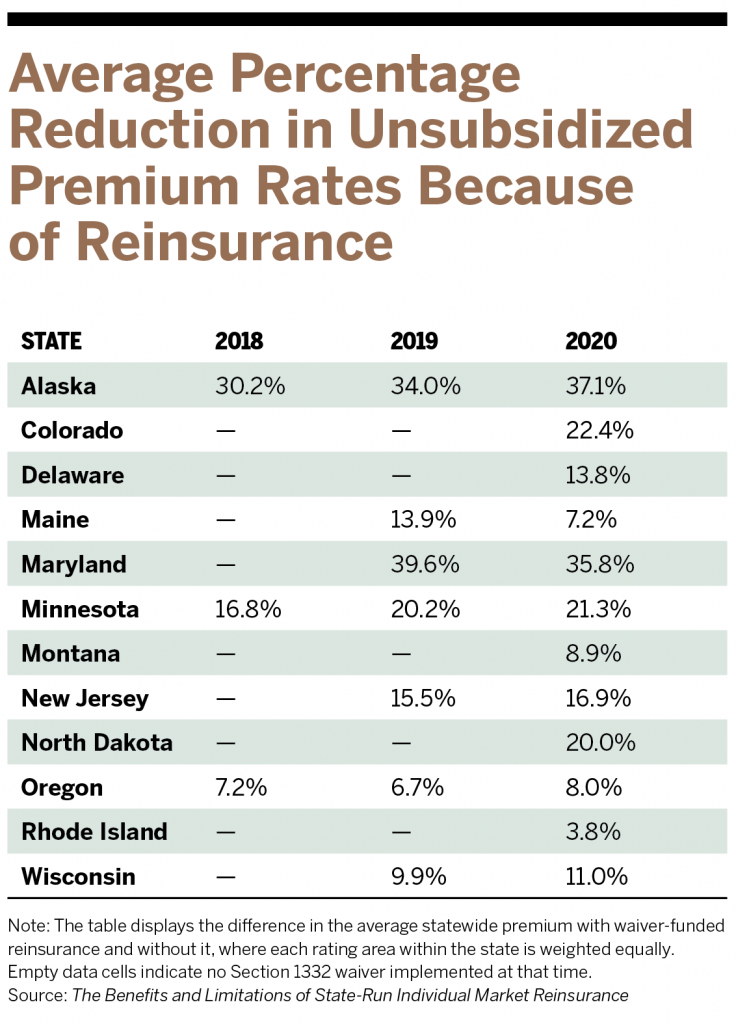

Every state that has implemented a waiver-funded individual market reinsurance program has experienced lower unsubsidized premiums as a result, though the extent of the savings varies. For example, in Maryland, the state’s $462 million claims-based program, with a $20,000 attachment point, lowered average premiums by nearly 40% in its first year, taking into consideration the difference between average statewide premiums with and without waiver-funded insurance. Maryland is also the only state in the nation to impose pricing controls on providers. Wisconsin implemented a $200 million claims-based reinsurance model with a $50,000 attachment point and saw an almost 10% reduction in individual market premiums.

In all states, reinsurance programs have continued to generate premium reductions in the years following initial implementation.

The Political Agenda

Although reinsurance programs offset expensive claims, they are not a silver bullet. For example, they are not designed to address the underlying drivers of healthcare costs or encourage more efficient care management or lower provider prices. Some states have opted for more control over health insurance, like a public-option program.

Colorado has a Section 1332 waiver program, and its individual market is built on a tiered system to deliver different co-insurance rates based on a beneficiary’s geographic location and ability to access care. But the state is continuing to pursue additional cost- and access-related solutions beyond that program. In a move to establish a public health insurance option, the state passed the Colorado Option bill last June, requiring Colorado’s Department of Insurance to establish a standardized health benefit plan before Jan. 1, 2022, aimed at improving access and affordability for consumers. Insurers will be required to offer the department’s standardized health plan to consumers with premiums that are at least 5% less than the plan’s 2021 premium rate by Jan. 1, 2023, or face penalties.

Despite some of the prevailing limitations of reinsurance programs, they continue to gain traction. Most recently, Virginia—whose waiver-application public comment period ended Nov. 1—wants to launch a $292.5 million claims-based reinsurance model in 2023.

Federal support may continue under the Biden administration. The Build Back Better reconciliation package includes a provision to create a $10 billion fund to subsidize state reinsurance programs and provide co-insurance and deductible support for individuals in exchange plans for up to three years.

During a tense round of negotiations between the administration and congressional Democrats on the president’s social spending package, this solution was not widely discussed. Still, its inclusion signals that lawmakers recognize a federally backed program that reimburses insurers for high-cost claims has the ability to rein in ACA premium costs.

All the ACA-related provisions in the Build Back Better bill, including permanently expanding enhanced premium tax credits, providing new reinsurance funding, and closing the Medicaid coverage gap, would reduce the number of uninsured by seven million in 2031 relative to current law but will cost $831 billion in the first 10 years, according to the American Action Forum. As Congress and the White House look to scale back Build Back Better to bring down the overall spending, lawmakers will have to evaluate whether those coverage gains justify the costs.

If state reinsurance program funding does not come to pass but the number of reinsurance-eligible claims increases due to continued ACA coverage gains, states may find themselves stretched too thin to support these arrangements. In almost all the states where programs have commenced, waiver funding covers most program costs, and in all states, this federal support has made reinsurance viable.

Growing Catastrophic Claims

So why should commercial brokers in the group insurance market pay attention to any of this?

The ACA exchanges currently serve as a safety net for more than 30 million Americans. The COVID-19 pandemic has been a prime example of the utility of these markets and the need to shore up the gap between employer-sponsored coverage and Medicaid coverage, for which a smaller subset of the population is eligible.

If the individual market destabilizes and pulls individuals into taxpayer-funded programs, that ultimately shifts costs onto the private insurance market as service providers seek to reclaim lost revenue by hiking prices under market-based contracts. And that could be problematic, because costs in the private market aren’t controlled like they are in Medicare. As of 2018, employers and private insurers paid hospitals on average 247% of what Medicare paid per service.

There are two market conditions prompting brokers to rethink how they manage client risk profiles: the rise in number of high-dollar claims and the appeal of the individual market.

Catastrophic claims have become more prevalent, and they disproportionately impact privately insured individuals, under both employer-sponsored and ACA plans. According to Sun Life, from 2016 to 2019, 22% of employers across the United States, ranging from 50 to more than 100,000 employees, had a member with more than $1 million in claims. Million-dollar-plus claims increased 9% in 2020 compared to the prior year and 31% since 2017. A 2017 Journal of the American Medical Association study revealed that privately insured individuals represented more than half the population experiencing catastrophic claims.

These types of claims are generated from a few sources. In particular, clinical advancements have allowed for the creation of cures and treatments for a number of chronic illnesses and previously untreatable diseases. New curative yet costly treatments and medications will likely drive future spending trends.

Prescription drug spend makes up 25% of the total cost of the highest claim conditions, including different cancers and chronic diseases. According to the December readout from the FDA, 50 new medications were launched in 2021 through December, and roughly 30% are highly complex and costly specialty pharmacy products targeting oncology and cancer treatments. Recent reporting from the Centers for Medicare and Medicaid Services (CMS) indicates that among 61 widely used specialty drugs treating chronic conditions, the average annual cost was nearly $80,000, which is more than $20,000 above the median U.S. household income.

Individual Market More Attractive

The second condition brokers are focusing on is increased carrier participation in the individual market. Participation was previously deterred by a greater potential for high-cost claims, the repeal of the individual mandate, and the number of states that initially opted not to expand Medicaid—which left sicker people eligible to enroll in individual coverage—resulting in less coverage choices and higher premiums.

Today, however, the individual market is becoming a more attractive option for insurers. According to CMS, the number of participating health insurers in the individual market will increase by 32 for a total of 213 carriers for the coming plan year. In 2021, there were 16 states where individual market premiums were less expensive compared to the small-group market.

Enter Individual Coverage HRAs (ICHRAs). An individual plan under a group umbrella gives employees non-taxed dollars to buy ACA coverage using a health reimbursement arrangement in lieu of enrolling in employer coverage. A 2020 survey from Willis Towers Watson showed that 15% of large employers planned to offer ICHRAs to their employees in 2022.

In January 2020, the Departments of Health and Human Services, Labor, and Treasury estimated that, by 2024, about 800,000 businesses would offer ICHRAs. That would cover close to 11 million employees and family members, leading the size of the individual market to increase by as much as 50%.

When The Council informally polled its Council of Employee Benefits Advisory Committee, comprised of 30 benefits executives from leading firms around the country, 75% said that they have a solid book of ICHRA business, they are actively working with clients to implement individual market solutions, or their clients recently expressed interest in defined contribution solutions.

While ICHRAs have been touted as a strategy to control spending on health insurance, their proliferation will depend in part on what ends up in the budget reconciliation package being considered by Congress. If ACA premium subsidies are made permanent, employers might be less inclined to offer individual market options because they make sense only when offered in locations with lower premiums.

Overall, higher claims driven by new medications and therapies and more stable individual market conditions have created a unique moment where new alternative coverage models can thrive.

Reinsurance pools have the potential to extend beyond the individual insurance market and into the group benefits market. The catch is how ready the industry is to discuss legislative solutions founded on a partnership with the federal government.

Click here to see which states are currently operating a reinsurance program.